State of texas minimum auto insurance requirements – Texas Minimum Auto Insurance Requirements are crucial for all drivers in the state. These requirements ensure that drivers have financial protection in case of an accident, protecting themselves and others on the road. The state mandates specific liability coverages to address potential damages and injuries. This article will delve into the specifics of Texas’s minimum auto insurance requirements, providing a comprehensive understanding of the legal basis, coverage types, and potential consequences of non-compliance.

Driving without the required minimum insurance can lead to serious penalties, including fines, license suspension, and even jail time. Furthermore, being uninsured in an accident can result in significant financial hardship, as you would be personally responsible for any damages or injuries caused. Therefore, it’s essential to understand and comply with Texas’s minimum auto insurance requirements to protect yourself and others on the road.

Texas Minimum Auto Insurance Requirements

Texas law mandates that all drivers carry a minimum amount of liability insurance to protect themselves and others on the road. This requirement aims to ensure that individuals who cause accidents have the financial resources to cover the damages they inflict.

Liability Coverage Requirements

Texas requires drivers to carry liability insurance to cover damages they cause to others in an accident. These requirements include:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries caused to another person in an accident. Texas law mandates a minimum of $30,000 per person and $60,000 per accident. This means that if you cause an accident injuring two people, your insurance will pay up to $30,000 for each individual, with a total maximum of $60,000 for the accident.

- Property Damage Liability: This coverage pays for damages to another person’s property, such as their vehicle, in an accident. Texas law mandates a minimum of $25,000 per accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient coverage to cover your losses. It provides financial protection for your medical expenses, lost wages, and property damage. Texas law requires that drivers carry uninsured/underinsured motorist coverage equal to their liability limits, which are $30,000 per person and $60,000 per accident for bodily injury and $25,000 per accident for property damage.

Financial Responsibility Laws

Texas has strict financial responsibility laws that require drivers to demonstrate proof of financial responsibility, typically through auto insurance. These laws aim to ensure that drivers are held accountable for their actions on the road and have the means to cover the costs of any accidents they cause.

If a driver is involved in an accident and does not have the required minimum liability insurance, they can face severe consequences, including:

- Suspension of driver’s license: The Texas Department of Motor Vehicles (TxDMV) can suspend the driver’s license until proof of insurance is provided.

- Fines and penalties: Drivers without insurance can face hefty fines, which can vary depending on the circumstances of the accident.

- Legal action: If you are involved in an accident with an uninsured driver, you may have to pursue legal action to recover your losses.

Understanding the Coverage Requirements

To drive legally in Texas, you must have the minimum required auto insurance coverage. This coverage protects you financially if you’re involved in an accident that causes damage to another person’s property or injuries. Understanding the different types of coverage and their specific purposes is crucial for making informed decisions about your insurance needs.

Liability Coverage

Liability coverage is the most important part of your auto insurance policy. It protects you from financial responsibility if you cause an accident that injures someone or damages their property. Texas law requires two types of liability coverage:

* Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other damages if you injure someone in an accident.

* Property Damage Liability (PDL): This coverage pays for repairs or replacement costs if you damage someone else’s property in an accident.

Minimum Coverage Amounts

Texas law sets minimum coverage amounts for BIL and PDL:

* Bodily Injury Liability (BIL): $30,000 per person / $60,000 per accident. This means your insurance will pay up to $30,000 for injuries to one person in an accident and up to $60,000 for all injuries in a single accident.

* Property Damage Liability (PDL): $25,000 per accident. This means your insurance will pay up to $25,000 for damage to another person’s property in an accident.

Examples of Insufficient Coverage

While the minimum coverage amounts are legally required, they might not be enough in many real-world scenarios. Here are some examples:

* Severe Injuries: If you cause an accident that results in severe injuries, the $30,000 per person limit for BIL may not cover all the medical expenses and lost wages.

* Multiple Vehicles: If you cause an accident involving multiple vehicles, the $25,000 limit for PDL may not be sufficient to cover the damage to all the vehicles involved.

