Auto insurance no fault states – Auto insurance no-fault states set the stage for this enthralling narrative, offering readers a glimpse into a unique system where fault is not the primary factor in determining who pays for accident-related damages. This system, prevalent in certain parts of the United States, has a fascinating history, a set of distinct advantages, and some inherent drawbacks that warrant careful consideration.

No-fault insurance, in essence, shifts the focus from assigning blame to ensuring prompt compensation for injuries and property damage. This approach, while appealing for its efficiency and potential cost-saving benefits, raises questions about the potential for limited compensation and the role of the traditional legal system in resolving disputes.

What is No-Fault Auto Insurance?

No-fault auto insurance is a type of insurance system where drivers are primarily responsible for covering their own losses after a car accident, regardless of who is at fault. This system aims to simplify the claims process and reduce the number of lawsuits.

No-fault insurance systems operate on the principle that each driver is responsible for their own injuries and damages, even if they were not at fault in an accident. This differs from traditional fault-based systems, where the at-fault driver is held responsible for the other driver’s losses.

Fundamental Principles of No-Fault Insurance Systems

No-fault insurance systems are built on several key principles that distinguish them from traditional fault-based systems.

- First-Party Coverage: Under a no-fault system, drivers are covered by their own insurance policy, regardless of who caused the accident. This means that drivers file claims with their own insurer for their medical expenses, lost wages, and property damage.

- Limited Right to Sue: No-fault systems generally restrict the right to sue for pain and suffering or other non-economic damages, except in cases of serious injury or death. This limitation aims to reduce litigation and expedite the claims process.

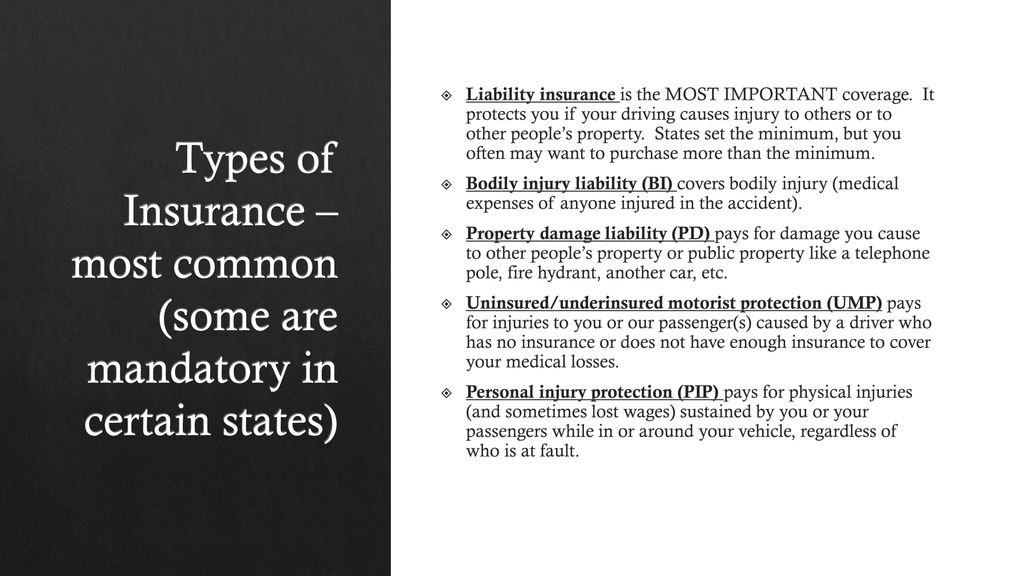

- Personal Injury Protection (PIP): No-fault systems typically include personal injury protection (PIP) coverage, which pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. This coverage is often mandatory in no-fault states.

- Thresholds for Filing Lawsuits: No-fault systems often establish thresholds, such as a specific dollar amount of medical expenses or a certain level of injury severity, that must be met before a driver can sue the at-fault party for pain and suffering or other non-economic damages.

Differences Between No-Fault and Traditional Fault-Based Systems

No-fault insurance systems differ significantly from traditional fault-based systems in terms of how claims are handled and who is responsible for paying for damages.

