State Farm travel trailer insurance provides peace of mind for your adventures on the road. Whether you’re a seasoned RV enthusiast or a first-time camper, State Farm offers comprehensive coverage tailored to your needs, protecting your investment and ensuring a worry-free journey.

From liability and collision coverage to comprehensive protection and personal property insurance, State Farm offers a range of options to customize your policy. Their team of experienced agents can guide you through the process, ensuring you have the right coverage for your specific travel trailer and lifestyle.

State Farm Travel Trailer Insurance Overview

State Farm offers comprehensive insurance coverage for travel trailers, protecting you from a wide range of potential risks. Whether you’re a seasoned RV enthusiast or a first-time travel trailer owner, State Farm provides tailored insurance options to meet your specific needs.

Types of Coverage Offered by State Farm

State Farm offers various coverage options for travel trailers, including:

- Liability Coverage: This coverage protects you financially if you are legally responsible for damage to another person’s property or injuries caused by an accident involving your travel trailer.

- Collision Coverage: This coverage pays for repairs or replacement of your travel trailer if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your travel trailer against damage from events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers in the event of an accident, regardless of fault.

- Towing and Labor Coverage: This coverage covers the costs of towing your travel trailer to a repair facility and the labor costs for repairs.

- Roadside Assistance Coverage: This coverage provides assistance with flat tires, jump starts, and other roadside emergencies.

- Vacation Liability Coverage: This coverage protects you from liability claims arising from accidents or injuries that occur while you’re using your travel trailer for recreational purposes.

Key Features and Benefits of State Farm’s Travel Trailer Insurance, State farm travel trailer insurance

State Farm’s travel trailer insurance offers several key features and benefits, including:

- Competitive Rates: State Farm strives to provide competitive insurance rates tailored to your specific needs and risk profile.

- Customizable Coverage Options: State Farm offers a wide range of coverage options, allowing you to choose the level of protection that best suits your needs and budget.

- Excellent Customer Service: State Farm is known for its excellent customer service, with agents available to answer your questions and provide support throughout the insurance process.

- Financial Stability: State Farm is a financially stable company with a long history of providing reliable insurance coverage.

- 24/7 Claims Service: State Farm offers 24/7 claims service, ensuring you have access to support whenever you need it.

- Discounts: State Farm offers various discounts for travel trailer insurance, such as safe driving discounts, multi-policy discounts, and good driver discounts.

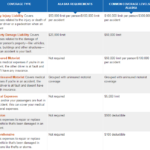

Comparison of State Farm’s Travel Trailer Insurance with Other Providers

When comparing State Farm’s travel trailer insurance with other providers, it’s essential to consider factors such as:

- Coverage Options: Compare the types of coverage offered by each provider and ensure they meet your specific needs.

- Insurance Rates: Obtain quotes from multiple providers to compare rates and determine the most affordable option.

- Customer Service: Research the reputation of each provider for customer service and responsiveness.

- Financial Stability: Check the financial strength and stability of each provider to ensure they can fulfill their insurance obligations.

Coverage Options for Travel Trailers

State Farm offers a variety of coverage options for travel trailers to protect you and your investment. These options can be tailored to meet your specific needs and budget, ensuring that you have the right protection for your travel trailer.

Liability Coverage

Liability coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. It covers legal costs, medical expenses, and property damage. Liability coverage is typically required by law in most states. State Farm’s liability coverage for travel trailers can be customized to meet your needs. You can choose different limits of liability, and you can also add optional coverage such as uninsured/underinsured motorist coverage.

Collision Coverage

Collision coverage pays for repairs or replacement of your travel trailer if it is damaged in an accident with another vehicle or object. It will cover damages regardless of who is at fault. You can choose a deductible amount for collision coverage, which is the amount you pay out of pocket before State Farm starts paying. The higher the deductible, the lower your premium will be.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your travel trailer if it is damaged by something other than a collision, such as theft, vandalism, fire, hail, or a natural disaster. Like collision coverage, you can choose a deductible amount for comprehensive coverage. The higher the deductible, the lower your premium will be.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This coverage can help pay for your medical expenses, lost wages, and property damage.

