Tesla insurance washington state – Tesla Insurance in Washington State offers a unique approach to auto insurance, leveraging data from Tesla vehicles to personalize pricing and coverage. This innovative program, designed specifically for Tesla owners, promises potential cost savings and a streamlined insurance experience.

Beyond traditional coverage, Tesla Insurance incorporates features like the “Safety Score” system, which rewards safe driving habits with lower premiums. Advanced driver-assistance systems (ADAS) and telematics play a crucial role in risk assessment, allowing for tailored premiums and personalized coverage options.

Tesla Insurance in Washington State: Tesla Insurance Washington State

Tesla Insurance is available in Washington State, offering a unique insurance option specifically tailored for Tesla owners.

Availability

Tesla Insurance is available to Tesla owners in Washington State. This means that if you own a Tesla and reside in Washington State, you can explore the possibility of getting insured through Tesla’s insurance program.

Eligibility Criteria

To be eligible for Tesla Insurance in Washington State, you must meet the following criteria:

- Own a Tesla vehicle

- Reside in Washington State

- Have a valid driver’s license

- Meet the minimum age requirement for insurance in Washington State

It’s essential to note that Tesla Insurance might have additional eligibility requirements that may vary depending on factors such as your driving history, credit score, and other relevant factors.

Coverage Options

Tesla Insurance in Washington State offers a range of coverage options designed to cater to the specific needs of Tesla owners. These coverage options might include:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

The specific coverage options and their details may vary, so it’s crucial to review the policy details carefully to understand the scope of coverage provided.

Pricing Structure

The pricing structure for Tesla Insurance in Washington State is based on various factors, including:

- Your driving history

- Your age and gender

- Your vehicle’s model and year

- Your location in Washington State

- Your driving habits and safety features in your Tesla

Tesla Insurance uses advanced technology and data analytics to assess risk and provide personalized pricing. The company emphasizes that its pricing is competitive and often lower than traditional insurance providers, especially for Tesla owners.

Comparison with Other Insurance Providers

Tesla Insurance distinguishes itself from other insurance providers in Washington State by offering several unique features and benefits:

- Leveraging Tesla Data: Tesla Insurance utilizes data from your Tesla vehicle, such as driving patterns, braking behavior, and other safety features, to assess risk and potentially offer lower premiums for safe drivers.

- Simplified Claims Process: Tesla Insurance aims to streamline the claims process by leveraging its technology and direct communication channels, making it potentially faster and more efficient than traditional insurance providers.

- Exclusive Benefits: Tesla Insurance may offer exclusive benefits tailored to Tesla owners, such as roadside assistance specifically designed for Tesla vehicles or access to Tesla’s charging network in case of an accident.

It’s important to compare quotes from different insurance providers, including Tesla Insurance, to determine the best coverage and pricing for your specific needs.

Key Features of Tesla Insurance

Tesla Insurance stands out by utilizing data from Tesla vehicles to create personalized pricing and coverage options. This approach goes beyond traditional insurance models, offering greater accuracy and fairness.

Data-Driven Pricing and Coverage

Tesla Insurance leverages data collected from Tesla vehicles to personalize pricing and coverage. This data includes driving behavior, vehicle maintenance records, and even the car’s location.

“By using this data, we can more accurately assess risk and provide more personalized pricing,” explains Tesla Insurance.

This data-driven approach allows Tesla Insurance to offer more accurate and competitive premiums. For example, drivers with a proven track record of safe driving may receive lower premiums compared to those with a history of accidents or violations.

The Benefits of the Safety Score System

Tesla Insurance employs a unique “Safety Score” system to assess driver behavior and provide personalized pricing. The Safety Score is calculated based on various driving factors, including:

- Forward Collision Warning: How effectively the driver responds to forward collision warnings.

- Hard Braking: The frequency and severity of hard braking events.

- Unsafe Turning: The number of times the driver makes unsafe turns.

- Speeding: The frequency and severity of speeding incidents.

- Following Distance: How closely the driver follows other vehicles.

A higher Safety Score reflects safer driving habits and can lead to lower premiums. Tesla Insurance encourages drivers to improve their scores through safe driving practices.

Advanced Driver-Assistance Systems (ADAS)

Tesla Insurance recognizes the role of advanced driver-assistance systems (ADAS) in promoting safer driving. Features like Autopilot and Full Self-Driving (FSD) are designed to enhance safety and reduce the risk of accidents.

“We believe that ADAS features can help make driving safer and more efficient,” states Tesla Insurance.

Tesla Insurance may offer discounts or adjust premiums based on the presence and usage of ADAS features. For example, drivers who frequently use Autopilot might receive a lower premium due to their reduced risk of accidents.