* High-Value Property: If you damage a high-value property like a luxury car or a commercial building, the $25,000 limit for PDL might not be enough to cover the repair or replacement costs.

Additional Coverage Options

While Texas law requires only the minimum liability coverage, many drivers choose to purchase additional coverage for greater protection. These optional coverage types provide financial security in various situations, such as accidents involving your own vehicle or medical expenses.

Understanding the benefits and drawbacks of these optional coverages is crucial for making informed decisions about your auto insurance policy.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of fault. This means you can get your car repaired or replaced, even if you are at fault for the accident.

Collision coverage is essential if you have a car loan or lease, as lenders often require it.

The cost of collision coverage depends on several factors, including the value of your vehicle, your driving record, and the deductible you choose. A higher deductible means you pay more out-of-pocket in case of an accident but will have lower premiums.

Comprehensive Coverage

Comprehensive coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or animal collisions.

Comprehensive coverage is optional, but it is recommended for vehicles with a higher value or if you live in an area prone to natural disasters.

The cost of comprehensive coverage is also influenced by factors such as the value of your vehicle, your driving record, and the deductible you choose.

Medical Payments Coverage

Medical payments coverage (Med Pay) covers the medical expenses of you and your passengers, regardless of fault, in case of an accident. It pays for medical bills, such as hospital stays, doctor visits, and ambulance services.

Med Pay coverage is a valuable addition to your policy, especially if you have a high deductible on your health insurance.

The cost of Med Pay coverage varies depending on the coverage amount you choose.

Personal Injury Protection (PIP), State of texas minimum auto insurance requirements

Personal injury protection (PIP) coverage, sometimes called no-fault coverage, covers your own medical expenses and lost wages if you are injured in an accident, regardless of fault.

PIP coverage is mandatory in some states but optional in Texas.

The cost of PIP coverage depends on the coverage amount you choose and your driving record.

Table of Coverage Options

| Coverage Type | Benefits | Typical Costs |

|---|---|---|

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Varies based on vehicle value, driving record, and deductible. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than accidents. | Varies based on vehicle value, driving record, and deductible. |

| Medical Payments Coverage | Covers medical expenses for you and your passengers, regardless of fault. | Varies based on the coverage amount you choose. |

| Personal Injury Protection (PIP) | Covers your own medical expenses and lost wages if you are injured in an accident, regardless of fault. | Varies based on the coverage amount you choose and your driving record. |

Consequences of Driving Without Insurance

Driving without the required minimum auto insurance in Texas can lead to serious legal and financial consequences. Even a minor accident can result in substantial costs, including medical bills, property damage, and legal fees.

Financial Consequences

The financial burden of an accident without insurance can be significant. If you cause an accident, you could be held liable for all damages, including:

- Medical bills for yourself and the other driver(s) involved.

- Property damage to your vehicle and the other vehicles involved.

- Lost wages due to injuries or inability to work.

- Legal fees for defending yourself against a lawsuit.

Even if you are not at fault for the accident, you could still be sued by the other driver(s) involved. Without insurance, you would be personally responsible for all damages.

Penalties and Legal Consequences

Driving without insurance in Texas is a serious offense that can result in a variety of penalties. These penalties can include:

- Fines: A first offense can result in a fine of $175 to $350. Subsequent offenses can lead to higher fines, up to $500.

- License Suspension: Your driver’s license may be suspended for up to six months.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may be required to pay court costs, which can add up to hundreds of dollars.

- Criminal Charges: In some cases, driving without insurance can lead to criminal charges, such as a Class C misdemeanor.

In addition to these penalties, driving without insurance can also affect your ability to obtain insurance in the future. Insurance companies may charge you higher premiums or refuse to insure you altogether if you have a history of driving without insurance.

It is important to remember that even if you have a clean driving record, driving without insurance in Texas can have serious consequences.

