State of Texas auto insurance is a necessity for all drivers, ensuring financial protection in the event of an accident. Texas has specific laws and regulations governing auto insurance, dictating minimum coverage requirements and influencing the rates you pay. This guide explores the complexities of Texas auto insurance, helping you understand your obligations and make informed decisions about your coverage.

Navigating the world of auto insurance can be confusing, especially with the various types of coverage available and factors influencing rates. We’ll break down the different coverage options, explore key factors impacting premiums, and provide tips for finding affordable insurance in Texas.

Texas Auto Insurance Laws and Regulations

Driving a vehicle in Texas comes with certain legal responsibilities, including having the necessary auto insurance coverage. Texas law mandates specific insurance requirements to ensure financial protection for drivers and their passengers in case of accidents. This section delves into the key aspects of Texas auto insurance laws and regulations.

Mandatory Auto Insurance Requirements in Texas

Texas law requires all drivers to carry a minimum amount of liability insurance to cover potential damages or injuries they may cause to others in an accident. This mandatory coverage is known as the “Texas Financial Responsibility Law.”

Minimum Liability Coverage Limits in Texas

The minimum liability coverage limits required by Texas law are as follows:

- Bodily Injury Liability: $30,000 per person, $60,000 per accident. This coverage protects you financially if you injure someone else in an accident. It covers medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: $25,000 per accident. This coverage pays for damages to another person’s property, such as their vehicle or other assets, if you are at fault in an accident.

Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a crucial role in regulating the auto insurance industry in Texas. The TDI ensures that insurance companies operate fairly and transparently, protecting consumers’ rights and interests.

Texas Financial Responsibility Law

The Texas Financial Responsibility Law mandates that all drivers carry proof of financial responsibility to cover potential damages or injuries caused in an accident. This law serves to protect innocent parties involved in accidents by ensuring that they have access to compensation for their losses.

“Drivers in Texas must have proof of financial responsibility, such as auto insurance, to cover potential damages or injuries caused in an accident.”

Types of Auto Insurance Coverage in Texas

In Texas, car insurance is mandatory for all drivers. The state requires drivers to have at least the minimum amount of liability insurance, which covers damages to other people and their property. However, you can choose to purchase additional coverage to protect yourself financially in case of an accident. Here’s a breakdown of the different types of auto insurance coverage available in Texas.

Liability Coverage

Liability coverage is the most basic type of car insurance and is required by law in Texas. This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. There are two types of liability coverage:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to other people in an accident that you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of property damaged in an accident that you caused, including the other driver’s vehicle, property, or belongings.

The minimum liability coverage required in Texas is 30/60/25, which means:

$30,000 per person for bodily injury liability

$60,000 per accident for bodily injury liability

$25,000 per accident for property damage liability

However, it is recommended to purchase higher limits of liability coverage, as the minimum coverage may not be enough to cover all damages in a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is highly recommended if you have a car loan or lease, as the lender will usually require you to have collision coverage.

- Benefits: It helps cover the cost of repairs or replacement of your vehicle after an accident, regardless of who is at fault. This can save you a significant amount of money, especially if you have a newer or more expensive car.

- Drawbacks: Collision coverage can be expensive, especially if you have a high-value vehicle. You will also have to pay a deductible, which is the amount you are responsible for paying before your insurance coverage kicks in.

Comprehensive Coverage

Comprehensive coverage protects you from damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, comprehensive coverage is optional.

- Benefits: It provides financial protection for damage to your vehicle from a wide range of events, giving you peace of mind.

- Drawbacks: It can be expensive, especially if you have a high-value vehicle. You will also have to pay a deductible, which is the amount you are responsible for paying before your insurance coverage kicks in.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage pays for your medical expenses, lost wages, and other damages resulting from injuries to you or your passengers in an accident caused by an uninsured or underinsured driver.

- Benefits: It provides financial protection if you are involved in an accident with a driver who does not have enough insurance to cover your losses. This can be especially important in Texas, where a significant number of drivers are uninsured.

- Drawbacks: UM/UIM coverage is optional in Texas, but it is highly recommended. It is usually included in your car insurance policy, but you may need to request it specifically.