Telematics and Risk Assessment

Tesla Insurance utilizes telematics, the use of technology to gather data on vehicle usage, to assess risk and adjust premiums. Telematics data can provide insights into:

- Driving Habits: The frequency and duration of driving trips, speed, acceleration, and braking patterns.

- Vehicle Maintenance: Regular maintenance schedules and any reported issues.

- Location and Time of Day: The areas where the vehicle is driven and the time of day.

By analyzing this data, Tesla Insurance can better understand individual driving patterns and identify potential risks. This allows for more precise risk assessment and personalized premiums.

Coverage Options

Tesla Insurance offers a range of coverage options to meet the specific needs of Tesla owners. These options include:

- Collision Coverage: Covers damage to the insured vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Protects against damage to the insured vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

- Liability Coverage: Provides financial protection for the insured in case of an accident where they are at fault, covering damages to other vehicles or property and injuries to other people.

- Uninsured/Underinsured Motorist Coverage: Protects the insured in case of an accident involving a driver without insurance or with insufficient insurance.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the insured and passengers in an accident, regardless of fault.

Tesla Insurance may also offer additional coverage options, such as roadside assistance, rental car reimbursement, and gap insurance.

Benefits of Tesla Insurance

Tesla Insurance offers a range of benefits designed to make owning and insuring a Tesla more convenient and affordable.

Cost Savings

Tesla Insurance leverages data from your vehicle’s sensors and driving patterns to assess risk more accurately, potentially leading to lower premiums compared to traditional insurance providers. This data-driven approach allows Tesla to personalize your insurance rates based on your actual driving behavior, rewarding safe driving habits with lower costs. For example, Tesla Insurance might offer discounts to drivers who consistently maintain safe speeds, avoid harsh braking, and adhere to traffic regulations.

Convenience, Tesla insurance washington state

Tesla Insurance offers a seamless experience through the Tesla app, allowing you to manage your policy, view coverage details, and submit claims directly from your smartphone. This digital platform streamlines the insurance process, eliminating the need for phone calls and paperwork. The app also provides real-time updates on your policy status and claims progress, keeping you informed throughout the entire process.

Customer Service and Support

Tesla Insurance provides dedicated customer service and support to Tesla owners, offering personalized assistance with policy questions, claims, and other insurance-related matters. This specialized support ensures that you have access to knowledgeable representatives who understand the unique aspects of Tesla vehicles and insurance.

Single Provider for Vehicle and Insurance

Having a single provider for both your Tesla vehicle and insurance can simplify the overall ownership experience. This streamlined approach eliminates the need to coordinate with multiple companies for maintenance, repairs, and insurance claims, resulting in a more efficient and convenient process.

Exclusive Perks and Benefits

Tesla Insurance offers exclusive perks and benefits to Tesla owners, such as:

- Access to Tesla’s network of service centers for repairs and maintenance

- Coverage for Tesla-specific features, such as Autopilot and Full Self-Driving

- Potential discounts on accessories and upgrades for your Tesla

Considerations for Tesla Owners in Washington State

Owning a Tesla in Washington State comes with unique considerations, particularly when it comes to insurance. Understanding the factors that influence Tesla insurance costs and the process of obtaining and filing claims is crucial for Tesla owners in the state.

Comparison with Other Insurance Providers

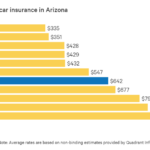

The cost of Tesla insurance can vary significantly depending on the insurance provider. It’s essential to compare quotes from different insurers to find the most competitive rates. While Tesla offers its own insurance program, other major insurance companies also provide coverage for Tesla vehicles. Factors such as driving history, vehicle model, and location can influence the price of insurance from different providers.

Factors Influencing Tesla Insurance Prices

Several factors contribute to the cost of Tesla insurance in Washington State. These include:

- Driving History: Drivers with a clean driving record, including no accidents or traffic violations, generally receive lower insurance premiums. Conversely, drivers with a history of accidents or violations can expect higher premiums.

- Vehicle Model: Tesla vehicles come in various models, each with its own safety features and performance capabilities. Higher-performance models or those with advanced technology features may attract higher insurance premiums due to their potential for higher repair costs or increased risk of accidents.

- Location: The location where the Tesla is registered can significantly impact insurance costs. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents often have higher insurance premiums.

- Coverage Options: The type and amount of coverage selected can also influence the price of Tesla insurance. Choosing comprehensive and collision coverage, which protects against damage from accidents and other incidents, will generally result in higher premiums compared to liability-only coverage.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.

Obtaining a Quote for Tesla Insurance

To obtain a quote for Tesla insurance in Washington State, you can follow these steps:

- Contact Insurance Providers: Reach out to various insurance providers, including Tesla Insurance and other major insurance companies.

- Provide Vehicle Information: You will need to provide details about your Tesla vehicle, such as the year, make, model, and VIN (Vehicle Identification Number).

