Average auto insurance cost in Washington state can vary significantly depending on a number of factors, including your driving history, the type of vehicle you drive, and the level of coverage you choose. While the national average for auto insurance may provide a general benchmark, understanding the unique factors that influence costs in Washington is crucial for making informed decisions about your coverage.

This guide will delve into the intricacies of auto insurance in Washington, exploring the key factors that impact premiums, offering tips for finding affordable coverage, and highlighting available discounts and savings opportunities. By understanding the nuances of Washington’s auto insurance landscape, you can navigate the process with confidence and secure the best possible protection for yourself and your vehicle.

Average Auto Insurance Costs in Washington State

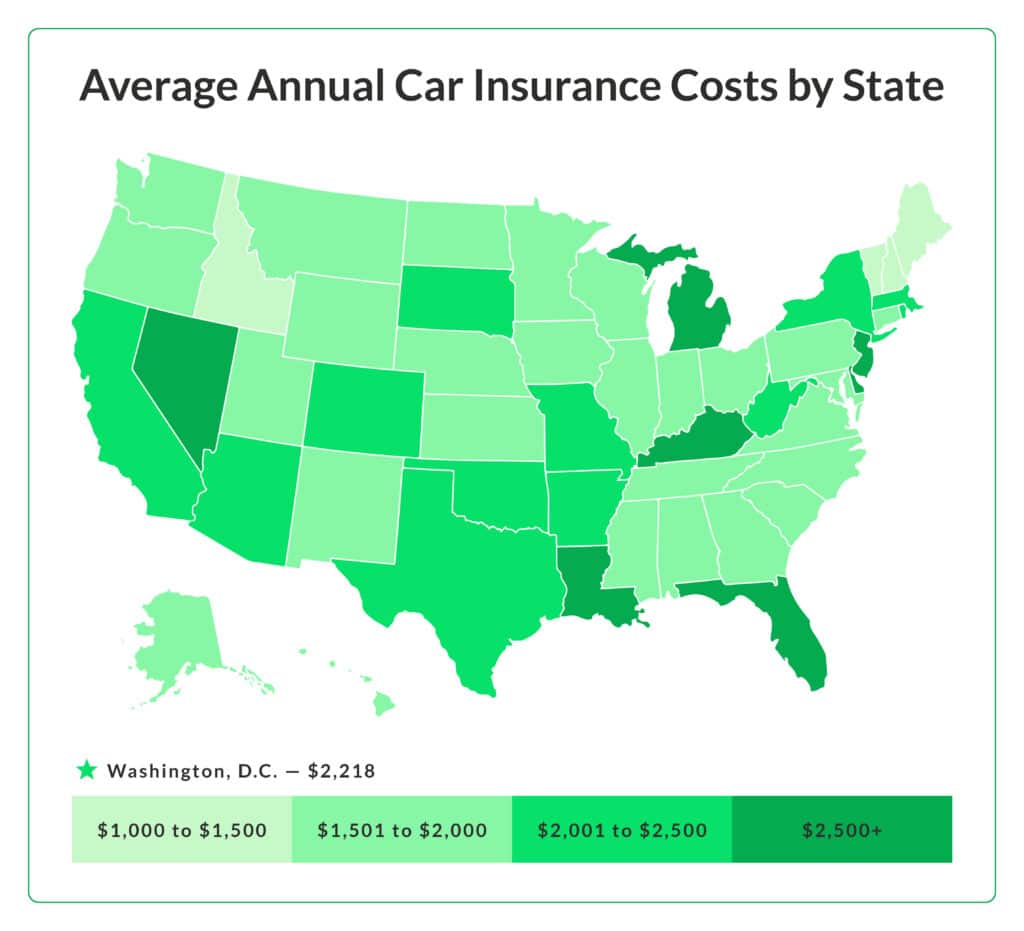

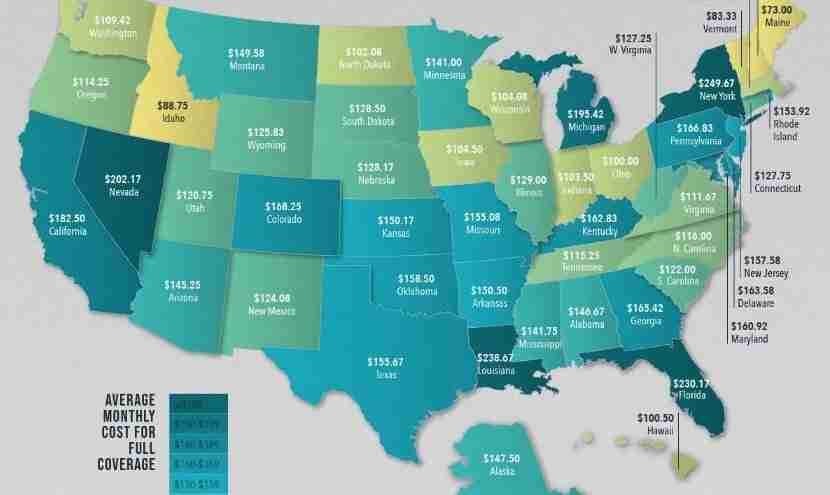

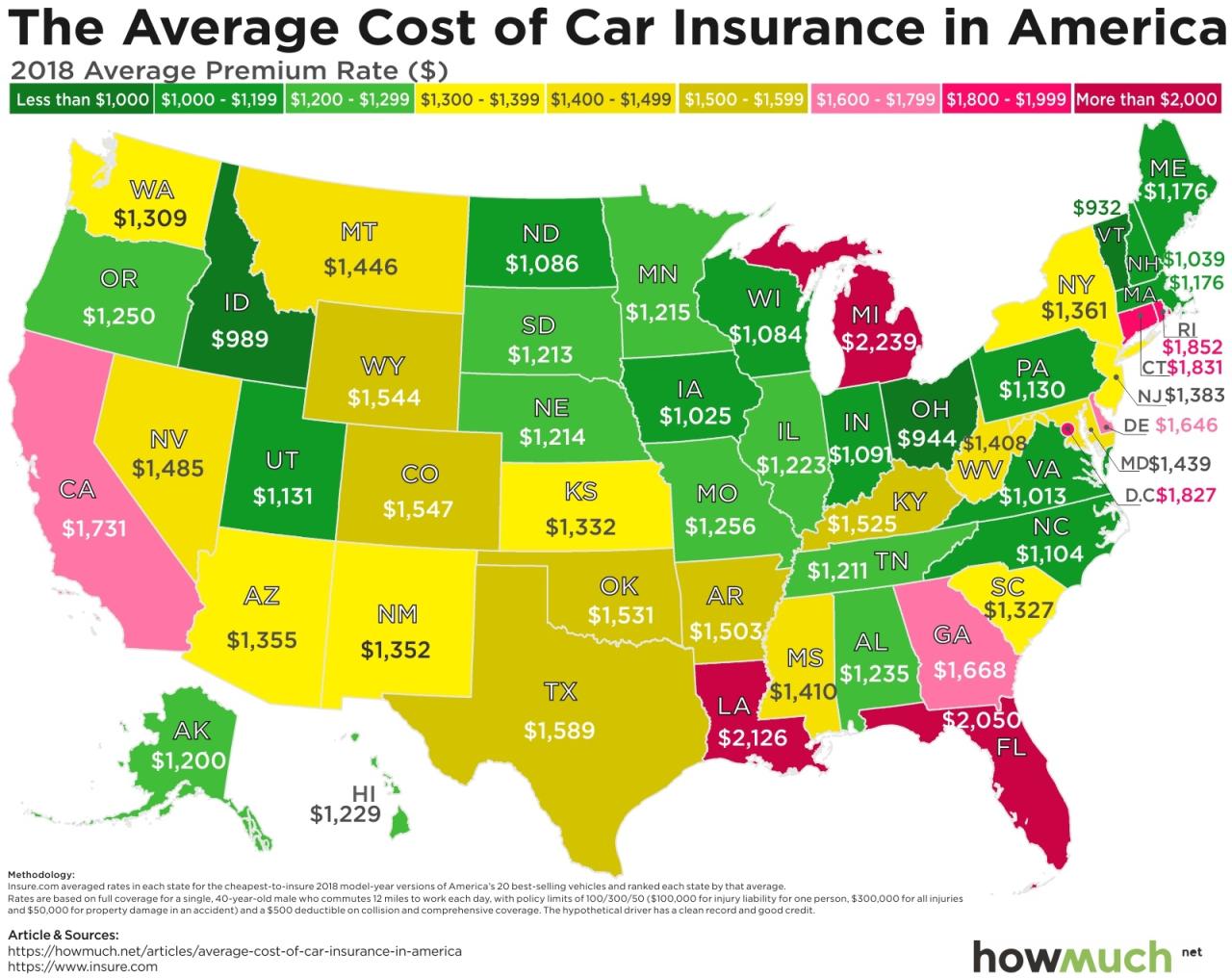

The cost of auto insurance in Washington state can vary depending on several factors. On average, drivers in Washington pay around $2,000 per year for car insurance, which is slightly higher than the national average of $1,771. However, the actual cost can fluctuate significantly based on individual circumstances.

Factors Influencing Average Costs

Several factors contribute to the variation in auto insurance costs in Washington state. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premiums.

- Demographics: Age, gender, and marital status can influence insurance rates. Younger and unmarried drivers often face higher premiums due to their higher risk profiles.

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, drivers with a history of accidents or traffic tickets may face higher rates.

