What is state minimum auto insurance? It’s a legal requirement in every state that forces car owners to carry a minimum level of insurance coverage. This coverage is designed to protect drivers and their passengers from financial ruin in the event of an accident. It’s not just about complying with the law, it’s about ensuring you’re prepared for the unexpected.

While the minimum coverage requirements vary from state to state, they typically include liability coverage, property damage liability, and personal injury protection. This coverage helps pay for damages to other vehicles or property, medical expenses, and lost wages in case of an accident.

What is State Minimum Auto Insurance?

Every state in the United States mandates that drivers carry a minimum amount of auto insurance to protect themselves and others in the event of an accident. This requirement ensures that drivers are financially responsible for any damages or injuries they may cause.

Minimum Coverage Requirements by State

Each state sets its own minimum coverage requirements, which vary depending on the type of coverage and the amount of financial protection they provide. The following table summarizes the minimum coverage requirements for each state:

| State | Liability Coverage (per person/per accident) | Property Damage Coverage | Personal Injury Protection (PIP) | Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|---|

| Alabama | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| Alaska | $50,000/$100,000 | $25,000 | Optional | $50,000/$100,000 |

| Arizona | $25,000/$50,000 | $15,000 | Optional | $25,000/$50,000 |

| Arkansas | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| California | $15,000/$30,000 | $5,000 | Mandatory | $15,000/$30,000 |

| Colorado | $25,000/$50,000 | $15,000 | Optional | $25,000/$50,000 |

| Connecticut | $20,000/$40,000 | $10,000 | Mandatory | $20,000/$40,000 |

| Delaware | $30,000/$60,000 | $10,000 | Optional | $30,000/$60,000 |

| Florida | $10,000/$20,000 | $10,000 | Mandatory | $10,000/$20,000 |

| Georgia | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| Hawaii | $20,000/$40,000 | $10,000 | Mandatory | $20,000/$40,000 |

| Idaho | $25,000/$50,000 | $15,000 | Optional | $25,000/$50,000 |

| Illinois | $20,000/$40,000 | $15,000 | Optional | $20,000/$40,000 |

| Indiana | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Iowa | $20,000/$40,000 | $15,000 | Optional | $20,000/$40,000 |

| Kansas | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Kentucky | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Louisiana | $15,000/$30,000 | $10,000 | Mandatory | $15,000/$30,000 |

| Maine | $50,000/$100,000 | $25,000 | Optional | $50,000/$100,000 |

| Maryland | $30,000/$60,000 | $15,000 | Optional | $30,000/$60,000 |

| Massachusetts | $20,000/$40,000 | $5,000 | Mandatory | $20,000/$40,000 |

| Michigan | $20,000/$40,000 | $10,000 | Mandatory | $20,000/$40,000 |

| Minnesota | $30,000/$60,000 | $10,000 | Mandatory | $30,000/$60,000 |

| Mississippi | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Missouri | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Montana | $25,000/$50,000 | $20,000 | Optional | $25,000/$50,000 |

| Nebraska | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| Nevada | $25,000/$50,000 | $15,000 | Optional | $25,000/$50,000 |

| New Hampshire | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| New Jersey | $15,000/$30,000 | $5,000 | Mandatory | $15,000/$30,000 |

| New Mexico | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| New York | $25,000/$50,000 | $10,000 | Mandatory | $25,000/$50,000 |

| North Carolina | $30,000/$60,000 | $25,000 | Optional | $30,000/$60,000 |

| North Dakota | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| Ohio | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Oklahoma | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Oregon | $25,000/$50,000 | $20,000 | Optional | $25,000/$50,000 |

| Pennsylvania | $15,000/$30,000 | $5,000 | Optional | $15,000/$30,000 |

| Rhode Island | $25,000/$50,000 | $10,000 | Mandatory | $25,000/$50,000 |

| South Carolina | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| South Dakota | $25,000/$50,000 | $25,000 | Optional | $25,000/$50,000 |

