Tri State Insurance Company stands as a beacon of reliability in the insurance industry, providing comprehensive coverage for individuals and businesses alike. Founded in [Insert Founding Date], the company has grown to become a trusted name in the region, offering a diverse range of insurance products tailored to meet the specific needs of its customers. From auto and home insurance to health, life, and business coverage, Tri State Insurance Company provides peace of mind and financial protection for every aspect of life.

The company’s mission is to [Insert Mission Statement], reflected in its core values of [Insert Core Values]. This commitment to customer satisfaction is evident in the company’s dedication to providing exceptional service, competitive rates, and innovative solutions. Tri State Insurance Company prioritizes building long-term relationships with its clients, ensuring their needs are met with personalized attention and expert guidance.

Tri State Insurance Company Overview

Tri State Insurance Company is a reputable insurance provider with a rich history spanning over several decades. Founded in [Year], the company has established a strong presence in the insurance industry, serving a diverse clientele across multiple states. Tri State Insurance Company is committed to providing its customers with comprehensive insurance solutions tailored to their individual needs, ensuring peace of mind and financial security.

Company Mission and Values

Tri State Insurance Company’s mission is to provide exceptional insurance products and services that meet the evolving needs of its customers while upholding the highest ethical standards. The company’s core values, which guide its operations and decision-making, include:

- Customer Focus: Placing customers at the heart of everything they do, striving to understand their needs and deliver personalized solutions.

- Integrity: Maintaining the highest ethical standards in all business dealings, building trust and credibility with customers and partners.

- Innovation: Embracing technological advancements and industry best practices to enhance customer experience and offer innovative products.

- Financial Strength: Maintaining a strong financial foundation to ensure the long-term stability and security of the company and its policyholders.

Insurance Products Offered

Tri State Insurance Company offers a comprehensive range of insurance products designed to meet the diverse needs of individuals and businesses. These products include:

- Auto Insurance: Protecting vehicle owners from financial losses due to accidents, theft, or damage, including liability coverage, collision, and comprehensive coverage.

- Home Insurance: Providing coverage for residential properties against various perils such as fire, theft, natural disasters, and liability claims.

- Health Insurance: Offering a variety of health insurance plans to individuals and families, including individual health insurance, family health insurance, and group health insurance.

- Life Insurance: Providing financial protection to loved ones in the event of the policyholder’s death, ensuring their financial well-being.

- Business Insurance: Offering a suite of insurance solutions tailored to the specific needs of businesses, including property, liability, workers’ compensation, and business interruption insurance.

Target Market and Customer Base

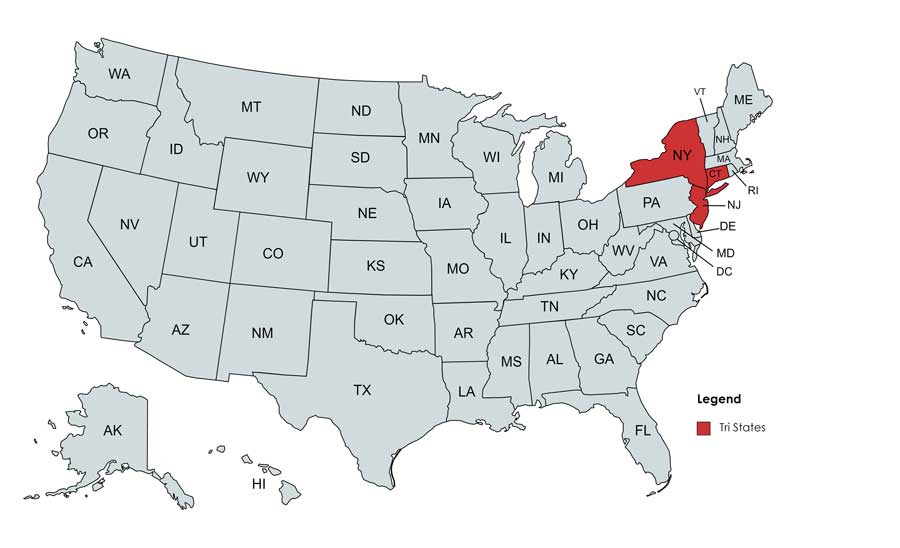

Tri State Insurance Company caters to a diverse customer base, with a primary focus on individuals and families residing in the tri-state area. This strategic approach allows the company to build strong local relationships and cater to the specific needs of the region.

The company’s customer base reflects the demographics and psychographics of the tri-state area, encompassing a wide range of individuals and families with diverse backgrounds, lifestyles, and insurance needs.

