State farm car insurance nc – State Farm car insurance in North Carolina is a popular choice for drivers seeking reliable coverage and comprehensive services. With a long history in the state, State Farm has established itself as a trusted name in the insurance industry, offering a wide range of car insurance options tailored to meet the needs of North Carolina residents.

From basic liability coverage to comprehensive and collision protection, State Farm provides a comprehensive suite of insurance products to safeguard drivers and their vehicles. The company also boasts a strong presence across the state, with a network of agents and offices conveniently located throughout North Carolina, ensuring accessibility and personalized support for policyholders.

State Farm Car Insurance in North Carolina

State Farm is one of the largest and most well-known insurance companies in the United States, offering a wide range of insurance products, including car insurance. In North Carolina, State Farm has a long history and a strong presence, serving millions of customers with their insurance needs.

State Farm’s History in North Carolina

State Farm has been providing insurance in North Carolina since 1940, and over the years, it has grown to become one of the leading car insurance providers in the state. The company’s commitment to customer service and its wide range of coverage options have contributed to its popularity in North Carolina. State Farm’s presence in North Carolina is significant, with a vast network of agents and offices throughout the state, making it easy for customers to access their services.

Types of Car Insurance Offered by State Farm in NC

State Farm offers a variety of car insurance options to cater to the diverse needs of its customers in North Carolina. Here are some of the common types of car insurance offered:

- Liability Insurance: This is the most basic type of car insurance and is required by law in North Carolina. It covers damages to other people’s property and injuries to others in case of an accident caused by the insured driver.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage protects the insured vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the insured driver and passengers in case of an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault.

State Farm’s Coverage Options and Benefits

State Farm provides a comprehensive range of coverage options to protect its customers in North Carolina. These options can be customized to meet individual needs and budgets. Some of the key coverage options and benefits offered by State Farm include:

- Accident Forgiveness: This feature prevents your premium from increasing after your first at-fault accident.

- Drive Safe & Save: This program offers discounts on premiums based on safe driving habits, which are tracked through a mobile app.

- Ride Sharing Coverage: This coverage provides protection for drivers who use ride-sharing services like Uber or Lyft.

- Customizable Coverage: State Farm allows customers to choose the coverage levels that best suit their needs and budgets, providing flexibility and control.

State Farm’s Presence in North Carolina

State Farm, a leading insurance provider in the United States, has a significant presence in North Carolina, offering a wide range of insurance products and services to residents and businesses. The company’s commitment to providing excellent customer service and comprehensive coverage has earned it a loyal customer base across the state.

State Farm’s Network in North Carolina

State Farm’s reach in North Carolina is extensive, with a network of agents and offices strategically located throughout the state. This widespread presence ensures that customers have easy access to personalized insurance advice and support.

- State Farm has a large network of agents across North Carolina, providing convenient access to insurance services for residents in all corners of the state.

- The company’s offices are strategically located in major cities and towns, ensuring that customers can easily find a State Farm agent near them.

State Farm’s Geographic Reach

State Farm’s services are available in all 100 counties of North Carolina, ensuring that residents throughout the state have access to comprehensive insurance coverage. The company’s extensive network of agents and offices allows it to provide localized support and tailored insurance solutions to meet the specific needs of each community.

State Farm’s Presence in Major Cities and Regions

| Region | Major Cities | Number of State Farm Agents | Number of Offices |

|---|---|---|---|

| Western North Carolina | Asheville, Charlotte, Hickory, Winston-Salem | 100+ | 50+ |

| Central North Carolina | Raleigh, Durham, Greensboro, Fayetteville | 200+ | 100+ |

| Eastern North Carolina | Wilmington, Greenville, Jacksonville, New Bern | 50+ | 25+ |

State Farm Car Insurance Rates in North Carolina

State Farm is a leading car insurance provider in North Carolina, offering competitive rates to a wide range of drivers. Understanding the factors that influence State Farm’s car insurance rates in NC is crucial for making informed decisions about your coverage.

Factors Influencing State Farm Car Insurance Rates in NC

Several factors determine State Farm’s car insurance rates in North Carolina, reflecting the company’s risk assessment approach. These factors include:

- Driving History: Your driving record, including accidents, tickets, and violations, plays a significant role in determining your insurance premiums. Drivers with a clean driving record typically enjoy lower rates compared to those with a history of traffic violations.

- Vehicle Type: The type of vehicle you drive, including its make, model, year, and safety features, impacts your insurance rates. Luxury cars, high-performance vehicles, and those with expensive parts tend to have higher premiums.

- Age: Younger drivers, particularly those under 25, are generally considered higher risk due to their inexperience and higher likelihood of accidents. As drivers age and gain experience, their insurance rates tend to decrease.

- Location: The area where you live can influence your insurance rates due to factors such as traffic density, crime rates, and the frequency of accidents. Areas with higher risk factors may have higher insurance premiums.

- Coverage Options: The type and amount of coverage you choose, including liability, collision, comprehensive, and uninsured motorist coverage, also affect your premiums. Higher coverage levels generally result in higher rates.

- Credit Score: In some states, including North Carolina, insurers may consider your credit score when determining your insurance rates. Individuals with good credit scores may qualify for lower premiums.

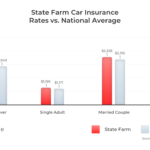

Comparison of State Farm Car Insurance Rates in NC with Other Providers

Comparing State Farm’s car insurance rates with other major insurance providers is essential to find the best value for your needs. While rates can vary depending on individual factors, a general comparison can provide insights into market trends.

| Provider | Average Annual Premium (NC) |

|---|---|

| State Farm | $1,200 |

| Geico | $1,150 |

| Progressive | $1,300 |

| Allstate | $1,250 |

Note: These figures are estimates based on industry data and may vary depending on individual factors.