- Vehicle Type: The type of vehicle you drive plays a significant role in insurance costs. Luxury cars, high-performance vehicles, and vehicles with expensive repair parts typically have higher insurance premiums.

- Location: The city or region where you live can impact your insurance rates. Areas with higher crime rates or traffic congestion tend to have higher insurance costs.

- Coverage Options: The type and amount of coverage you choose will directly affect your premium. Choosing a higher deductible or opting for less comprehensive coverage can lower your monthly payments.

Average Costs by City or Region, Average auto insurance cost in washington state

While the average cost of auto insurance in Washington state is around $2,000 per year, the actual cost can vary significantly depending on the specific city or region. For example, drivers in Seattle might face higher premiums compared to those in rural areas due to factors like higher population density, traffic congestion, and potential for theft.

Factors Affecting Auto Insurance Premiums: Average Auto Insurance Cost In Washington State

Numerous factors influence your auto insurance premiums in Washington state, impacting the final cost you pay. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your insurance rates. Insurance companies use this information to assess your risk of being involved in an accident.

- Accidents: If you have been involved in accidents, especially those where you were at fault, your insurance premiums will likely increase. The severity of the accident and the number of claims you have filed will impact the increase. For instance, a minor fender bender might result in a smaller premium increase compared to a major accident with significant damage or injuries.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, or driving under the influence (DUI), can significantly raise your insurance rates. These violations indicate a higher risk of future accidents, leading insurance companies to charge higher premiums. For example, a DUI conviction could result in a substantial increase in your premiums, as it demonstrates a pattern of risky behavior.

Vehicle Type and Value

The type and value of your vehicle directly influence your insurance premiums.

- Vehicle Type: Sports cars and luxury vehicles are generally more expensive to repair or replace, leading to higher insurance premiums. This is because these vehicles often have more advanced features and components, which can be costly to repair or replace in the event of an accident. On the other hand, older, less expensive vehicles may have lower insurance premiums due to their lower repair and replacement costs.

- Vehicle Value: The higher the value of your vehicle, the more it will cost to insure. This is because insurance companies have to pay more to replace or repair a high-value vehicle in the event of an accident. For instance, a new luxury car will have a significantly higher premium than a used, less expensive vehicle.

Coverage Levels

The amount of coverage you choose impacts your insurance premiums.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause damage to another person’s property or injuries. Higher liability limits provide more protection but will result in higher premiums. For instance, a minimum liability coverage limit might cost less than a higher limit, but it offers less financial protection in the event of a significant accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault. Choosing a higher deductible, which is the amount you pay out of pocket before your insurance kicks in, can lower your premiums. However, you will have to pay more upfront in the event of an accident.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, or natural disasters. Like collision coverage, a higher deductible can lower your premiums.