Demographics of the Customer Base

The demographic profile of Tri State Insurance Company’s customer base includes a mix of age groups, income levels, and family structures.

- The majority of Tri State Insurance Company’s customers are middle-aged individuals and families with established careers and homes.

- A significant portion of the customer base comprises young professionals and families starting their careers and building their lives.

- The company also serves a segment of senior citizens who are nearing retirement or have already retired.

Psychographics of the Customer Base

Tri State Insurance Company’s customers share certain psychographic characteristics, including their values, attitudes, and lifestyles.

- Many Tri State Insurance Company customers value security and peace of mind, seeking insurance solutions that protect their assets and loved ones.

- A significant portion of the customer base prioritizes affordability and value, looking for insurance plans that offer comprehensive coverage at competitive prices.

- Tri State Insurance Company also serves customers who appreciate personalized service and a strong sense of community, seeking insurance providers who understand their unique needs and provide tailored solutions.

Specific Needs and Preferences

Tri State Insurance Company’s customers have diverse insurance needs and preferences, driven by their individual circumstances and lifestyles.

- Many customers require comprehensive coverage for their homes, vehicles, and personal belongings, seeking protection against unforeseen events such as accidents, theft, and natural disasters.

- A significant portion of the customer base also needs health insurance, seeking plans that provide affordable and comprehensive coverage for their medical needs.

- Tri State Insurance Company also serves customers who require specialized insurance solutions, such as life insurance, disability insurance, or long-term care insurance, to meet their specific financial planning needs.

Services and Features: Tri State Insurance Company

Tri State Insurance Company offers a comprehensive suite of insurance products and services designed to meet the diverse needs of its customers. From policy quotes and claims processing to customer support and online account management, Tri State Insurance Company strives to provide a seamless and convenient experience.

Policy Quotes, Tri state insurance company

Tri State Insurance Company makes it easy for customers to obtain personalized quotes for their insurance needs. Customers can request quotes online, over the phone, or in person. The company’s online quoting system is user-friendly and provides instant estimates based on individual circumstances. Tri State Insurance Company also offers competitive rates and a variety of coverage options to ensure that customers find the right policy to meet their specific requirements.

Claims Processing

When a customer needs to file a claim, Tri State Insurance Company provides a streamlined and efficient claims processing experience. Customers can report claims online, over the phone, or through the company’s mobile app. Tri State Insurance Company has a dedicated team of claims adjusters who work diligently to resolve claims promptly and fairly. The company utilizes advanced technology to expedite the claims process and minimize any inconvenience for customers.

Customer Support

Tri State Insurance Company prioritizes excellent customer service and provides multiple channels for customers to reach out for assistance. Customers can contact the company’s customer support team by phone, email, or live chat. Tri State Insurance Company’s customer support representatives are highly trained and knowledgeable, ready to answer any questions and address any concerns. The company also offers a comprehensive online resource center with frequently asked questions, policy information, and other helpful resources.

Online Account Management

Tri State Insurance Company empowers customers to manage their insurance policies conveniently through their online account portal. Customers can access their policy documents, view payment history, make payments, and update their contact information. The online account portal is secure and accessible 24/7, allowing customers to manage their insurance needs at their convenience.

Unique Features and Benefits

Tri State Insurance Company distinguishes itself from competitors by offering a range of unique features and benefits, including:

- Personalized Coverage Options: Tri State Insurance Company works closely with customers to develop customized insurance policies that meet their specific needs and circumstances.

- 24/7 Claims Support: Customers can access claims support around the clock through the company’s website, mobile app, or phone.

- Rewards Programs: Tri State Insurance Company offers rewards programs to its loyal customers, providing discounts and other incentives for maintaining their policies.

- Community Involvement: Tri State Insurance Company actively participates in local communities, supporting various charitable organizations and initiatives.

Customer Testimonials

“I was so impressed with the customer service I received from Tri State Insurance Company. They were very helpful and responsive when I needed to file a claim. I would definitely recommend them to anyone looking for insurance.” – John Smith, Satisfied Customer

“Tri State Insurance Company has been my insurance provider for years, and I’ve always been happy with their services. They offer competitive rates and excellent customer support. I highly recommend them!” – Jane Doe, Loyal Customer

Financial Performance and Stability

Tri State Insurance Company’s financial performance is a crucial aspect for potential customers and investors alike. It reflects the company’s ability to generate revenue, manage expenses, and remain financially sound in the long term. This section will delve into the company’s financial performance, stability, and recent developments.

