State of Texas car insurance takes center stage as we delve into the unique landscape of this crucial aspect of Texan life. Navigating the complexities of Texas car insurance requires a clear understanding of the market, its regulations, and the diverse options available to drivers. This guide aims to equip Texans with the knowledge they need to make informed decisions about their car insurance, ensuring peace of mind on the road.

Texas boasts a dynamic car insurance market shaped by factors such as population density, driving habits, and a robust regulatory framework. Understanding these factors is crucial for navigating the process of securing the right coverage. This guide will provide a comprehensive overview of the different types of car insurance available in Texas, the factors that influence rates, and the steps involved in choosing a policy that meets individual needs.

Texas Car Insurance Landscape

Texas boasts a unique car insurance market, known for its competitive landscape and diverse driver profiles. Understanding its specific characteristics is crucial for navigating the intricacies of securing the right coverage.

Factors Influencing Car Insurance Rates

Car insurance rates in Texas are influenced by a combination of factors, each contributing to the final cost of coverage.

- Driving History: Accidents, traffic violations, and driving record are significant factors. Drivers with a clean record generally enjoy lower rates.

- Vehicle Type: The make, model, and year of your car play a role. Luxury vehicles and high-performance cars often have higher premiums due to their cost of repair and replacement.

- Location: Urban areas with higher traffic density and accident rates tend to have higher insurance rates compared to rural areas.

- Age and Gender: Younger drivers, particularly males, typically face higher premiums due to their higher risk of accidents.

- Credit Score: In Texas, insurers can use credit history as a factor in determining rates. A good credit score generally leads to lower premiums.

- Coverage Levels: The type and amount of coverage you choose, such as liability limits and comprehensive coverage, directly impact your premium.

Role of the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a vital role in regulating the car insurance industry in Texas.

- Consumer Protection: The TDI ensures fair and transparent practices by insurers, protecting consumers from unfair rate hikes and deceptive practices.

- Market Oversight: The TDI monitors the financial stability of insurance companies, ensuring they can fulfill their obligations to policyholders.

- Rate Regulation: While Texas is a “free market” state, the TDI has the authority to review and approve rate filings by insurance companies.

Types of Car Insurance Coverage in Texas

In Texas, car insurance is a necessity. Not only is it required by law, but it also protects you financially in case of an accident. There are different types of coverage available, each designed to cover specific aspects of a car accident. Understanding these types of coverage is crucial for making informed decisions about your car insurance policy.

Mandatory Coverage in Texas

Texas law requires all drivers to carry a minimum amount of liability insurance. This coverage protects other drivers and their property if you cause an accident.

