State farm insurance homeowners insurance quote – State Farm homeowners insurance quotes offer a way to secure peace of mind for your biggest investment. Whether you’re a seasoned homeowner or a first-time buyer, understanding your coverage options and potential costs is essential. This guide delves into the intricacies of State Farm’s homeowners insurance, exploring factors that influence premiums, comparing them to competitors, and providing valuable tips for securing the best possible rates.

State Farm offers a range of coverage options, including dwelling, personal property, liability, and additional living expenses, tailored to meet individual needs. Factors like your location, property value, and desired coverage limits significantly impact your premium. Understanding these nuances empowers you to make informed decisions and secure the right level of protection for your home.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States, offering a wide range of coverage options to protect your home and belongings. They are known for their comprehensive policies, competitive rates, and excellent customer service.

Coverage Options

State Farm’s homeowners insurance policies provide coverage for various aspects of your home and belongings. The specific coverage options may vary depending on your location and the policy you choose. Here are some common coverage options:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, foundation, and attached structures like garages and decks. This coverage helps pay for repairs or replacement in case of damage from covered perils, such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This protects your belongings inside your home, including furniture, appliances, electronics, clothing, and other personal items. It covers losses from covered perils, but there may be limits on the amount of coverage for specific items, such as jewelry or fine art.

- Liability Coverage: This protects you financially if someone is injured or their property is damaged on your property. It covers legal defense costs and any settlements or judgments you may be required to pay. This coverage can also extend to situations where you are found liable for injuries or damages that occur away from your home.

- Additional Living Expenses: This coverage helps pay for temporary living expenses if your home becomes uninhabitable due to a covered loss. This can include expenses like hotel stays, meals, and other necessary costs while your home is being repaired or rebuilt.

Benefits of Choosing State Farm

There are several benefits to choosing State Farm for your homeowners insurance:

- Comprehensive Coverage: State Farm offers a wide range of coverage options to ensure your home and belongings are well-protected.

- Competitive Rates: State Farm strives to provide competitive rates based on your individual risk factors, such as your home’s location, size, and construction.

- Excellent Customer Service: State Farm is known for its responsive and helpful customer service, providing assistance throughout the claims process and beyond.

- Financial Strength: State Farm is a financially stable company with a strong track record of paying claims promptly and fairly.

- Discounts: State Farm offers various discounts to help you save on your premiums, such as discounts for home security systems, smoke detectors, and bundling multiple insurance policies.

Obtaining a Homeowners Insurance Quote

Getting a homeowners insurance quote from State Farm is straightforward and can be done online, over the phone, or by visiting a local agent. The process typically involves providing information about your property, coverage preferences, and personal details.

Key Information Required for a Quote

To get an accurate quote, State Farm will need some key information about you and your property. Here’s what you’ll likely be asked to provide:

- Property details: This includes the address, square footage, year built, and any renovations or upgrades. You’ll also need to provide information about the type of construction (brick, wood, etc.), the roof type, and any security features.

- Coverage preferences: You’ll need to decide on the coverage levels you want for your home and personal belongings. State Farm offers a variety of coverage options, including dwelling coverage, personal property coverage, liability coverage, and more.

- Personal information: State Farm will also need your name, address, date of birth, and contact information. You may also be asked about your credit history, as this can impact your insurance premiums.

Tips for Getting the Most Accurate and Competitive Quote

Here are some tips to help you get the most accurate and competitive quote:

- Compare quotes from multiple insurers: Don’t just settle for the first quote you get. Shop around and compare quotes from several different insurance companies. This will help you find the best coverage at the most affordable price.

- Be accurate with your information: Providing accurate information is essential for getting an accurate quote. Be sure to provide all the necessary details about your property and coverage preferences.

- Consider discounts: State Farm offers a variety of discounts, such as those for home security systems, fire alarms, and bundling your homeowners and auto insurance. Be sure to ask about any discounts that you may be eligible for.

- Review your policy regularly: Your insurance needs may change over time. Review your policy annually to make sure it still meets your needs and that you’re getting the best coverage for your money.