| Tennessee | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

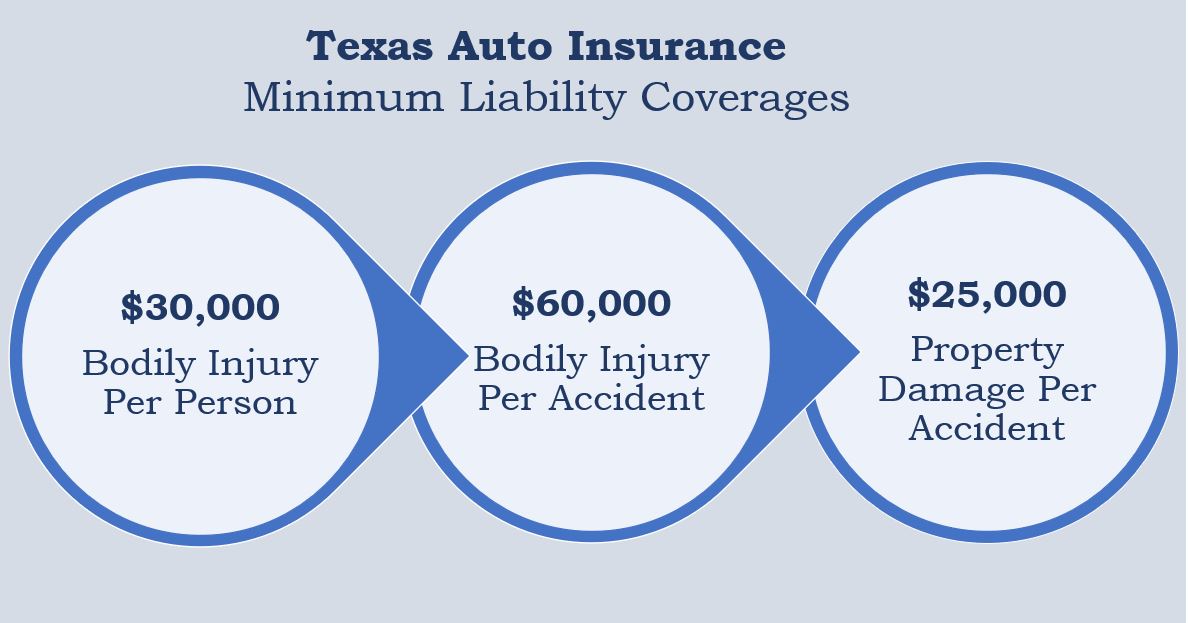

| Texas | $30,000/$60,000 | $25,000 | Optional | $30,000/$60,000 |

| Utah | $25,000/$65,000 | $15,000 | Optional | $25,000/$65,000 |

| Vermont | $25,000/$50,000 | $10,000 | Mandatory | $25,000/$50,000 |

| Virginia | $25,000/$50,000 | $20,000 | Optional | $25,000/$50,000 |

| Washington | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| West Virginia | $25,000/$50,000 | $10,000 | Optional | $25,000/$50,000 |

| Wisconsin | $25,000/$50,000 | $10,000 | Mandatory | $25,000/$50,000 |

| Wyoming | $25,000/$50,000 | $20,000 | Optional | $25,000/$50,000 |

States Allowing Opt-Out of Coverage

Some states allow drivers to opt out of certain coverages, such as uninsured/underinsured motorist coverage, if they choose to. However, this can be a risky decision, as it leaves drivers financially vulnerable in the event of an accident with an uninsured or underinsured motorist.

- New Hampshire: Drivers in New Hampshire can opt out of liability coverage if they can prove they have enough assets to cover any potential damages or injuries they may cause.

- Pennsylvania: Pennsylvania allows drivers to opt out of uninsured/underinsured motorist coverage if they provide written notice to their insurer. However, they are still required to carry liability coverage.

- Virginia: Virginia allows drivers to opt out of uninsured/underinsured motorist coverage if they provide written notice to their insurer. However, they are still required to carry liability coverage.

Types of Coverage Included in State Minimum Auto Insurance

State minimum auto insurance requirements typically include a few essential types of coverage that protect you financially in case of an accident. These coverages are designed to help pay for damages to other people’s property or injuries they sustain if you’re at fault in an accident.

