Insurance quotes Washington state are crucial for finding the right coverage at the best price. Whether you’re a new driver, homeowner, or business owner, understanding how insurance works in Washington is essential. This guide will walk you through the key factors that influence insurance quotes, the different types of insurance available, and how to find the best deals. We’ll also discuss mandatory insurance requirements, available discounts, and the claims process.

Navigating the world of insurance can be overwhelming, but with the right information, you can make informed decisions and protect yourself financially. This guide provides a comprehensive overview of insurance quotes in Washington state, empowering you to confidently choose the best coverage for your needs.

Understanding Insurance Quotes in Washington State: Insurance Quotes Washington State

Getting an insurance quote in Washington State involves a variety of factors, and understanding these factors can help you get the best possible price for your coverage.

Key Factors Influencing Insurance Quotes

The price of your insurance quote in Washington State is influenced by a number of factors. These include:

- Your driving history: Your driving record, including accidents, tickets, and violations, significantly impacts your insurance premiums. Drivers with a clean record typically pay lower premiums.

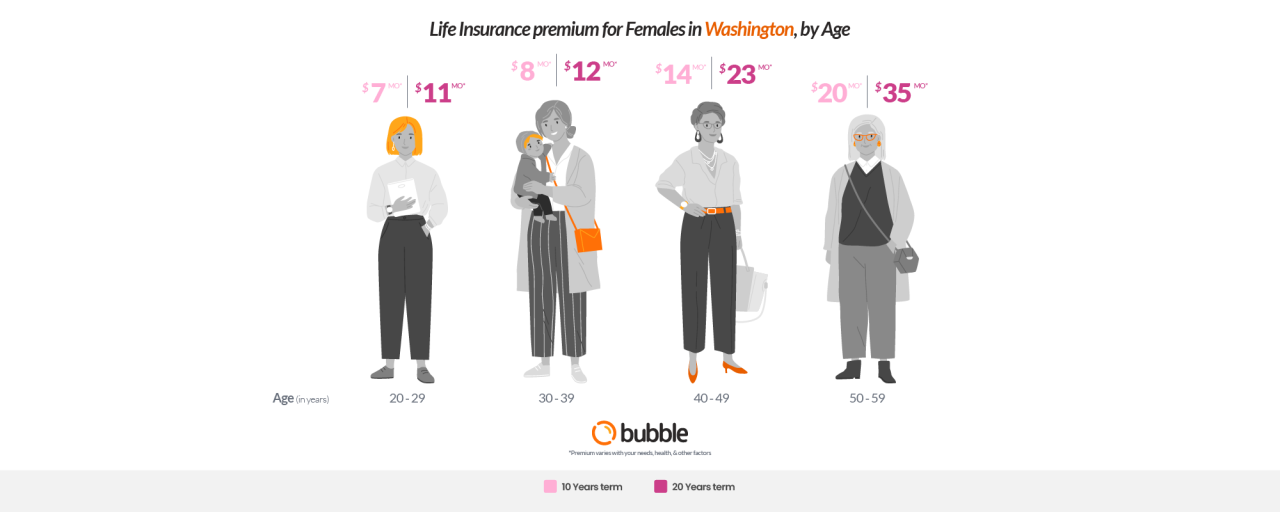

- Your age and gender: Younger drivers and males generally pay higher premiums due to increased risk factors.

- Your vehicle: The make, model, year, and safety features of your car affect your insurance cost. Newer cars with advanced safety features often have lower premiums.

- Your location: The risk of accidents and theft varies depending on where you live. Areas with higher crime rates or traffic congestion may have higher insurance rates.

- Your coverage level: The amount of coverage you choose, such as liability limits and deductibles, affects your premium. Higher coverage levels generally result in higher premiums.

- Your credit score: In Washington State, insurance companies are allowed to use your credit score to determine your insurance rates. A good credit score can lead to lower premiums.

Types of Insurance Available in Washington State

Washington State offers a range of insurance options to meet diverse needs. The most common types include:

- Auto insurance: This is required for all drivers in Washington State. It covers damages to your vehicle and injuries to others in the event of an accident.

- Homeowners insurance: This protects your home and belongings from various risks, such as fire, theft, and natural disasters.

- Renters insurance: This provides coverage for your personal belongings and liability protection if someone is injured in your rental unit.

- Health insurance: This covers medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Life insurance: This provides financial protection for your loved ones in the event of your death.

- Disability insurance: This replaces a portion of your income if you are unable to work due to an illness or injury.

Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) plays a vital role in regulating the insurance industry in the state. The OIC:

- Ensures fair and competitive insurance rates: The OIC monitors insurance rates to ensure they are reasonable and not discriminatory.

- Protects consumers from unfair practices: The OIC investigates complaints against insurance companies and takes action to resolve consumer issues.

