Auto insurance rates washington state – Auto insurance rates in Washington State can vary significantly depending on a number of factors, making it essential for drivers to understand how these rates are determined and how to find the best coverage at the most affordable price. The Washington State Office of Insurance Commissioner (OIC) plays a crucial role in regulating auto insurance rates, ensuring fair and competitive pricing for consumers.

This guide will delve into the key factors that influence auto insurance rates in Washington State, including driving history, vehicle type, age and gender of the driver, location, and coverage levels. It will also provide practical tips for lowering auto insurance rates and resources for finding the right auto insurance policy.

Understanding Auto Insurance Rates in Washington State

Auto insurance rates in Washington State, like those in other states, are influenced by various factors. These factors are designed to reflect the risk associated with insuring a particular driver and vehicle.

Factors Influencing Auto Insurance Rates

Several factors contribute to the calculation of auto insurance rates in Washington State. Understanding these factors can help you make informed decisions to potentially lower your premiums.

- Driving History: Your driving record is a major factor. A history of accidents, traffic violations, or DUI convictions will likely result in higher premiums. Maintaining a clean driving record is essential for lower rates.

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher premiums. Similarly, insurance companies may adjust rates based on gender due to historical trends in driving behavior.

- Vehicle Type and Value: The type and value of your vehicle significantly impact insurance costs. Luxury cars or high-performance vehicles are generally more expensive to repair or replace, resulting in higher premiums.