Liability Coverage, What is state minimum auto insurance

Liability coverage is the most common type of auto insurance, and it’s mandatory in most states. It protects you from financial responsibility if you cause an accident that results in damage to another person’s property or injuries to another person.

- Bodily Injury Liability Coverage: This covers medical expenses, lost wages, and pain and suffering for people injured in an accident that you caused. It’s usually expressed as a per-person limit and a per-accident limit, such as $25,000/$50,000. This means the policy will pay up to $25,000 for injuries to one person and up to $50,000 for all injuries in a single accident.

- Property Damage Liability Coverage: This coverage pays for damage to another person’s vehicle or property if you’re at fault in an accident. It’s usually expressed as a single limit, such as $25,000. This means the policy will pay up to $25,000 for damage to another person’s property in a single accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Uninsured Motorist Coverage: This coverage pays for your medical expenses and property damage if you’re hit by a driver who doesn’t have insurance. It’s usually expressed as a per-person limit and a per-accident limit, similar to bodily injury liability coverage.

- Underinsured Motorist Coverage: This coverage kicks in if you’re hit by a driver who has insurance but doesn’t have enough to cover your damages. It’s usually expressed as a per-person limit and a per-accident limit, similar to bodily injury liability coverage.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as no-fault insurance, covers your own medical expenses and lost wages, regardless of who is at fault in an accident. This type of coverage is mandatory in some states and optional in others.

Collision Coverage

Collision coverage pays for damage to your own vehicle if you’re involved in an accident, regardless of who is at fault. This coverage is optional and not typically included in state minimum requirements.

Comprehensive Coverage

Comprehensive coverage protects you from damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, or hail. This coverage is also optional and not typically included in state minimum requirements.

Examples of How Coverage Applies

The following table provides examples of how different types of coverage apply in various accident scenarios:

| Scenario | Coverage Type | Description |

|---|---|---|

| You cause an accident that injures another driver and damages their vehicle. | Liability Coverage | Your liability coverage would pay for the other driver’s medical expenses, lost wages, and pain and suffering, as well as the damage to their vehicle. |

| You are hit by an uninsured driver. | Uninsured Motorist Coverage | Your uninsured motorist coverage would pay for your medical expenses, lost wages, and pain and suffering, as well as the damage to your vehicle. |

| You are hit by a driver with insufficient insurance to cover your damages. | Underinsured Motorist Coverage | Your underinsured motorist coverage would pay for the difference between your damages and the amount covered by the other driver’s insurance. |

| You are involved in an accident that damages your own vehicle. | Collision Coverage | Your collision coverage would pay for the repairs to your vehicle, minus your deductible. |

| Your vehicle is damaged by a hailstorm. | Comprehensive Coverage | Your comprehensive coverage would pay for the repairs to your vehicle, minus your deductible. |

Importance of State Minimum Auto Insurance

Driving without minimum auto insurance is a serious offense in most states and can have significant financial consequences. While you might think you can save money by forgoing insurance, the potential costs of an accident can far outweigh any short-term savings. State minimum auto insurance acts as a safety net, protecting drivers from financial ruin in the event of an accident.

Financial Consequences of Driving Without Minimum Auto Insurance

Driving without minimum auto insurance can result in a range of severe financial penalties. These penalties can include:

- Fines and Penalties: States impose hefty fines on drivers caught driving without insurance. These fines can vary depending on the state and the number of offenses.

- License Suspension: In addition to fines, your driver’s license can be suspended, making it illegal for you to drive. This can significantly impact your daily life and ability to commute, work, or run errands.

- Vehicle Impoundment: Your vehicle can be impounded, which means it will be towed and held by the authorities until you pay the necessary fines and obtain insurance.

- Jail Time: In some cases, driving without insurance can lead to jail time, especially if you are involved in an accident that results in injury or property damage.

- Higher Insurance Premiums: If you eventually obtain insurance after driving without it, your premiums will likely be much higher than they would have been if you had maintained continuous coverage.

Protection from Financial Ruin

State minimum auto insurance provides a crucial layer of protection for drivers involved in accidents. This protection comes in the form of coverage for:

- Liability Coverage: This covers damages to other people’s property or injuries to other people if you are at fault in an accident.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance.