Comparison Table

Here is a table summarizing the key features and costs of each type of auto insurance coverage in Texas:

| Coverage Type | Description | Benefits | Drawbacks | Cost |

|---|---|---|---|---|

| Liability | Covers damage to other people and their property | Protects you financially if you are at fault in an accident | May not be enough to cover all damages in a serious accident | Low |

| Collision | Covers damage to your vehicle in an accident | Helps cover the cost of repairs or replacement of your vehicle | Can be expensive, especially for high-value vehicles | Moderate to high |

| Comprehensive | Covers damage to your vehicle from events other than accidents | Provides financial protection for damage to your vehicle from a wide range of events | Can be expensive, especially for high-value vehicles | Moderate to high |

| Uninsured/Underinsured Motorist | Covers your losses if you are involved in an accident with an uninsured or underinsured driver | Provides financial protection if you are involved in an accident with a driver who does not have enough insurance | Optional, but highly recommended | Low to moderate |

Factors Influencing Auto Insurance Rates in Texas

Auto insurance rates in Texas are determined by a complex interplay of factors, with each contributing to the overall cost of coverage. Understanding these factors can help Texans make informed decisions about their insurance choices and potentially save money on their premiums.

Driving History, State of texas auto insurance

Your driving history is a crucial factor in determining your auto insurance rates. Insurance companies use your driving record to assess your risk as a driver.

- Accidents: Having a history of accidents, especially at-fault accidents, will significantly increase your insurance premiums. Insurance companies consider you a higher risk because you’ve been involved in accidents previously.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions can also lead to higher premiums. These violations indicate a pattern of risky driving behavior.

- Clean Driving Record: Maintaining a clean driving record with no accidents or violations is the best way to ensure lower insurance rates.

Age

Age is another significant factor in auto insurance rates. Younger drivers are statistically more likely to be involved in accidents, making them a higher risk for insurance companies.

- Teenagers: Teen drivers have limited experience behind the wheel and are more likely to engage in risky behaviors. Insurance companies often charge higher premiums for teenagers.

- Experienced Drivers: As drivers gain experience, they become more cautious and have a lower risk of accidents. Insurance rates typically decrease for drivers in their late 20s and 30s.

- Senior Drivers: While senior drivers have more experience, they may face health challenges that can impact their driving ability. Insurance companies may adjust rates for older drivers based on their individual circumstances.

Gender

Gender can also influence auto insurance rates, although this factor is becoming less prevalent in some states.

- Historically, insurance companies have observed that men tend to be involved in more accidents than women. This has led to higher premiums for men in some cases.

- However, in recent years, many states, including Texas, have passed legislation to prohibit insurance companies from using gender as a primary factor in setting rates.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your auto insurance rates.

- High-Performance Vehicles: Sports cars, luxury vehicles, and other high-performance cars are more expensive to repair and replace in the event of an accident. Insurance companies charge higher premiums for these vehicles.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer. Insurance companies may offer discounts for these features.

- Vehicle Value: The overall value of your vehicle also affects your insurance rates. More expensive vehicles will typically have higher insurance premiums.

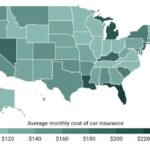

Location

Where you live in Texas can also impact your auto insurance rates.

- Urban Areas: Cities tend to have higher traffic density and more accidents. Insurance companies may charge higher premiums in urban areas to reflect this increased risk.

- Rural Areas: Rural areas often have lower traffic density and fewer accidents. Insurance companies may offer lower premiums in these areas.

- Crime Rates: Areas with higher crime rates may have higher insurance rates due to the increased risk of theft or vandalism.

Table Illustrating Impact of Factors on Insurance Rates

| Factor | Impact on Rates | Example |

|---|---|---|

| Driving History (Accidents) | Higher | A driver with two at-fault accidents will likely pay higher premiums than a driver with a clean record. |

| Age (Teenager) | Higher | A 17-year-old driver will typically pay higher premiums than a 30-year-old driver. |

| Vehicle Type (Sports Car) | Higher | A driver of a high-performance sports car will generally pay higher premiums than a driver of a compact car. |

| Location (Urban Area) | Higher | A driver living in a major city like Houston will likely pay higher premiums than a driver living in a rural area. |

Finding Affordable Auto Insurance in Texas

Navigating the world of auto insurance in Texas can be a bit overwhelming, especially when you’re looking for the most affordable option. The good news is that with some smart strategies, you can find a policy that fits your budget without sacrificing essential coverage.

