State farm car insurance georgia – State Farm car insurance in Georgia offers comprehensive coverage and a long history of serving the state’s residents. This guide explores the intricacies of State Farm’s offerings, including its unique coverage options, competitive pricing, and commitment to customer satisfaction.

From understanding mandatory insurance requirements to navigating the quote process, this resource provides valuable insights for drivers seeking reliable and personalized car insurance in Georgia.

State Farm Car Insurance in Georgia: State Farm Car Insurance Georgia

State Farm is one of the largest and most well-known insurance providers in the United States, with a strong presence in Georgia. Its roots in the state run deep, and it has played a significant role in providing insurance solutions to Georgians for decades.

History of State Farm in Georgia

State Farm’s journey in Georgia began in the 1930s, with the establishment of its first agency in the state. Since then, it has expanded its network, establishing a strong presence across Georgia with numerous agencies and a dedicated team of agents. This growth has been fueled by its commitment to customer service and its ability to adapt to the evolving needs of Georgia’s residents.

Services Offered by State Farm in Georgia

State Farm offers a comprehensive range of insurance products in Georgia, including car insurance. Its car insurance policies are designed to provide coverage for various situations, from accidents and theft to natural disasters.

Unique Aspects of State Farm’s Car Insurance in Georgia

State Farm’s car insurance offerings in Georgia include several unique features and benefits designed to cater to the specific needs of Georgia residents. These include:

Coverage Options

State Farm provides various coverage options tailored to different driving needs and risk profiles. These options include:

- Liability Coverage: This covers damages to other people and their property if you are at fault in an accident.

- Collision Coverage: This covers damage to your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-accident events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have adequate insurance.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages if you are injured in an accident, regardless of fault.

Discounts

State Farm offers several discounts to its Georgia policyholders, which can help lower their premiums. These discounts include:

- Safe Driving Discount: This discount is offered to drivers with a clean driving record.

- Good Student Discount: This discount is available to students who maintain a certain GPA.

- Multi-Policy Discount: This discount is offered to policyholders who bundle multiple insurance policies, such as car and home insurance, with State Farm.

- Anti-theft Device Discount: This discount is offered to policyholders who have anti-theft devices installed in their vehicles.

- Defensive Driving Course Discount: This discount is available to policyholders who complete a defensive driving course.

Car Insurance Requirements in Georgia

Driving in Georgia comes with specific insurance requirements to ensure financial protection for yourself and others on the road. Understanding these requirements is crucial for all drivers.

Mandatory Car Insurance Coverage in Georgia

Georgia mandates certain car insurance coverage to protect drivers and others in the event of an accident. These requirements help cover potential costs like medical expenses, property damage, and legal fees.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. Georgia requires a minimum liability coverage of:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident

- Property Damage Liability: $25,000 per accident

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, helps cover your medical expenses and lost wages, regardless of who caused the accident. Georgia requires a minimum PIP coverage of $5,000.

Optional Car Insurance Coverage in Georgia

While not mandatory, several optional coverage options can provide additional protection and financial peace of mind for Georgia drivers.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s especially useful if you have a newer or financed vehicle. For example, if you get into an accident and your car is totaled, collision coverage will help cover the cost of a new car or the remaining loan balance.

- Comprehensive Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged due to events other than accidents, such as theft, vandalism, fire, or hail. For example, if your car is stolen, comprehensive coverage can help you replace it or pay for the cost of repairs.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. For example, if you are hit by a driver who does not have insurance and you suffer injuries, UM/UIM coverage can help cover your medical expenses and lost wages.

- Medical Payments Coverage (Med Pay): This coverage helps pay for your medical expenses, regardless of who caused the accident. It can be a valuable addition to your insurance policy, especially if you have a high deductible on your health insurance. For example, if you are injured in a minor accident and your health insurance has a high deductible, Med Pay can help cover the cost of your medical bills.

State Farm Car Insurance Quotes in Georgia

Getting a car insurance quote from State Farm in Georgia is a straightforward process. You can obtain a quote online, over the phone, or by visiting a local State Farm agent. To get an online quote, you’ll need to provide some basic information about yourself, your vehicle, and your driving history. A State Farm agent can provide you with a personalized quote after a brief conversation.

Factors Affecting Car Insurance Premiums in Georgia

Several factors influence car insurance premiums in Georgia, including:

- Vehicle type: The make, model, and year of your vehicle play a significant role in determining your premium. Luxury cars and high-performance vehicles are typically more expensive to insure than standard vehicles.

- Driving history: Your driving record, including accidents, tickets, and DUI convictions, can significantly impact your premium. Drivers with clean records generally pay lower premiums than those with a history of violations.

