What states dont require car insurance – What states don’t require car insurance? This question is surprisingly relevant, as some states in the U.S. do not mandate car insurance coverage. While this might sound appealing, it’s crucial to understand the potential financial and legal risks associated with driving uninsured in these states. This exploration delves into the specifics of these states, the financial implications of driving without insurance, and the safety considerations surrounding uninsured drivers.

The absence of mandatory car insurance in these states raises significant concerns about financial responsibility and road safety. While some drivers may choose to self-insure or rely on alternative coverage options, the lack of a universal requirement can create a situation where accidents can lead to substantial financial burdens for both the uninsured driver and the other parties involved. This exploration will examine the financial implications of driving without insurance, the safety considerations, and the potential for alternative coverage options to mitigate risks in these states.

States That Don’t Require Car Insurance: What States Dont Require Car Insurance

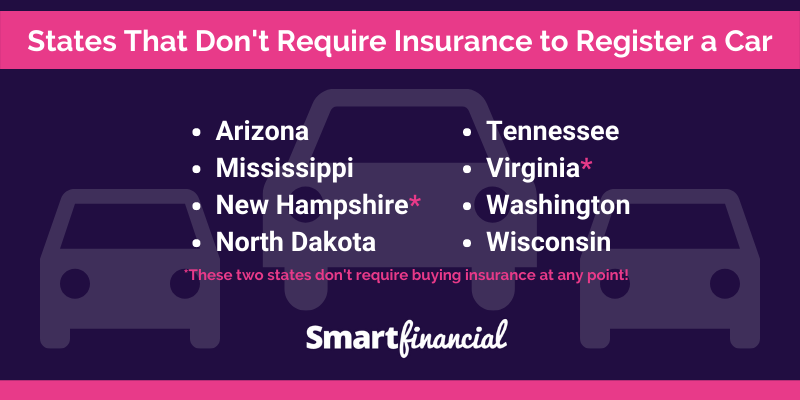

While most states in the U.S. mandate car insurance, there are a few exceptions. These states, known as “no-fault” or “financial responsibility” states, don’t require drivers to carry liability insurance. However, this doesn’t mean driving without insurance is risk-free.

Legal Ramifications of Driving Without Insurance

Driving without insurance in states that don’t require it can still have significant legal consequences. These states typically have financial responsibility laws that require drivers to prove they can cover the costs of any accidents they cause. This proof can come in the form of insurance, a surety bond, or a deposit of cash or securities.

If you’re involved in an accident and you can’t demonstrate financial responsibility, you could face:

- License suspension: Your driver’s license can be suspended until you prove you can pay for damages caused.

- Vehicle registration suspension: Your vehicle’s registration can be suspended until you meet the financial responsibility requirements.

- Fines and penalties: You could face hefty fines and penalties for driving without insurance.

- Civil lawsuits: The injured party can sue you for damages, and you’ll be responsible for covering all costs, including medical expenses, property damage, and legal fees.

Financial Risks of Driving Uninsured

Driving without insurance in a state that doesn’t require it can lead to significant financial risks. Even if you’re not directly responsible for an accident, you could still be held liable for damages.

Here’s why driving uninsured is a risky gamble:

- High out-of-pocket costs: If you cause an accident, you’ll be responsible for covering all costs, including medical bills, property damage, and legal fees. These costs can quickly add up, potentially leading to significant financial hardship.

- Loss of assets: If you can’t afford to pay for damages, the injured party can pursue legal action to recover their losses. This could lead to the seizure of your assets, including your home, bank accounts, and other valuable possessions.

- Damage to your credit score: Unpaid medical bills and legal judgments can negatively impact your credit score, making it difficult to secure loans, rent an apartment, or even get a job.

Financial Implications of Driving Without Insurance

Driving without insurance in states that do not require it can have serious financial implications, potentially leading to significant financial hardship. A single accident can result in substantial costs, leaving individuals responsible for covering expenses that could have been mitigated with insurance coverage.