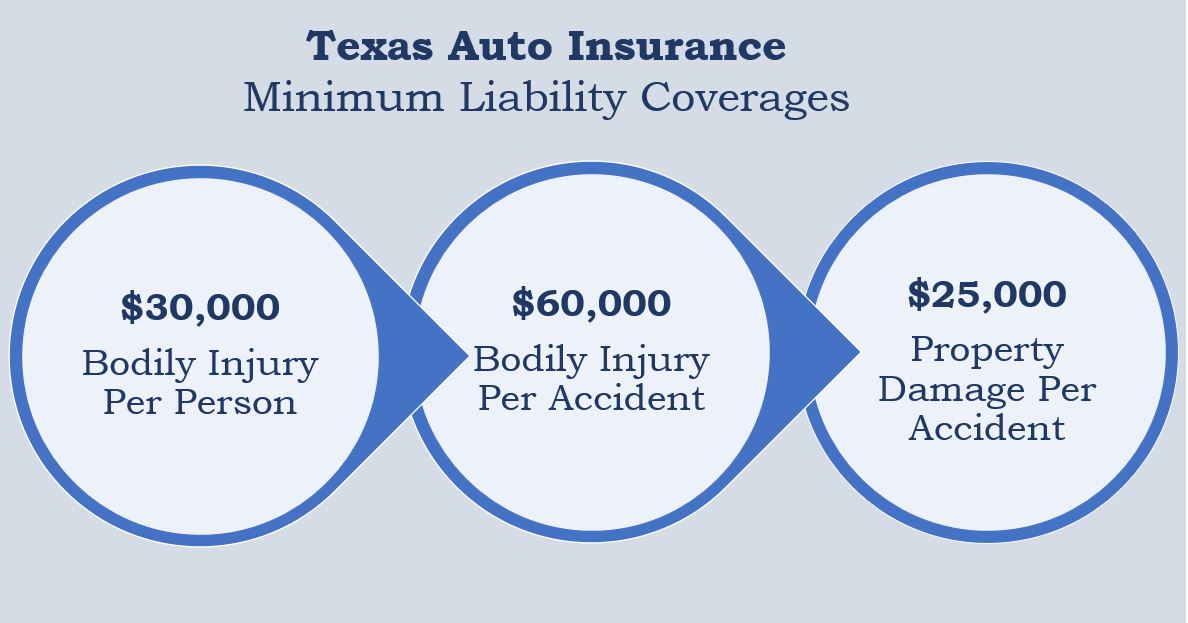

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident that you are at fault for. It is expressed as a per-person limit, a per-accident limit, and a property damage limit. For example, 30/60/25 means up to $30,000 per person, $60,000 per accident, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. It can cover medical expenses, lost wages, and property damage.

Optional Coverage Options

While liability coverage is mandatory, there are additional optional coverage options that can provide more comprehensive protection.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault. If you are involved in an accident with another vehicle or hit a stationary object, collision coverage will help pay for repairs or replacement of your car.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It can help cover the cost of repairs or replacement of your vehicle.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault. It can cover medical bills, lost wages, and other related expenses.

- Personal Injury Protection (PIP): This coverage provides benefits for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault. It is optional in Texas but is often included in policies.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident. It can be helpful if you need to use your car for work or other essential purposes.

- Roadside Assistance Coverage: This coverage provides assistance for unexpected situations on the road, such as flat tires, dead batteries, or lockouts. It can provide peace of mind knowing that help is just a phone call away.

Factors Affecting Car Insurance Rates in Texas

Car insurance rates in Texas are influenced by a variety of factors, each playing a significant role in determining the final premium you pay. These factors are carefully considered by insurance companies to assess the risk associated with insuring you and your vehicle.

Driving History

Your driving history is a key factor that insurance companies consider when calculating your car insurance rates. A clean driving record with no accidents or violations can lead to lower premiums, while a history of accidents, traffic violations, or DUI convictions can significantly increase your rates.

- Accidents: Each accident you’ve been involved in, regardless of fault, is recorded on your driving record. The more accidents you have, the higher your insurance rates are likely to be.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations also contribute to higher insurance premiums. The severity of the violation and the frequency with which they occur will impact your rates.

- DUI Convictions: Driving under the influence (DUI) convictions are among the most serious offenses that can significantly increase your car insurance rates. Insurance companies view DUI convictions as a sign of high-risk behavior, making them more likely to charge higher premiums.

Age

Age is another important factor that insurance companies consider when setting car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums for this age group.

- Young Drivers: Inexperience and higher risk-taking behavior among young drivers contribute to higher insurance rates. However, as drivers gain experience and age, their premiums tend to decrease.

- Older Drivers: While older drivers may have more experience, they may also face health issues that could affect their driving ability. Insurance companies may adjust rates for older drivers based on their health and driving record.

Vehicle Type

The type of vehicle you drive also influences your car insurance rates. Insurance companies consider factors such as the vehicle’s make, model, year, and safety features when assessing the risk associated with insuring it.

- Make and Model: Certain car makes and models are known for their safety features, performance, and theft rates. These factors can influence insurance rates, with safer and less desirable vehicles often leading to lower premiums.

- Year: Newer vehicles generally have more advanced safety features, which can result in lower insurance rates. Older vehicles may lack these features, leading to higher premiums.

- Value: The value of your vehicle is also a factor. More expensive vehicles generally have higher insurance rates because the cost to repair or replace them is higher.

Credit Score

In Texas, insurance companies are allowed to use your credit score as a factor in determining your car insurance rates. This practice is based on the belief that individuals with good credit are more financially responsible and therefore less likely to file claims.

- Credit Score Impact: A higher credit score generally leads to lower insurance premiums, while a lower credit score can result in higher premiums.