Personal Property Coverage

Personal property coverage protects your belongings inside your travel trailer from damage or theft. This coverage can help pay for the replacement of items such as furniture, clothing, electronics, and other personal possessions. You can choose a limit of coverage for personal property, which is the maximum amount State Farm will pay for your belongings.

Coverage Options Comparison Table

| Coverage Option | Benefits | Limitations |

|---|---|---|

| Liability Coverage | Protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. | Does not cover damage to your own travel trailer. |

| Collision Coverage | Pays for repairs or replacement of your travel trailer if it is damaged in an accident with another vehicle or object. | Does not cover damage caused by events other than a collision. |

| Comprehensive Coverage | Pays for repairs or replacement of your travel trailer if it is damaged by something other than a collision, such as theft, vandalism, fire, hail, or a natural disaster. | Does not cover damage caused by a collision. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. | Only covers damages caused by an uninsured or underinsured motorist. |

| Personal Property Coverage | Protects your belongings inside your travel trailer from damage or theft. | Has a limit on the amount of coverage. |

Factors Influencing Travel Trailer Insurance Costs: State Farm Travel Trailer Insurance

The cost of travel trailer insurance can vary widely depending on a number of factors. Understanding these factors can help you get the best possible rate for your coverage.

The Age and Value of the Travel Trailer

The age and value of your travel trailer are major factors in determining your insurance premium. Newer trailers are typically more expensive to insure than older trailers, as they have a higher replacement cost. The value of your trailer is also important, as it determines how much you will be paid if your trailer is damaged or stolen.

The Location Where the Trailer is Stored and Used

The location where you store and use your travel trailer can also affect your insurance premium. If you live in an area with a high risk of theft or vandalism, your insurance premium may be higher. Similarly, if you frequently travel to areas with harsh weather conditions, your premium may be higher.

The Driver’s Driving History and Credit Score

Your driving history and credit score can also influence your travel trailer insurance premium. If you have a history of accidents or traffic violations, your insurance premium may be higher. Similarly, if you have a poor credit score, you may be considered a higher risk by insurance companies and your premium may be higher.

The Coverage Options Chosen

The coverage options you choose will also affect your travel trailer insurance premium. For example, if you choose comprehensive coverage, which covers damage from a variety of causes, your premium will be higher than if you choose liability coverage only.

Obtaining a Quote and Purchasing Insurance

Getting a quote for State Farm travel trailer insurance is a straightforward process that can be completed online, over the phone, or in person at a local State Farm agent’s office.

Obtaining a Quote

To obtain a quote, you’ll need to provide some basic information about yourself and your travel trailer. This information will help State Farm assess your risk and determine the appropriate premium for your coverage.

- Your personal information: This includes your name, address, date of birth, and contact information.

- Your travel trailer information: This includes the make, model, year, and VIN (Vehicle Identification Number) of your travel trailer.

- Your driving history: State Farm will ask about your driving record, including any accidents or violations.

- Your desired coverage: You’ll need to specify the type of coverage you’re looking for, such as liability, collision, comprehensive, and personal property coverage.

- Your location: Your location can affect your insurance premium, as rates can vary depending on the area you live in.

Purchasing a Policy

Once you have received a quote and decided to purchase a policy, you will need to provide State Farm with the necessary information and documentation to complete the process.

- Gather necessary information: This includes your personal information, travel trailer information, and financial details.

- Submit an application: You can submit your application online, over the phone, or in person.

- Make payment: You can typically pay for your policy online, over the phone, or by mail.

Required Documents

The specific documents you will need to provide may vary depending on your individual circumstances. However, generally, you will need the following:

- Proof of ownership: This could be a bill of sale, title, or registration.

- Driver’s license: This is required to verify your identity and driving record.

- Insurance history: This can be provided by your previous insurance company.

- Vehicle identification number (VIN): This is a unique number that identifies your travel trailer.

- Proof of address: This could be a utility bill, bank statement, or lease agreement.

Claims Process and Customer Support

When you need to file a claim for your travel trailer insurance, State Farm makes the process as straightforward as possible. Their team of dedicated professionals is available to guide you through every step, ensuring a smooth and efficient resolution.

