State of Alaska insurance presents a unique challenge, shaped by the state’s vast geography, harsh climate, and remote communities. Unlike other states, Alaskans face specific insurance needs due to the region’s unique conditions. From protecting homes against harsh winters to securing coverage for remote transportation, Alaskans require specialized insurance solutions.

This guide delves into the intricacies of the Alaskan insurance market, exploring the types of insurance available, factors influencing costs, and tips for navigating the process. We’ll also discuss emerging trends shaping the future of insurance in Alaska.

Alaska’s Unique Insurance Landscape

Alaska’s insurance market presents a distinct landscape compared to other states, driven by its unique geographical, climatic, and demographic characteristics. These factors influence the types of insurance policies needed, the risks faced by residents, and the overall cost of coverage.

Geographic and Climatic Influences

Alaska’s vast, remote, and often unforgiving terrain significantly shapes its insurance needs. The state’s rugged mountains, dense forests, and extensive coastline create unique risks for residents and businesses.

- Natural Disasters: Alaska experiences frequent earthquakes, volcanic eruptions, tsunamis, and wildfires, making natural disaster coverage a crucial component of insurance policies. For example, the 1964 Good Friday earthquake caused widespread damage and highlighted the need for robust earthquake insurance in the state.

- Extreme Weather: Alaska’s harsh winters with heavy snowfall, strong winds, and freezing temperatures pose challenges for transportation, infrastructure, and property maintenance. This necessitates comprehensive coverage for property damage, liability, and business interruption due to weather-related events.

- Remote Locations: Many parts of Alaska are sparsely populated and isolated, making access to emergency services and medical care challenging. This factor drives the need for comprehensive health insurance plans, including evacuation coverage and air ambulance services.

Types of Insurance in Alaska

Alaska’s unique environment and lifestyle demand a comprehensive approach to insurance. This section delves into the key types of insurance prevalent in the state, exploring their specific requirements and regulations.

Auto Insurance, State of alaska insurance

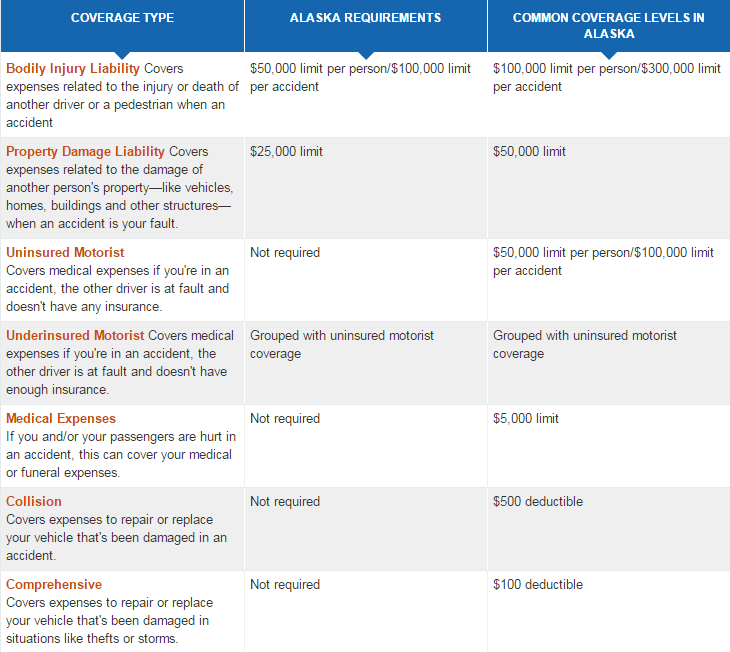

Auto insurance is mandatory in Alaska, ensuring financial protection in case of accidents. The state requires drivers to carry minimum liability coverage, including:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $25,000 per accident

While these minimums are legally required, many Alaskans opt for higher coverage limits to protect themselves from substantial financial losses.

Homeowners Insurance

Homeowners insurance in Alaska is essential to protect your property against various risks, including fire, theft, and natural disasters. Alaska’s unique geographical location, with its susceptibility to earthquakes and wildfires, makes comprehensive coverage crucial.

- Earthquake Coverage: While not mandatory, earthquake coverage is highly recommended, especially for homes located in earthquake-prone areas. This coverage helps cover repair costs and potential displacement due to earthquakes.

- Flood Insurance: Alaska’s extensive coastline and river systems make flood insurance a vital consideration. It protects homeowners against damage caused by flooding, which is often excluded from standard homeowners policies.

Health Insurance

Alaska offers a variety of health insurance options, including individual and employer-sponsored plans. The state also participates in the Affordable Care Act (ACA), providing subsidies to eligible individuals and families.

- Medicaid: Alaska’s Medicaid program, known as “Medicaid,” provides health coverage to low-income individuals and families, including children, pregnant women, and people with disabilities.

- Individual Health Insurance Market: Alaskans can purchase individual health insurance plans through the ACA Marketplace, which offers a range of options and financial assistance.

- Employer-Sponsored Plans: Many employers in Alaska offer health insurance to their employees, often with a range of plan options and cost-sharing arrangements.