Comparing Quotes

Comparing quotes from multiple insurance providers is crucial to finding the best deal. This allows you to see a range of prices and coverage options, enabling you to make an informed decision. Many online platforms and websites specialize in facilitating quote comparisons. These platforms allow you to enter your information once and receive quotes from various insurers, simplifying the process.

- Online Comparison Websites: Popular websites like Insurance.com, The Zebra, and QuoteWizard allow you to compare quotes from numerous insurers in one place. These platforms provide a convenient way to gather information and find competitive rates.

- Insurance Provider Websites: Many insurance companies have user-friendly websites where you can get a quote directly. This allows you to explore their specific coverage options and discounts.

- Insurance Agents: Working with an independent insurance agent can be beneficial. They can help you compare quotes from multiple insurers and provide personalized recommendations based on your needs.

Negotiating Rates

Once you have a few quotes, don’t hesitate to negotiate with insurers to try and secure a better rate. Many insurers are willing to negotiate, especially if you have a good driving record and are willing to bundle multiple policies.

- Highlight Your Good Driving Record: Emphasize your clean driving history, lack of accidents, and any defensive driving courses you may have completed. This demonstrates your low risk to insurers.

- Bundle Policies: If you have multiple insurance policies, such as homeowners or renters insurance, bundling them with your auto insurance can often result in significant discounts.

- Ask About Discounts: Many insurers offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Be sure to inquire about these discounts and see if you qualify.

Exploring Discounts

Insurers often offer various discounts to reduce your premium. Researching and taking advantage of these discounts can significantly impact your overall cost.

- Good Student Discount: This discount is available to students with good grades. Insurers often consider students with high GPAs as responsible and less likely to be involved in accidents.

- Safe Driver Discount: If you have a clean driving record and have not been involved in any accidents, you may be eligible for a safe driver discount.

- Multi-Car Discount: Insuring multiple vehicles with the same insurer can often result in a discount on your premiums.

- Anti-theft Device Discount: Installing anti-theft devices in your car can reduce your premium. These devices deter theft and make your car less appealing to criminals.

- Loyalty Discount: Some insurers offer loyalty discounts to long-term customers who have maintained their policies for a certain period.

Considering Coverage Needs and Budget

When selecting a policy, it’s crucial to balance your coverage needs with your budget. While comprehensive coverage is essential, it’s important to avoid unnecessary extras that might not be worth the cost.

- Liability Coverage: This coverage is crucial and protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of fault. It’s typically optional but can be valuable depending on the age and value of your car.

- Comprehensive Coverage: This coverage protects your car from damage caused by non-accident events, such as theft, vandalism, or natural disasters. It’s often optional, but it can be essential if your car is relatively new or has high value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

Common Auto Insurance Claims in Texas

Auto insurance claims in Texas are common, and understanding the process can help you navigate the system efficiently. Knowing the most common types of claims, the steps involved in filing them, and tips for maximizing your chances of a successful claim can provide you with peace of mind and ensure you receive the compensation you deserve.

Types of Auto Insurance Claims in Texas

Auto insurance claims in Texas are categorized into various types, each addressing specific situations. The most common types include:

- Accidents: These are the most frequent claims, involving collisions with other vehicles, pedestrians, or objects.

- Theft: Claims for stolen vehicles are another common occurrence, and auto insurance policies often cover theft, vandalism, and damage to your car.

- Natural Disasters: Texas is prone to natural disasters like hurricanes, tornadoes, and hailstorms, which can cause significant damage to vehicles. These events often lead to insurance claims for repairs or replacement.

Filing an Auto Insurance Claim

When filing an auto insurance claim in Texas, following these steps ensures a smooth process:

- Report the Accident or Incident: Contact your insurance company immediately after an accident or theft, providing details about the event, including the date, time, location, and any injuries involved.

- Gather Documentation: Collect all relevant documents, including police reports, witness statements, photos of the damage, and repair estimates.

- Submit the Claim: Complete the claim form provided by your insurance company and submit it along with the supporting documentation.

