Texas state minimum auto insurance sets the stage for this discussion, offering a clear understanding of the legal requirements for driving in the Lone Star State. This article explores the essential coverage types, factors affecting insurance rates, and strategies for finding affordable insurance.

Driving in Texas comes with its own set of regulations, and understanding the state’s minimum auto insurance requirements is crucial. This guide provides a comprehensive overview of the essential coverage types, factors influencing insurance rates, and tips for finding affordable options. We’ll also delve into the potential financial risks associated with insufficient coverage and emphasize the importance of having adequate protection.

Texas Minimum Auto Insurance Requirements: Texas State Minimum Auto Insurance

Driving in Texas requires you to have the minimum amount of auto insurance coverage, which is mandated by law. This ensures that you can cover the costs associated with accidents, protecting yourself and others on the road.

Liability Coverage

Liability coverage is crucial, as it protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of:

* Bodily injury liability: This covers medical expenses, lost wages, and pain and suffering for injuries to others in an accident you cause.

* Property damage liability: This covers damage to another person’s vehicle or property in an accident you cause.

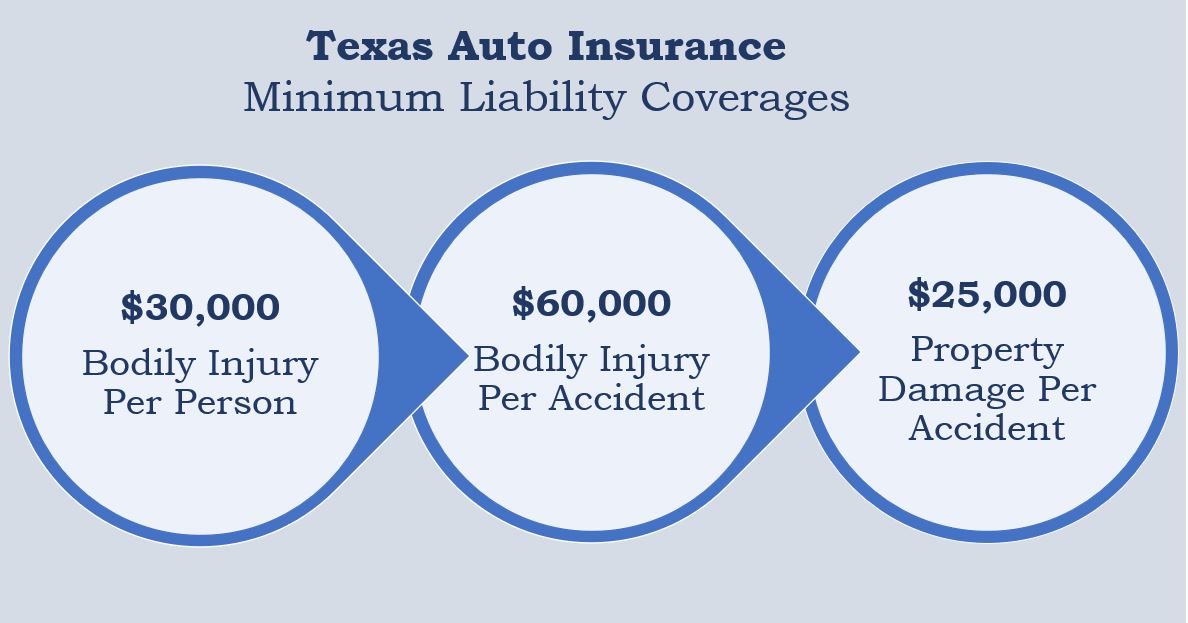

The minimum liability coverage amounts required in Texas are:

* $30,000: Bodily injury liability per person

* $60,000: Bodily injury liability per accident

* $25,000: Property damage liability per accident

Medical Payments Coverage

Medical payments coverage (Med Pay) is designed to cover your medical expenses, regardless of who is at fault in an accident. It helps pay for:

* Medical bills: This includes expenses for doctor visits, hospital stays, and surgeries.

* Other medical expenses: This can include ambulance fees, physical therapy, and prescription drugs.

The minimum Med Pay coverage required in Texas is:

* $2,500: Per person

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It helps pay for:

* Injuries: This covers medical expenses, lost wages, and pain and suffering.

* Property damage: This covers damage to your vehicle or property.

The minimum UM/UIM coverage amounts required in Texas are:

* $30,000: Bodily injury liability per person

* $60,000: Bodily injury liability per accident

* $25,000: Property damage liability per accident

Exceptions to Minimum Coverage Requirements

While the minimum coverage requirements are standard, there are some exceptions and situations where additional coverage might be required:

* Leased vehicles: Lenders often require additional coverage for leased vehicles to protect their investment.

