Auto insurance comparison by state is crucial for finding the best coverage at the most affordable price. Understanding how state regulations and individual factors impact your rates can save you hundreds of dollars annually.

This guide will delve into the intricacies of auto insurance, covering everything from the basics of coverage to state-specific requirements, factors influencing rates, and effective comparison strategies. By understanding these key aspects, you can make informed decisions about your insurance needs and secure the best possible protection for your vehicle and your finances.

Understanding Auto Insurance Basics

Auto insurance is a vital financial safety net that protects you and your vehicle in case of accidents, theft, or other unforeseen events. Understanding the key components and coverage options can help you make informed decisions about your policy and ensure you have adequate protection.

Key Components of Auto Insurance Policies

Auto insurance policies are designed to cover a range of potential risks associated with vehicle ownership. These policies typically include several key components, each addressing a specific aspect of protection.

- Liability Coverage: This is the most crucial component of auto insurance, providing financial protection to others in case you cause an accident. Liability coverage typically includes bodily injury liability and property damage liability, covering medical expenses and property damage to the other party involved in the accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. It helps cover the cost of repairs or a replacement vehicle, reducing your financial burden.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects. It provides financial assistance for repairs or replacement of your vehicle in such situations.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you and your passengers in case you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers medical expenses and property damage, ensuring you’re not left financially responsible for the other driver’s negligence.

- Personal Injury Protection (PIP): This coverage, often required in certain states, provides medical benefits for you and your passengers, regardless of who’s at fault in an accident. PIP covers medical expenses, lost wages, and other related costs.

Common Coverage Options

Beyond the core components, auto insurance policies offer a range of additional coverage options to enhance your protection. These options provide customized coverage for specific needs and situations.

- Rental Car Coverage: This coverage provides reimbursement for rental car expenses while your vehicle is being repaired after an accident. It ensures you have transportation while your car is unavailable.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, dead batteries, and lockouts. It offers peace of mind knowing help is available when you need it most.

- Medical Payments Coverage (Med Pay): This coverage supplements your health insurance by paying for medical expenses for you and your passengers, regardless of who is at fault in an accident. It provides additional financial support for medical bills.

- Gap Insurance: This coverage protects you if your vehicle is totaled and your insurance payout is less than the outstanding loan balance. It covers the difference, ensuring you’re not left with a significant debt after an accident.

Factors Influencing Auto Insurance Costs, Auto insurance comparison by state

Several factors play a role in determining your auto insurance premium. Understanding these factors can help you make choices that may influence your insurance costs.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance premium. A clean driving record usually translates to lower premiums, while a history of incidents can lead to higher rates.

- Age and Gender: Younger and inexperienced drivers often face higher insurance premiums due to their higher risk of accidents. Gender can also influence premiums, as statistics show certain genders have higher accident rates.

- Vehicle Type and Value: The type and value of your vehicle play a role in determining your insurance premium. Luxury or high-performance vehicles tend to have higher premiums due to their greater repair costs and higher risk of theft.

- Location: Your location, including the state, city, and neighborhood, influences your insurance rates. Areas with higher crime rates or traffic congestion tend to have higher premiums due to increased risk of accidents and theft.

- Credit Score: In some states, your credit score can impact your auto insurance premium. Insurance companies use credit scores as a proxy for risk, believing that individuals with lower credit scores are more likely to file claims.

- Driving Habits: Your driving habits, such as mileage driven, commuting distance, and driving style, can influence your insurance premiums. Drivers who commute long distances or engage in risky driving behaviors may face higher rates.

State-Specific Regulations and Requirements

State laws play a significant role in shaping auto insurance coverage and costs. Each state has its own set of regulations that dictate the types of coverage required, the minimum coverage limits, and other factors that affect insurance premiums. Understanding these state-specific requirements is crucial for drivers to ensure they have the appropriate coverage and comply with the law.

Mandatory Coverage Requirements

Each state mandates certain types of auto insurance coverage to protect drivers, passengers, and others involved in accidents. These mandatory coverage requirements vary by state, but they typically include:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): Also known as “no-fault” coverage, PIP covers your own medical expenses and lost wages, regardless of who caused the accident. Some states require PIP, while others offer it as an optional coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and property damage.

- Property Damage Liability: This coverage pays for damage you cause to another person’s property, such as their vehicle, in an accident.

Key Differences in State Regulations

Beyond mandatory coverage requirements, there are several other key differences in state regulations that impact auto insurance coverage and costs:

- Minimum Coverage Limits: States set minimum coverage limits for liability, PIP, and property damage liability. These limits dictate the maximum amount your insurance company will pay for covered losses.