- Licenses and regulates insurance companies: The OIC ensures that insurance companies meet certain financial and operational standards.

- Provides information and resources to consumers: The OIC offers educational materials and tools to help consumers understand insurance options and make informed decisions.

Finding the Best Insurance Quotes in Washington State

Finding the best insurance quotes in Washington State involves a comprehensive comparison of various providers and a thorough understanding of your specific needs. By taking the time to evaluate different options, you can secure the most suitable and cost-effective coverage for your circumstances.

Comparing Insurance Quotes

It’s crucial to compare insurance quotes from multiple providers to ensure you’re getting the best possible deal. This process involves gathering quotes from different insurance companies and analyzing them side-by-side.

- Utilize Online Comparison Tools: Many websites and apps allow you to input your information and receive quotes from various insurance providers simultaneously. This simplifies the process and saves you time.

- Contact Insurance Companies Directly: Reach out to insurance companies directly to request quotes and discuss your specific needs. This allows for more personalized communication and tailored coverage options.

- Review Policy Details Carefully: When comparing quotes, pay close attention to the coverage limits, deductibles, and any exclusions. This ensures you understand the scope of protection offered by each policy.

Coverage Limits and Deductibles

Understanding coverage limits and deductibles is essential for determining the right level of protection and affordability.

- Coverage Limits: The maximum amount an insurance company will pay for a covered claim. Higher coverage limits generally lead to higher premiums but offer greater financial protection in case of a significant loss.

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

Key Factors to Consider When Choosing an Insurance Provider

When selecting an insurance provider, several factors are crucial to consider to ensure you choose a reliable and reputable company that meets your needs.

- Financial Stability: Choose a company with a strong financial rating, indicating its ability to meet its obligations and pay claims.

- Customer Service: Look for a provider with a history of excellent customer service, including prompt claim processing and responsive communication.

- Reputation: Research the company’s reputation by reading online reviews and seeking feedback from others who have used their services.

- Discounts: Inquire about available discounts, such as safe driving discounts, multi-policy discounts, or good student discounts, to potentially lower your premiums.

Insurance Requirements in Washington State

Driving without insurance in Washington State is illegal and can result in serious consequences. The state mandates that all drivers carry specific types of insurance coverage to protect themselves and others on the road.

Minimum Insurance Requirements

Washington State requires all drivers to have the following minimum insurance coverage:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures another person or damages their property. It includes:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries you cause to others in an accident. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damages you cause to another person’s vehicle or property in an accident. The minimum requirement is $10,000 per accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. The minimum requirement is $25,000 per person and $50,000 per accident for bodily injury, and $10,000 for property damage.

Penalties for Driving Without Insurance

Driving without insurance in Washington State can result in:

- Fines: You can be fined up to $1,000 for driving without insurance, and the fine may be doubled for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for up to 90 days for driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded if you are caught driving without insurance.

- Court Costs: You may be required to pay court costs if you are found guilty of driving without insurance.

- Increased Insurance Premiums: If you get into an accident without insurance, you will likely face significantly higher insurance premiums in the future.

Obtaining Proof of Insurance

You can obtain proof of insurance from your insurance company. It is typically provided in the form of an insurance card or a digital document. You must carry proof of insurance with you at all times while driving and present it to law enforcement officers upon request.

Insurance Discounts and Savings in Washington State

Lowering your insurance premiums in Washington State is possible by taking advantage of various discounts offered by insurance companies. These discounts can significantly reduce your overall costs, making insurance more affordable.

Types of Insurance Discounts

Understanding the different types of discounts available is crucial for maximizing your savings. Insurance companies offer a wide range of discounts based on various factors, including your driving habits, vehicle features, and lifestyle. Here are some common insurance discounts available in Washington State:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating responsible driving habits. It usually applies to individuals who haven’t been involved in accidents or received traffic violations within a specific timeframe.

- Safe Driver Discount: This discount is similar to the good driver discount, but it may be based on specific driving behaviors, such as using a telematics device that monitors your driving habits and provides feedback.

- Multi-Car Discount: Insurance companies often offer discounts when you insure multiple vehicles under the same policy. This discount encourages policyholders to bundle their insurance needs with one provider, leading to potential cost savings.

- Multi-Policy Discount: This discount applies when you insure multiple types of insurance, such as home, auto, and life insurance, with the same company. This encourages customers to consolidate their insurance needs with a single provider, potentially resulting in lower premiums.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies may offer discounts to drivers who have successfully completed such courses, acknowledging their effort to improve their driving skills.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can deter theft and reduce the risk of insurance claims. Insurance companies may offer discounts for vehicles equipped with anti-theft devices, recognizing the added security they provide.

- Good Student Discount: This discount is often available to students who maintain good academic standing. Insurance companies may view good students as more responsible and less likely to engage in risky behavior, leading to lower premiums.