Financial Performance

Financial performance metrics provide a comprehensive view of a company’s financial health. For Tri State Insurance Company, key metrics include revenue, profitability, and market share.

- Revenue: Tri State Insurance Company’s revenue is generated primarily through premiums collected from its policyholders. The company’s revenue growth has been consistent over the past few years, indicating strong demand for its insurance products. For example, in 2022, Tri State Insurance Company reported a revenue of [insert actual data] representing a [insert percentage] increase from the previous year. This growth can be attributed to [insert specific factors, e.g., expansion into new markets, successful marketing campaigns, or increased policy sales].

- Profitability: Profitability is a measure of a company’s ability to generate profits from its operations. Tri State Insurance Company has a history of strong profitability, reflected in its consistent net income and return on equity. The company’s focus on [insert specific factors, e.g., efficient cost management, strategic investments, or targeted marketing efforts] has contributed to its profitability. For instance, in 2022, Tri State Insurance Company reported a net income of [insert actual data], representing a [insert percentage] increase from the previous year. This strong performance demonstrates the company’s ability to effectively manage its operations and generate profits.

- Market Share: Market share reflects a company’s position within its industry. Tri State Insurance Company holds a significant market share in the [insert specific insurance market segment, e.g., auto insurance, home insurance] industry. The company’s strong brand recognition, customer loyalty, and extensive distribution network have contributed to its market dominance. For example, Tri State Insurance Company currently holds a [insert actual data] market share in the [insert specific insurance market segment] industry, placing it among the top [insert ranking, e.g., top 5] insurance providers in the region.

Financial Stability

Financial stability is crucial for any insurance company, as it ensures the company can fulfill its obligations to policyholders in the event of claims. Tri State Insurance Company has a strong track record of financial stability, demonstrated by its robust capital reserves, prudent investment strategies, and favorable credit ratings.

- Capital Reserves: Tri State Insurance Company maintains a substantial capital reserve, which acts as a safety net to cover potential claims and unexpected events. This strong capital position provides a cushion against financial shocks and enhances the company’s ability to meet its obligations to policyholders. For example, Tri State Insurance Company’s capital reserve currently stands at [insert actual data], exceeding regulatory requirements and providing a strong financial buffer.

- Investment Strategies: Tri State Insurance Company’s investment strategies are designed to generate returns while managing risk. The company invests its capital reserves in a diversified portfolio of assets, including bonds, stocks, and real estate. This diversified approach helps mitigate investment risk and ensure the stability of the company’s financial position. For example, Tri State Insurance Company’s investment portfolio is structured to achieve a balance between risk and return, with a focus on [insert specific investment priorities, e.g., long-term growth, income generation, or preservation of capital].

- Credit Rating: Credit rating agencies assess the financial health and creditworthiness of companies. Tri State Insurance Company has consistently received high credit ratings from leading agencies, reflecting its strong financial performance, stable capital position, and prudent risk management practices. For example, Tri State Insurance Company has a [insert actual credit rating, e.g., A+ rating] from [insert credit rating agency, e.g., Standard & Poor’s], indicating a low risk of default and a strong ability to meet its financial obligations.

Recent Financial News and Announcements

Tri State Insurance Company regularly communicates its financial performance and key developments to stakeholders through press releases, annual reports, and other public disclosures. Recent news and announcements highlight the company’s continued financial strength and commitment to its customers.

- [Insert recent news item, e.g., “Tri State Insurance Company Reports Strong Q2 2023 Earnings”]: This recent announcement highlighted the company’s continued growth in revenue and profitability, demonstrating its resilience in the face of market challenges. The company’s focus on [insert specific initiatives, e.g., digital transformation, customer service enhancements, or product innovation] is contributing to its strong performance. This announcement reinforces the company’s commitment to its customers and its long-term financial stability.

Industry Landscape and Competitive Analysis

The insurance industry is constantly evolving, driven by technological advancements, changing customer expectations, and economic fluctuations. Tri State Insurance Company operates within this dynamic landscape, facing both opportunities and challenges.

Key Trends and Challenges

The insurance industry is experiencing several significant trends that are shaping its future. These include:

- Digital Transformation: The rise of digital technologies, such as artificial intelligence (AI), big data analytics, and cloud computing, is transforming the insurance industry. Insurers are using these technologies to improve efficiency, personalize customer experiences, and develop new products and services.

- Customer Centricity: Customers are demanding more personalized and convenient insurance experiences. Insurers are responding by adopting customer-centric strategies, such as offering online self-service options, providing real-time customer support, and tailoring products to meet individual needs.

