State minimum insurance coverage is a vital aspect of responsible driving, ensuring that drivers have financial protection in the event of an accident. Every state in the United States mandates a minimum level of insurance coverage, designed to cover basic costs associated with accidents, such as medical expenses and property damage. This minimum coverage varies across states, reflecting factors like population density, traffic volume, and accident rates. While state minimums provide a baseline of protection, understanding the limitations and potential consequences of relying solely on minimum coverage is crucial for drivers.

This article delves into the intricacies of state minimum insurance coverage, examining its purpose, coverage limits, influencing factors, and the importance of considering additional coverage options. We’ll explore the impact of minimum coverage on drivers, both financially and legally, and discuss the significance of uninsured motorist coverage. Finally, we’ll look at potential future trends in state minimum insurance requirements and the role of technological advancements in shaping insurance regulations.

What is State Minimum Insurance Coverage?

State minimum insurance coverage refers to the minimum amount of liability insurance that drivers are required to carry in each state. It’s designed to protect drivers from financial ruin in the event of an accident where they are at fault.

Purpose of State Minimum Insurance Coverage

The primary purpose of state minimum insurance coverage is to ensure that drivers have sufficient financial resources to cover the costs associated with accidents they cause. This includes medical expenses for injured parties, property damage, and lost wages. By requiring drivers to carry a minimum amount of insurance, states aim to protect both drivers and pedestrians from the financial burden of accidents.

Types of Insurance Coverage Required by Each State

Each state mandates different types of insurance coverage, and the minimum amounts vary widely. Typically, the required coverage includes:

* Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused by the insured driver to other people in an accident.

* Property Damage Liability: This coverage pays for damage to another person’s vehicle or property caused by the insured driver.

* Uninsured/Underinsured Motorist Coverage: This coverage protects the insured driver if they are involved in an accident with a driver who has no insurance or insufficient insurance.

State Minimum Coverage Requirements

The following table compares the minimum coverage requirements for bodily injury liability and property damage liability across different states:

| State | Bodily Injury Liability per Person | Bodily Injury Liability per Accident | Property Damage Liability |

|---|---|---|---|

| Alabama | $25,000 | $50,000 | $25,000 |

| Alaska | $50,000 | $100,000 | $25,000 |

| Arizona | $25,000 | $50,000 | $15,000 |

| Arkansas | $25,000 | $50,000 | $25,000 |

| California | $15,000 | $30,000 | $5,000 |

Understanding the Coverage Limits

State minimum insurance coverage, while mandatory, often comes with strict limits on the amount of financial protection it provides. Understanding these limits is crucial, as they directly impact how much financial assistance you can receive in the event of an accident.

Consequences of Minimum Coverage

The potential consequences of having only minimum coverage in case of an accident can be significant. Minimum coverage might not be enough to cover all the expenses arising from an accident, leaving you responsible for the remaining costs. This can lead to significant financial burdens, potentially affecting your financial stability.

Examples of Insufficient Coverage

- Imagine a situation where you are involved in an accident that results in severe injuries to another driver and significant damage to their vehicle. The minimum coverage might not be sufficient to cover their medical expenses, lost wages, and vehicle repairs. You could be held personally liable for the remaining costs.

- In another scenario, you might be involved in an accident where your vehicle is totaled. The minimum coverage might only cover the actual cash value of your vehicle, which is typically lower than the market value. You might not be able to replace your vehicle with a similar one, leaving you with a significant financial shortfall.

Factors Influencing State Minimums: State Minimum Insurance Coverage

State minimum insurance coverage requirements are influenced by a complex interplay of factors, including the state’s unique demographics, traffic patterns, and accident statistics. These requirements aim to strike a balance between providing adequate financial protection for accident victims and ensuring affordability for drivers.

Impact of Demographic Factors

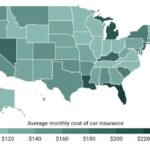

The state’s population density, traffic volume, and accident rates significantly influence minimum coverage requirements. States with higher population densities and traffic volumes generally have stricter minimum coverage requirements to address the increased risk of accidents and potential for greater financial losses.

- States with higher population densities and traffic volumes, like New York and California, tend to have stricter minimum insurance coverage requirements than states with lower population densities, like Wyoming or Montana.

- The number of accidents and the severity of injuries sustained in accidents also influence state minimums. States with higher accident rates and more severe injuries, like Florida and Texas, may have higher minimum coverage requirements to compensate for the increased risk.

Comparison with Industry Recommendations

State minimum insurance coverage requirements often differ from the recommendations of insurance industry associations. These associations typically recommend higher coverage limits to provide more comprehensive financial protection for accident victims. However, state legislatures may prioritize affordability for drivers, leading to lower minimum coverage requirements.

- For instance, the Insurance Institute for Highway Safety (IIHS) recommends minimum liability coverage limits of $100,000 per person and $300,000 per accident, which is significantly higher than the minimum coverage requirements in many states.

