State farm insurance homeowners quote – State Farm homeowners insurance quotes offer a comprehensive approach to protecting your most valuable asset – your home. Whether you’re a first-time homeowner or a seasoned property owner, understanding the nuances of homeowners insurance is crucial. This guide delves into the key features, coverage options, and factors that influence the pricing of State Farm homeowners insurance, equipping you with the knowledge to make informed decisions.

From exploring the benefits of dwelling, liability, and personal property coverage to navigating the process of obtaining a quote, we’ll cover everything you need to know. We’ll also discuss essential considerations like coverage limits, deductibles, and discounts, ensuring you have a clear understanding of how to maximize your coverage while minimizing your costs.

Understanding State Farm Homeowners Insurance

State Farm is a well-known and trusted name in the insurance industry, offering a comprehensive range of homeowners insurance policies designed to protect your biggest investment. Their homeowners insurance is designed to provide financial protection against various risks that could impact your home and belongings.

Coverage Options

State Farm’s homeowners insurance offers a variety of coverage options to suit your individual needs and budget. The key coverage options include:

- Dwelling Coverage: This protects the physical structure of your home, including the attached structures like garages and porches, against covered perils like fire, windstorm, hail, and vandalism. The coverage amount is typically based on the replacement cost of your home, which means it will pay to rebuild or repair your home to its current value, minus any applicable deductible.

- Personal Property Coverage: This covers your belongings inside your home, including furniture, electronics, clothing, and other personal items. The coverage amount is typically based on a percentage of your dwelling coverage, although you can purchase additional coverage if needed. It’s important to note that there are usually limits on specific types of items, like jewelry or fine art.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you are held liable for damages to someone else’s property. Liability coverage also protects you from legal costs associated with defending against such claims. The coverage amount is typically a set dollar limit, such as $100,000 or $300,000, depending on your policy.

- Other Coverage Options: State Farm offers a range of optional coverage options that can be added to your policy, such as:

- Personal Injury Coverage: Protects you from claims related to slander, libel, or invasion of privacy.

- Medical Payments Coverage: Pays for medical expenses for people who are injured on your property, regardless of fault.

- Loss of Use Coverage: Provides financial assistance if your home is uninhabitable due to a covered loss, covering expenses like temporary housing and additional living costs.

- Flood Insurance: This is not typically included in standard homeowners insurance policies, but State Farm offers it as an optional add-on for homes located in flood-prone areas.

State Farm’s Reputation and Financial Stability

State Farm has a long-standing reputation as a reliable and financially sound insurance provider. They consistently rank highly in customer satisfaction surveys and have a strong financial rating from independent agencies.

“State Farm is known for its strong financial strength, consistently receiving high ratings from independent agencies like A.M. Best and Moody’s.”

This financial stability means that State Farm is well-equipped to handle claims and pay out benefits to policyholders, even in the event of major catastrophic events.

Getting a Homeowners Insurance Quote

Getting a quote for State Farm homeowners insurance is a straightforward process. You can obtain a quote online, over the phone, or by visiting a local State Farm agent.

Factors Affecting Homeowners Insurance Pricing

Several factors influence the cost of homeowners insurance. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

- Location: Your home’s location plays a significant role in determining your insurance premium. Areas prone to natural disasters, such as earthquakes, hurricanes, or floods, typically have higher insurance costs. For example, homeowners in coastal areas with a high risk of hurricanes will generally pay more than those living in inland areas with lower risk.

- Property Value: The value of your home is directly related to your insurance premium. The higher the value of your home, the more it will cost to rebuild or repair it in case of damage, resulting in a higher premium. For instance, a luxury home with a market value of $1 million will likely have a higher insurance premium than a modest home valued at $200,000.

- Coverage Level: The level of coverage you choose impacts your premium. Higher coverage levels, which provide greater financial protection in case of damage or loss, will generally result in higher premiums. It’s crucial to consider your individual needs and risk tolerance when selecting your coverage level. For instance, if you have valuable possessions, you may want to consider additional coverage for personal property.

- Deductible: Your deductible is the amount you agree to pay out-of-pocket in case of a claim. A higher deductible generally translates to a lower premium, while a lower deductible results in a higher premium. For example, a $1,000 deductible will typically result in a lower premium than a $500 deductible.

- Home’s Age and Condition: The age and condition of your home can influence your premium. Older homes with outdated wiring or plumbing may be considered higher risk, leading to higher premiums. Similarly, homes with updated safety features, such as smoke detectors and fire sprinklers, may qualify for discounts.

- Credit Score: In some states, insurance companies consider your credit score when determining your premium. Individuals with good credit scores may receive lower premiums than those with poor credit. However, it’s important to note that this practice varies by state.