- Claim Filing and Payment: In a no-fault system, drivers file claims with their own insurer, while in a fault-based system, the injured party typically files a claim with the at-fault driver’s insurer.

- Liability Determination: No-fault systems do not require a determination of fault for the insured driver to receive benefits, while fault-based systems require a determination of fault to assign liability and determine compensation.

- Right to Sue: No-fault systems generally restrict the right to sue for non-economic damages, while fault-based systems allow injured parties to sue the at-fault driver for all damages, including pain and suffering.

- Focus on Compensation: No-fault systems focus on providing prompt and fair compensation to injured drivers, while fault-based systems often involve lengthy legal battles to determine fault and compensation.

No-Fault States in the US

No-fault auto insurance is a system where drivers are primarily responsible for covering their own losses after an accident, regardless of who is at fault. This system is in place in 12 states and the District of Columbia.

States with No-Fault Insurance

This section will Artikel the states that have adopted no-fault insurance, along with the year of adoption.

| State | Year Adopted |

|---|---|

| Florida | 1971 |

| Hawaii | 1974 |

| Kansas | 1974 |

| Kentucky | 1975 |

| Michigan | 1973 |

| Minnesota | 1974 |

| New Jersey | 1973 |

| New York | 1973 |

| North Dakota | 1975 |

| Pennsylvania | 1975 |

| Rhode Island | 1971 |

| Utah | 1973 |

| District of Columbia | 1975 |

States with Modified No-Fault Systems

Some states have adopted a modified no-fault system, which allows drivers to sue for damages in certain situations.

For example, drivers may be able to sue for damages if their injuries exceed a certain threshold, such as a specific amount of medical expenses or a permanent disability.

The following states have modified no-fault systems:

- Delaware: Delaware has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- Massachusetts: Massachusetts has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- Maryland: Maryland has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- New Hampshire: New Hampshire has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- New York: New York has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- Oregon: Oregon has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- Texas: Texas has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

- Virginia: Virginia has a modified no-fault system that allows drivers to sue for damages if their injuries exceed a certain threshold.

Benefits of No-Fault Auto Insurance: Auto Insurance No Fault States

No-fault insurance offers several advantages for both drivers and insurance companies, compared to traditional fault-based systems. It streamlines the claims process, promotes efficiency, and can lead to lower overall insurance costs.

Benefits for Drivers

No-fault insurance offers several advantages for drivers, making it a more convenient and potentially cost-effective option:

- Faster Claim Processing: No-fault insurance eliminates the need for lengthy investigations to determine fault after an accident. This streamlines the claims process, allowing drivers to receive compensation more quickly.

- Reduced Legal Costs: By eliminating the need to prove fault in court, no-fault insurance reduces the potential for expensive legal battles. This can save drivers significant money in legal fees and court costs.

- Guaranteed Coverage: No-fault insurance provides drivers with guaranteed coverage for their own medical expenses and lost wages, regardless of who caused the accident. This ensures that drivers are protected in case of an accident, even if they are at fault.

- Increased Access to Treatment: No-fault insurance often provides broader coverage for medical expenses, including rehabilitation and physical therapy. This allows drivers to receive the necessary treatment to recover from their injuries without facing financial barriers.

Benefits for Insurance Companies

No-fault insurance also offers benefits for insurance companies:

- Reduced Litigation Costs: By eliminating the need to defend against lawsuits, no-fault insurance significantly reduces litigation costs for insurance companies. This allows them to allocate more resources to other areas of their business.

- Predictable Costs: No-fault insurance provides insurance companies with a more predictable claims environment, as they are not subject to the fluctuations of fault determination and litigation. This allows them to better manage their risk and pricing.

- Simplified Claims Process: No-fault insurance streamlines the claims process, making it easier and faster for insurance companies to process claims. This reduces administrative costs and improves efficiency.