- These discrepancies highlight the ongoing debate between providing adequate financial protection for accident victims and ensuring affordability for drivers.

The Importance of Additional Coverage

While state minimum insurance coverage is legally required, it often falls short of providing comprehensive protection in the event of an accident. Opting for additional coverage beyond the minimum can significantly enhance your financial security and peace of mind.

Additional coverage can help you cover expenses that go beyond what the state minimum mandates. These expenses might include medical bills, lost wages, property damage, or legal fees. Purchasing additional coverage can provide a safety net in situations where the state minimum might not be enough to cover your losses.

Types of Additional Coverage

Several types of additional coverage can enhance your insurance policy and provide greater protection.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It helps cover your medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This can be crucial in protecting yourself from financial hardship if you are responsible for an accident or if the other driver is uninsured.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It can help you replace or repair your vehicle if it is damaged by these events.

- Medical Payments Coverage (Med Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of fault. It can provide essential financial assistance in the event of an accident, even if you are not at fault.

- Rental Car Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It can provide convenience and peace of mind, allowing you to maintain your mobility during the repair process.

Scenarios Where Additional Coverage is Essential

Several scenarios highlight the importance of additional coverage beyond the state minimum.

- Hit and Run Accidents: If you are involved in a hit-and-run accident, the other driver will not be available to provide insurance information. In such cases, uninsured/underinsured motorist coverage can protect you from significant financial losses.

- Accidents with Drivers with Limited Insurance: Even if the other driver has insurance, it might not be enough to cover all your expenses, especially if you have significant medical bills or property damage. Underinsured motorist coverage can bridge the gap and ensure you are adequately compensated.

- Accidents Involving Expensive Vehicles: If you own a high-value vehicle, collision and comprehensive coverage are crucial. These coverages can help you replace or repair your vehicle if it is damaged in an accident or by other events.

- Accidents with Multiple Passengers: If you frequently transport passengers, medical payments coverage can be invaluable. This coverage can help pay for medical expenses for your passengers, regardless of fault, ensuring they receive the necessary care.

The Impact of State Minimum Coverage on Drivers

State minimum insurance coverage can have both financial and legal implications for drivers. While it may seem like a simple requirement, understanding its limitations and potential challenges is crucial for responsible driving.

Financial Impact of Minimum Coverage

Drivers with only minimum coverage might face significant financial burdens in the event of an accident. Here are some key points:

- Limited Coverage: Minimum coverage often falls short of covering the full cost of repairs, medical bills, or lost wages, especially in serious accidents.

- Out-of-Pocket Expenses: Drivers may have to pay out-of-pocket for expenses exceeding the coverage limits, leading to substantial financial strain.

- Higher Premiums: Despite limited coverage, drivers with only minimum insurance may still face relatively high premiums, especially if they have a poor driving record.

Legal Implications of Minimum Coverage

Minimum coverage can have significant legal consequences for drivers. Here are some key considerations:

- Liability Coverage: Minimum liability coverage may not be enough to cover the damages caused to other drivers or their property in an accident.

- Legal Action: Drivers with inadequate coverage could face lawsuits from injured parties seeking compensation for their losses.

- Financial Ruin: If a driver is found liable for a significant accident, they could be held personally responsible for damages exceeding their coverage limits, potentially leading to financial ruin.

Challenges Faced by Drivers with Minimum Coverage

Drivers with only minimum coverage face several challenges:

- Inability to Cover Losses: Minimum coverage may not be sufficient to cover the full cost of repairs, medical expenses, and lost wages, leaving drivers with significant financial burdens.

- Limited Protection: Minimum coverage offers limited protection against financial ruin in the event of a serious accident, leaving drivers vulnerable to significant financial losses.

- Increased Risk: Driving with only minimum coverage can lead to increased financial risk and potential legal complications.

Understanding the Limitations of State Minimum Insurance

It is crucial to understand the limitations of state minimum insurance:

- Minimum Coverage: State minimums are the bare minimum required by law, and they may not be sufficient to cover the costs of a serious accident.

- Varying Requirements: State minimums vary significantly, and drivers should be aware of the specific requirements in their state.

- Individual Needs: Drivers should assess their individual needs and consider purchasing additional coverage to ensure adequate financial protection.

State Minimum Coverage and Uninsured Motorists

Driving without insurance is illegal in most states, but unfortunately, many drivers on the road still don’t have the required coverage. This means you could be involved in an accident with an uninsured motorist and face significant financial hardship.

Uninsured Motorist Coverage: Why It Matters

Uninsured motorist coverage (UM) is an optional insurance add-on that provides financial protection in case you are involved in an accident with a driver who doesn’t have insurance. This coverage helps cover your medical expenses, lost wages, and property damage.

Challenges of Uninsured Motorist Accidents, State minimum insurance coverage

Accidents involving uninsured motorists can be incredibly challenging for victims.