- Fault Systems: States have different fault systems for determining liability in accidents. Some states have “no-fault” systems, where drivers are compensated by their own insurance company regardless of fault. Other states have “tort” systems, where drivers can sue the at-fault party for damages.

- Rate Regulation: States regulate how insurance companies set rates. Some states allow insurers to set rates based on factors such as driving history, age, and credit score, while others have more restrictions.

- Insurance Company Licensing: States license insurance companies to operate within their borders. Each state has its own licensing requirements and regulations that ensure the financial stability and solvency of insurance companies.

Examples of State-Specific Regulations

- New York: New York requires drivers to have a minimum of $25,000 in liability coverage per person, $50,000 per accident, and $10,000 for property damage. The state also mandates PIP coverage.

- California: California requires drivers to have a minimum of $15,000 in liability coverage per person, $30,000 per accident, and $5,000 for property damage. The state also mandates uninsured motorist coverage.

- Texas: Texas has a “tort” system, meaning drivers can sue the at-fault party for damages. The state requires drivers to have a minimum of $30,000 in liability coverage per person, $60,000 per accident, and $25,000 for property damage.

Factors Affecting Auto Insurance Rates

Your driving history, vehicle type, age, location, credit score, and insurance history are among the key factors that insurance companies consider when calculating your auto insurance premiums. Let’s delve into how these factors influence your rates.

Driving History

Your driving history is a significant factor in determining your auto insurance rates. Insurance companies assess your driving record to evaluate your risk as a driver.

- A clean driving record with no accidents or traffic violations typically results in lower premiums.

- Conversely, a history of accidents, speeding tickets, or DUI convictions can lead to higher premiums.

- Insurance companies often use a points system to track your driving history. Each violation accumulates points, increasing your risk score and, consequently, your premiums.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your insurance rates.

- High-performance cars, luxury vehicles, and SUVs are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Conversely, smaller, less expensive cars typically have lower insurance premiums.

- The safety features of your vehicle also impact your rates. Cars equipped with advanced safety features like anti-lock brakes, airbags, and stability control often receive lower premiums.

Age

Your age is another factor that influences your auto insurance rates.

- Younger drivers, particularly those under 25, often face higher premiums due to their lack of experience and higher risk of accidents.

- As drivers gain experience and reach their mid-20s and beyond, their premiums tend to decrease.

- Older drivers, while statistically less likely to be involved in accidents, may also face higher premiums due to factors like age-related health issues or reduced reaction times.

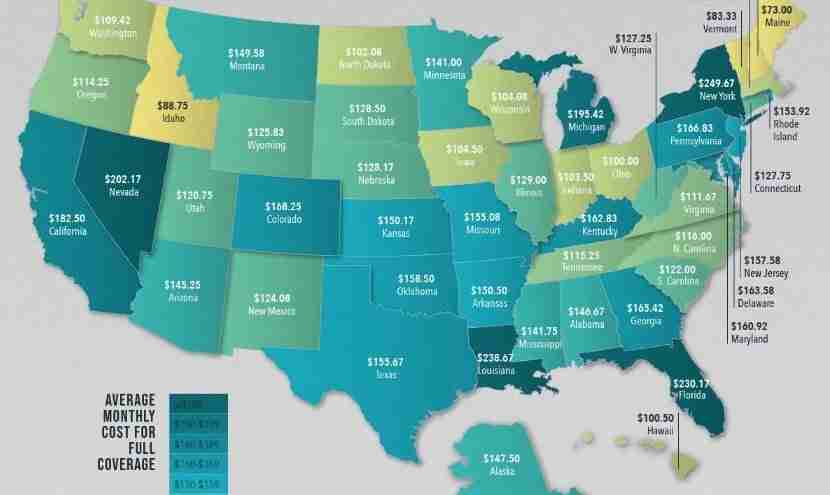

Location

The location where you live significantly impacts your auto insurance rates.

- Urban areas with higher traffic density and crime rates generally have higher premiums than rural areas.

- Insurance companies also consider the frequency of accidents and claims in specific regions.

- For instance, areas prone to natural disasters, such as earthquakes or hurricanes, may have higher insurance rates.

Credit Score

Your credit score, surprisingly, can also affect your auto insurance premiums.

- Insurance companies use credit scores as a proxy for financial responsibility. Individuals with good credit scores are often perceived as less risky, leading to lower premiums.