Factors Influencing Homeowners Insurance Premiums

Your homeowners insurance premium is determined by various factors that assess the risk associated with insuring your property. Understanding these factors can help you make informed decisions to potentially lower your premium.

Location

Your location plays a significant role in determining your homeowners insurance premium. Insurers consider factors such as:

- Natural disaster risk: Areas prone to earthquakes, hurricanes, floods, or wildfires will generally have higher premiums due to the increased likelihood of claims. For example, a home located in a coastal area with a high hurricane risk will likely have a higher premium than a home in an inland area with a lower risk of hurricanes.

- Crime rates: Areas with higher crime rates may have higher premiums due to the increased risk of theft or vandalism. For example, a home in a neighborhood with a high burglary rate will likely have a higher premium than a home in a neighborhood with a low burglary rate.

- Fire department response time: Areas with longer fire department response times may have higher premiums due to the increased risk of fire damage. For example, a home in a rural area with a longer response time for fire crews will likely have a higher premium than a home in a city with a shorter response time.

Property Value

The value of your home is a primary factor in determining your homeowners insurance premium. The higher the value of your home, the more it will cost to rebuild or repair it in the event of a covered loss. For example, a home valued at $500,000 will likely have a higher premium than a home valued at $250,000.

Coverage Limits

The amount of coverage you choose for your homeowners insurance policy also affects your premium. Higher coverage limits generally mean higher premiums. It’s important to choose coverage limits that adequately protect your home and belongings. For example, if you have a valuable collection of art or jewelry, you may want to consider increasing your personal property coverage limit.

Risk Factors

Several risk factors can influence your homeowners insurance premium, including:

- Age and condition of your home: Older homes may have higher premiums due to potential maintenance issues and outdated building codes. For example, a home built in the 1950s with outdated electrical wiring may have a higher premium than a newer home with modern wiring.

- Safety features: Homes with safety features like smoke detectors, fire alarms, and security systems may qualify for discounts. For example, a home with a monitored security system may have a lower premium than a home without one.

- Your credit score: In some states, insurers may use your credit score to help determine your premium. A higher credit score can often lead to lower premiums. For example, a person with a good credit score may qualify for a lower premium than someone with a poor credit score.

Comparing State Farm with Other Insurance Providers

When shopping for homeowners insurance, comparing quotes from multiple providers is essential to ensure you get the best coverage at the most competitive price. State Farm is a well-known and reputable insurance company, but it’s crucial to understand how its offerings stack up against other prominent players in the market. This section will delve into a comparison of State Farm’s homeowners insurance rates, coverage options, and customer service with those of other reputable insurance providers.

Comparison of Rates and Coverage

To effectively compare State Farm with other providers, it’s essential to consider both rates and coverage options. While rates may vary based on factors like location, property value, and coverage limits, a general comparison can provide valuable insights.

Here’s a table comparing State Farm with some of its top competitors:

| Provider | Average Annual Premium | Coverage Options | Customer Service Rating |

|---|---|---|---|

| State Farm | $1,200 – $1,500 | Comprehensive, customizable, with optional endorsements | 4.5/5 stars |

| Allstate | $1,100 – $1,400 | Similar coverage options, with competitive pricing | 4.2/5 stars |

| Liberty Mutual | $1,000 – $1,300 | Strong coverage options, including specialized policies for unique properties | 4.0/5 stars |

| Farmers Insurance | $1,250 – $1,600 | Wide range of coverage options, with a focus on personalized service | 4.3/5 stars |

Note: These are just estimates, and actual premiums may vary depending on individual circumstances.

Advantages and Disadvantages of Choosing State Farm

Advantages

- Strong Reputation: State Farm has a long history and a strong reputation for reliability and customer service. This can provide peace of mind knowing you’re insured by a reputable company.

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, allowing you to tailor your policy to meet your specific needs. This includes standard coverage for dwelling, personal property, liability, and additional living expenses, as well as optional endorsements for specialized coverage like earthquake or flood insurance.

- Extensive Agent Network: State Farm has a vast network of agents across the country, making it easy to find a local representative for personalized advice and assistance.