Obtaining and Maintaining Insurance

Securing and maintaining auto insurance in Texas is a crucial aspect of responsible driving. It ensures you are financially protected in case of an accident and helps you avoid legal consequences. This section will guide you through the process of obtaining and maintaining your insurance coverage.

Obtaining Auto Insurance

The process of obtaining auto insurance in Texas is relatively straightforward. Here’s a step-by-step guide:

- Gather Information: Before you begin, gather the necessary information. This includes your driver’s license, vehicle registration, and any previous insurance information.

- Get Quotes: Contact several insurance companies and request quotes. You can obtain quotes online, over the phone, or by visiting an insurance agent in person. Be sure to compare quotes carefully, considering factors such as coverage options, deductibles, and premiums.

- Choose a Policy: Once you have received several quotes, carefully review them and choose the policy that best suits your needs and budget. Consider the level of coverage, the premium cost, and the reputation of the insurance company.

- Pay Your Premium: Once you’ve chosen a policy, you’ll need to pay your first premium. You can usually pay online, by phone, or by mail.

- Receive Your Policy: Your insurance company will provide you with a policy document outlining the terms of your coverage.

Maintaining Continuous Insurance Coverage

Maintaining continuous insurance coverage is vital. Failure to do so can result in serious consequences, including fines, license suspension, and even jail time.

- Pay Premiums on Time: Make sure to pay your insurance premiums on time to avoid late fees and potential policy cancellation.

- Notify Your Insurance Company of Changes: If there are any changes to your vehicle or driving situation, such as a change in address, the addition of a new driver, or a change in the vehicle itself, promptly notify your insurance company. This ensures that your policy remains accurate and covers your current situation.

- Review Your Policy Periodically: It’s a good idea to review your policy periodically to ensure that it still meets your needs and that the coverage levels are appropriate. You may need to adjust your coverage as your driving situation changes or your financial circumstances change.

Updating Insurance Information

When changes occur to your vehicle or driving situation, it’s crucial to update your insurance information. This ensures that your policy remains accurate and provides the necessary coverage. Here’s a step-by-step guide on how to update your insurance information:

- Contact Your Insurance Company: The first step is to contact your insurance company. You can do this by phone, email, or through their website.

- Provide the Necessary Information: Be prepared to provide your insurance company with the necessary information about the changes. This might include your new address, the details of the new driver, or information about the new vehicle.

- Review Your Policy: Once you have updated your information, review your policy to ensure that the changes have been reflected correctly.

- Receive Confirmation: Your insurance company will provide you with confirmation that your information has been updated. Keep a record of this confirmation for your own records.

Final Thoughts: State Of Texas Minimum Auto Insurance Requirements

Navigating the world of auto insurance in Texas can be challenging, but understanding the minimum requirements is essential. Ensuring you have the necessary coverage protects you from financial ruin and legal consequences. It’s vital to review your policy regularly and ensure it meets the state’s minimum requirements. By understanding the intricacies of Texas’s auto insurance laws, drivers can make informed decisions to safeguard themselves and their finances.

FAQ Resource

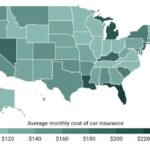

How much does Texas minimum auto insurance cost?

The cost of minimum auto insurance in Texas varies based on factors like your driving history, age, vehicle type, and location. It’s best to obtain quotes from multiple insurers to compare prices and find the best coverage for your needs.

What happens if I get in an accident without insurance?

Driving without insurance in Texas can result in severe penalties, including fines, license suspension, and even jail time. Additionally, you’ll be responsible for covering all damages and injuries caused by the accident, potentially leading to significant financial hardship.

Can I get insurance if I have a bad driving record?

Yes, but you may face higher premiums. Insurance companies consider your driving history when calculating rates. If you have a history of accidents or violations, you may need to explore options with specialized high-risk insurance providers.

What if I’m only driving a short distance without insurance?

It’s crucial to remember that even a short drive without insurance can lead to severe consequences. Texas law requires continuous insurance coverage, and any lapse in coverage can result in penalties.