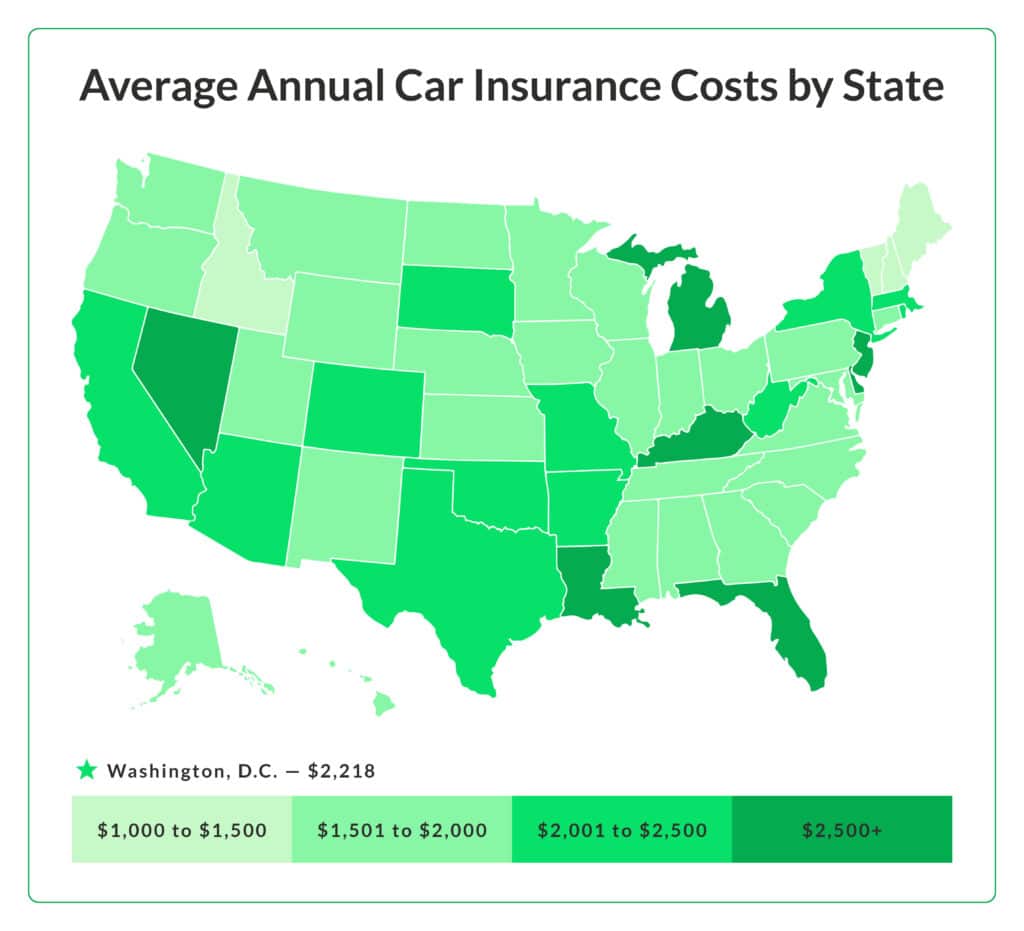

- Location: Where you live influences your insurance rates. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance premiums.

- Credit History: In Washington State, insurance companies are allowed to consider your credit history when determining your rates. Good credit history can indicate financial responsibility, potentially leading to lower premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits, comprehensive, and collision coverage, will affect your premium. Higher coverage levels typically mean higher premiums.

- Discounts: Many insurance companies offer discounts for various factors, including good driving records, safety features in your vehicle, multiple policies with the same insurer, and membership in certain organizations.

Role of the Washington State Office of Insurance Commissioner (OIC)

The Washington State Office of Insurance Commissioner (OIC) plays a crucial role in regulating auto insurance rates. The OIC ensures that insurance rates are fair, reasonable, and not unfairly discriminatory. They have the authority to:

- Review and Approve Rate Filings: Insurance companies must submit rate filings to the OIC for review and approval. The OIC examines these filings to ensure they are justified and comply with state regulations.

- Investigate Complaints: The OIC investigates consumer complaints regarding insurance rates and practices. They can take action against insurance companies that violate state laws or regulations.

- Educate Consumers: The OIC provides information and resources to consumers about auto insurance rates and their rights. This includes guidance on understanding their policies, comparing rates, and filing complaints.

Average Auto Insurance Rates in Washington State

Average auto insurance rates in Washington State can vary depending on the factors discussed earlier. However, as of [insert year], the average annual premium for full coverage auto insurance in Washington State is estimated to be around $2,000. This is slightly higher than the national average, which is approximately $1,800.

It’s important to note that these are just averages, and your individual rate may be higher or lower depending on your specific circumstances.

Key Factors Affecting Auto Insurance Rates

Your auto insurance rates in Washington State are determined by various factors that insurers consider to assess your risk. These factors are used to calculate your premium, which is the amount you pay for coverage. Understanding these factors can help you make informed decisions about your insurance policy and potentially lower your costs.

Driving History

Your driving history is one of the most significant factors affecting your auto insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, having a history of accidents, traffic violations, or DUI convictions can significantly increase your rates. Insurers view these incidents as indicators of a higher risk of future accidents.

- Accidents: Even a single accident can lead to a substantial increase in your insurance rates. The severity of the accident, the fault assigned, and the number of claims filed can all impact your premium.

- Violations: Traffic violations, such as speeding tickets, running red lights, or driving without a license, also contribute to higher rates. These violations demonstrate a lack of safe driving practices and increase the likelihood of future accidents.

- DUI Convictions: Driving under the influence of alcohol or drugs is considered a serious offense and can result in extremely high insurance premiums. Insurers view DUI convictions as a major risk factor, reflecting a pattern of reckless behavior.

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining your auto insurance rates.

- Vehicle Type: Some vehicles are considered higher risk than others due to their performance, safety features, or susceptibility to theft. For example, sports cars or luxury vehicles often have higher premiums due to their higher repair costs and potential for higher speeds.

- Vehicle Value: The value of your vehicle directly impacts your insurance premium. More expensive vehicles typically have higher insurance rates because the cost to repair or replace them is greater.

Age and Gender of the Driver

Age and gender are also factors that insurers consider when calculating auto insurance rates.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher insurance premiums for younger drivers. As drivers gain experience and age, their rates tend to decrease.

- Gender: Historically, insurance companies have observed that male drivers, particularly younger males, have higher accident rates than females. This difference has led to some insurers charging higher premiums for male drivers. However, this practice is becoming less common as gender-based pricing is being challenged in many states.