- This practice is not universal, and some states have laws prohibiting insurance companies from using credit scores for pricing. However, it remains a significant factor in many states.

Insurance History

Your insurance history, including your claims history and driving record, plays a crucial role in determining your rates.

- Maintaining a clean claims history, avoiding accidents and filing claims, can lead to lower premiums and potential discounts.

- Conversely, frequent claims or a history of accidents can increase your premiums.

- Insurance companies also consider your loyalty to a particular insurer, offering discounts for long-term customers.

Navigating the Comparison Process

Now that you understand the basics of auto insurance and the factors influencing your rates, it’s time to start comparing quotes. This process can seem daunting, but with a structured approach, you can find the best policy for your needs and budget.

Step-by-Step Guide for Comparing Auto Insurance Quotes

To ensure you get the most competitive quotes, follow these steps:

- Gather Your Information: Before you start, collect all the necessary information about your vehicles, driving history, and personal details. This includes your driver’s license number, vehicle identification number (VIN), details about your driving record, and your address and contact information.

- Use Online Comparison Tools: Online comparison websites like Policygenius, NerdWallet, and Insurance.com allow you to enter your information once and receive quotes from multiple insurers. These tools save you time and effort by eliminating the need to contact each insurer individually.

- Contact Insurers Directly: After using online comparison tools, it’s beneficial to contact a few insurers directly. This allows you to discuss your specific needs and get personalized quotes. You can often find better rates by speaking to an agent directly, especially if you have unique circumstances or require specialized coverage.

- Compare Quotes Carefully: Once you have received quotes from several insurers, compare them side-by-side. Pay attention to the coverage limits, deductibles, premiums, and any additional fees or discounts offered. Make sure you understand the terms and conditions of each policy before making a decision.

- Read Policy Documents: Before committing to a policy, carefully read the policy documents provided by the insurer. Ensure you understand the coverage details, exclusions, and any limitations. If you have any questions, don’t hesitate to contact the insurer for clarification.

- Consider Customer Service and Claims Handling: In addition to price, consider the insurer’s reputation for customer service and claims handling. Look for companies with positive reviews and a track record of resolving claims efficiently and fairly. You can find this information on websites like J.D. Power and Consumer Reports.

Tips for Using Online Comparison Tools Effectively

Online comparison tools can be valuable resources, but it’s important to use them effectively:

- Be Accurate with Your Information: Provide accurate information about your vehicles, driving history, and personal details. Any inaccuracies can result in inaccurate quotes and potentially lead to issues later on.

- Compare Quotes from Multiple Insurers: Don’t rely on just one or two quotes. Compare quotes from at least five to ten insurers to get a comprehensive understanding of the market. This will help you find the best deals and ensure you’re not missing out on any hidden discounts.

- Consider Different Coverage Options: Most comparison tools allow you to adjust your coverage levels and deductibles. Experiment with different options to see how they affect your premium and find the right balance for your needs and budget.

- Read Reviews and Ratings: Before choosing an insurer, check their online reviews and ratings on websites like J.D. Power and Consumer Reports. This can give you insights into their customer service, claims handling, and overall reputation.

Key Factors to Consider When Evaluating Quotes

When comparing quotes, consider the following factors:

- Coverage Limits: Ensure the coverage limits are sufficient to protect you in case of an accident. This includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Deductibles: A higher deductible means a lower premium, but you’ll have to pay more out of pocket if you have a claim. Choose a deductible you can afford while still maintaining adequate coverage.

- Premiums: Compare the monthly or annual premiums for each policy. Make sure you understand how the premium is calculated and what factors are included in the price.

- Discounts: Many insurers offer discounts for good driving records, safety features, bundling policies, and other factors. Ask about available discounts and see if you qualify for any.

- Customer Service: Look for insurers with a reputation for excellent customer service. This includes responsiveness, helpfulness, and the ability to resolve issues efficiently.

- Claims Handling: Consider the insurer’s track record for claims handling. Look for companies with a reputation for fair and efficient claim processing.

- Financial Stability: Ensure the insurer is financially stable and has a strong rating from agencies like A.M. Best. This indicates the company is likely to be able to pay claims in the future.

Understanding Coverage Options

Choosing the right auto insurance coverage is crucial, as it protects you financially in case of an accident or other covered event. This section delves into different coverage types and their importance, helping you make informed decisions about your insurance needs.