- Financial Burden: The costs associated with an accident, such as medical bills, vehicle repairs, and lost wages, can quickly add up. Without insurance coverage from the at-fault driver, you are responsible for these expenses.

- Legal Battles: Proving fault and pursuing compensation from an uninsured driver can be a long and expensive process. You may need to hire an attorney to navigate the legal system and protect your rights.

- Limited Options for Recovery: Even if you successfully prove fault, there is no guarantee that you will receive full compensation from an uninsured driver who may not have the financial means to cover your losses.

State Minimum Insurance and Uninsured Motorist Protection

State minimum insurance requirements aim to protect drivers and their property, but they often fall short of providing adequate coverage for accidents involving uninsured motorists.

- Limited Coverage Limits: State minimums may only cover a small portion of your potential losses, leaving you responsible for the remaining costs.

- Focus on Liability: State minimums primarily focus on liability coverage, which protects other drivers if you cause an accident. They often offer limited or no coverage for your own losses.

- Lack of Comprehensive Protection: State minimum insurance may not cover all types of accidents or losses, such as hit-and-run accidents or injuries caused by uninsured pedestrians.

Future Trends in State Minimum Insurance

State minimum insurance coverage requirements are likely to evolve in the coming years, driven by a confluence of factors, including technological advancements, changing societal needs, and evolving economic conditions.

Factors Influencing Changes in Minimum Coverage Requirements

Several factors may influence future changes in state minimum insurance coverage requirements. These include:

- Rising Healthcare Costs: As healthcare costs continue to escalate, states may consider increasing minimum coverage limits to ensure that individuals have sufficient financial protection in the event of an accident.

- Increased Traffic Congestion and Accident Rates: With growing urbanization and increased traffic density, states may consider raising minimum coverage requirements to address the potential for more severe accidents and higher costs associated with injuries and property damage.

- Technological Advancements in Vehicle Safety: The introduction of autonomous vehicles and advanced driver-assistance systems (ADAS) may lead to a reassessment of minimum coverage requirements. These technologies could potentially reduce the frequency and severity of accidents, potentially leading to lower minimum coverage limits in some states.

- Economic Conditions: Economic downturns or periods of high inflation may prompt states to adjust minimum coverage requirements to reflect changes in the cost of living and the affordability of insurance for drivers.

- Public Policy Initiatives: State legislatures and regulatory bodies may enact new laws or policies that mandate changes to minimum coverage requirements, such as increasing minimum coverage limits for uninsured/underinsured motorist coverage to better protect victims of accidents caused by drivers without sufficient insurance.

The Impact of Technological Advancements on Insurance Regulations

Technological advancements are likely to have a significant impact on state minimum insurance coverage requirements.

- Telematics and Usage-Based Insurance: Telematics devices, which track driving behavior, can provide valuable data that insurers can use to assess risk and offer personalized premiums. This data could potentially lead to changes in minimum coverage requirements, with lower limits for safer drivers and higher limits for those with riskier driving habits.

- Autonomous Vehicles: The widespread adoption of autonomous vehicles may necessitate a reassessment of minimum coverage requirements. As these vehicles are expected to reduce accidents and injuries, some states may consider lowering minimum coverage limits. However, other states may choose to maintain or even increase coverage limits to address potential liability issues associated with autonomous vehicles.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are increasingly being used in the insurance industry for risk assessment, fraud detection, and claims processing. These technologies could potentially lead to more accurate and efficient insurance pricing, which could impact minimum coverage requirements.

Final Conclusion

Navigating the world of insurance can be complex, and understanding the nuances of state minimum insurance coverage is essential for every driver. By recognizing the limitations of minimum coverage, considering additional protection options, and staying informed about future trends, drivers can make informed decisions to ensure adequate financial protection in the event of an accident. Remember, driving responsibly and understanding your insurance coverage are key to staying safe on the road.

FAQ Summary

What happens if I only have state minimum insurance coverage and I cause a serious accident?

If you cause a serious accident and only have state minimum insurance coverage, you may not have enough coverage to cover all the damages and injuries. This could lead to significant financial hardship, including legal fees, medical expenses, and property damage repairs. You could also face legal consequences, such as fines, license suspension, or even jail time.

Is state minimum insurance coverage enough for everyone?

No, state minimum insurance coverage is not enough for everyone. It is designed to provide basic protection, but many drivers may benefit from additional coverage to better protect themselves financially in the event of an accident. Factors like the value of your vehicle, your driving history, and your personal financial situation can influence the need for additional coverage.

How can I find out the state minimum insurance requirements in my state?

You can find the state minimum insurance requirements for your state by visiting your state’s Department of Motor Vehicles (DMV) website or contacting your insurance agent.

What are some examples of additional coverage options that I can consider?

Some examples of additional coverage options include:

- Collision coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Underinsured/Uninsured Motorist coverage: This protects you in the event of an accident with a driver who has insufficient or no insurance.

- Medical Payments coverage: This covers medical expenses for you and your passengers, regardless of fault.