- Credit Score Transparency: Insurance companies are required to inform you about their use of credit scores and provide you with the opportunity to dispute any errors in your credit report.

Location

The location where you live also plays a role in your car insurance rates. Insurance companies consider factors such as the density of traffic, crime rates, and the frequency of accidents in your area.

- Urban vs. Rural: Urban areas tend to have higher insurance rates due to denser traffic, increased risk of accidents, and higher theft rates. Rural areas often have lower rates due to lower traffic density and fewer accidents.

- Specific Neighborhoods: Within a city, certain neighborhoods may have higher insurance rates due to higher crime rates or accident statistics.

Choosing the Right Car Insurance in Texas

Navigating the world of car insurance in Texas can feel overwhelming, but it doesn’t have to be. Choosing the right policy for your needs and budget is crucial. By following a strategic approach, you can find a policy that provides adequate coverage without breaking the bank.

Step-by-Step Guide to Choosing Car Insurance

Here’s a step-by-step guide to help you select the most suitable car insurance policy:

- Assess Your Needs: Begin by evaluating your individual circumstances. Consider factors such as your driving history, the type of vehicle you own, and your financial situation. For example, if you have a high-value car, you might need more comprehensive coverage.

- Determine Your Budget: Set a realistic budget for your car insurance premiums. Consider how much you can comfortably afford to pay each month.

- Compare Quotes: Get quotes from multiple insurance providers to compare their coverage options and premiums. This will give you a better understanding of the market and help you find the best value for your money.

- Review Coverage Options: Carefully review the different types of coverage offered by each provider. Make sure you understand the benefits and limitations of each option.

- Choose the Right Deductible: Decide on a deductible amount that you are comfortable with. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Consider Discounts: Inquire about any discounts offered by the insurance providers, such as safe driver discounts, good student discounts, or multi-car discounts.

- Read the Fine Print: Before you commit to a policy, carefully review the policy documents to ensure you understand the terms and conditions.

- Make an Informed Decision: Based on your assessment, compare the quotes, and review the coverage options, choose the policy that best meets your needs and budget.

Comparing Car Insurance Providers

Here’s a table comparing some of the key factors to consider when evaluating different car insurance providers in Texas:

| Provider | Average Premium | Coverage Options | Discounts | Customer Service |

|---|---|---|---|---|

| State Farm | $1,100 | Comprehensive, Collision, Liability, Uninsured Motorist | Safe Driver, Good Student, Multi-Car | Excellent |

| Geico | $1,050 | Comprehensive, Collision, Liability, Uninsured Motorist | Safe Driver, Good Student, Multi-Car | Good |

| Progressive | $1,000 | Comprehensive, Collision, Liability, Uninsured Motorist | Safe Driver, Good Student, Multi-Car | Average |

| Allstate | $1,150 | Comprehensive, Collision, Liability, Uninsured Motorist | Safe Driver, Good Student, Multi-Car | Good |

Questions to Ask Potential Insurance Providers

Before you commit to a policy, it’s essential to ask the following questions to ensure you’re making an informed decision:

- What coverage options do you offer?

- What are your average premiums for my specific needs?

- What discounts are available to me?

- What is your claims process like?

- How is your customer service?

- What is your financial stability rating?

- Do you offer any additional services, such as roadside assistance or rental car coverage?

Texas Car Insurance Claims Process: State Of Texas Car Insurance

Navigating the car insurance claims process in Texas can be a stressful experience, but understanding the steps involved can make it smoother. Here’s a breakdown of the process, from reporting the accident to receiving compensation.

Reporting the Accident

After an accident, it’s crucial to report the incident to your insurance company promptly. This allows them to begin investigating the claim and initiate the claims process.

- Contact your insurance company by phone or online, providing details of the accident, including the date, time, location, and parties involved.

- If possible, gather information from the other driver(s), including their name, contact information, and insurance details.

- Take photos of the damage to your vehicle, the accident scene, and any injuries sustained.

- If there are witnesses, obtain their contact information.

Filing a Claim

Once you’ve reported the accident, your insurance company will guide you through the claim filing process. This may involve providing additional documentation, such as a police report, medical records, or repair estimates.