* Financing a vehicle: When financing a vehicle, lenders may require additional coverage, such as collision and comprehensive coverage, to ensure the loan is secured.

* Specific circumstances: Depending on your individual circumstances, such as your driving history or the value of your vehicle, you may need to consider additional coverage beyond the minimum requirements.

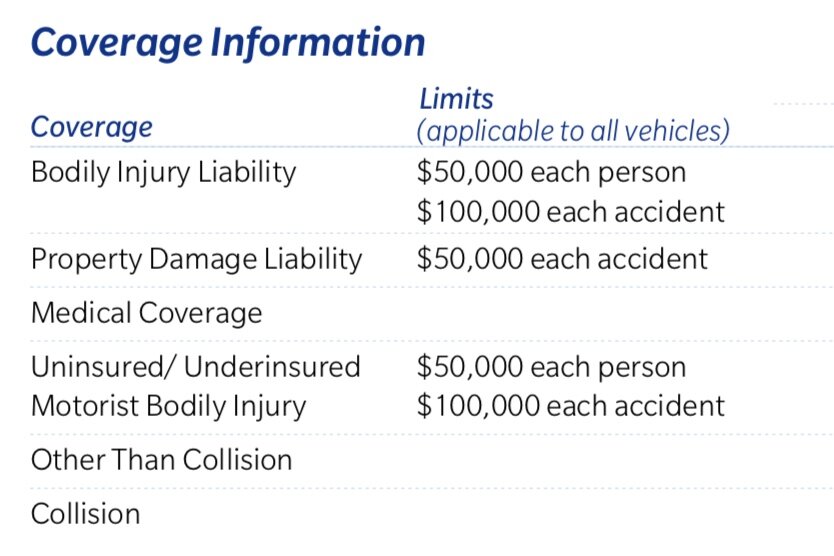

Understanding Texas Auto Insurance Coverage Types

Texas law requires drivers to carry specific types of auto insurance, but you can choose to purchase additional coverage to protect yourself further. Understanding the different types of coverage available can help you make informed decisions about your insurance needs.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be beneficial if you have a newer car or a loan on your vehicle. If you have an older car with a lower value, you might choose to waive collision coverage and rely on your own funds to cover repairs in the event of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. This coverage is also optional and can be particularly helpful if you live in an area prone to severe weather events or if your vehicle is a high-value asset.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, also known as “no-fault” coverage, pays for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. This coverage is required in Texas, and it’s designed to help you recover from injuries sustained in a car accident.

Factors Affecting Texas Auto Insurance Rates

Your auto insurance rates in Texas are determined by a variety of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Your age is a significant factor in determining your insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums. As you gain experience and age, your rates generally decrease.

Driving History

Your driving history is a crucial factor. A clean driving record with no accidents or violations will result in lower rates. However, accidents, speeding tickets, and other traffic violations can significantly increase your premiums. For example, a DUI conviction can lead to a substantial rate increase.

Vehicle Type

The type of vehicle you drive also impacts your insurance rates. Sports cars and luxury vehicles are often more expensive to repair and replace, leading to higher premiums. Conversely, smaller, less expensive cars typically have lower insurance rates.

Location

Your location plays a significant role in determining your insurance rates. Areas with higher crime rates and traffic congestion tend to have higher accident rates, leading to higher premiums. For example, living in a densely populated urban area might result in higher rates compared to a rural location.

Table Illustrating Potential Impact of Different Factors on Insurance Premiums

| Factor | Impact on Premiums |

|—|—|

| Age (under 25) | Higher |

| Age (over 25) | Lower |

| Clean Driving History | Lower |

| Accidents or Violations | Higher |

| Sports Car or Luxury Vehicle | Higher |

| Smaller, Less Expensive Car | Lower |

| High Crime Rate Area | Higher |

| Rural Location | Lower |

Finding Affordable Texas Auto Insurance

Finding affordable car insurance in Texas can feel like navigating a maze. But, with the right strategies, you can secure coverage that fits your budget without compromising on necessary protection.

Comparing Quotes

Getting quotes from multiple insurance providers is crucial for finding the best deal. This allows you to compare prices, coverage options, and discounts. Online comparison websites and insurance brokers can streamline this process.

Negotiating with Insurers

Don’t be afraid to negotiate with insurers. If you have a good driving record and have been with your current insurer for a while, you might be able to get a better rate. You can also ask about discounts for bundling policies, taking safety courses, or installing safety features in your car.

Exploring Discounts

Texas insurance companies offer various discounts to help policyholders save money. Here are some common discounts:

- Good Driver Discount: This is one of the most common discounts, rewarding drivers with a clean driving record.

- Safe Driver Discount: Taking defensive driving courses can earn you this discount, demonstrating your commitment to safe driving practices.