Benefits Compared to Traditional Systems

No-fault insurance offers several advantages over traditional fault-based systems:

- Faster Claim Resolution: No-fault insurance eliminates the need for lengthy investigations to determine fault, resulting in faster claim resolution. This is in contrast to traditional systems, where claims can be delayed by disputes over fault.

- Reduced Legal Disputes: By eliminating the need to prove fault in court, no-fault insurance reduces the number of legal disputes. This promotes a more amicable and efficient claims process.

- Potentially Lower Premiums: While not always the case, no-fault insurance can potentially lead to lower premiums for drivers. The reduced litigation costs and predictable claims environment can contribute to lower insurance premiums.

Drawbacks of No-Fault Auto Insurance

No-fault auto insurance, despite its advantages, also presents certain drawbacks that are important to consider. While it aims to streamline the claims process and reduce litigation, some aspects of the system can lead to challenges for policyholders.

Limited Compensation

No-fault insurance systems often have limits on the amount of compensation available for certain types of damages. This can be a significant concern for individuals who have suffered serious injuries or significant property damage in an accident. For example, a policy might have a cap on the amount payable for pain and suffering, or for medical expenses exceeding a specific threshold. These limits can leave individuals struggling to cover their medical bills, lost wages, and other expenses.

Potential for Higher Premiums

While no-fault systems aim to reduce litigation costs, some argue that they can lead to higher insurance premiums in the long run. This is because the system often encourages more claims, as individuals are more likely to file for compensation even for minor injuries. The increased claims volume can lead to higher payouts for insurance companies, which they may pass on to policyholders in the form of increased premiums.

Difficulty in Pursuing Fault-Based Claims

No-fault insurance systems can make it difficult for individuals to pursue fault-based claims for damages that exceed the no-fault benefits. This is because the system prioritizes the quick resolution of claims through the no-fault process, and pursuing a fault-based claim can be a more complex and time-consuming process. This can be particularly challenging for individuals who have suffered significant injuries and believe they are entitled to greater compensation.

“No-fault insurance is a system of automobile insurance that requires drivers to be compensated for their own injuries and damages by their own insurance company, regardless of who is at fault in an accident.”

Concerns Regarding Unfairness

Some argue that no-fault systems can be unfair to victims of accidents who have suffered serious injuries, especially when the limits on compensation are low. They argue that individuals who have been injured by negligent drivers should be able to pursue full compensation for their losses, regardless of the no-fault system’s limitations.

Limited Coverage for Non-Economic Damages

No-fault insurance often provides limited coverage for non-economic damages such as pain and suffering, emotional distress, and loss of companionship. This can be a significant issue for individuals who have suffered severe injuries or lost loved ones in an accident.

Key Components of No-Fault Insurance

No-fault insurance is a system that aims to simplify and expedite the claims process after a car accident. This system has several key components that are essential for its functionality.

Personal Injury Protection (PIP), Auto insurance no fault states

PIP coverage is a crucial part of no-fault insurance. It provides financial protection for medical expenses, lost wages, and other related costs incurred due to injuries sustained in a car accident, regardless of who was at fault. This coverage is usually mandatory in no-fault states, and the amount of coverage varies by state. PIP coverage can be used to pay for:

- Medical expenses, including doctor visits, hospital stays, and rehabilitation services

- Lost wages, which can help compensate for income lost due to injury-related absences from work

- Other expenses, such as funeral costs in the event of a fatality

Assigned Benefits System

The assigned benefits system is a key feature of no-fault insurance. It simplifies the claims process by assigning responsibility for handling the claim to the insurer of the injured party, rather than the at-fault driver’s insurer. This system streamlines the process and helps avoid lengthy disputes over fault. The assigned benefits system works as follows:

- After an accident, the injured party files a claim with their own insurance company.

- The insurer then becomes responsible for handling the claim and paying benefits, regardless of who caused the accident.

- This process eliminates the need for complex investigations and negotiations between multiple insurance companies, making the claims process more efficient.

Filing a Claim Under No-Fault Insurance

Filing a claim under no-fault insurance is typically straightforward. The process usually involves the following steps:

- Contact your insurance company as soon as possible after the accident.