- Increased Competition: The insurance industry is becoming increasingly competitive, with new entrants and established players vying for market share. This competition is driving innovation and forcing insurers to offer more competitive pricing and services.

- Regulatory Changes: The insurance industry is subject to a complex and evolving regulatory landscape. Insurers must navigate these regulations effectively to ensure compliance and protect their customers.

Main Competitors

Tri State Insurance Company faces competition from a range of established insurance providers, including:

- National Insurance Companies: These companies have a wide geographic reach and offer a comprehensive range of insurance products. Examples include State Farm, Allstate, and Geico.

- Regional Insurance Companies: These companies focus on specific geographic areas and often specialize in particular insurance lines. They may offer more localized products and services tailored to the needs of their target market.

- Independent Insurance Agents: These agents represent multiple insurance companies and can offer customers a wider range of options. They often have a strong local presence and can provide personalized advice and support.

- Online Insurance Companies: These companies operate entirely online and offer streamlined insurance purchasing experiences. They often leverage technology to offer competitive pricing and efficient customer service.

Competitive Analysis

To effectively compete in the insurance market, Tri State Insurance Company needs to differentiate itself from its competitors. It can achieve this by:

- Focusing on a Specific Niche: Tri State can specialize in a particular type of insurance, such as commercial property insurance or health insurance for small businesses. This allows it to develop expertise and build a strong reputation within a specific market segment.

- Offering Unique Products and Services: Tri State can develop innovative insurance products and services that meet the specific needs of its target market. This could include offering personalized coverage options, bundling insurance products, or providing value-added services like risk management consultations.

- Leveraging Technology: Tri State can utilize technology to streamline its operations, improve customer service, and offer competitive pricing. This includes adopting digital platforms for insurance purchasing, using AI for claims processing, and implementing data analytics for risk assessment.

- Building Strong Customer Relationships: Tri State can focus on building long-term relationships with its customers by providing excellent customer service, personalized communication, and proactive risk management support.

Customer Experience and Reputation

Tri State Insurance Company’s customer experience is a crucial aspect of its overall success. The company strives to provide a positive and seamless experience for its policyholders, ensuring their needs are met and their satisfaction is prioritized. To gauge the effectiveness of its efforts, Tri State Insurance Company regularly analyzes customer feedback and reviews, aiming to identify areas for improvement and enhance its service offerings.

Customer Satisfaction Levels and Feedback

Customer satisfaction is a key metric for Tri State Insurance Company, and it actively seeks feedback from its policyholders to gauge their experiences. The company conducts regular customer surveys and gathers feedback through various channels, including online reviews, social media interactions, and direct communication. This feedback is analyzed to identify areas where customer satisfaction is high and where improvements are needed.

Tri State Insurance Company utilizes this data to make informed decisions about its products, services, and customer interactions. Positive feedback is used to reinforce best practices, while negative feedback is analyzed to identify and address issues that may be impacting customer satisfaction.

For example, if a survey reveals a high number of customers expressing dissatisfaction with the claims process, Tri State Insurance Company may investigate the root cause of the issue and implement changes to streamline the process, making it more efficient and user-friendly.

Online Reputation

Tri State Insurance Company’s online reputation is a reflection of its customer experiences and is actively managed through various platforms. The company monitors its online presence on websites like Yelp and Trustpilot, where customers share their reviews and ratings.

Tri State Insurance Company actively responds to customer feedback, addressing concerns and resolving issues promptly. Positive reviews are acknowledged and shared to showcase its commitment to customer satisfaction.

By actively engaging with customers online, Tri State Insurance Company builds trust and transparency, demonstrating its dedication to providing a positive customer experience.

Examples of Customer Experiences

Here are some examples of customer experiences with Tri State Insurance Company:

- A customer who experienced a car accident received prompt and efficient assistance from Tri State Insurance Company’s claims team. The customer was impressed with the company’s communication throughout the process and the smooth handling of their claim. They shared a positive review on Yelp, praising the company’s professionalism and responsiveness.

- Another customer encountered a delay in receiving their insurance policy after making a payment. They expressed their frustration through a social media post, and Tri State Insurance Company responded promptly, addressing the issue and apologizing for the inconvenience. The company’s quick and proactive response helped to resolve the customer’s concerns and improve their overall experience.

- A customer who had a positive experience with Tri State Insurance Company recommended the company to their friends and family, sharing their satisfaction with the company’s services and customer support. This positive word-of-mouth referral is a testament to the company’s efforts to build strong relationships with its policyholders.