Credit Score and Age

Your credit score and age can also affect your insurance premiums.

- Credit Score: Insurance companies use credit scores as a proxy for risk assessment. A higher credit score generally indicates a lower risk of filing a claim, resulting in lower premiums. This is because individuals with good credit histories tend to be more financially responsible and less likely to engage in risky behaviors, including reckless driving.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, insurance companies charge higher premiums for young drivers. However, as drivers age and gain experience, their premiums tend to decrease. This is because older drivers have a lower risk of being involved in accidents due to their greater experience and better driving habits.

Finding Affordable Auto Insurance

Finding affordable auto insurance in Washington state is crucial, especially considering the high average costs. Fortunately, several strategies can help you secure competitive rates and save money on your premiums.

Comparing Quotes from Different Insurance Providers

It’s essential to compare quotes from multiple insurance providers to find the best deal. This allows you to evaluate different coverage options, deductibles, and pricing structures.

- Utilize online comparison websites that aggregate quotes from various insurers. These platforms streamline the process and allow you to quickly compare rates side-by-side.

- Contact insurance providers directly to obtain personalized quotes. This allows you to discuss your specific needs and ask questions about their policies.

- Consider contacting independent insurance brokers who represent multiple insurers. They can help you compare quotes and find the best coverage for your needs.

Bundling Auto and Other Insurance Policies

Bundling your auto insurance with other policies, such as homeowners, renters, or life insurance, can lead to significant discounts. Insurance companies often offer bundled discounts to encourage customers to purchase multiple policies from them.

Negotiating Lower Premiums with Insurers

Negotiating lower premiums with insurers is a valuable skill that can save you money.

- Demonstrate a good driving record by highlighting your years of safe driving experience and lack of accidents or violations.

- Inquire about discounts for safety features in your vehicle, such as anti-theft devices, airbags, and anti-lock brakes.

- Explore options for increasing your deductible, which can lower your premium. Remember to choose a deductible you can comfortably afford in case of an accident.

- Consider paying your premium annually instead of monthly to potentially secure a lower rate.

Understanding Policy Terms and Conditions

Before signing any auto insurance policy, it’s crucial to carefully read and understand the terms and conditions.

- Familiarize yourself with the coverage limits, deductibles, and exclusions.

- Pay close attention to the definitions of key terms, such as “accident,” “collision,” and “comprehensive coverage.”

- Ensure you understand the process for filing a claim and the responsibilities of the insurer in case of an accident.

Insurance Discounts and Savings

Lowering your auto insurance premiums in Washington state is possible by taking advantage of various discounts offered by insurance companies. These discounts can significantly reduce your overall costs, making insurance more affordable.

Discounts Available in Washington State

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits. Insurance companies often offer discounts for drivers who have not been involved in accidents or received traffic violations within a specified period.

- Good Student Discount: Students who maintain a high GPA (typically 3.0 or higher) can qualify for this discount. Insurance companies recognize that good students tend to be more responsible and less likely to engage in risky behavior.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company often results in a multi-car discount. This discount is typically applied to all vehicles on the policy, providing a cost-effective solution for families or individuals with multiple cars.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms, immobilizers, or GPS tracking systems, can lower your premium. These devices deter theft and reduce the risk of claims for the insurance company.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies often offer discounts to drivers who have successfully completed these courses, recognizing their enhanced driving skills.

- Loyalty Discount: Insurance companies may reward long-term customers with loyalty discounts. This discount acknowledges the sustained relationship with the insured and encourages continued business.

- Bundling Discount: Bundling your auto insurance with other insurance policies, such as home, renters, or life insurance, can lead to significant savings. Insurance companies often offer discounts for bundling multiple policies together.

Benefits of Driver Safety Courses

Taking a driver safety course can offer numerous benefits beyond just saving money on your insurance. These courses provide valuable information and skills that can enhance your driving abilities, improve your safety on the road, and reduce your risk of accidents.