Life Insurance

Life insurance provides financial security to loved ones in the event of the policyholder’s death. It helps cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance and is suitable for individuals with temporary coverage needs.

- Permanent Life Insurance: This type of insurance offers lifelong coverage, providing a death benefit and accumulating cash value that can be borrowed against or withdrawn.

Business Insurance

Business insurance is crucial for protecting businesses from various risks, including property damage, liability claims, and employee injuries.

- General Liability Insurance: This coverage protects businesses from financial losses due to third-party claims of negligence or property damage.

- Workers’ Compensation Insurance: This insurance is mandatory in Alaska and covers medical expenses and lost wages for employees injured on the job.

- Property Insurance: This coverage protects businesses from financial losses due to damage to their property, such as buildings, equipment, and inventory.

Factors Affecting Insurance Costs in Alaska

Alaska’s unique geographic location and challenging environment significantly impact insurance costs. While some factors are common across the US, others are specific to Alaska, making it crucial to understand the factors driving insurance premiums.

Comparison of Insurance Costs in Alaska with Other States

Alaska’s insurance costs are generally higher than the national average. This is due to a combination of factors, including the state’s remoteness, harsh weather conditions, and higher risk of natural disasters. For example, the average annual premium for car insurance in Alaska is around $2,500, while the national average is about $1,500. Similarly, homeowners insurance premiums are also higher in Alaska, reflecting the increased risk of earthquakes, wildfires, and other natural disasters.

Factors Influencing Insurance Premiums in Alaska

- Location: Insurance premiums are often higher in urban areas with high population density and traffic congestion. Alaska’s larger cities like Anchorage and Fairbanks tend to have higher insurance costs due to increased risk of accidents and property damage. Rural areas may face higher premiums due to limited access to emergency services and infrastructure.

- Age and Gender: Younger drivers, particularly those under 25, typically pay higher insurance premiums due to their higher risk of accidents. Gender can also play a role, with men generally paying slightly higher premiums than women, reflecting historical trends in accident rates.

- Driving Record: A clean driving record with no accidents or violations can significantly reduce insurance premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions will likely face higher premiums. In Alaska, where driving conditions can be challenging, a clean driving record is particularly important.

- Property Value: Homeowners insurance premiums are directly linked to the value of the property being insured. In Alaska, where property values can fluctuate due to the real estate market and location, homeowners insurance premiums can vary significantly.

- Health History: Health insurance premiums are influenced by factors like age, health conditions, and lifestyle choices. In Alaska, where access to healthcare can be limited in some areas, health insurance premiums may be higher to cover the higher cost of medical services and potential travel expenses.

Average Insurance Costs in Alaska

| Type of Insurance | Average Annual Premium |

|---|---|

| Auto Insurance | $2,500 |

| Homeowners Insurance | $1,800 |

| Health Insurance | $6,000 |

| Life Insurance | $1,200 |

Navigating the Insurance Market in Alaska: State Of Alaska Insurance

Finding the right insurance coverage in Alaska can be a challenging endeavor, especially with the unique factors that influence insurance costs in the state. However, with careful planning and a strategic approach, you can secure comprehensive and affordable insurance protection.

Comparing Quotes from Multiple Insurance Providers

Comparing quotes from multiple insurance providers is crucial to securing the most competitive rates and finding the best coverage for your needs. By comparing different policies, you can identify potential savings and tailor your coverage to your specific circumstances.

- Use online comparison tools: Several websites allow you to enter your details and receive quotes from multiple insurers simultaneously, simplifying the comparison process.

- Contact insurance agents directly: Connect with insurance agents in your area to discuss your needs and obtain personalized quotes. Agents can offer valuable insights and guidance on the available options.

- Consider insurers specializing in Alaskan coverage: Some insurance companies have specific expertise in covering risks unique to Alaska, such as earthquake or wildfire insurance.

Resources for Insurance Information in Alaska

Navigating the complex world of insurance in Alaska can be challenging, but it doesn’t have to be. Numerous resources are available to help Alaskans find the right insurance coverage and understand their rights as consumers. These resources provide information on insurance options, regulations, and consumer protection.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumers. They provide information on insurance requirements, licensing, and consumer rights. Here are some key agencies:

- Alaska Division of Insurance: The Division of Insurance is responsible for regulating the insurance industry in Alaska. It sets standards for insurance companies, licenses insurance agents and brokers, and investigates consumer complaints. Their website provides information on insurance regulations, consumer rights, and resources for finding insurance providers. https://www.insurance.alaska.gov/

- Alaska Department of Commerce, Community, and Economic Development (DCCED): DCCED oversees the Division of Insurance and provides information on consumer protection and business regulations. Their website includes resources on insurance, as well as other business-related topics. https://commerce.alaska.gov/

- National Association of Insurance Commissioners (NAIC): While not specific to Alaska, the NAIC is a national organization of state insurance regulators that provides information on insurance regulations, consumer protection, and industry trends. Their website includes resources for consumers, including a database of state insurance laws and regulations. https://www.naic.org/

Consumer Protection Organizations

Consumer protection organizations advocate for consumer rights and provide information on insurance issues. These organizations can help Alaskans understand their insurance policies, file complaints, and resolve disputes with insurance companies.