- Provide Personal Information: You will also need to provide personal information, including your driving history, address, and contact details.

- Compare Quotes: Once you receive quotes from different providers, compare the prices and coverage options to find the best fit for your needs.

Filing a Claim with Tesla Insurance

If you need to file a claim with Tesla Insurance, follow these steps:

- Report the Incident: Contact Tesla Insurance immediately to report the accident or incident.

- Provide Details: Provide all relevant details about the incident, including the date, time, location, and any injuries involved.

- Follow Instructions: Tesla Insurance will guide you through the claim process, including any required documentation or inspections.

Specific Requirements and Regulations

Washington State has specific requirements and regulations regarding Tesla insurance. These include:

- Minimum Liability Coverage: Washington State requires all drivers to carry a minimum amount of liability insurance, which covers damages to other vehicles and individuals in the event of an accident. The minimum requirements include:

- $25,000 for injury or death to one person in an accident

- $50,000 for injury or death to two or more people in an accident

- $10,000 for property damage in an accident

- Financial Responsibility: Tesla owners in Washington State must demonstrate financial responsibility by carrying adequate insurance coverage or providing proof of financial resources to cover potential damages.

Impact of Tesla Insurance on the Automotive Industry

Tesla Insurance, with its direct-to-consumer model and data-driven approach, is shaking up the traditional insurance industry. This disruption is not just confined to the insurance sector; it has implications for the broader automotive industry, influencing the development of new technologies and business models.

Disruption of Traditional Insurance Models

Tesla Insurance disrupts traditional insurance models by leveraging the vast amount of data collected from Tesla vehicles. This data allows Tesla to assess risk more accurately and offer personalized premiums based on individual driving habits. By eliminating intermediaries and relying on data-driven insights, Tesla Insurance offers a more transparent and potentially cost-effective solution compared to traditional insurance providers.

Potential for Other Automakers to Offer Similar Insurance Products

The success of Tesla Insurance has inspired other automakers to explore similar insurance products. Automakers like General Motors and Ford are already developing their own insurance offerings, leveraging data from connected vehicles to personalize premiums and improve risk assessment. This trend is expected to accelerate as more vehicles become connected and generate valuable data insights.

Challenges and Opportunities Faced by the Insurance Industry

The rise of data-driven insurance presents both challenges and opportunities for the insurance industry.

- Traditional insurance companies face the challenge of adapting to the changing landscape, where data plays a pivotal role in risk assessment and pricing. They need to invest in technology and data analytics to remain competitive.

- However, the industry also has the opportunity to leverage data to develop innovative insurance products and services. This includes offering personalized coverage based on individual driving behavior, providing real-time risk alerts, and developing predictive models to anticipate potential accidents.

Implications of Data-Driven Insurance for the Future of the Automotive Industry

Data-driven insurance has significant implications for the future of the automotive industry. It encourages the development of safer vehicles and promotes responsible driving habits.

- Automakers can use data from insurance to identify areas for improvement in vehicle safety and design. This data can also be used to develop advanced driver assistance systems (ADAS) and autonomous driving technologies.

- Data-driven insurance also incentivizes drivers to adopt safer driving practices, as their premiums can be affected by their driving behavior. This can lead to a reduction in accidents and overall safer roads.

Evolving Landscape of Insurance in the Context of Autonomous Vehicles

The emergence of autonomous vehicles presents a unique challenge and opportunity for the insurance industry.

- As autonomous vehicles become more prevalent, the traditional model of insurance based on individual driver behavior will need to adapt. Insurance premiums will likely be based on the performance of the autonomous driving system, the manufacturer’s track record, and the vehicle’s safety features.

- The insurance industry will need to develop new risk assessment models and insurance products specifically tailored to autonomous vehicles. This will require collaboration with automakers and technology companies to understand the complexities of autonomous driving and its impact on safety and liability.

Ultimate Conclusion

Tesla Insurance presents a compelling alternative for Washington State Tesla owners, offering potential cost savings, convenience, and unique features tailored to the specific needs of electric vehicle drivers. By understanding the benefits, considerations, and impact of Tesla Insurance, owners can make informed decisions about their insurance needs and potentially unlock significant advantages.

Popular Questions

Is Tesla Insurance available to all Tesla owners in Washington State?

Tesla Insurance is currently available to Tesla owners in Washington State, but specific eligibility criteria may apply. It’s best to contact Tesla Insurance directly for the most up-to-date information.

How do I get a quote for Tesla Insurance?

You can obtain a quote for Tesla Insurance through the Tesla app or by visiting the Tesla Insurance website. You’ll need to provide information about your vehicle, driving history, and other relevant details.

What happens if I have an accident with my Tesla?

If you’re involved in an accident, you can file a claim with Tesla Insurance through the Tesla app or by contacting their customer service team. They will guide you through the claims process and assist you in resolving any issues.