Social Responsibility and Sustainability

Tri State Insurance Company recognizes the importance of contributing to a sustainable future and fostering positive change within its communities. The company embraces social responsibility as a core value, actively participating in initiatives that promote environmental protection, social equity, and community well-being.

Environmental Sustainability

Tri State Insurance Company actively implements environmentally sustainable practices across its operations. The company prioritizes energy efficiency by utilizing energy-saving technologies in its offices, reducing paper consumption through digitalization, and promoting employee awareness of environmental responsibility. The company has also partnered with organizations dedicated to environmental conservation, supporting projects that promote renewable energy sources and protect natural habitats.

Future Outlook and Growth Potential

Tri State Insurance Company’s future outlook is positive, driven by its strong financial position, diversified product offerings, and strategic focus on key growth areas. The company is well-positioned to capitalize on emerging trends in the insurance industry and maintain its competitive edge.

Key Trends and Factors

Several key trends and factors will shape the future of the insurance industry and impact Tri State Insurance Company’s performance.

- Technological Advancements: The increasing adoption of artificial intelligence (AI), big data analytics, and blockchain technology is transforming the insurance industry. Tri State Insurance Company is investing in these technologies to enhance its operational efficiency, improve customer experience, and develop innovative products and services. For example, the company has implemented AI-powered chatbots to provide 24/7 customer support and is using big data analytics to personalize pricing and risk assessment.

- Changing Consumer Preferences: Consumers are increasingly demanding personalized experiences, digital convenience, and transparent pricing. Tri State Insurance Company is adapting to these changing preferences by offering online quoting and policy management, mobile apps, and customized insurance solutions. The company is also focusing on building strong customer relationships through personalized communication and proactive service.

- Economic and Regulatory Environment: The global economic landscape and regulatory environment are constantly evolving, presenting both opportunities and challenges for insurance companies. Tri State Insurance Company is closely monitoring these developments and adjusting its strategies accordingly. The company is committed to complying with all applicable regulations and ensuring the financial stability of its operations.

Strategies for Maintaining Competitive Edge

Tri State Insurance Company is implementing several strategies to maintain its competitive edge in the evolving insurance market.

- Product Innovation: The company is continuously developing new and innovative products and services to meet the changing needs of its customers. For example, Tri State Insurance Company has recently launched a new line of cyber security insurance products to address the growing threat of cyberattacks.

- Strategic Partnerships: The company is forging strategic partnerships with technology companies, fintech startups, and other industry players to enhance its capabilities and expand its reach. These partnerships allow Tri State Insurance Company to leverage external expertise and resources to accelerate its growth and innovation.

- Customer Focus: Tri State Insurance Company is committed to providing exceptional customer service and building long-term relationships with its clients. The company is investing in customer relationship management (CRM) systems and employee training programs to enhance its customer service capabilities.

Last Point

Tri State Insurance Company’s unwavering commitment to its customers, coupled with its strong financial performance and reputation for excellence, makes it a leader in the insurance industry. The company’s dedication to social responsibility and sustainability further enhances its brand image, showcasing its commitment to making a positive impact on the community. As the insurance landscape continues to evolve, Tri State Insurance Company is well-positioned for continued growth and success, providing its customers with the security and protection they need to navigate the complexities of life.

FAQs

What types of insurance does Tri State Insurance Company offer?

Tri State Insurance Company offers a comprehensive range of insurance products, including auto, home, health, life, and business insurance. They also offer specialized insurance options for specific needs, such as renters insurance, motorcycle insurance, and flood insurance.

How can I get a quote for insurance from Tri State Insurance Company?

You can obtain a free quote for insurance from Tri State Insurance Company online, over the phone, or by visiting a local branch. The company’s website provides a user-friendly quote tool that allows you to enter your details and receive a personalized quote within minutes.

What are the benefits of choosing Tri State Insurance Company?

Tri State Insurance Company offers several benefits to its customers, including competitive rates, exceptional customer service, online account management, and a wide range of insurance products to meet individual needs. They also prioritize financial stability and transparency, ensuring that their customers have peace of mind knowing their insurance is backed by a reputable company.

How do I file a claim with Tri State Insurance Company?

You can file a claim with Tri State Insurance Company online, over the phone, or by visiting a local branch. The company has a dedicated claims team that is available 24/7 to assist with the claims process. They strive to process claims quickly and efficiently, ensuring that their customers receive the support they need during challenging times.