State Auto Insurance quotes offer a potential pathway to affordable and reliable car insurance. Navigating the world of auto insurance can be overwhelming, but understanding the nuances of State Auto Insurance quotes can empower you to make informed decisions about your coverage.

From exploring the history and offerings of State Auto Insurance to comparing their quotes against competitors, this guide delves into the essential aspects of securing a quote that aligns with your needs and budget. We’ll examine the factors that influence quote pricing, explore various coverage options, and provide valuable tips for obtaining the most competitive quote.

Understanding State Auto Insurance

State Auto Insurance is a well-established insurance company with a long history of providing reliable and affordable coverage to its customers. Founded in 1921, State Auto has grown into a leading provider of personal and commercial insurance products across the United States.

History and Background

State Auto Insurance traces its roots back to 1921 when it was established as a mutual insurance company in Columbus, Ohio. Over the years, State Auto has expanded its operations and product offerings to serve a wider customer base. The company’s focus on providing personalized service and competitive rates has earned it a reputation for reliability and customer satisfaction.

Types of Insurance Offered

State Auto Insurance offers a comprehensive range of insurance products to meet the diverse needs of its customers. These products include:

- Auto Insurance: State Auto provides various auto insurance coverages, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The company also offers optional add-ons such as roadside assistance, rental car reimbursement, and gap insurance.

- Home Insurance: State Auto offers homeowners insurance policies that protect against a wide range of perils, including fire, theft, and natural disasters. The company also provides coverage for personal property, liability, and medical payments.

- Business Insurance: State Auto provides business insurance solutions for a variety of industries, including commercial property, general liability, workers’ compensation, and professional liability insurance.

- Life Insurance: State Auto offers a range of life insurance products, including term life, whole life, and universal life insurance. These policies provide financial protection for loved ones in the event of the policyholder’s death.

- Other Insurance Products: State Auto also offers other insurance products, such as motorcycle insurance, recreational vehicle insurance, and umbrella insurance.

Coverage Areas and Availability

State Auto Insurance operates in a significant number of states across the United States. The company’s coverage area extends to a wide geographic region, providing insurance solutions to individuals and businesses in various locations.

- States with Full Coverage: State Auto offers full coverage in the following states: Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Mexico, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, Utah, Virginia, West Virginia, and Wisconsin.

- States with Limited Coverage: State Auto provides limited coverage in certain states, such as Arizona, Colorado, Maryland, New Jersey, and Pennsylvania. This means that the company may not offer all of its insurance products or services in these states.

- States Without Coverage: State Auto does not offer insurance in some states, such as California, New York, and Oregon. It is essential to check with State Auto directly to confirm their coverage availability in your specific location.

Obtaining a Quote

Getting a State Auto Insurance quote is a simple process that can be done in several ways. You can request a quote online, over the phone, or by visiting a local State Auto agent. Regardless of your preferred method, the information you provide will be used to calculate your personalized rate.

Information Required for a Quote

To get an accurate quote, you’ll need to provide some basic information about yourself and your vehicle. This includes:

- Your name, address, and date of birth

- Your driving history, including any accidents or violations

- The make, model, and year of your vehicle

- Your vehicle’s mileage and usage

- Your desired coverage levels

Factors Influencing Quote Prices

The price of your State Auto Insurance quote will depend on several factors, including:

- Your driving history: A clean driving record with no accidents or violations will typically result in lower rates.

- Your age and gender: Younger drivers and males generally pay higher premiums due to higher risk factors.

- Your location: Rates can vary depending on the location of your residence due to factors like crime rates and traffic congestion.

- Your vehicle: The make, model, year, and safety features of your vehicle can impact your insurance costs. For example, newer vehicles with advanced safety features may qualify for discounts.

- Your coverage levels: The amount of coverage you choose will directly affect your premium. Higher coverage limits generally mean higher premiums.

- Your credit score: In some states, insurance companies can use your credit score to determine your rates. A good credit score can lead to lower premiums.

Comparing State Auto Insurance Quotes

It’s important to compare quotes from multiple insurance providers to find the best coverage at the most affordable price. State Auto Insurance offers competitive rates, but it’s essential to see how they stack up against other major insurance companies.