- Alaska Division of Insurance Consumer Services: The Division of Insurance provides consumer services to help Alaskans with insurance-related questions and complaints. They offer information on insurance regulations, consumer rights, and dispute resolution. https://www.insurance.alaska.gov/consumer-services/

- Better Business Bureau (BBB): The BBB is a non-profit organization that provides information on businesses and helps consumers resolve disputes. They offer information on insurance companies, ratings, and consumer complaints. https://www.bbb.org/

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including insurance. Their website offers information on insurance companies, policy features, and consumer tips. https://www.consumerreports.org/

Industry Associations

Industry associations represent insurance companies and provide information on insurance products, services, and industry trends. These associations can be helpful for understanding insurance options and finding reputable insurance providers.

- Alaska Insurance Agents & Brokers Association (AIA&BA): The AIA&BA represents insurance agents and brokers in Alaska. Their website provides information on insurance products, services, and industry trends. https://aiaaba.org/

- National Association of Insurance Agents & Brokers (NAIA&B): The NAIA&B is a national organization of insurance agents and brokers that provides information on insurance products, services, and industry trends. Their website includes resources for consumers, including a directory of insurance agents and brokers. https://www.naia.org/

- Insurance Information Institute (III): The III is a non-profit organization that provides information on insurance issues, including trends, statistics, and consumer education. Their website offers resources on insurance products, services, and consumer protection. https://www.iii.org/

Insurance Trends in Alaska

The Alaskan insurance market is constantly evolving, driven by a combination of unique factors like the state’s remote location, challenging climate, and growing population. Understanding these trends is crucial for both individuals and businesses seeking to navigate the insurance landscape effectively.

Growing Demand for Specialized Insurance Products

The need for specialized insurance products in Alaska is driven by the state’s unique industries and environmental conditions. For instance, the oil and gas industry requires specialized insurance policies to cover risks associated with drilling, exploration, and transportation. Similarly, tourism operators require coverage for liability risks associated with outdoor activities and remote locations.

- Marine Insurance: Alaska’s extensive coastline and dependence on maritime transportation necessitates comprehensive marine insurance policies for vessels, cargo, and liability. This includes coverage for potential hazards like ice, storms, and marine wildlife.

- Aviation Insurance: Alaska’s vast distances and reliance on air travel necessitate specialized aviation insurance policies for aircraft owners and operators. This includes coverage for risks associated with remote landing strips, harsh weather conditions, and potential wildlife encounters.

- Earthquake Insurance: Alaska is prone to earthquakes, making earthquake insurance a crucial consideration for homeowners and businesses. Policies can cover damage to buildings, personal property, and business interruption.

Impact of Climate Change on Insurance Costs

Climate change is having a significant impact on Alaska’s environment and economy, which is reflected in the insurance market. Rising sea levels, increased frequency of extreme weather events, and permafrost thaw are all contributing to higher insurance premiums.

- Coastal Erosion: Coastal erosion is a growing concern in Alaska, as rising sea levels and storm surges threaten coastal communities and infrastructure. This has led to increased insurance premiums for properties located in vulnerable areas.

- Wildfires: Wildfires are becoming more frequent and intense in Alaska due to climate change, posing a significant risk to homes, businesses, and forests. Insurance premiums for properties in wildfire-prone areas have increased as a result.

- Permafrost Thaw: Permafrost thaw is causing damage to infrastructure and buildings, leading to higher insurance premiums. The thawing ground can lead to foundation instability, damage to roads and pipelines, and increased risk of landslides.

Increasing Adoption of Technology in the Insurance Industry

Technology is transforming the insurance industry in Alaska, offering greater efficiency, convenience, and personalized experiences for customers.

- Online Insurance Platforms: Online platforms are making it easier for Alaskans to compare insurance quotes, purchase policies, and manage their coverage. These platforms offer convenience and transparency, allowing customers to access information and make informed decisions.

- Telematics: Telematics devices are being used to monitor driving behavior and provide personalized insurance rates. This technology can help reduce premiums for safe drivers and promote safer driving practices.

- Artificial Intelligence (AI): AI is being used to automate insurance processes, such as claims processing and risk assessment. This can lead to faster processing times and more accurate assessments.

Concluding Remarks

Understanding the nuances of the Alaskan insurance market is crucial for residents and businesses alike. By carefully considering insurance needs, comparing quotes, and leveraging available resources, Alaskans can secure comprehensive and affordable coverage. As the state continues to evolve, the insurance landscape will adapt to meet the growing demands of its unique population.

User Queries

What are the main insurance providers in Alaska?

Alaska has a mix of national and regional insurance providers. Some major players include State Farm, Allstate, Farmers Insurance, and Alaska Mutual Insurance Company.

What are the common insurance scams in Alaska?

Be wary of scams involving fake insurance companies, promises of unrealistically low premiums, and pressure tactics. Always verify the legitimacy of any insurance provider and carefully review policy terms before signing.

How can I find affordable insurance in Alaska?

Compare quotes from multiple providers, consider increasing deductibles, bundle policies, and explore discounts offered for safety features, good driving records, and membership in certain organizations.