- Review and Negotiate: Your insurance company will review your claim and may request additional information. You have the right to negotiate the settlement amount if you believe it is insufficient.

Tips for Maximizing Your Chances of a Successful Claim

- Document Everything: Take photos and videos of the damage, the accident scene, and any injuries. This documentation can be crucial in supporting your claim.

- Seek Medical Attention: If you have been injured, seek immediate medical attention and document all your medical expenses.

- Be Honest and Accurate: Provide accurate information to your insurance company, as any inconsistencies can delay or even deny your claim.

- Contact an Attorney: If you are dealing with a complex claim or facing difficulties with your insurance company, consider consulting an experienced auto insurance attorney.

Texas Auto Insurance Companies and Their Services

Choosing the right auto insurance company is crucial for securing financial protection in case of an accident or other unforeseen events. Texas boasts a diverse landscape of insurance providers, each offering a unique range of services and policy options. Understanding the key features and strengths of different companies can help you make an informed decision that aligns with your individual needs and budget.

Major Auto Insurance Companies in Texas

Texas is home to a wide array of insurance companies, both national and regional. Some of the major players in the market include:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Farmers

- Liberty Mutual

- Nationwide

- Texas Farm Bureau

Comparison of Services Offered by Different Companies

Each insurance company offers a unique set of services, tailored to cater to different customer needs and preferences. Key areas of comparison include customer support, claims handling, and policy options.

Customer Support

Excellent customer support is essential for a positive insurance experience. Factors to consider include:

- Availability of multiple communication channels (phone, email, online chat)

- Response time and resolution of inquiries

- Friendliness and helpfulness of customer service representatives

- Availability of online resources and self-service tools

Claims Handling

The claims process can be stressful, so choosing a company with a streamlined and efficient claims handling system is crucial. Consider:

- Speed and ease of reporting a claim

- Transparency and communication throughout the process

- Fair and prompt settlement of claims

- Availability of 24/7 claims support

Policy Options

Different insurance companies offer varying policy options, allowing you to customize your coverage based on your specific needs. Key areas of focus include:

- Types of coverage offered (liability, collision, comprehensive, etc.)

- Deductible options

- Discounts and premium savings opportunities

- Add-on features like roadside assistance or rental car coverage

Key Features and Ratings of Different Insurance Companies

| Company | Customer Support Rating | Claims Handling Rating | Financial Strength Rating | Overall Rating |

|---|---|---|---|---|

| State Farm | 4.5/5 | 4.0/5 | A+ | 4.2/5 |

| Geico | 4.0/5 | 4.5/5 | A+ | 4.3/5 |

| Progressive | 3.5/5 | 3.0/5 | A | 3.3/5 |

| Allstate | 4.0/5 | 3.5/5 | A+ | 3.8/5 |

| USAA | 4.8/5 | 4.7/5 | A+ | 4.8/5 |

| Farmers | 3.0/5 | 3.5/5 | A | 3.3/5 |

| Liberty Mutual | 3.5/5 | 4.0/5 | A | 3.8/5 |

| Nationwide | 4.0/5 | 3.0/5 | A+ | 3.5/5 |

| Texas Farm Bureau | 4.5/5 | 4.0/5 | A | 4.3/5 |

Note: Ratings are based on a combination of industry reviews, customer feedback, and financial stability assessments. They are intended as a general guide and may vary depending on individual experiences and specific policy details.

End of Discussion

Understanding Texas auto insurance is crucial for every driver. By understanding the laws, coverage options, and factors influencing rates, you can make informed decisions to protect yourself financially and ensure you have the right coverage for your needs. Remember to shop around, compare quotes, and consider discounts to find the most affordable and comprehensive policy.

Detailed FAQs: State Of Texas Auto Insurance

What are the minimum liability coverage limits required in Texas?

Texas requires drivers to have a minimum of $30,000 in liability coverage per person, $60,000 per accident, and $25,000 for property damage.

What is the difference between collision and comprehensive coverage?

Collision coverage protects your vehicle in case of an accident, while comprehensive coverage covers damages from non-collision events like theft, vandalism, or natural disasters.

How can I find affordable auto insurance in Texas?

Compare quotes from multiple insurance companies, negotiate rates, and explore discounts for safe driving, good credit, and bundling policies.