Without this minimum coverage, you could be held personally liable for all costs associated with the accident, including medical bills, property damage, and legal fees. This could lead to significant financial hardship, including:

- Bankruptcy: The costs of an accident can be overwhelming, leading to debt and potential bankruptcy.

- Wage Garnishment: Creditors can legally pursue your wages to recover unpaid debts.

- Lien on Your Property: Creditors can place a lien on your property, making it difficult to sell or refinance.

Real-Life Examples of Minimum Auto Insurance Protection

“I was driving to work one morning when a car ran a red light and hit my car. I was thankful I had minimum auto insurance, which covered the damage to my car and my medical bills. Without it, I would have been facing a mountain of debt.” – Sarah, a driver in California

“I was involved in an accident with an uninsured driver. Thankfully, my minimum auto insurance covered my medical expenses and the damage to my car. The uninsured motorist coverage saved me from financial ruin.” – John, a driver in Florida

Factors Affecting Minimum Auto Insurance Costs

The cost of minimum auto insurance can vary significantly depending on several factors. These factors influence how insurers assess your risk profile and determine your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a major factor in determining your minimum auto insurance cost. Insurers consider your past driving record, including accidents, traffic violations, and DUI convictions. A clean driving record with no accidents or violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums. This is because insurers view you as a higher risk driver.

Vehicle Type

The type of vehicle you drive also plays a significant role in your insurance costs. Insurers consider factors like the vehicle’s make, model, year, and safety features. For instance, luxury vehicles or high-performance cars are often more expensive to repair or replace, leading to higher insurance premiums. Conversely, older, less expensive vehicles may have lower premiums. Vehicles with advanced safety features, such as anti-lock brakes or airbags, may qualify for discounts, lowering your insurance cost.

Age

Your age is another factor that influences minimum auto insurance costs. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurers often charge higher premiums for young drivers due to this increased risk. As drivers age, their experience and driving habits improve, leading to lower premiums. However, premiums may increase again for drivers over 70, as they may experience age-related physical limitations.

Location

The location where you live can also impact your minimum auto insurance cost. Insurers consider factors like the population density, crime rates, and number of accidents in your area. Areas with high traffic volume and more accidents generally have higher insurance premiums. Similarly, urban areas with higher theft rates may have higher insurance costs.

Credit Score

While not universal, some insurers use your credit score as a factor in determining your insurance premiums. This practice is based on the idea that people with good credit scores are more financially responsible and less likely to file claims. However, this practice is controversial and not allowed in all states. If your credit score is poor, you may face higher premiums.

Average Minimum Auto Insurance Costs by State

| State | Average Minimum Auto Insurance Cost |

|---|---|

| Michigan | $2,648 |

| Louisiana | $2,427 |

| New Jersey | $2,361 |

| Florida | $2,344 |

| Pennsylvania | $2,123 |

| Texas | $1,885 |

| California | $1,846 |

| New York | $1,773 |

| Ohio | $1,672 |

| Illinois | $1,635 |

Note: The average minimum auto insurance costs presented above are based on national data and may vary depending on individual factors.

Beyond State Minimum

While state minimum auto insurance is a legal requirement, it may not provide sufficient coverage for all potential financial risks associated with driving. Consider these additional coverage options to enhance your protection.

Additional Coverage Options

Beyond the state minimum, there are various optional coverages you can choose to add to your auto insurance policy. These coverages can provide you with additional financial protection in the event of an accident or other unforeseen circumstances.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault. This coverage is essential if you want to be protected against the costs of repairs or replacement for your own vehicle, even if you are not at fault for the accident. For example, if you are hit by an uninsured driver, collision coverage can help you pay for the repairs to your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. It can help you pay for repairs or replacement if your vehicle is damaged by these events. For example, if your car is stolen or damaged by a hailstorm, comprehensive coverage can help you recover the costs.