Claim Investigation

Your insurance company will investigate the claim to determine liability and the extent of damages. This may involve reviewing the police report, interviewing witnesses, and inspecting your vehicle.

Claim Settlement

After the investigation is complete, your insurance company will determine the amount of compensation you are eligible for. This may include coverage for repairs, medical expenses, lost wages, and other related costs.

Common Car Insurance Claim Scenarios, State of texas car insurance

Here are some common car insurance claim scenarios:

- Collision: This occurs when your vehicle collides with another vehicle or an object. For example, if you rear-end another car at a stoplight.

- Comprehensive: This covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or hail damage.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. For example, if you are injured in an accident caused by another driver.

- Uninsured/Underinsured Motorist (UM/UIM): This protects you if you are involved in an accident with a driver who is uninsured or underinsured. For example, if you are hit by a driver who doesn’t have insurance or has insufficient coverage.

Importance of Documentation and Communication

Throughout the claims process, maintaining thorough documentation and clear communication with your insurance company is essential. This includes:

- Keep all documentation related to the accident: This includes police reports, medical records, repair estimates, and photos.

- Respond promptly to all communication from your insurance company: This ensures that the claims process moves smoothly.

- Be honest and accurate in your communication: Providing false information can jeopardize your claim.

- Follow up with your insurance company regularly: This helps ensure that your claim is progressing as expected.

Texas Car Insurance Laws and Regulations

Texas has a unique approach to car insurance, with laws designed to balance the needs of drivers and insurers. Understanding these laws and regulations is crucial for navigating the Texas car insurance landscape.

Key Provisions of Texas Car Insurance Laws

Texas law requires all drivers to carry at least the minimum amount of liability insurance, known as “Financial Responsibility.” This minimum coverage protects you financially if you are at fault in an accident. The minimum coverage amounts are:

- $30,000 for bodily injury liability per person

- $60,000 for bodily injury liability per accident

- $25,000 for property damage liability

This minimum coverage may not be enough to cover all damages in a serious accident, so many drivers choose to purchase additional coverage.

Rights and Responsibilities of Drivers and Insurers in Texas

Drivers in Texas have the right to choose their insurance company and coverage. However, they also have the responsibility to comply with the state’s insurance laws.

- Drivers must maintain the required minimum liability insurance. Failure to do so can result in fines, license suspension, and even jail time.

- Insurers are obligated to pay valid claims. If a driver has valid coverage, the insurer must pay for damages up to the policy limits. However, insurers can deny claims if they believe the claim is fraudulent or not covered by the policy.

Filing a Complaint with the Texas Department of Insurance

If you have a dispute with your insurance company, you can file a complaint with the Texas Department of Insurance (TDI). The TDI investigates complaints and works to resolve disputes between consumers and insurers.

- You can file a complaint online, by phone, or by mail.

- TDI can help with issues such as:

- Denial of a claim

- Unfair rate increases

- Misleading advertising

Final Wrap-Up

Armed with the information provided in this guide, Texans can approach the world of car insurance with confidence. By understanding the intricacies of the market, the various coverage options, and the factors that influence rates, drivers can make informed decisions that protect their financial well-being and ensure peace of mind on the road. Whether you are a seasoned driver or a new Texan, this guide serves as a valuable resource to help you navigate the complexities of Texas car insurance.

Question & Answer Hub

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a change in driving habits, vehicle ownership, or financial situation.

What are the consequences of driving without car insurance in Texas?

Driving without car insurance in Texas is illegal and carries serious consequences, including fines, license suspension, and even jail time.

What are some tips for lowering my car insurance premiums in Texas?

There are several ways to potentially lower your car insurance premiums in Texas, such as maintaining a good driving record, increasing your deductible, bundling your insurance policies, and exploring discounts offered by your insurer.

What is the role of the Texas Department of Insurance in regulating the car insurance industry?

The Texas Department of Insurance plays a crucial role in regulating the car insurance industry in Texas, ensuring fair practices, protecting consumer rights, and overseeing the financial stability of insurers.

What are some common car insurance claim scenarios in Texas?

Common car insurance claim scenarios in Texas include accidents, theft, vandalism, and natural disasters.