Liability Coverage

Liability coverage is essential for any driver, as it safeguards you financially if you cause an accident that injures someone or damages their property. It’s typically divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages for individuals injured in an accident you caused. The coverage limit is usually expressed as a per-person limit and a per-accident limit, such as 25/50/10, meaning $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Property Damage Liability: This coverage pays for repairs or replacement of property damaged in an accident you caused. The coverage limit is usually expressed as a single amount, such as $25,000, which covers all property damage in an accident.

It’s crucial to understand that liability coverage only protects you, not the other party involved in the accident. If your coverage limits are insufficient to cover the damages, you may be held personally liable for the remaining amount.

Comprehensive and Collision Coverage

Comprehensive and collision coverage are optional but highly recommended, as they protect your vehicle against various risks:

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by non-collision events such as theft, vandalism, fire, hail, or natural disasters.

- Collision Coverage: This coverage pays for damages to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault.

The deductible for both comprehensive and collision coverage is the amount you pay out-of-pocket before your insurance company covers the remaining costs. Choosing a higher deductible can lower your premiums, but you’ll need to pay more in case of a claim.

Optional Coverage Options

While not mandatory, certain optional coverages can provide additional protection and peace of mind:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or has insufficient insurance to cover your damages.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit.

- Rental Reimbursement: This coverage helps cover the cost of renting a vehicle while your car is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance in case of a flat tire, dead battery, or other roadside emergencies.

The value of these optional coverages depends on your individual needs and risk tolerance. It’s wise to consult with an insurance agent to determine which options are best for you.

Finding the Best Value

Finding the best value in auto insurance involves more than just comparing prices. You need to ensure you’re getting adequate coverage at a price that fits your budget. Here’s a breakdown of key factors to consider and strategies to employ:

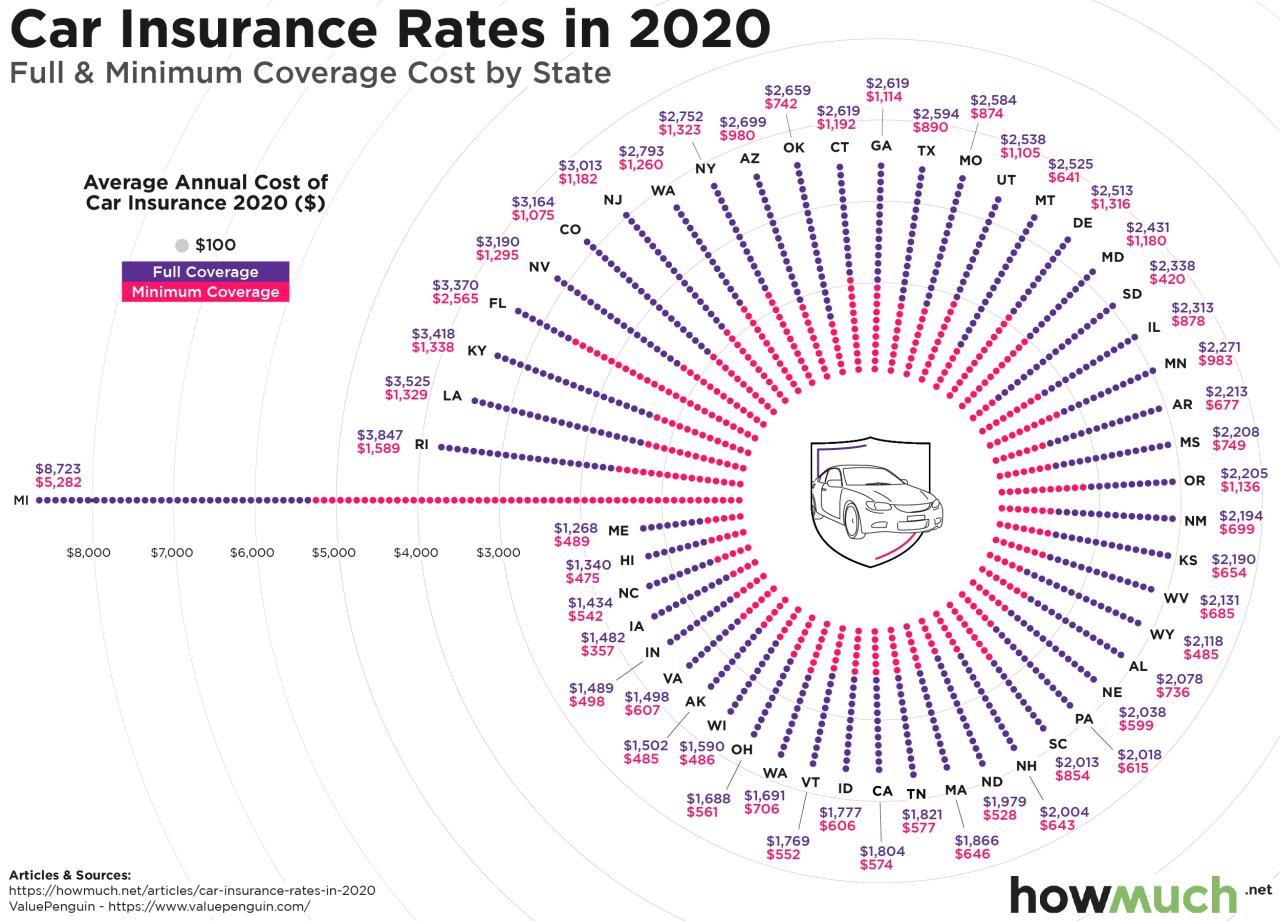

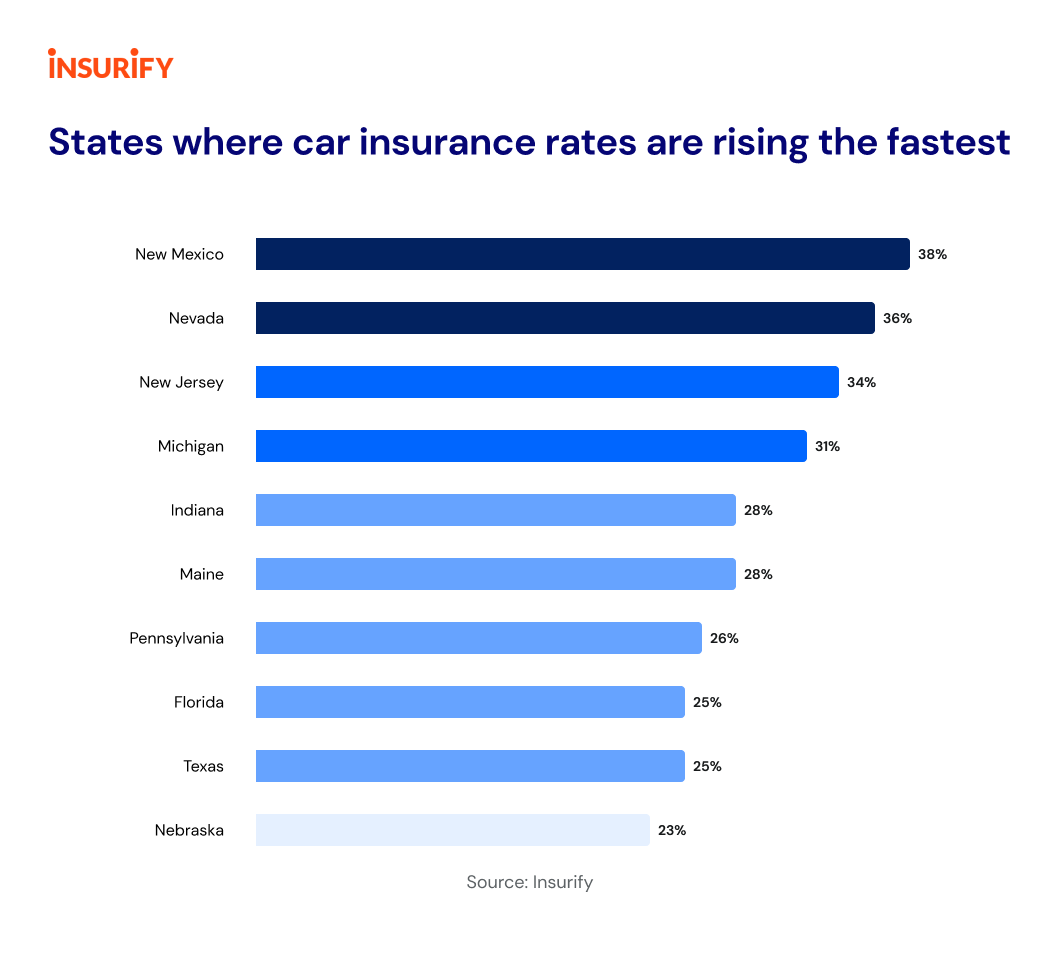

Average Auto Insurance Rates Across States

Auto insurance rates vary significantly across states, influenced by factors such as traffic density, accident rates, and state-specific regulations. This table presents a general overview of average auto insurance premiums across various states, showcasing the minimum and maximum coverage options typically available:

| State | Average Premium | Minimum Coverage | Maximum Coverage |

|---|---|---|---|

| California | $2,000 | Liability Only | Comprehensive and Collision |

| Texas | $1,500 | Liability Only | Comprehensive and Collision |

| Florida | $2,500 | Liability Only | Comprehensive and Collision |

| New York | $1,800 | Liability Only | Comprehensive and Collision |

Negotiating Lower Insurance Premiums

Negotiating lower premiums is a common practice, and there are several strategies you can employ to achieve this:

- Bundle your insurance policies: Combining your auto insurance with other policies like home or renters insurance can often result in significant discounts.

- Improve your credit score: A higher credit score can demonstrate financial responsibility and often leads to lower premiums.

- Take defensive driving courses: Completing a defensive driving course can show you’re committed to safe driving, potentially earning you discounts.

- Maintain a clean driving record: Avoiding traffic violations and accidents can significantly impact your premium. A clean record often translates into lower rates.

- Ask about discounts: Many insurers offer discounts for various factors, such as being a good student, having a car with safety features, or being a member of certain organizations.

- Shop around: Comparing quotes from multiple insurers can help you find the best deals. Online comparison tools can streamline this process.

Beyond Price: Auto Insurance Comparison By State

While finding the cheapest auto insurance is tempting, it’s crucial to consider factors beyond just the price tag. A lower premium might seem attractive, but if the insurer has poor customer service or a complicated claims process, you could end up paying more in the long run.

Customer Service and Claims Handling

A reliable auto insurance company should provide excellent customer service and a smooth claims process. This is especially important when you need to file a claim, as you’ll want to ensure that the process is straightforward and efficient.

- Responsive Customer Service: Look for companies that offer multiple ways to contact them, such as phone, email, and online chat, and ensure they have a reputation for prompt and helpful responses.

- Transparent Claims Process: Choose a company with a clear and easy-to-understand claims process. They should provide detailed information on how to file a claim, the required documentation, and the expected timeline for processing.

- Positive Customer Reviews: Read online reviews from other customers to get a sense of the insurer’s reputation for customer service and claims handling. Look for reviews that mention positive experiences, such as quick claim processing, fair settlements, and helpful customer service representatives.

Choosing an Insurance Company

When selecting an insurance company, consider factors beyond just the price. Look for a company with a solid reputation for customer service, financial stability, and a wide range of coverage options.

- Financial Stability: Check the insurer’s financial rating from agencies like AM Best or Standard & Poor’s. A high rating indicates that the company is financially sound and likely to be able to pay out claims in the future.

- Coverage Options: Ensure the insurer offers the coverage options you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. You might also consider additional options like rental car reimbursement or roadside assistance.

- Discounts and Rewards: Look for insurers that offer discounts for safe driving, good grades, multiple policy bundling, and other factors. Some companies also offer rewards programs for loyal customers.

Understanding Policy Terms and Conditions

Before signing up for a policy, carefully read the terms and conditions. This will help you understand your coverage, limitations, and any exclusions.

Pay close attention to the policy’s definitions, exclusions, and limits. For example, understand the deductible amount, the coverage limits, and any specific situations that are not covered.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means a lower premium.

- Coverage Limits: The coverage limits determine the maximum amount your insurer will pay for a covered loss. Ensure the limits are sufficient for your needs, considering the value of your vehicle and potential liabilities.

- Exclusions: The policy will list specific events or situations that are not covered. Understand these exclusions to avoid surprises when you need to file a claim.

Concluding Remarks

Finding the right auto insurance policy is a vital step in protecting yourself and your vehicle. By carefully comparing rates, understanding coverage options, and considering factors beyond price, you can make an informed decision that meets your specific needs and budget. Remember, auto insurance is not a one-size-fits-all solution. Take the time to explore your options and find the policy that provides the best value for you.

FAQ Corner

How often should I compare auto insurance quotes?

It’s generally recommended to compare quotes at least once a year, or even more frequently if you experience significant life changes, such as moving to a new state, getting married, or adding a new driver to your policy.

Can I get a discount for bundling my auto and home insurance?

Yes, many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance. This can save you a significant amount of money on your premiums.

What happens if I get into an accident and don’t have the right coverage?

If you don’t have the appropriate coverage, you could be responsible for paying out-of-pocket for damages, injuries, and legal expenses. This can lead to significant financial hardship.