- Provide your insurance company with details of the accident, including the date, time, location, and the other parties involved.

- Seek medical attention if you have been injured and provide your insurance company with medical records and bills.

- Your insurance company will review your claim and process payments for eligible expenses.

Impact of No-Fault Insurance on Claims

No-fault insurance significantly impacts the claims process, streamlining it and simplifying the initial stages of claim resolution. However, the impact extends beyond mere simplification, influencing how claims are filed, processed, and ultimately resolved.

Assigned Benefits System

The assigned benefits system is a cornerstone of no-fault insurance, directly influencing how claims are handled. In no-fault states, drivers are typically required to seek treatment and file claims with their own insurer, regardless of who caused the accident. This system eliminates the need for fault determination during the initial stages of the claim, accelerating the process.

- Simplified Initial Claim Filing: The assigned benefits system simplifies the initial claim filing process, as policyholders file claims with their own insurer, regardless of fault. This eliminates the need for complex fault investigations and the associated delays.

- Prompt Payment of Benefits: No-fault insurance mandates prompt payment of benefits to policyholders, regardless of fault, within a specified timeframe. This ensures policyholders receive timely medical and other benefits without having to wait for fault determination.

- Limited Legal Disputes: The assigned benefits system generally minimizes legal disputes during the initial stages of the claim. Since fault is not a primary concern for the initial claim, disputes related to fault are less likely to arise.

Common Claim Scenarios in No-Fault States

No-fault insurance simplifies the initial claim process, but certain scenarios still require specific considerations.

- Medical Expenses: No-fault insurance covers medical expenses incurred due to an accident, regardless of fault. This includes expenses for emergency care, hospitalization, rehabilitation, and other medical treatments.

- Lost Wages: In many no-fault states, lost wages are covered under the policy, allowing policyholders to receive compensation for income lost due to injuries sustained in an accident. This helps individuals maintain financial stability during their recovery period.

- Property Damage: While no-fault insurance primarily focuses on personal injury claims, it may also cover property damage in some cases. However, the coverage for property damage may be limited, and the threshold for coverage may vary by state.

- Serious Injuries: In cases of serious injuries, the no-fault system may transition to a tort system, allowing the injured party to pursue legal action against the at-fault driver. This transition typically occurs when the injuries exceed a certain threshold, known as the “serious injury threshold,” as defined by the state’s no-fault laws.

No-Fault Insurance and Legal Considerations

No-fault insurance systems, while designed to simplify the claims process and expedite compensation, also introduce unique legal considerations that affect both policyholders and insurers. This section explores the legal framework surrounding no-fault insurance, including its relationship with the traditional tort system and the implications for legal disputes.

The Role of the Tort System in No-Fault States

In no-fault states, the traditional tort system, which allows individuals to sue for damages caused by negligence, still exists but is modified. While no-fault insurance covers basic medical expenses and lost wages, it doesn’t necessarily eliminate the right to sue for additional damages.

- Limited Tort: Some no-fault states adopt a “limited tort” system, restricting the right to sue for pain and suffering unless the injuries meet certain thresholds, such as serious injury or permanent disability. This aims to reduce frivolous lawsuits and keep insurance premiums lower.

- No-Fault Thresholds: In limited tort states, thresholds for suing for pain and suffering vary. Some states may require significant medical expenses, while others might require permanent disability or disfigurement.

- Tort System and No-Fault: No-fault insurance operates alongside the tort system, meaning that if your injuries exceed the no-fault coverage, you can still pursue a claim through the traditional tort system to recover additional damages.

Legal Cases Involving No-Fault Insurance

No-fault insurance has led to a variety of legal cases, particularly concerning the interpretation of no-fault laws, the application of thresholds, and the interplay between no-fault and tort systems.

- Threshold Disputes: Cases often arise regarding the interpretation of thresholds for pain and suffering claims. For instance, courts may be asked to determine whether a specific injury meets the threshold for suing under a limited tort system.

- Stacking Coverage: Cases may involve disputes about stacking coverage, where multiple no-fault policies are available, such as in situations involving multiple vehicles or family members.