Key Considerations for Homeowners Insurance

Choosing the right homeowners insurance policy is crucial for protecting your most valuable asset: your home. Carefully considering your needs and understanding the different aspects of homeowners insurance will help you secure adequate coverage and manage your costs effectively.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for covered losses. It’s essential to choose limits that align with the replacement cost of your home and belongings. For example, if your home’s replacement cost is $300,000, you might consider a dwelling coverage limit of $300,000 or more.

Deductibles, State farm insurance homeowners quote

Deductibles are the out-of-pocket expenses you pay before your insurance coverage kicks in. Higher deductibles typically result in lower premiums. However, you’ll need to pay more out of pocket if you file a claim. Carefully consider your risk tolerance and financial situation when choosing a deductible.

Discounts

Many homeowners insurance companies offer discounts to policyholders who meet certain criteria. These discounts can significantly reduce your premiums. Common discounts include:

- Safety Features: Installing smoke detectors, fire alarms, and security systems can qualify you for discounts.

- Bundling Policies: Combining your homeowners insurance with other policies, such as auto insurance, can often lead to discounts.

- Loyalty Discounts: Long-term customers may receive discounts for their continued business.

- Payment Methods: Paying your premiums annually or semi-annually may result in discounts.

Endorsements

Endorsements are additional coverage options that can be added to your homeowners insurance policy to customize it to your specific needs. Some common endorsements include:

- Flood Insurance: This coverage protects your home from damage caused by flooding, which is typically not covered by standard homeowners insurance.

- Earthquake Insurance: If you live in an earthquake-prone area, earthquake insurance can provide coverage for damage caused by earthquakes.

- Personal Liability Coverage: This coverage protects you from lawsuits arising from accidents or injuries that occur on your property.

Minimizing Costs and Maximizing Coverage

Here are some tips for minimizing your homeowners insurance costs while maximizing your coverage:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates and coverage options.

- Improve Your Home’s Security: Installing security systems, upgrading locks, and adding exterior lighting can reduce your risk of theft and qualify you for discounts.

- Maintain Your Home: Regular maintenance, such as roof inspections and plumbing checks, can prevent costly repairs and potentially lower your premiums.

- Consider a Higher Deductible: A higher deductible can result in lower premiums, but make sure you can afford the out-of-pocket expense if you need to file a claim.

The Value of Homeowners Insurance

Your home is likely your most valuable asset. It represents years of hard work, memories, and financial investment. Homeowners insurance acts as a safety net, providing financial protection in case of unexpected events that could damage your home or belongings.

Homeowners insurance offers peace of mind by safeguarding your financial well-being in the face of unforeseen circumstances. It helps you recover from losses caused by covered perils, such as fire, theft, or natural disasters.

Financial Protection in Case of Loss

Homeowners insurance provides financial protection for various covered losses, including:

* Fire: Covers damage or destruction of your home and belongings due to a fire.

* Theft: Protects against losses from burglary or theft of your personal property.

* Windstorms and Hail: Offers coverage for damage caused by strong winds, hailstorms, or tornadoes.

* Natural Disasters: May include coverage for losses caused by earthquakes, floods, or other natural disasters, depending on your policy and location.

* Liability: Provides protection if someone is injured on your property.

Consequences of Inadequate Coverage

Not having adequate homeowners insurance coverage can have significant financial consequences:

* Financial Ruin: Without insurance, you may be responsible for the entire cost of repairing or rebuilding your home after a covered loss.

* Loss of Personal Belongings: You could lose irreplaceable possessions like furniture, electronics, and personal items.

* Legal Liabilities: If someone is injured on your property, you could face lawsuits and substantial legal fees.

Real-World Examples of Coverage Benefits

Homeowners insurance has helped countless policyholders recover from unexpected events:

* A family’s home was destroyed by a fire: Their homeowners insurance covered the cost of rebuilding their home and replacing their belongings, allowing them to start over.

* A homeowner’s property was damaged by a hailstorm: Their insurance covered the cost of repairs, preventing them from incurring significant out-of-pocket expenses.

* A homeowner’s home was flooded during a hurricane: Their flood insurance (often a separate policy) covered the cost of repairs and rebuilding, allowing them to restore their home.

State Farm’s Online and Mobile Resources

State Farm offers a variety of online and mobile resources to help you obtain quotes, manage your policies, and access customer support. These tools can save you time and effort while ensuring you have the insurance coverage you need.

Online Tools and Resources

State Farm’s website provides a comprehensive suite of online tools for managing your insurance needs. You can:

- Get a quote: Easily obtain a quote for homeowners insurance online by providing your address and other relevant information. The website’s user-friendly interface makes the process quick and straightforward.