- Multi-Car Discount: Insuring multiple vehicles with the same company can lead to a significant discount.

- Bundling Discount: Combining your auto insurance with other policies, such as homeowners or renters insurance, can result in savings.

- Loyalty Discount: Long-term customers often qualify for a loyalty discount for their continued business.

- Safety Feature Discount: Installing safety features like anti-theft devices or airbags can lower your premium.

- Student Discount: Good student discounts are often available for students who maintain a certain GPA.

- Military Discount: Active military personnel and veterans may qualify for discounts.

Resources for Obtaining Quotes

Several websites and resources can help you obtain quotes from multiple insurance providers. Here are a few options:

- Online Comparison Websites: These websites allow you to enter your information once and receive quotes from various insurance companies. Some popular options include:

- Insurify

- Policygenius

- The Zebra

- Insurance Brokers: Brokers act as intermediaries between you and insurance companies, helping you find the best coverage at the best price.

- Direct from Insurance Companies: You can also get quotes directly from insurance companies’ websites or by calling them.

Importance of Adequate Auto Insurance Coverage

While Texas law mandates minimum auto insurance coverage, it’s crucial to understand that these minimums might not be sufficient to protect you financially in the event of an accident. Having adequate auto insurance coverage is essential to safeguard your financial well-being and protect your assets.

Potential Financial Risks of Insufficient Coverage, Texas state minimum auto insurance

Insufficient auto insurance coverage can lead to significant financial burdens, potentially impacting your savings, assets, and future financial stability. Here are some potential risks associated with inadequate coverage:

- Medical Expenses: If you’re involved in an accident where you’re at fault, your insurance coverage might not be enough to cover the medical expenses of the other party, leaving you liable for the remaining costs.

- Property Damage: Similarly, if you cause damage to another person’s vehicle, your insurance might not cover the full repair or replacement costs, leaving you responsible for the difference.

- Lost Wages: If you’re injured in an accident and unable to work, your coverage might not cover your lost wages, forcing you to rely on your savings or incur debt.

- Legal Fees: If you’re involved in a lawsuit, even if you’re not at fault, legal fees can be substantial. Inadequate coverage might not cover these costs, leaving you financially vulnerable.

Real-Life Scenarios of Inadequate Coverage

Let’s consider some real-life scenarios where inadequate auto insurance coverage could lead to significant financial burdens:

- Scenario 1: Imagine you’re driving and accidentally hit a parked car, causing significant damage. Your minimum liability coverage might only cover a portion of the repair costs, leaving you responsible for the remaining amount. This could force you to sell assets or take on debt to cover the expenses.

- Scenario 2: In another scenario, you’re involved in a multi-vehicle accident where you’re at fault. Your minimum medical payments coverage might not be enough to cover the medical bills of the other drivers and passengers involved. This could lead to a substantial financial burden, potentially forcing you to declare bankruptcy.

Importance of Sufficient Coverage to Protect Individuals and Their Assets

Having adequate auto insurance coverage is crucial for protecting yourself and your assets in the event of an accident.

- Peace of Mind: Knowing you have sufficient coverage can provide peace of mind, allowing you to focus on your recovery or the legal aspects of the situation without worrying about the financial implications.

- Financial Security: Adequate coverage helps safeguard your financial security by protecting your savings, assets, and future financial stability. It prevents you from incurring substantial debt or facing financial ruin due to an accident.

- Legal Protection: Sufficient coverage provides legal protection, covering legal fees and other costs associated with defending yourself in a lawsuit. This ensures you’re not burdened with significant legal expenses.

Closure

Navigating the world of Texas auto insurance can seem daunting, but armed with the right information, finding the right coverage for your needs becomes manageable. By understanding the legal requirements, exploring available coverage options, and employing strategies for finding affordable insurance, you can confidently drive the roads of Texas with peace of mind. Remember, adequate auto insurance provides financial protection and safeguards you against potential risks.

User Queries

What happens if I drive without minimum auto insurance in Texas?

Driving without the minimum required auto insurance in Texas can result in fines, license suspension, and even vehicle impoundment.

Can I get discounts on my Texas auto insurance?

Yes, many insurance companies offer discounts for factors like good driving history, safety features in your vehicle, and bundling insurance policies.

How often should I review my Texas auto insurance policy?

It’s advisable to review your auto insurance policy at least annually, or whenever you experience significant life changes like a new vehicle, address change, or change in driving habits.

Is it better to have more than the minimum auto insurance coverage?

While the minimum coverage meets legal requirements, it’s often recommended to consider additional coverage, like collision and comprehensive, for enhanced financial protection.

What should I do if I get into an accident in Texas?

In the event of an accident, it’s important to stay calm, prioritize safety, and exchange information with the other parties involved. Contact your insurance company to report the accident and follow their instructions.