Comparison of State Auto Insurance Quotes with Other Providers

To help you make an informed decision, here’s a table comparing State Auto Insurance quotes with other major insurance providers:

| Provider | Coverage | Price | Features |

|---|---|---|---|

| State Auto Insurance | Liability, Collision, Comprehensive, Uninsured Motorist | $1,200 per year | Discount for safe driving, good credit, and multiple policies |

| Progressive | Liability, Collision, Comprehensive, Uninsured Motorist | $1,000 per year | Name Your Price tool, Snapshot device for discounts |

| Geico | Liability, Collision, Comprehensive, Uninsured Motorist | $1,100 per year | Easy online quoting, 24/7 customer service |

| Allstate | Liability, Collision, Comprehensive, Uninsured Motorist | $1,300 per year | Drive Safe & Save program, mobile app for claims |

Advantages and Disadvantages of Choosing State Auto Insurance, State auto insurance quote

Choosing State Auto Insurance can be beneficial, but it’s essential to weigh the pros and cons:

Advantages

- Competitive rates: State Auto Insurance often offers competitive prices, especially for drivers with good driving records and credit scores.

- Wide range of coverage options: State Auto provides a comprehensive range of coverage options to meet your specific needs.

- Excellent customer service: State Auto is known for its friendly and responsive customer service.

- Financial stability: State Auto has a strong financial history, providing peace of mind that they will be there to pay claims.

Disadvantages

- Limited availability: State Auto Insurance is not available in all states, so it may not be an option for some drivers.

- Fewer discounts: Compared to some competitors, State Auto offers fewer discounts.

- Less online functionality: State Auto’s website may not be as user-friendly or offer as many online features as some other insurance providers.

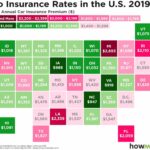

Comparison of State Auto Insurance Quotes Across Different States and Regions

State Auto Insurance rates can vary significantly depending on the state and region. Factors that influence pricing include:

- State regulations: Each state has its own regulations regarding insurance coverage and rates.

- Cost of living: Areas with higher costs of living tend to have higher insurance premiums.

- Driving history: Your driving record significantly impacts your insurance rates.

- Vehicle type: The type of vehicle you drive also influences your premium.

It’s crucial to obtain quotes from State Auto Insurance and other providers in your specific state to compare prices accurately.

Understanding Coverage Options

State Auto Insurance offers a range of coverage options to cater to different needs and preferences. Choosing the right coverage is crucial to ensure adequate protection in case of an accident or other unforeseen events. It is essential to understand the benefits and limitations of each coverage option to make an informed decision.

Liability Coverage

Liability coverage is a crucial aspect of any car insurance policy. It provides financial protection if you are found liable for an accident that causes damage to another person’s property or injuries to others.

- Bodily Injury Liability Coverage: This coverage pays for medical expenses, lost wages, and other damages caused to other people in an accident where you are at fault. It typically has two limits: per person and per accident. For example, a policy with a 25/50 limit would cover up to $25,000 per person injured and up to $50,000 for all injuries in a single accident.

- Property Damage Liability Coverage: This coverage pays for damages to other people’s vehicles or property in an accident where you are at fault. The limit on this coverage represents the maximum amount your insurance company will pay for damages to another person’s property in a single accident.

For example, if you are involved in an accident and cause $10,000 in damages to another vehicle, your property damage liability coverage will pay for the repairs, up to the limit of your policy. If your limit is $25,000, your insurance company will pay the full $10,000. However, if your limit is only $5,000, your insurance company will only pay $5,000, and you will be responsible for the remaining $5,000.

Collision Coverage

Collision coverage protects your vehicle in case of an accident, regardless of who is at fault.

- This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object. It also covers damages caused by hitting a stationary object, such as a tree or a fence.

- Collision coverage is optional, but it is highly recommended if you have a car loan or lease.

If you have a car loan or lease, the lender will typically require you to have collision coverage to protect their investment in your vehicle. If you choose not to have collision coverage, you will be responsible for paying for repairs or replacement of your vehicle out of pocket.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions.

- This coverage pays for repairs or replacement of your vehicle if it is damaged by fire, theft, vandalism, hail, or other covered perils.

- Comprehensive coverage is optional, but it is recommended if you have a new or expensive vehicle.

If your vehicle is damaged by a covered event, comprehensive coverage will pay for repairs or replacement, minus your deductible. For example, if your vehicle is damaged by hail and your deductible is $500, your insurance company will pay for repairs or replacement up to the actual cash value of your vehicle, minus the $500 deductible.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you and your passengers in case you are involved in an accident with a driver who is uninsured or underinsured.

- This coverage pays for medical expenses, lost wages, and other damages caused by the uninsured or underinsured driver.

- UM/UIM coverage is optional, but it is highly recommended.

If you are involved in an accident with an uninsured driver, you will be responsible for paying for your own medical expenses and other damages. UM/UIM coverage will help cover these costs.

Personal Injury Protection (PIP)

PIP coverage, also known as “no-fault” coverage, pays for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- PIP coverage is required in some states.