- Location: The location where you live and drive can also influence your premium. Areas with higher crime rates or traffic congestion may have higher insurance rates.

- Coverage options: The amount and type of coverage you choose will also affect your premium. Higher coverage limits and additional features, such as comprehensive and collision coverage, can lead to higher premiums.

- Age and gender: Younger drivers and male drivers generally pay higher premiums than older drivers and female drivers.

- Credit score: In some states, including Georgia, insurance companies may consider your credit score when determining your premium. Drivers with good credit scores often receive lower premiums.

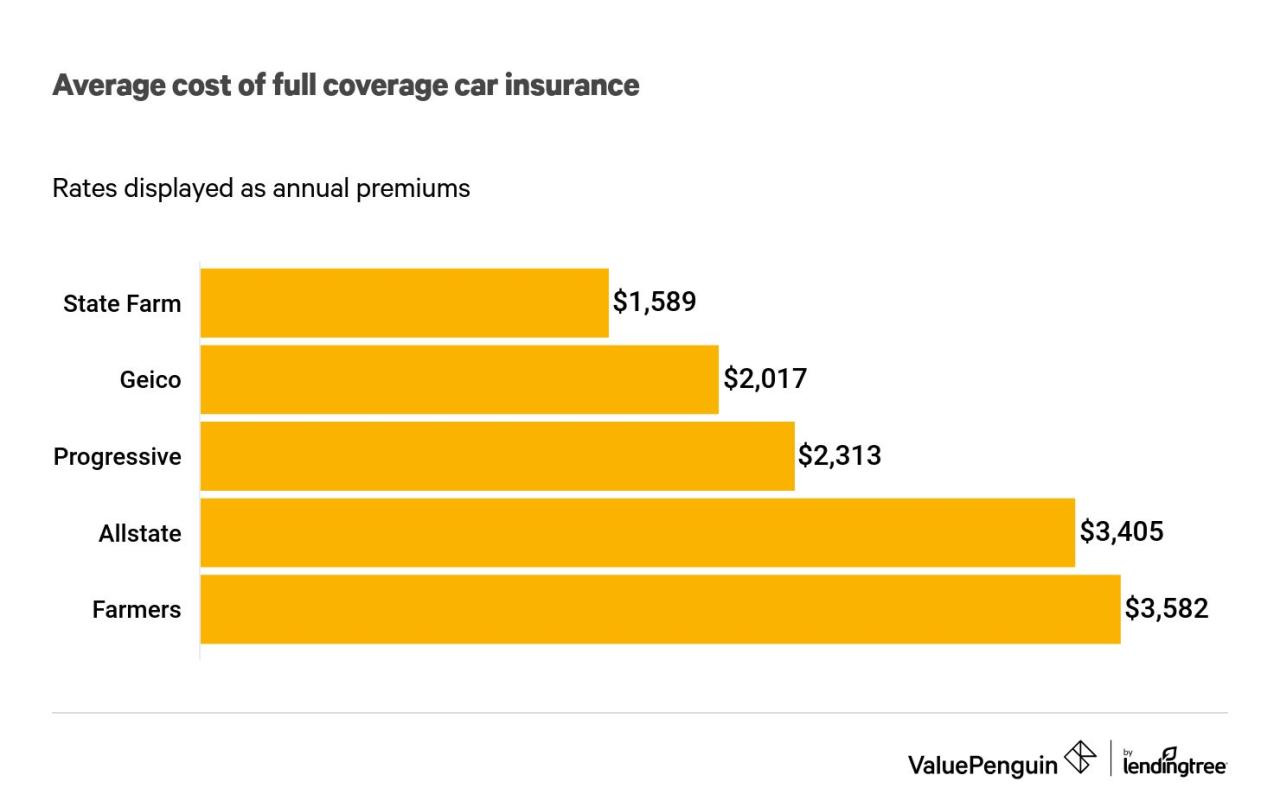

Comparison of State Farm’s Car Insurance Rates in Georgia

State Farm is one of the largest and most well-known insurance companies in the United States. However, it’s crucial to compare rates from multiple insurance providers to ensure you’re getting the best deal. You can use online comparison tools or contact several insurance companies directly to get quotes.

It’s essential to remember that insurance rates can vary significantly based on individual circumstances. Comparing quotes from different insurance companies is crucial to find the best coverage at the most affordable price.

Customer Experience with State Farm in Georgia

Navigating the world of car insurance can be daunting, especially in a state like Georgia with its unique requirements and regulations. State Farm, a leading insurance provider, aims to simplify this process by offering comprehensive coverage and exceptional customer service. To understand the true impact of State Farm’s services in Georgia, it’s crucial to delve into the experiences of their customers.