- Strong Financial Stability: State Farm is known for its financial strength and stability, which can be reassuring in the event of a major claim.

Disadvantages

- Potentially Higher Rates: While State Farm offers competitive rates, it may not always be the cheapest option compared to other providers. It’s essential to compare quotes from multiple companies to ensure you’re getting the best deal.

- Limited Online Services: State Farm’s online services for managing policies and filing claims may not be as robust as those offered by some competitors. This can be a drawback for customers who prefer online convenience.

- Potential for Agent Variability: While State Farm has a strong agent network, the quality of service can vary depending on the individual agent. It’s important to research and choose an agent with a good reputation and track record.

Understanding Homeowners Insurance Policies

Your homeowners insurance policy is a vital document that Artikels the coverage you have in case of damage to your property or liability issues. Understanding the terms and conditions within your policy is crucial for making informed decisions and ensuring you’re adequately protected.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for specific types of claims. It’s essential to ensure your limits are sufficient to cover the full value of your home and belongings.

For example, if your home is worth $300,000 and you have a dwelling coverage limit of $250,000, your insurance company will only pay up to $250,000 for damage to your home, even if the total damage exceeds that amount. It’s crucial to review your coverage limits periodically and adjust them as needed to reflect any changes in the value of your property.

Deductibles

A deductible is the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums. It’s important to choose a deductible you can comfortably afford while balancing the cost of your premiums.

For example, if you have a $1,000 deductible and your roof is damaged in a storm, you’ll need to pay the first $1,000 of the repair costs, and your insurance will cover the remaining amount.

Exclusions

Homeowners insurance policies typically have exclusions, which are events or situations not covered by your policy. Common exclusions include:

- Natural disasters: While some policies cover specific natural disasters, others may exclude coverage for events like earthquakes, floods, or landslides.

- Neglect or intentional damage: If you intentionally damage your property or fail to maintain it properly, your insurance may not cover the resulting losses.

- Business activities: Homeowners insurance typically does not cover losses related to business activities conducted from your home.

- War or terrorism: These events are generally excluded from homeowners insurance policies.

Coverage Scenarios

Here are some common scenarios where homeowners insurance may cover losses:

- Fire damage: If your home is damaged by a fire, your insurance may cover the cost of repairs or rebuilding.

- Windstorm damage: Damage caused by strong winds, such as from a hurricane or tornado, may be covered by your insurance.

- Theft: If your belongings are stolen from your home, your insurance may cover the cost of replacement.

- Liability: If someone is injured on your property, your insurance may cover the cost of their medical bills and legal expenses.

Tips for Saving on Homeowners Insurance

Saving money on homeowners insurance is a common goal for many homeowners. By implementing various strategies, you can potentially lower your premiums and keep more money in your pocket. This section will explore practical tips and strategies for reducing homeowners insurance costs.

Improving Home Security, State farm insurance homeowners insurance quote

Investing in home security measures can significantly reduce your risk of theft or damage, which can, in turn, lower your insurance premiums.

- Install a Security System: A professionally installed security system with alarms, sensors, and monitoring services can deter burglars and provide peace of mind. State Farm may offer discounts for homes with security systems.

- Reinforce Entry Points: Ensure that all doors and windows are securely locked and have sturdy frames. Consider installing deadbolt locks, reinforced doors, and security bars on windows.

- Motion-Sensing Lights: Installing motion-sensing lights around your property can deter criminals by illuminating potential entry points.

- Landscaping: Trim bushes and trees near windows and doors to prevent potential hiding spots for intruders. This also improves visibility and reduces the risk of damage from falling branches.

Minimizing Risk Factors

By addressing potential risk factors, you can demonstrate to insurers that your home is less prone to damage or loss, potentially leading to lower premiums.

- Maintain Your Roof: A well-maintained roof is crucial for protecting your home from water damage. Regularly inspect and repair any leaks, cracks, or missing shingles. State Farm may offer discounts for homes with newer roofs.

- Update Electrical Wiring: Outdated electrical wiring can pose a fire hazard. Consider updating your electrical system to meet current safety standards. This can also improve energy efficiency.