- Loyalty Discount: Some insurance companies offer discounts to long-term policyholders as a reward for their continued business. This demonstrates appreciation for loyal customers and encourages them to stay with the company.

- Group Discount: Some organizations, such as professional associations or employers, may offer group discounts to their members or employees. These discounts can be negotiated by the group with insurance companies, resulting in lower premiums for participating individuals.

- Homeowner Discount: If you own your home and insure it with the same company, you may qualify for a homeowner discount on your auto insurance. This discount acknowledges the reduced risk associated with homeowners, as they tend to be more responsible and have a vested interest in maintaining their property.

- Military Discount: Active military personnel and veterans may qualify for military discounts on their auto insurance. These discounts are often offered as a way to show appreciation for their service and commitment to the country.

Qualifying for Insurance Discounts

To qualify for these discounts, you need to meet specific criteria set by the insurance company.

- Provide Documentation: Be prepared to provide relevant documentation to support your eligibility for specific discounts. This may include your driving record, proof of completion for defensive driving courses, documentation of anti-theft devices, or academic transcripts for good student discounts.

- Contact Your Insurance Provider: Reach out to your insurance provider to inquire about the discounts you may qualify for. They can provide specific details about the requirements and application process for each discount.

- Review Your Policy Regularly: It’s essential to review your insurance policy periodically to ensure you’re still eligible for all applicable discounts. Changes in your circumstances, such as getting married, buying a new car, or completing a defensive driving course, may affect your eligibility for certain discounts.

Tips for Saving Money on Insurance Premiums, Insurance quotes washington state

Beyond discounts, several strategies can help you save on your insurance premiums:

- Compare Quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to find the best rates. Online comparison tools can make this process easier and more efficient.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can also lead to lower premiums. Consider your financial situation and risk tolerance when choosing your deductible.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations is crucial for maintaining a good driving record and qualifying for discounts. Defensive driving courses can also help improve your driving habits and potentially lower your premiums.

- Bundle Your Insurance: Combining multiple insurance policies, such as auto and home insurance, with the same company can lead to significant savings through multi-policy discounts.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s a good idea to shop around for better rates periodically. Don’t be afraid to switch providers if you find a better deal.

Insurance Claims Process in Washington State

Filing an insurance claim in Washington State can be a daunting process, but understanding the steps involved can make it less stressful. The process begins with reporting the incident to your insurance company and ends with the settlement of your claim. This guide will provide an overview of the process, the different types of claims, and the role of the insurance adjuster.

Types of Insurance Claims in Washington State

Insurance claims in Washington State can be categorized based on the type of insurance policy involved. Some common types of claims include:

- Auto Insurance Claims: These claims are filed when an insured vehicle is involved in an accident, resulting in damage to the vehicle or injury to the driver or passengers.

- Homeowners Insurance Claims: These claims are filed when an insured property is damaged due to events such as fire, theft, or natural disasters.

- Health Insurance Claims: These claims are filed when an insured individual incurs medical expenses due to illness or injury.

- Life Insurance Claims: These claims are filed when an insured individual passes away, and the beneficiary of the policy seeks to claim the death benefit.

The Role of the Insurance Adjuster

The insurance adjuster plays a crucial role in the claims process. They are responsible for investigating the claim, assessing the damage, and determining the amount of compensation to be paid to the insured. Here’s how the adjuster works:

- Investigating the Claim: The adjuster will gather information about the incident, including witness statements, police reports, and photographs. They will also review the insurance policy to determine the coverage and limits.

- Assessing the Damage: The adjuster will assess the extent of the damage and determine the cost of repairs or replacement. They may hire independent experts, such as appraisers or contractors, to assist in this process.

- Negotiating a Settlement: Once the adjuster has gathered all the necessary information, they will negotiate a settlement with the insured. This settlement may include payment for repairs, medical expenses, lost wages, or other damages.

Closing Summary

Finding the best insurance quotes in Washington state requires research, comparison, and a clear understanding of your needs. By considering factors like coverage limits, deductibles, and discounts, you can secure affordable and comprehensive insurance protection. Remember to shop around, compare quotes, and choose a reputable provider with excellent customer service. With a little effort, you can find the perfect insurance plan that fits your budget and provides peace of mind.

FAQ Resource

What are the mandatory insurance requirements for drivers in Washington state?

Drivers in Washington state are required to have liability insurance, which covers damages to other vehicles and injuries to other people in case of an accident. The minimum coverage requirements are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

How do I qualify for insurance discounts in Washington state?

Many insurance providers offer discounts for various factors, including good driving records, safety features in your vehicle, multiple policies with the same insurer, and being a member of certain organizations. It’s important to ask your insurance provider about available discounts and provide any relevant documentation to qualify.