Filing a Claim

The first step in filing a claim is to report the incident to State Farm as soon as possible. This can be done by calling their 24/7 customer service line or submitting a claim online through their website. When reporting the claim, you’ll need to provide details about the incident, including the date, time, location, and any injuries or damages.

Resolving a Claim

Once you’ve reported the claim, State Farm will begin the process of investigating and resolving it. This typically involves the following steps:

Providing Documentation

You’ll be asked to provide supporting documentation, such as a police report, photos of the damage, and repair estimates. This documentation helps State Farm assess the extent of the damage and determine the appropriate compensation.

Negotiating a Settlement

State Farm will review your claim and negotiate a settlement based on the policy coverage and the extent of the damage. If you agree to the settlement, State Farm will issue a payment to you or directly to the repair shop.

Customer Support Resources

State Farm offers a variety of customer support resources to help you throughout the claims process. These resources include:

- 24/7 customer service line

- Online claim filing

- Mobile app for claim updates and communication

- Dedicated claims representatives

Tips for Maintaining Coverage and Saving Money

Maintaining continuous travel trailer insurance coverage is crucial for protecting your investment and ensuring you have financial protection in case of accidents, theft, or damage. By following some simple tips, you can ensure your coverage remains active and explore ways to potentially reduce your insurance premiums.

Maintaining Continuous Coverage

It’s essential to understand that gaps in coverage can leave you vulnerable and might make it challenging to obtain insurance later. Here’s how to maintain continuous coverage:

- Pay your premiums on time: Missed payments can lead to policy cancellation, leaving you without coverage. Set reminders or use automatic payments to ensure timely payments.

- Notify your insurer of any changes: Inform your insurer about any changes in your travel trailer, such as upgrades, modifications, or changes in its usage. Failure to do so could result in inadequate coverage or even policy cancellation.

- Review your policy periodically: Regularly review your policy to ensure it still meets your needs and that the coverage amounts are appropriate. Adjust your coverage as needed to reflect any changes in your travel trailer or your risk profile.

Reducing Insurance Premiums

While maintaining continuous coverage is essential, you can also explore ways to potentially reduce your insurance premiums.

- Maintain a good driving record: A clean driving record with no accidents or violations can often qualify you for discounts on your insurance premiums. Drive responsibly and avoid traffic violations to benefit from lower rates.

- Install safety features: Consider installing safety features like anti-theft devices, smoke detectors, and fire extinguishers. These features can demonstrate your commitment to safety and potentially lead to lower premiums.

- Bundle insurance policies: Combining your travel trailer insurance with other policies, such as homeowners or auto insurance, with the same insurer can often result in significant discounts. Explore bundling options to see if they offer savings.

Seeking Professional Advice

Consulting with an insurance agent can provide valuable insights and help you make informed decisions about your travel trailer insurance.

- Personalized guidance: An agent can assess your individual needs and recommend the most suitable coverage options based on your specific situation and risk profile.

- Negotiating discounts: They can help you explore potential discounts and negotiate the best possible rates for your insurance policy.

- Understanding policy details: Insurance policies can be complex. An agent can clarify the terms and conditions, ensuring you understand the coverage you’re purchasing.

Conclusion

Investing in State Farm travel trailer insurance is a wise decision for any RV owner. With their comprehensive coverage options, competitive rates, and exceptional customer support, you can rest assured knowing your investment is protected. Embrace the open road with confidence, knowing State Farm has your back.

Question Bank

How much does State Farm travel trailer insurance cost?

The cost of State Farm travel trailer insurance varies based on factors like the age and value of your trailer, your driving history, and the coverage options you choose.

What are the benefits of bundling my travel trailer insurance with other State Farm policies?

Bundling your travel trailer insurance with other State Farm policies, such as auto or homeowners insurance, can often lead to discounts on your premiums.

What if I need to file a claim?

State Farm has a straightforward claims process. You can report a claim online, by phone, or through their mobile app. Their team will guide you through the steps and work to resolve your claim efficiently.