- The amount of PIP coverage you choose will determine how much your insurance company will pay for your medical expenses and lost wages.

For example, if you have $10,000 in PIP coverage and are involved in an accident, your insurance company will pay up to $10,000 for your medical expenses and lost wages.

Medical Payments Coverage

Medical payments coverage (Med Pay) pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Med Pay is optional, but it can be helpful to have if you have a high deductible on your health insurance or if you are concerned about coverage for your passengers.

- Med Pay coverage is separate from your health insurance.

For example, if you have $1,000 in Med Pay coverage and are involved in an accident, your insurance company will pay up to $1,000 for your medical expenses, regardless of whether you are at fault.

Rental Reimbursement Coverage

Rental reimbursement coverage pays for the cost of renting a car while your vehicle is being repaired after an accident.

- This coverage is optional, but it can be helpful if you rely on your vehicle for transportation.

- The amount of rental reimbursement coverage you choose will determine how much your insurance company will pay for your rental car.

For example, if you have $50 per day in rental reimbursement coverage and your vehicle is in the shop for five days, your insurance company will pay up to $250 for your rental car.

Towing and Labor Coverage

Towing and labor coverage pays for the cost of towing your vehicle to a repair shop after an accident or breakdown.

- This coverage is optional, but it can be helpful to have if you live in an area where towing costs are high.

- The amount of towing and labor coverage you choose will determine how much your insurance company will pay for towing and labor.

For example, if you have $100 in towing and labor coverage and your vehicle needs to be towed 20 miles, your insurance company will pay up to $100 for towing and labor.

Roadside Assistance Coverage

Roadside assistance coverage provides help with common roadside emergencies, such as flat tires, dead batteries, and lockouts.

- This coverage is optional, but it can be helpful to have if you are concerned about being stranded on the side of the road.

- The amount of roadside assistance coverage you choose will determine how many times you can use the service each year.

For example, if you have roadside assistance coverage and your car breaks down on the side of the road, you can call your insurance company for help. They will send a tow truck to your location, or they will help you jump-start your car or change your tire.

Gap Coverage

Gap coverage is a type of insurance that helps pay the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

- This coverage is optional, but it can be helpful if you have a new or expensive vehicle.

- Gap coverage can help you avoid being upside down on your loan or lease.

For example, if you have a car loan for $25,000 and your vehicle is totaled in an accident, your insurance company will only pay you the actual cash value of your vehicle. If the actual cash value of your vehicle is only $15,000, you will still owe $10,000 on your loan. Gap coverage will help you pay off the remaining $10,000.

Other Coverage Options

State Auto Insurance may also offer other coverage options, such as:

- Custom Equipment Coverage: This coverage protects you if your vehicle has custom equipment, such as a sound system or a sunroof.

- Loan/Lease Coverage: This coverage protects you if your vehicle is damaged or totaled and you owe more on your loan or lease than the actual cash value of your vehicle.

- Ride-Sharing Coverage: This coverage protects you if you use your vehicle for ride-sharing services, such as Uber or Lyft.

It is important to discuss your specific needs with your insurance agent to determine which coverage options are right for you.

State Auto Insurance Customer Experience

State Auto Insurance strives to provide a positive customer experience. The company focuses on offering reliable service and support to its policyholders. State Auto aims to make insurance easy and convenient, both online and through its network of agents.

Customer Service Experience

State Auto Insurance is known for its commitment to providing excellent customer service. The company offers a variety of ways for customers to connect with representatives, including phone, email, and live chat. State Auto also has a comprehensive online help center with frequently asked questions and articles.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the experiences of State Auto Insurance policyholders. While customer satisfaction varies, many customers praise the company’s responsiveness, helpfulness, and efficiency.

“I’ve been with State Auto for years, and I’ve always been happy with their service. They’re always there when I need them, and they’re always willing to help.” – John S.

“I recently had to file a claim, and the process was so easy. State Auto took care of everything for me, and I was very satisfied with the outcome.” – Mary L.

Online Tools and Resources

State Auto Insurance provides various online tools and resources to enhance the customer experience. These tools include:

- Online Account Management: Customers can manage their policies, make payments, view their claims history, and access other important information through their online account.

- Mobile App: The State Auto mobile app offers convenient access to policy information, claims reporting, and roadside assistance.

- Online Quote Tool: Customers can obtain an instant quote for auto insurance online, making it easy to compare coverage options and pricing.

Tips for Getting the Best Quote

Securing the most competitive State Auto Insurance quote involves a strategic approach. By following these tips, you can increase your chances of obtaining a favorable rate and ensuring you have the coverage you need.

