Indiana State Minimum Car Insurance is a legal requirement for all drivers in the state, ensuring financial protection in case of accidents. Understanding the minimum coverage limits and factors influencing costs is crucial for drivers seeking affordable and compliant insurance.

This guide will provide a comprehensive overview of Indiana’s minimum car insurance requirements, including the types of coverage, factors affecting premiums, and tips for finding affordable options. We’ll also discuss the penalties for driving without insurance and explore resources available to Indiana drivers.

Indiana State Minimum Car Insurance Requirements

Driving a car in Indiana is a privilege, and it comes with responsibilities, including having the required car insurance coverage. The Indiana Department of Insurance mandates specific minimum insurance coverages to protect you and others on the road.

Liability Coverage Requirements

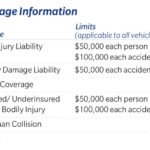

Liability insurance is essential to cover damages you cause to others in an accident. It protects you financially if you are at fault in an accident and are liable for injuries or property damage. Indiana requires the following minimum liability coverage limits:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages for injuries caused to others in an accident. The minimum limit is $25,000 per person and $50,000 per accident. This means that if you injure one person, your insurance will pay up to $25,000, and if you injure multiple people in the same accident, your insurance will pay up to $50,000 total.

- Property Damage Liability: This covers damages to another person’s property, such as their vehicle or other belongings. The minimum limit is $25,000.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. Indiana requires a minimum of $25,000 per person and $50,000 per accident for uninsured motorist bodily injury coverage. This means that if you are involved in an accident with an uninsured driver, your insurance will pay up to $25,000 for your injuries, and up to $50,000 for the injuries of others in your vehicle.

Penalties for Driving Without Minimum Insurance Coverage

Driving without the required minimum car insurance in Indiana is a serious offense. If you are caught driving without insurance, you could face the following penalties:

- Fines: You could be fined up to $1,000 for the first offense and up to $2,500 for subsequent offenses.

- License Suspension: Your driver’s license could be suspended until you provide proof of insurance.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance.

- Court Costs: You may have to pay court costs associated with the violation.

Factors Influencing Indiana Car Insurance Costs

Several factors influence your car insurance premium in Indiana, making it essential to understand how these factors work to ensure you get the best possible rate. This section will explore the key factors that determine your car insurance premium and explain how they contribute to the overall cost.

Age

Your age plays a significant role in determining your car insurance premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher insurance premiums for young drivers. As you gain experience and age, your premiums tend to decrease because you become a lower risk to insurers.

Driving History

Your driving history is a crucial factor in determining your car insurance premium. A clean driving record with no accidents, violations, or claims translates to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your premium. Insurers consider you a higher risk if you have a history of driving violations, as it suggests you may be more likely to be involved in future accidents.

Vehicle Type

The type of vehicle you drive also influences your car insurance premium. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to repair or replace, making them more costly to insure. Conversely, smaller, less expensive cars often come with lower insurance premiums.

Location

Where you live can significantly impact your car insurance premiums. Areas with high crime rates, traffic congestion, and a higher number of accidents tend to have higher insurance premiums. This is because insurers face a higher risk of paying out claims in these areas.

Types of Car Insurance Coverage Available in Indiana

Indiana offers a variety of car insurance coverages to protect drivers and their vehicles. While the state requires specific minimum coverages, additional options can provide more comprehensive protection.

Collision Coverage

Collision coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but can be beneficial, especially if your vehicle is relatively new or has a high value.

- Benefits: Covers repairs or replacement of your vehicle after an accident, regardless of fault.

- Drawbacks: You’ll have to pay a deductible, and coverage is limited to the actual cash value of your vehicle.

- Example: If you hit a parked car and damage your vehicle, collision coverage would help pay for the repairs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It’s optional but can be particularly valuable if you live in an area prone to such events.

- Benefits: Covers damages to your vehicle caused by events other than accidents.

- Drawbacks: You’ll have to pay a deductible, and coverage is limited to the actual cash value of your vehicle.

- Example: If your car is stolen or damaged by a hailstorm, comprehensive coverage would help pay for repairs or replacement.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, helps cover medical expenses, lost wages, and other related costs for you and your passengers after an accident, regardless of who is at fault. It’s mandatory in Indiana.

- Benefits: Covers medical expenses, lost wages, and other related costs for you and your passengers after an accident, regardless of fault.

- Drawbacks: The amount of coverage is limited, and you may have to pay a deductible.

- Example: If you are injured in an accident, PIP coverage would help pay for your medical bills, even if the other driver is at fault.