Location and Driving Habits

Your location and driving habits also influence your auto insurance rates.

- Location: The geographic area where you live can impact your insurance premiums. Areas with high crime rates, heavy traffic, or a higher frequency of accidents may have higher insurance rates.

- Driving Habits: Your driving habits, such as the number of miles you drive annually, the time of day you drive, and your commute distance, can also affect your rates. For example, drivers who commute long distances or frequently drive during peak rush hours may face higher premiums due to increased exposure to accidents.

Coverage Levels

The amount of coverage you choose for your auto insurance policy also influences your premium.

- Liability Coverage: Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Higher liability limits provide greater protection but also result in higher premiums.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

Types of Auto Insurance Coverage in Washington State

Understanding the different types of auto insurance coverage available in Washington State is crucial for making informed decisions about your policy. This knowledge will help you determine the level of protection that best suits your needs and budget.

Liability Coverage, Auto insurance rates washington state

Liability coverage is a crucial component of auto insurance. It protects you financially if you are at fault in an accident that causes injury or damage to another person or property. This coverage pays for the other party’s medical expenses, lost wages, property repairs, and legal fees.

Liability coverage is usually expressed in two numbers, such as 25/50/10.

This means the policy will pay up to $25,000 per person for bodily injury, up to $50,000 per accident for bodily injury, and up to $10,000 per accident for property damage.

It’s important to note that liability coverage only protects you for the damages you cause to others. It doesn’t cover your own injuries or vehicle damage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is essential if you want to protect yourself from financial loss in the event of an accident.

For example, if you collide with another vehicle and your car is totaled, collision coverage will pay the actual cash value of your vehicle, minus your deductible.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, hail, and natural disasters. This coverage is also optional, but it is highly recommended for most drivers, as it can protect you from significant financial losses.

For instance, if your car is stolen and never recovered, comprehensive coverage will pay the actual cash value of your vehicle, minus your deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage pays for your medical expenses, lost wages, and other damages.

For example, if you are hit by a driver who doesn’t have insurance, UM/UIM coverage will pay for your injuries, even if the other driver is at fault.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as “no-fault” coverage, pays for your medical expenses, lost wages, and other damages, regardless of who is at fault in an accident. This coverage is mandatory in Washington State.

PIP coverage provides a certain amount of benefits, such as medical expenses, lost wages, and other expenses, regardless of who is at fault. It is essential for covering your own injuries and expenses in the event of an accident.

Tips for Lowering Auto Insurance Rates

Auto insurance rates in Washington State can vary widely depending on several factors. Fortunately, there are several steps you can take to lower your rates. By understanding the factors that influence your premiums, you can make informed choices to save money on your auto insurance.

Maintaining a Clean Driving Record

A clean driving record is crucial for keeping your auto insurance rates low. In Washington State, insurance companies consider your driving history when determining your premiums. A history of traffic violations, accidents, or DUI convictions will likely result in higher rates.

- Avoid traffic violations: Even minor offenses like speeding tickets can significantly impact your insurance rates. Drive defensively and obey all traffic laws to maintain a clean driving record.

- Take defensive driving courses: Completing a defensive driving course can demonstrate your commitment to safe driving and may even earn you a discount on your insurance premiums. Many insurers offer discounts for completing these courses.

- Report any accidents promptly: If you’re involved in an accident, it’s essential to report it to your insurance company immediately. Failing to do so could jeopardize your coverage and lead to higher premiums.

Choosing a Safe Vehicle

The type of vehicle you drive plays a significant role in determining your auto insurance rates. Safer vehicles with advanced safety features tend to have lower insurance premiums.

- Research vehicle safety ratings: Before purchasing a new or used vehicle, check its safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA). These organizations conduct crash tests and provide safety ratings based on various criteria.

- Consider vehicles with advanced safety features: Vehicles equipped with features like anti-lock brakes, electronic stability control, and airbags can significantly reduce the risk of accidents and, in turn, lower your insurance premiums.