Potential Costs of Accidents, What states dont require car insurance

The financial burden of driving without insurance can be substantial, encompassing a range of expenses, including medical bills, property damage, and legal fees. These costs can quickly accumulate, potentially exceeding thousands of dollars, depending on the severity of the accident.

- Medical Bills: In the event of an accident, medical expenses can be significant, especially if injuries are severe. These costs can include emergency room visits, hospital stays, surgeries, physical therapy, and ongoing medical care.

- Property Damage: Accidents often involve damage to vehicles and other property, such as buildings or street signs. Repairing or replacing damaged property can be expensive, depending on the extent of the damage.

- Legal Fees: Even minor accidents can lead to legal disputes, requiring the involvement of lawyers. Legal fees can be substantial, especially in cases involving serious injuries or property damage.

Impact of Uninsured Motorist Coverage

Uninsured motorist coverage is an optional insurance policy that protects drivers from financial losses caused by accidents with uninsured or underinsured motorists. In states that do not require car insurance, this coverage is particularly crucial, as it can help cover medical expenses, lost wages, and property damage if an accident occurs with an uninsured driver.

Uninsured motorist coverage is a valuable safeguard for drivers in states that do not require car insurance. It can provide financial protection in situations where the other driver is uninsured or underinsured.

Financial Burden of Driving Without Insurance

Driving without insurance in states that do not require it can lead to significant financial hardship, particularly in the event of an accident. Without insurance, drivers are fully responsible for covering all accident-related costs, which can quickly drain their savings and lead to debt. Moreover, they may face legal repercussions, including fines, license suspension, or even jail time.

Safety Considerations and Uninsured Drivers

The absence of mandatory car insurance can have significant consequences for road safety, potentially leading to a higher concentration of uninsured drivers and a greater risk of financial burden for accident victims. It is essential to examine the potential safety risks associated with a higher concentration of uninsured drivers and analyze the impact of uninsured drivers on overall road safety.

Accident Rates and Insurance Claims

The presence of mandatory car insurance laws is generally associated with lower accident rates and fewer uninsured motorist claims. This is because insurance laws incentivize drivers to be more responsible, as they are financially accountable for any accidents they cause. In states without mandatory car insurance, drivers may be less likely to carry insurance, potentially leading to a higher concentration of uninsured drivers on the road. This can increase the likelihood of accidents involving uninsured drivers, resulting in higher costs for victims and the overall healthcare system.

Alternative Coverage Options

While states without mandatory car insurance requirements offer drivers the freedom to choose their coverage levels, it’s crucial to understand the potential financial risks associated with driving uninsured. To mitigate these risks, drivers can explore various alternative coverage options.

These alternatives aim to provide financial protection in the event of an accident, offering drivers a way to manage their risk without relying solely on traditional insurance policies.

Self-Insurance

Self-insurance involves setting aside a specific amount of money to cover potential accident-related costs. This approach allows drivers to assume personal responsibility for financial liabilities arising from accidents.

Benefits of Self-Insurance

- Cost Savings: Drivers can potentially save money on insurance premiums by opting for self-insurance.

- Control over Coverage: Self-insured drivers have complete control over their coverage, deciding how much money to set aside and what types of risks to cover.

Drawbacks of Self-Insurance

- High Financial Risk: Self-insurance carries a significant financial risk, as drivers are solely responsible for covering all accident-related costs.

- Limited Coverage: Self-insurance typically provides limited coverage compared to traditional insurance policies, potentially leaving drivers vulnerable to substantial financial losses.

- Potential for Bankruptcy: A major accident could result in significant financial losses that exceed a driver’s self-insurance fund, potentially leading to bankruptcy.

Surety Bonds

Surety bonds are financial guarantees provided by a surety company, offering protection to third parties in case of financial losses caused by a driver’s negligence.