- Subrogation: No-fault insurers have the right to subrogate, meaning they can pursue a claim against a negligent party who caused the accident to recover the benefits they paid out. This can lead to legal disputes over liability and the amount of recovery.

“No-fault insurance systems, while designed to simplify the claims process and expedite compensation, also introduce unique legal considerations that affect both policyholders and insurers.”

No-Fault Insurance and the Future

The future of no-fault insurance in the US is a subject of ongoing debate and speculation. Several factors will likely influence its evolution, leading to potential changes in the system as we know it.

Factors Influencing the Future of No-Fault Insurance

Several factors are likely to influence the future of no-fault insurance in the US.

- Changing Demographics: The aging population and increasing urbanization are leading to more complex traffic patterns and a higher risk of accidents. These changes may necessitate adjustments to no-fault systems to address the evolving needs of drivers.

- Technological Advancements: The rise of autonomous vehicles and connected car technology has the potential to significantly impact no-fault systems. These technologies could reduce accidents, but they also raise new questions about liability and insurance coverage.

- Economic Conditions: Economic fluctuations can influence insurance premiums and the affordability of no-fault coverage. Periods of economic hardship may lead to calls for reforms to make no-fault insurance more accessible.

- Public Opinion: Public perception of no-fault insurance is another important factor. Growing dissatisfaction with the system or concerns about its effectiveness could lead to calls for reform or even the abolition of no-fault insurance.

Predictions about the Future of No-Fault Insurance

While predicting the future is always challenging, several possibilities exist regarding the evolution of no-fault insurance in the US.

- Expansion of No-Fault Systems: Some states may consider expanding their no-fault systems to cover more types of accidents or injuries. This could be driven by a desire to streamline the claims process and reduce litigation costs. For example, some states might expand coverage to include accidents involving pedestrians or cyclists.

- Modifications to Existing Systems: Rather than complete overhauls, some states may choose to modify their existing no-fault systems to address specific concerns. These modifications could involve changes to benefit levels, eligibility criteria, or the dispute resolution process. For instance, states could adjust the threshold for accessing tort liability in certain cases.

- Hybrid Systems: Some states might adopt hybrid systems that combine elements of no-fault insurance with traditional tort liability. This could involve allowing injured parties to sue for damages in specific circumstances, such as when the injuries are severe or when the other driver was at fault. For example, a hybrid system might allow victims to pursue a tort claim if their injuries exceed a certain threshold.

- Potential for Decline: While less likely, some states may consider abandoning no-fault insurance altogether, particularly if public dissatisfaction with the system grows or if alternative models emerge as more effective. For instance, some states might consider adopting a system based on shared responsibility or a comprehensive insurance scheme.

Final Conclusion

Navigating the world of auto insurance can be complex, especially when dealing with no-fault systems. Understanding the intricacies of this system, its benefits, and its limitations is crucial for making informed decisions about your coverage. Whether you reside in a no-fault state or are considering moving to one, this guide has provided a comprehensive overview to help you navigate the landscape of auto insurance with greater clarity.

Top FAQs

What is the main difference between no-fault and traditional fault-based auto insurance?

In a traditional fault-based system, the at-fault driver is responsible for covering the damages of the other party. In a no-fault system, each driver is responsible for their own damages, regardless of fault.

How does Personal Injury Protection (PIP) work in no-fault states?

PIP coverage pays for medical expenses, lost wages, and other related expenses resulting from an accident, regardless of fault. The amount of coverage varies by state.

Can I sue the other driver in a no-fault state?

In most no-fault states, you can only sue the other driver if your injuries exceed a certain threshold, known as the “threshold.” This threshold varies by state.

What are the potential drawbacks of no-fault insurance?

Potential drawbacks include the possibility of limited compensation, increased insurance premiums, and potential difficulty in recovering damages for serious injuries.

What are the future trends in no-fault insurance?

The future of no-fault insurance is uncertain. Some states are considering modifications to their no-fault systems, while others are debating whether to adopt no-fault altogether.