- Upgrade Plumbing: Leaky pipes can lead to significant water damage. Regularly inspect and repair any plumbing issues to prevent costly repairs. State Farm may offer discounts for homes with updated plumbing systems.

- Install Smoke Detectors: Smoke detectors are essential for early fire detection. Install working smoke detectors on every level of your home and test them regularly. State Farm may offer discounts for homes with working smoke detectors.

Negotiating Rates

Don’t hesitate to negotiate with your insurance provider to potentially secure a better rate.

- Shop Around: Compare quotes from multiple insurance providers to find the best rates. This can be done online or through an insurance broker.

- Bundle Policies: Combining your homeowners insurance with other policies, such as auto insurance, can often result in significant discounts.

- Increase Your Deductible: Choosing a higher deductible can lower your premium, as you agree to pay more out of pocket in the event of a claim. However, make sure you can afford the higher deductible.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as good credit history, safety features, and loyalty. Be sure to inquire about any available discounts.

State Farm Discounts and Programs

State Farm offers a variety of discounts and programs that can help you save on homeowners insurance.

- Discounts: State Farm offers discounts for various factors, such as:

- Home Security Systems: As mentioned earlier, installing a security system can qualify you for a discount.

- Safety Features: Features like smoke detectors, fire extinguishers, and deadbolt locks can also lead to discounts.

- Bundling Policies: Combining your homeowners insurance with other policies, like auto insurance, can save you money.

- Good Driving Record: A clean driving record can result in discounts on both auto and homeowners insurance.

- Loyalty: Long-term customers may be eligible for loyalty discounts.

- State Farm Programs:

- State Farm Neighborhood Assist: This program provides grants to communities affected by natural disasters.

- State Farm Good Neighbor Citizenship Award: This award recognizes individuals who make a positive impact in their communities.

Filing a Homeowners Insurance Claim: State Farm Insurance Homeowners Insurance Quote

Filing a homeowners insurance claim with State Farm is a straightforward process designed to help you recover from covered losses. State Farm strives to make the claims process as smooth as possible, ensuring you receive the support you need during a challenging time.