Finding Affordable Car Insurance in Indiana

Finding affordable car insurance in Indiana can be a challenge, but it’s possible with a little effort. By understanding your options and making informed decisions, you can secure a policy that meets your needs without breaking the bank.

Comparing Quotes

Getting quotes from multiple insurance companies is crucial to finding the best price. Online comparison tools allow you to enter your information once and receive quotes from various insurers. This saves you time and helps you identify the most competitive rates.

Exploring Discounts

Insurance companies offer various discounts to reduce premiums. Some common discounts include:

- Good driver discounts: For drivers with clean driving records.

- Safe driver discounts: For drivers who complete defensive driving courses.

- Multi-car discounts: For insuring multiple vehicles with the same company.

- Bundling discounts: For combining auto insurance with other insurance products, like homeowners or renters insurance.

- Loyalty discounts: For long-term customers who have been with the same insurer for several years.

- Payment discounts: For paying premiums in full or choosing automatic payments.

It’s important to inquire about available discounts when you’re getting quotes.

Adjusting Coverage Levels

The amount of coverage you choose can significantly impact your premium. While it’s essential to have adequate coverage, you can save money by considering the following:

- Deductible: The amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically means lower premiums.

- Liability limits: The maximum amount your insurance company will pay for damages to others. Lower limits generally result in lower premiums.

- Optional coverage: Consider whether you need additional coverage, such as comprehensive or collision coverage, which may not be required by law but can offer additional protection.

Role of Insurance Brokers and Agents

Insurance brokers and agents can be valuable resources when searching for affordable car insurance. They work with multiple insurance companies and can help you compare quotes and find the best policy for your needs. They also understand the nuances of insurance policies and can provide expert advice.

Navigating the Car Insurance Buying Process

Here’s a step-by-step guide to navigating the car insurance buying process in Indiana:

- Gather your information: This includes your driver’s license, vehicle registration, and any previous insurance policies.

- Get quotes: Use online comparison tools or contact insurance companies directly.

- Review quotes: Compare prices, coverage options, and discounts offered by different insurers.

- Choose a policy: Select the policy that best suits your needs and budget.

- Make payment: Pay your premium and receive your insurance card.

Resources for Indiana Drivers

Navigating the world of car insurance can be a bit overwhelming, especially for new drivers. Thankfully, Indiana offers a variety of resources to help drivers understand their options and make informed decisions.

Indiana Department of Insurance

The Indiana Department of Insurance (IDOI) serves as a valuable resource for Indiana drivers, offering a wide range of information and services.

- Website: https://www.idoi.in.gov/

- Phone: (317) 232-2381

- Email: consumer@idoi.in.gov

The IDOI website provides comprehensive information on car insurance requirements, consumer protection tips, and resources for filing complaints against insurance companies. You can also access information on insurance rates, find licensed insurance agents, and learn about insurance fraud prevention.

Consumer Protection Organizations, Indiana state minimum car insurance

Several consumer protection organizations can assist Indiana drivers with insurance-related issues. These organizations advocate for consumer rights and provide resources for resolving disputes with insurance companies.

- Indiana Consumer Protection Division: https://www.in.gov/attorneygeneral/2383.htm

- Better Business Bureau (BBB): https://www.bbb.org/us/in

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/

The Indiana Consumer Protection Division investigates consumer complaints and enforces consumer protection laws. The BBB provides information on businesses, including insurance companies, and helps resolve consumer disputes. The NAIC is a national organization that advocates for consumer protection in the insurance industry.

Insurance Comparison Websites

Insurance comparison websites offer a convenient way to compare quotes from multiple insurance companies. These websites allow you to enter your information once and receive quotes from several insurers, saving you time and effort.

- Insurify: https://www.insurify.com/

- Policygenius: https://www.policygenius.com/

- The Zebra: https://www.thezebra.com/

These websites typically offer a variety of features, including the ability to customize your coverage, compare prices, and read reviews of insurance companies.

Wrap-Up

Navigating the world of car insurance can be overwhelming, but with the right information and resources, Indiana drivers can find affordable and compliant coverage that meets their needs. By understanding the state’s minimum requirements, exploring various coverage options, and comparing quotes, drivers can ensure they are protected on the road while managing their insurance costs effectively.

Query Resolution: Indiana State Minimum Car Insurance

What happens if I get into an accident without minimum car insurance?

You could face significant financial penalties, including fines, license suspension, and even jail time. Additionally, you may be held personally liable for any damages or injuries caused to others.

Can I get discounts on my car insurance in Indiana?

Yes, many insurance companies offer discounts for good driving records, safe driving courses, multiple policies, and other factors. Be sure to ask about available discounts when getting quotes.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or whenever you experience a major life change, such as a new car, a change in your driving record, or a move to a new location.