Customer Testimonials and Reviews, State farm car insurance georgia

To gain insights into the customer experience with State Farm car insurance in Georgia, it’s essential to consider testimonials and reviews from actual policyholders. These firsthand accounts provide valuable perspectives on various aspects of State Farm’s services, including claims processing, customer support, and overall satisfaction.

“I’ve been a State Farm customer for over 10 years and have always been impressed with their professionalism and responsiveness. When I had an accident, the claims process was smooth and efficient. I highly recommend State Farm to anyone looking for reliable car insurance in Georgia.” – John S., Atlanta, GA

“State Farm’s customer service is top-notch. I had a question about my policy and was able to get a quick and helpful response from a friendly agent. I appreciate their commitment to providing excellent customer care.” – Sarah M., Savannah, GA

These testimonials highlight the positive experiences many customers have had with State Farm in Georgia. The consistent themes of professionalism, responsiveness, and excellent customer service are indicative of State Farm’s commitment to customer satisfaction.

Customer Satisfaction Levels

Customer satisfaction levels are a key indicator of the quality of service provided by an insurance company. Various studies and surveys have consistently ranked State Farm highly in terms of customer satisfaction.

For instance, J.D. Power’s 2023 U.S. Auto Insurance Satisfaction Study ranked State Farm among the top insurance providers in the country, reflecting a high level of customer satisfaction. This positive rating underscores State Farm’s dedication to providing exceptional customer experiences.

Customer Service Channels

State Farm offers a variety of customer service channels to ensure easy access and support for its policyholders in Georgia. These channels cater to diverse preferences and communication styles, ensuring a convenient experience for every customer.

- Phone Support: State Farm provides 24/7 phone support, allowing customers to reach a representative at any time, day or night. This readily available option ensures immediate assistance for urgent matters or general inquiries.

- Email: Customers can also reach State Farm via email, providing a convenient and documented method for communication. This option is particularly useful for non-urgent inquiries or follow-up questions.

- Online Portals: State Farm’s online portals offer a comprehensive platform for managing policies, making payments, and accessing account information. These portals provide 24/7 access to policy details, simplifying account management and enhancing convenience.

These diverse channels empower customers to choose the communication method that best suits their needs, ensuring a seamless and efficient experience.

State Farm’s Role in the Georgia Community

State Farm is deeply committed to supporting the communities it serves, and Georgia is no exception. Beyond providing reliable car insurance, State Farm actively participates in various initiatives that aim to make a positive impact on the lives of Georgians.

State Farm’s dedication to the Georgia community manifests in several ways, including financial support for local organizations, employee volunteerism, and participation in community events.

State Farm’s Community Involvement

State Farm’s commitment to community involvement is evident in its generous support of various charitable organizations and programs in Georgia. Here are some examples:

- State Farm has a long-standing partnership with the American Red Cross, providing financial support and volunteer assistance for disaster relief efforts across the state.

- State Farm is a major supporter of the Boys & Girls Clubs of America, providing funding for after-school programs that promote youth development and educational success.

- State Farm agents and employees actively participate in community events, such as local festivals, charity runs, and school fundraisers, demonstrating their commitment to making a difference in their communities.

State Farm’s Support for Local Businesses

State Farm recognizes the importance of supporting local businesses in Georgia. This support is demonstrated through various initiatives, such as:

- State Farm agents often partner with local businesses to offer discounts and promotions to their customers.

- State Farm’s advertising campaigns often feature local businesses, helping to raise their visibility and attract new customers.

- State Farm agents are active members of their local chambers of commerce, participating in networking events and advocating for the interests of local businesses.

Benefits of Choosing State Farm in Georgia

Choosing State Farm car insurance in Georgia offers several benefits, including:

- The peace of mind that comes from knowing you are insured by a company that is deeply invested in your community.

- Access to a network of local agents who are committed to providing personalized service and support.

- The opportunity to support local businesses and organizations through State Farm’s community involvement initiatives.

Conclusive Thoughts

Whether you’re a seasoned driver or just starting out, State Farm car insurance in Georgia provides a solid foundation for peace of mind on the road. With its extensive coverage options, competitive pricing, and strong community presence, State Farm stands as a trusted partner for drivers seeking comprehensive protection and exceptional service.

Essential FAQs

What are the minimum car insurance requirements in Georgia?

Georgia requires drivers to carry liability insurance, which covers damages to others in an accident. The minimum limits are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage.

What are some discounts offered by State Farm in Georgia?

State Farm offers various discounts in Georgia, including good driver discounts, safe driver discounts, multi-car discounts, and discounts for bundling insurance policies.

How can I file a claim with State Farm in Georgia?

You can file a claim with State Farm online, through their mobile app, or by calling their customer service line. They have a 24/7 claims reporting system for your convenience.