Benefits of Surety Bonds

- Financial Protection for Third Parties: Surety bonds ensure that third parties involved in accidents with the bonded driver receive compensation for their losses.

- Reduced Risk for Drivers: Surety bonds can reduce the financial risk for drivers by providing a safety net in case of an accident.

Drawbacks of Surety Bonds

- Higher Costs: Surety bonds can be more expensive than traditional insurance policies, especially for drivers with a poor driving record.

- Limited Coverage: Surety bonds typically offer limited coverage compared to comprehensive insurance policies.

- Potential for Claims Disputes: Disputes may arise between the surety company and the bonded driver regarding coverage and claim payouts.

The Role of Financial Responsibility Laws

In states that don’t mandate car insurance, financial responsibility laws play a crucial role in ensuring drivers can cover the costs of accidents they cause. These laws require drivers to demonstrate their ability to pay for damages resulting from accidents, either through insurance or by posting a financial security bond.

Consequences of Failing to Meet Financial Responsibility Requirements

These laws are designed to protect victims of accidents from being left financially burdened by uninsured drivers. Drivers who fail to meet financial responsibility requirements face serious consequences, including:

- Suspension of driver’s license: A driver’s license can be suspended until they meet the financial responsibility requirements. This can significantly impact their ability to drive legally and can lead to further penalties.

- Vehicle registration suspension: The state can also suspend a driver’s vehicle registration until they demonstrate their ability to cover accident-related costs. This prevents them from driving their vehicle legally.

- Fines and penalties: Drivers who violate financial responsibility laws may face fines and penalties, which can add to the financial burden of driving without insurance.

- Imprisonment: In some cases, failing to meet financial responsibility requirements can lead to imprisonment, especially if the driver is involved in multiple accidents or has a history of violating these laws.

Effectiveness of Financial Responsibility Laws

The effectiveness of financial responsibility laws in ensuring driver accountability is a complex issue. While these laws aim to deter drivers from driving without insurance and protect accident victims, their effectiveness can vary depending on factors like:

- Enforcement: The effectiveness of these laws depends heavily on the state’s ability to enforce them. Strict enforcement measures, including frequent checks and prompt action against violators, are crucial to ensure compliance.

- Penalties: The severity of penalties imposed for violating financial responsibility laws also plays a role. Strong penalties can deter drivers from taking risks and encourage compliance.

- Awareness: Public awareness about financial responsibility laws and their consequences is crucial. Drivers must be informed about the legal requirements and the potential consequences of failing to meet them.

Final Summary

Navigating the complexities of driving without insurance in states that don’t require it requires careful consideration of financial, legal, and safety implications. While the absence of a mandatory requirement might seem appealing, it’s essential to weigh the potential risks against the potential benefits. Understanding the financial responsibilities, the potential consequences of accidents, and the alternative coverage options available is crucial for making informed decisions. By carefully evaluating these factors, drivers can make responsible choices that protect themselves and others on the road.

Query Resolution

What are the states that don’t require car insurance?

Currently, only New Hampshire and Virginia don’t require drivers to have liability insurance. However, Virginia does require drivers to demonstrate financial responsibility through other means, such as a surety bond or cash deposit.

What happens if I get into an accident without car insurance in a state that doesn’t require it?

Even in states without mandatory car insurance, you’re still responsible for any damages or injuries caused in an accident. You could face significant financial burdens, including medical bills, property damage repairs, and legal fees. Additionally, you might lose your driving privileges.

Is it cheaper to drive without insurance in states that don’t require it?

It might seem cheaper in the short term, but the potential costs of an accident without insurance far outweigh any savings. The financial risks are substantial, and you could end up facing a lifetime of debt.

What are the alternative coverage options available in states without mandatory car insurance?

Some states offer alternative coverage options like self-insurance, surety bonds, or cash deposits to demonstrate financial responsibility. However, these options often come with stringent requirements and may not provide the same level of protection as traditional car insurance.