Rental Reimbursement Coverage

Rental reimbursement coverage provides you with financial assistance to cover the cost of a rental car while your vehicle is being repaired or replaced after an accident. This coverage can be very helpful if you rely on your vehicle for transportation and need to rent a car while yours is out of commission. For example, if you are involved in an accident and your vehicle is totaled, rental reimbursement coverage can help you pay for a rental car until you can purchase a new one.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you from financial losses if you are injured in an accident caused by a driver who is uninsured or underinsured. It can help cover medical expenses, lost wages, and other related costs. For example, if you are hit by a driver who does not have insurance or does not have enough insurance to cover your damages, UM/UIM coverage can help you pay for your injuries and other losses.

Other Optional Coverages

There are several other optional coverages that you can add to your auto insurance policy, such as:

* Towing and Labor Coverage: Covers the cost of towing your vehicle to a repair shop after a breakdown or accident.

* Roadside Assistance Coverage: Provides help with services such as jump starts, flat tire changes, and lockout assistance.

* Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your auto loan if your vehicle is totaled.

* Medical Payments Coverage: Pays for medical expenses for you and your passengers, regardless of who is at fault.

Table of Optional Coverage

| Coverage | Description | Potential Benefits |

|—|—|—|

| Collision | Pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault. | Protection against the costs of repairs or replacement for your own vehicle, even if you are not at fault for the accident. |

| Comprehensive | Protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. | Protection against the costs of repairs or replacement if your vehicle is damaged by these events. |

| Rental Reimbursement | Provides financial assistance to cover the cost of a rental car while your vehicle is being repaired or replaced after an accident. | Helps you pay for a rental car while your vehicle is out of commission. |

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you from financial losses if you are injured in an accident caused by a driver who is uninsured or underinsured. | Helps cover medical expenses, lost wages, and other related costs. |

| Towing and Labor | Covers the cost of towing your vehicle to a repair shop after a breakdown or accident. | Pays for towing and labor costs. |

| Roadside Assistance | Provides help with services such as jump starts, flat tire changes, and lockout assistance. | Provides peace of mind and assistance in emergency situations. |

| Gap Insurance | Covers the difference between the actual cash value of your vehicle and the amount you owe on your auto loan if your vehicle is totaled. | Protects you from financial losses if your vehicle is totaled and you owe more than the vehicle is worth. |

| Medical Payments | Pays for medical expenses for you and your passengers, regardless of who is at fault. | Provides additional coverage for medical expenses, even if you are not at fault for the accident. |

Finding the Right Auto Insurance Policy

Finding the right auto insurance policy involves more than just picking the cheapest option. You need to consider your individual needs and ensure the coverage aligns with your risk profile and financial situation.

Comparing Quotes from Multiple Insurers

It’s crucial to compare quotes from multiple insurers before settling on a policy. This helps you get a comprehensive understanding of the available options and find the best value for your money.

- Online Comparison Tools: Websites like NerdWallet and PolicyGenius allow you to compare quotes from various insurers simultaneously.

- Directly Contact Insurers: You can also contact insurance companies directly to obtain quotes. This allows you to ask specific questions and discuss your individual needs.

Ultimate Conclusion: What Is State Minimum Auto Insurance

Understanding the state minimum auto insurance requirements is crucial for every driver. It provides a safety net against potential financial hardship in case of an accident. While the minimum coverage may be sufficient for some, many drivers choose to purchase additional coverage beyond the minimum. This additional coverage can provide greater peace of mind and financial security in the event of a more serious accident. By understanding the basics of state minimum auto insurance, drivers can make informed decisions about their coverage needs and ensure they are adequately protected on the road.

FAQ Section

What happens if I don’t have minimum auto insurance?

If you’re caught driving without the required minimum auto insurance, you could face hefty fines, suspension of your driver’s license, and even the impoundment of your vehicle.

Is state minimum auto insurance enough?

While the minimum coverage is a good starting point, it may not be enough to cover all potential expenses in the event of a serious accident. Consider purchasing additional coverage like collision, comprehensive, and uninsured/underinsured motorist coverage for added protection.

How can I find affordable auto insurance?

Shop around and compare quotes from multiple insurance companies. Consider factors like your driving history, vehicle type, and location. You can also look for discounts offered by insurance companies.