Average Car Insurance Premiums for Different Driver Profiles in NC

To illustrate the impact of different factors on car insurance rates, here is a table comparing average annual premiums for various driver profiles in North Carolina:

| Driver Profile | Average Annual Premium |

|---|---|

| 25-year-old male, clean driving record, driving a Honda Civic | $1,000 |

| 35-year-old female, one speeding ticket, driving a Toyota Camry | $1,200 |

| 50-year-old male, no accidents, driving a BMW X5 | $1,500 |

| 60-year-old female, multiple accidents, driving a Ford F-150 | $2,000 |

Remember that these are just examples, and your actual rates may vary based on your specific circumstances.

State Farm Customer Service and Claims Process in North Carolina: State Farm Car Insurance Nc

State Farm, being one of the largest insurance providers in the US, offers a comprehensive range of customer service channels and a streamlined claims process for its policyholders in North Carolina.

State Farm Customer Service Channels in North Carolina

State Farm provides various ways for customers in North Carolina to connect with them for inquiries, policy changes, or assistance with claims.

- Phone: State Farm has a dedicated customer service line for North Carolina residents, available 24/7. Policyholders can reach out to this line for general inquiries, policy updates, or to report claims.

- Online: State Farm offers a user-friendly online portal for managing policies, making payments, and accessing account information. Customers can also submit claims online through the portal.

- Mobile App: The State Farm mobile app allows policyholders to access their insurance information, manage policies, pay bills, and file claims conveniently from their smartphones. The app offers a personalized experience and allows for quick and easy communication with State Farm.

- Local Agents: State Farm has a vast network of local agents throughout North Carolina. Customers can visit their local agent’s office for personalized assistance with their insurance needs, including policy reviews, claims guidance, and general advice.

State Farm’s Claims Process for Car Accidents in North Carolina, State farm car insurance nc

In the event of a car accident, State Farm provides a straightforward claims process for its policyholders in North Carolina.

- Report the Accident: The first step is to report the accident to State Farm, either through the phone, online portal, or mobile app.

- Gather Information: Policyholders should collect information from the other driver(s) involved in the accident, including their name, contact information, insurance details, and driver’s license number.

- File a Claim: After reporting the accident, policyholders need to file a claim with State Farm. This can be done online, through the mobile app, or by contacting a local agent.

- Claim Assessment: State Farm will assess the claim and gather necessary information, including photos of the damage, police reports, and medical records.

- Claim Resolution: Once the claim is assessed, State Farm will provide a settlement offer. The policyholder can accept the offer or negotiate if they believe it is not fair.

Customer Reviews and Experiences with State Farm’s Services in North Carolina

Customer satisfaction with State Farm’s services in North Carolina varies, with a range of positive and negative reviews.

- Positive Reviews: Many customers praise State Farm for its responsive customer service, efficient claims processing, and competitive rates. They also appreciate the availability of local agents and the user-friendly online portal.

- Negative Reviews: Some customers have expressed dissatisfaction with long wait times for claims processing, difficulty in reaching customer service representatives, and issues with claim settlements.

State Farm’s Community Involvement in North Carolina

State Farm is deeply committed to supporting the communities where its customers and employees live and work. This commitment extends beyond providing insurance services to actively participating in local initiatives and philanthropic endeavors. State Farm’s dedication to community involvement in North Carolina is evident in its various programs and partnerships that aim to improve the well-being of residents.

State Farm’s Philanthropic Activities in North Carolina

State Farm actively engages in philanthropic activities throughout North Carolina, demonstrating its commitment to giving back to the communities it serves. The company supports a wide range of charitable organizations and causes, focusing on areas such as education, disaster relief, and community development. State Farm’s philanthropic endeavors are designed to address pressing needs and make a positive impact on the lives of North Carolinians.

- State Farm’s Neighborhood Assist Program: This program provides grants to non-profit organizations working on community improvement projects across the country, including North Carolina. State Farm encourages community members to nominate projects they believe are worthy of funding. These grants help fund a variety of projects, such as revitalizing parks, supporting educational programs, and assisting with disaster recovery efforts.

- State Farm’s Support for Educational Initiatives: State Farm recognizes the importance of education and invests in programs that promote academic success. The company partners with organizations like the Boys & Girls Clubs of America and the United Way to provide resources and support to students in need. State Farm also sponsors educational programs that focus on financial literacy, road safety, and other important topics.

- State Farm’s Disaster Relief Efforts: State Farm is known for its quick and compassionate response to natural disasters. The company provides financial assistance to individuals and families affected by hurricanes, tornadoes, and other calamities. State Farm also mobilizes its resources to support relief efforts, including providing temporary housing, food, and other essential supplies.

Ending Remarks

Whether you’re a seasoned driver or a new motorist, understanding the nuances of car insurance is crucial. State Farm car insurance in North Carolina offers a comprehensive solution, combining competitive rates, customizable coverage options, and exceptional customer service. By carefully considering your individual needs and exploring the various aspects of State Farm’s offerings, you can make an informed decision that provides peace of mind on the road.

Answers to Common Questions

What discounts are available for State Farm car insurance in NC?

State Farm offers various discounts in North Carolina, including safe driver discounts, good student discounts, multi-policy discounts, and more. It’s best to contact a local agent for specific discount details.

How can I file a claim with State Farm in NC?

You can file a claim online, through the mobile app, or by calling State Farm’s customer service line. The company provides 24/7 claims support.

What are the requirements for getting car insurance in NC?

North Carolina requires all drivers to have liability insurance, including bodily injury liability, property damage liability, and uninsured motorist coverage.