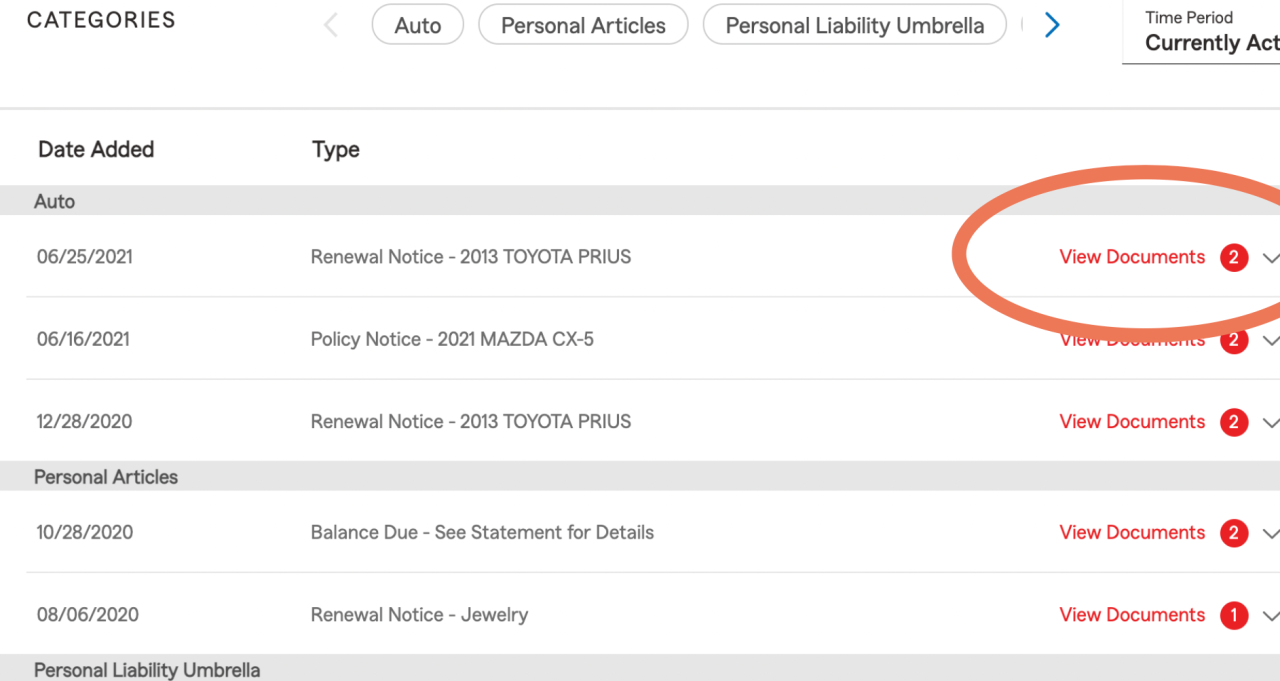

- Manage your policy: Access your policy documents, make payments, and update your contact information online. You can also track claims and view your coverage details.

- Access helpful resources: Explore articles, videos, and other resources on various insurance topics, including home safety tips, disaster preparedness, and claim filing procedures.

State Farm Mobile App

State Farm’s mobile app offers a convenient way to manage your insurance on the go. With the app, you can:

- View your policy details: Access your policy information, including coverage details, deductibles, and payment history.

- Report a claim: Quickly and easily report a claim directly from your phone, providing photos and details of the incident.

- Manage payments: Make payments, view your payment history, and set up automatic payments.

- Contact customer service: Connect with a State Farm agent or representative through the app for assistance with any insurance-related questions or concerns.

Customer Service

State Farm prioritizes customer satisfaction and offers multiple channels for contacting them. You can:

- Call customer service: Reach a representative by phone 24/7 for immediate assistance.

- Contact your local agent: Connect with your dedicated State Farm agent for personalized support and guidance.

- Use online chat: Get quick answers to your questions through State Farm’s online chat feature, available on their website.

- Submit a request online: Use State Farm’s online forms to submit inquiries or requests for specific services.

Last Point: State Farm Insurance Homeowners Quote

Securing adequate homeowners insurance is essential for peace of mind and financial protection. By understanding the intricacies of State Farm’s offerings, comparing quotes, and making informed decisions, you can ensure that your home is adequately protected against unforeseen events. This guide serves as a valuable resource, empowering you to navigate the world of homeowners insurance with confidence and clarity.

FAQ Resource

What are the main types of coverage offered by State Farm homeowners insurance?

State Farm homeowners insurance typically includes coverage for dwelling, liability, personal property, and additional living expenses. These coverages protect your home, your belongings, and your financial liability in case of covered events.

How do I get a personalized quote for State Farm homeowners insurance?

You can obtain a quote online through State Farm’s website, by calling their customer service line, or by visiting a local State Farm agent. You’ll need to provide information about your home, location, and desired coverage levels.

What factors influence the cost of my State Farm homeowners insurance?

Factors that affect the price of your homeowners insurance include your home’s location, value, age, construction materials, coverage levels, and your credit score.

Are there any discounts available for State Farm homeowners insurance?

Yes, State Farm offers various discounts, such as multi-policy discounts for bundling your homeowners and auto insurance, safety discounts for installing security systems, and discounts for being a loyal customer.