- Improved Driving Skills: Driver safety courses focus on essential driving techniques, such as defensive driving strategies, hazard recognition, and safe vehicle handling. This knowledge can help you become a more confident and skilled driver.

- Enhanced Road Awareness: These courses emphasize the importance of situational awareness and understanding the potential risks associated with driving. By learning to anticipate potential hazards, you can make safer decisions on the road.

- Reduced Risk of Accidents: By acquiring safer driving practices, you can significantly reduce your risk of being involved in accidents. This not only protects yourself and others but also lowers your insurance premiums.

- Potential Traffic Ticket Reduction: In some cases, completing a driver safety course may qualify you for a reduction in traffic ticket fines. Check with your local traffic court for specific requirements and eligibility.

Maximizing Discounts and Savings

To maximize your savings on auto insurance premiums, it’s essential to understand the discounts available and how to qualify for them.

- Compare Quotes: Shop around and compare quotes from multiple insurance companies to find the best rates and discounts.

- Review Your Policy: Regularly review your insurance policy to ensure you’re taking advantage of all available discounts.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to maintain your safe driver discount.

- Bundle Policies: Combine your auto insurance with other insurance policies to benefit from bundling discounts.

- Consider Safety Features: Install anti-theft devices or other safety features in your vehicle to qualify for relevant discounts.

- Take a Driver Safety Course: Invest in a defensive driving course to improve your skills and potentially reduce your premiums.

State Regulations and Laws

Washington state has a comprehensive set of auto insurance regulations designed to protect drivers, passengers, and pedestrians. These regulations ensure that drivers have adequate financial responsibility to cover potential damages and injuries caused by accidents.

Minimum Liability Coverage Requirements

Washington state mandates that all drivers carry a minimum amount of liability insurance to cover potential damages and injuries to others in case of an accident. This mandatory insurance is known as “financial responsibility” insurance.

- Bodily Injury Liability: This coverage protects you from financial losses if you injure someone in an accident. The minimum required coverage is $25,000 per person and $50,000 per accident. This means that if you injure one person, your insurance will cover up to $25,000 in medical expenses, lost wages, and other damages. If you injure multiple people in the same accident, your insurance will cover up to $50,000 in total.

- Property Damage Liability: This coverage protects you from financial losses if you damage someone else’s property in an accident. The minimum required coverage is $10,000 per accident. This means that if you damage someone’s car or other property, your insurance will cover up to $10,000 in repairs or replacement costs.

Financial Responsibility Laws

Washington state’s financial responsibility laws ensure that drivers have the financial means to cover potential damages and injuries resulting from accidents. These laws are designed to protect innocent parties and prevent uninsured drivers from causing financial hardship.

- Proof of Insurance: All drivers in Washington state are required to carry proof of insurance in their vehicle. This proof can be in the form of an insurance card, a declaration page from their insurance policy, or an electronic version of their insurance information. Drivers can be pulled over and fined for not having proof of insurance.

- Financial Responsibility Requirements: If a driver is involved in an accident and does not have insurance, they may be required to provide proof of financial responsibility to the state. This can be done by purchasing insurance or by posting a bond with the state. Failure to comply with these requirements can result in license suspension or revocation.

End of Discussion

Navigating the world of auto insurance in Washington can seem daunting, but with the right knowledge and strategies, you can find affordable coverage that meets your specific needs. By understanding the factors that influence premiums, exploring available discounts, and comparing quotes from different providers, you can make informed decisions and secure the best possible protection for yourself and your vehicle.

FAQ Compilation

What are the minimum liability coverage requirements in Washington state?

Washington state requires drivers to carry a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 for property damage liability.

How does my credit score affect my auto insurance rates?

In Washington, insurers can use your credit score as a factor in determining your auto insurance rates. A higher credit score generally leads to lower premiums.

Are there any discounts available for young drivers in Washington?

Yes, some insurers offer discounts for young drivers who maintain good grades or complete driver education courses.