Bundling Insurance Policies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can often result in significant savings.

- Inquire about multi-policy discounts: Contact your insurance company to see if they offer discounts for bundling your policies. Many insurers provide discounts for combining auto insurance with other types of insurance.

Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums.

- Evaluate your risk tolerance: Consider how much you’re comfortable paying out of pocket in case of an accident. Increasing your deductible can save you money on premiums, but it also means you’ll have to pay more in case of a claim.

Shopping Around for Quotes

It’s essential to compare quotes from multiple insurers to find the best rates for your specific needs.

- Use online comparison tools: Several online comparison websites allow you to enter your information and receive quotes from various insurers. This can save you time and effort in gathering quotes manually.

- Contact insurers directly: Don’t hesitate to contact insurers directly to get personalized quotes and discuss your insurance needs.

Finding the Right Auto Insurance Policy

Finding the right auto insurance policy is crucial for protecting yourself financially in case of an accident. It’s not just about getting the cheapest policy, but about ensuring you have the right coverage to meet your needs and budget.

Comparing Quotes from Different Insurers

Comparing quotes from different insurers is the most effective way to find the best coverage at the most affordable price. Each insurer uses its own rating factors and pricing models, resulting in varying rates for the same coverage. By comparing quotes, you can identify the insurer offering the best value for your specific needs.

Resources and Tools for Finding and Comparing Auto Insurance Quotes

Several resources and tools are available to help you find and compare auto insurance quotes in Washington State.

- Online Comparison Websites: Websites like Insurance.com, Bankrate, and NerdWallet allow you to enter your information once and receive quotes from multiple insurers. These websites can save you time and effort in comparing quotes.

- Insurance Agent or Broker: An independent insurance agent or broker can work with you to compare quotes from multiple insurers and recommend the best policy based on your individual needs.

- Direct Insurers: Many insurers offer online quoting tools and allow you to purchase policies directly through their websites. This can be a convenient option, but it’s essential to compare quotes from multiple insurers before making a decision.

Comparing Key Features and Rates of Popular Auto Insurance Providers in Washington State

The following table compares key features and rates of some popular auto insurance providers in Washington State. It’s essential to note that rates can vary significantly based on individual factors like driving history, age, location, and vehicle type.

| Insurer | Average Annual Premium | Key Features |

|---|---|---|

| Geico | $1,200 | Excellent customer service, competitive rates, discounts for good drivers and bundling policies |

| State Farm | $1,300 | Wide range of coverage options, strong financial stability, extensive agent network |

| Progressive | $1,100 | Innovative features like Name Your Price tool, personalized coverage options, discounts for safe driving |

| USAA | $1,000 | Exclusive to military members and their families, excellent customer service, competitive rates |

Outcome Summary: Auto Insurance Rates Washington State

Navigating the world of auto insurance can be daunting, but by understanding the factors that affect rates and utilizing available resources, Washington State drivers can find the coverage they need at a price that fits their budget. By comparing quotes from different insurers, maintaining a clean driving record, and taking advantage of discounts, drivers can save money on their auto insurance premiums while ensuring they are adequately protected on the road.

FAQs

What is the average auto insurance rate in Washington State?

The average auto insurance rate in Washington State can vary depending on factors like coverage levels, vehicle type, and driver profile. It’s best to get personalized quotes from different insurers to determine your specific rate.

How often can I adjust my auto insurance policy?

You can usually adjust your auto insurance policy at any time, such as when you get a new car, move to a different location, or experience a change in your driving record. It’s advisable to review your policy periodically to ensure it still meets your needs.

What happens if I get into an accident with an uninsured driver?

If you get into an accident with an uninsured driver, your uninsured/underinsured motorist coverage can help protect you. This coverage will pay for damages to your vehicle and medical expenses, up to your policy limits.

How can I get a discount on my auto insurance?

There are several ways to get a discount on your auto insurance, such as maintaining a clean driving record, taking a defensive driving course, bundling your insurance policies, and installing safety features in your vehicle.