Negotiating with State Auto Insurance

Negotiating with State Auto Insurance can help you secure a better rate. Here are some strategies to consider:

- Bundle your policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. State Auto often offers discounts for bundling multiple policies.

- Shop around for quotes: Obtain quotes from multiple insurance providers to compare rates and coverage options. This competitive process can give you leverage when negotiating with State Auto.

- Highlight your driving record: If you have a clean driving record, emphasize this to State Auto. They may offer a discount for good driving history.

- Explore discounts: Ask about available discounts, such as those for safety features in your vehicle, good student status, or membership in certain organizations.

- Be prepared to walk away: If State Auto doesn’t offer a competitive quote, be prepared to take your business elsewhere. This can motivate them to reconsider their offer.

Avoiding Common Mistakes

Certain common mistakes can hinder your efforts to obtain the best quote. Here are some pitfalls to avoid:

- Not comparing quotes: Failing to compare quotes from multiple insurance providers can lead to overpaying for your insurance. Take the time to get quotes from several companies before making a decision.

- Not disclosing all relevant information: Be truthful and transparent when providing information about your driving history, vehicle, and other factors that may affect your insurance rate. Omitting information could lead to higher premiums or even policy cancellation.

- Not understanding your coverage needs: Ensure you understand the different types of coverage available and choose the options that best suit your needs. Over- or under-insuring can lead to financial consequences in the event of an accident.

- Not asking about discounts: Many insurance companies offer discounts for various factors. Inquire about available discounts and take advantage of any that apply to you.

State Auto Insurance vs. Competitors

Choosing the right auto insurance provider can be a daunting task, especially when you’re faced with a plethora of options. To help you make an informed decision, we’ll compare State Auto Insurance with some of its major competitors. We’ll analyze their coverage, pricing, and customer service, providing you with insights to help you determine the best fit for your needs.

Comparing Key Features

To understand how State Auto Insurance stacks up against its rivals, let’s delve into a comparative analysis. We’ll examine key features such as coverage, pricing, and customer service.

| Provider | Coverage | Price | Features |

|---|---|---|---|

| State Auto Insurance | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | Competitive, varies by state and individual factors | Discount programs, 24/7 customer support, online quote tool, mobile app |

| Progressive | Similar coverage options to State Auto | Highly competitive, known for its Name Your Price tool | Wide range of discounts, strong online presence, robust mobile app |

| Geico | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | Generally affordable, known for its competitive pricing | Extensive advertising, 24/7 customer service, online quote tool |

| Allstate | Comprehensive, Collision, Liability, Personal Injury Protection, Uninsured/Underinsured Motorist | Competitive, offers various discounts | Strong brand recognition, 24/7 customer support, mobile app |

Strengths and Weaknesses of State Auto Insurance

State Auto Insurance boasts a number of strengths that make it a compelling choice for many drivers. These include:

* Competitive pricing: State Auto Insurance offers competitive rates, often aligning with or even exceeding the affordability of its rivals.

* Comprehensive coverage options: State Auto provides a wide range of coverage options, ensuring that you can find a policy that meets your specific needs.

* Discount programs: State Auto offers a variety of discounts, such as safe driver, good student, and multi-car discounts, allowing you to potentially save on your premiums.

* Strong customer service: State Auto has a reputation for providing responsive and helpful customer service.

However, State Auto Insurance also has some weaknesses to consider:

* Limited availability: State Auto Insurance is not available in all states, which might limit its appeal to some drivers.

* Less prominent brand recognition: Compared to some of its larger competitors, State Auto Insurance has a smaller market share and less brand recognition, which could be a factor for some consumers.

* Limited online presence: State Auto’s online presence, while improving, might not be as robust as some of its rivals.

Final Conclusion

Ultimately, the journey to finding the right auto insurance involves careful consideration and research. By understanding the ins and outs of State Auto Insurance quotes, you can confidently evaluate your options and make an informed decision that best suits your individual circumstances. Whether you’re a seasoned driver or a new car owner, this guide equips you with the knowledge to navigate the complexities of auto insurance and secure the coverage you deserve.

User Queries

What are the main factors that influence State Auto Insurance quotes?

State Auto Insurance quotes are influenced by various factors, including your driving history, age, location, vehicle type, and coverage options.

How do I get a State Auto Insurance quote online?

You can typically obtain a quote online by visiting the State Auto Insurance website and providing your personal and vehicle information.

What are the benefits of choosing State Auto Insurance?

State Auto Insurance may offer competitive pricing, various coverage options, and potentially good customer service. It’s important to compare their quotes with other providers to determine if they align with your needs and budget.