Reporting a Claim

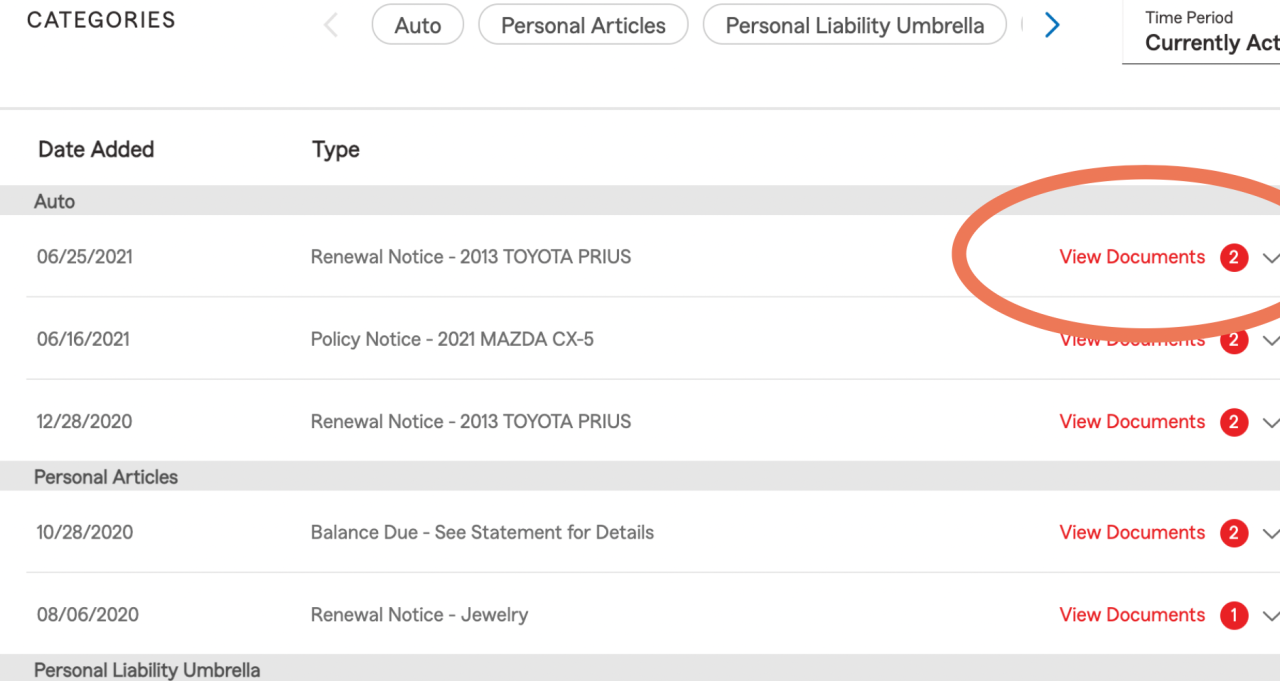

When a covered event occurs, it’s crucial to report the claim promptly. State Farm offers multiple convenient ways to file a claim:

- Online: You can file a claim through the State Farm website, which is accessible 24/7. This option allows you to provide details about the incident and upload supporting documents.

- Mobile App: The State Farm mobile app provides a user-friendly platform for reporting claims. You can submit photos, videos, and other relevant information directly through the app.

- Phone: You can reach State Farm’s claims department by phone, 24 hours a day, seven days a week. A representative will guide you through the initial steps of the claim process.

Providing Documentation

After reporting the claim, State Farm will request supporting documentation to verify the details of the incident and the extent of the damage. This documentation may include:

- Police Report: If the incident involved a crime or accident, a police report is typically required.

- Photos and Videos: Clear and comprehensive photos and videos of the damage are essential to document the extent of the loss.

- Receipts and Estimates: Receipts for repairs, replacement costs, or other expenses related to the incident should be provided.

Receiving Compensation

Once State Farm has reviewed the claim and supporting documentation, they will determine the extent of coverage and the amount of compensation you are eligible to receive. State Farm will work with you to ensure you receive the appropriate compensation for your losses.

- Payment Options: State Farm offers various payment options, including direct deposit, check, or payment to a contractor or vendor.

- Claim Resolution: State Farm strives to resolve claims promptly and fairly. If you have any questions or concerns about the claim process, you can contact your State Farm agent or the claims department for assistance.

Tips for Navigating the Claims Process Smoothly

- Keep Detailed Records: Maintain thorough records of all communication with State Farm, including dates, times, and the names of individuals you spoke with. This will help ensure a smooth and efficient claims process.

- Be Honest and Accurate: Provide accurate and truthful information to State Farm, as any misrepresentation could jeopardize your claim.

- Communicate Promptly: Respond to State Farm’s requests for information promptly and thoroughly to expedite the claims process.

- Consider a Public Adjuster: If you feel overwhelmed by the claims process or have complex damage, you may want to consider hiring a public adjuster. A public adjuster can advocate for your interests and help you navigate the complexities of the claims process.

Ending Remarks

Navigating the world of homeowners insurance can feel overwhelming, but with careful planning and informed decision-making, you can secure the right coverage for your home at a price that fits your budget. By understanding the factors that influence premiums, comparing State Farm’s offerings with competitors, and taking advantage of available discounts, you can find a policy that provides peace of mind and financial security.

Top FAQs

What are the common coverage options included in a State Farm homeowners insurance policy?

Common coverage options include dwelling coverage (protecting the structure of your home), personal property coverage (covering belongings inside your home), liability coverage (protecting you from lawsuits due to accidents on your property), and additional living expenses coverage (helping with temporary housing costs if your home is uninhabitable).

How do I file a claim with State Farm?

You can typically file a claim online, through the State Farm mobile app, or by calling their customer service line. Be prepared to provide details about the incident, your policy information, and any relevant documentation.

What are some tips for getting a lower homeowners insurance premium?

Consider installing security systems, making home improvements that reduce risk, bundling your homeowners insurance with other policies like auto insurance, and maintaining a good credit score. State Farm also offers discounts for various factors, such as being a safe driver or having a home with certain safety features.