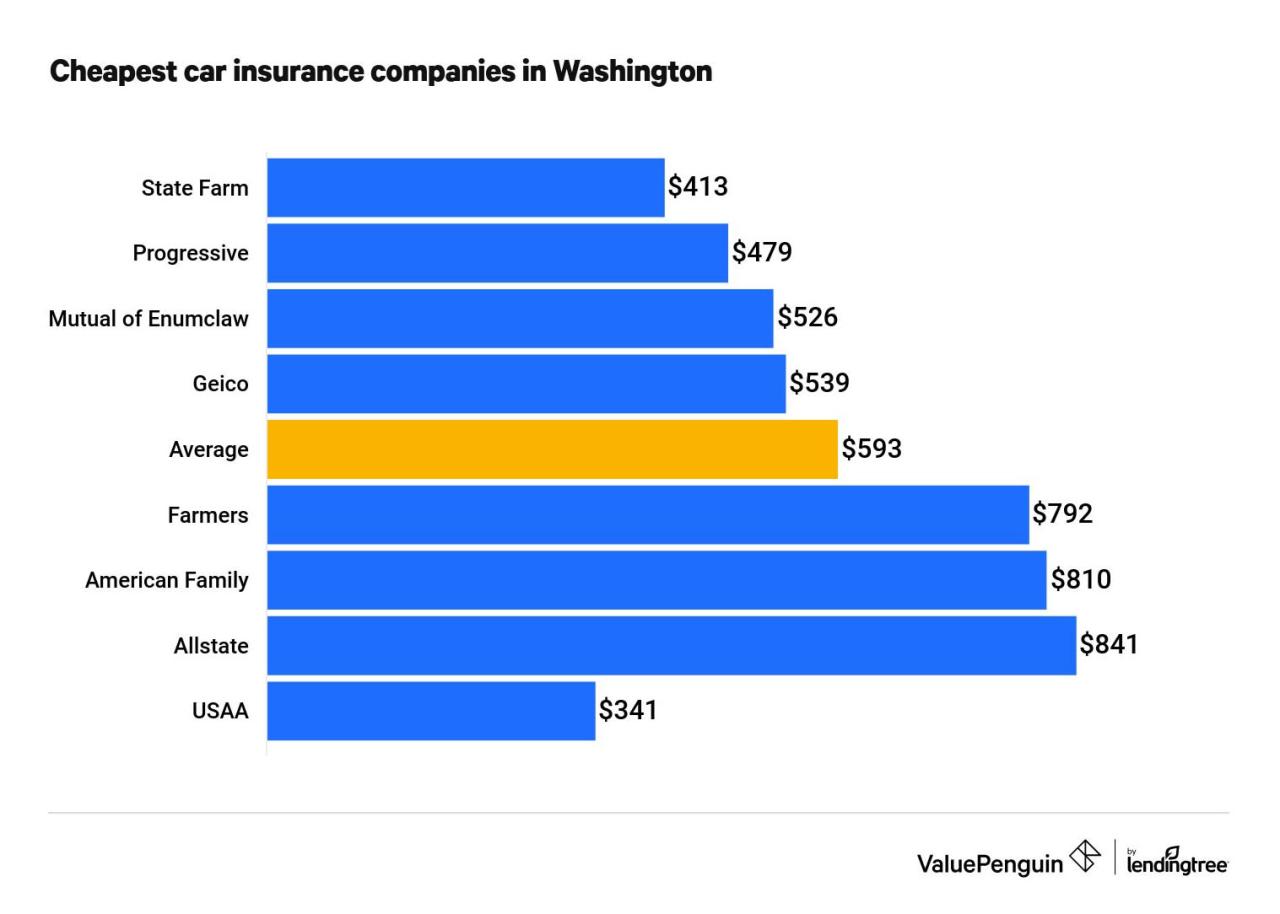

Cheap insurance Washington state – it’s a phrase that resonates with many residents seeking affordable protection. Washington’s unique insurance market, influenced by factors like demographics, regulations, and economic conditions, presents both challenges and opportunities for finding cost-effective coverage. Whether you’re looking for auto, health, home, or life insurance, understanding the landscape and exploring available options is crucial.

Navigating the insurance world can feel overwhelming, but with the right approach, finding affordable coverage that meets your needs is achievable. This guide will delve into the intricacies of Washington’s insurance market, providing valuable insights and actionable tips to help you make informed decisions and secure the best possible rates.

Understanding Washington State Insurance Market

Washington state’s insurance market is characterized by a unique blend of factors that influence insurance costs and availability. These factors include the state’s demographics, regulations, and economic conditions, all of which contribute to a complex landscape for insurance providers and consumers alike.

Factors Influencing Insurance Costs

The cost of insurance in Washington is influenced by a variety of factors, including:

- Demographics: Washington state has a diverse population, with varying levels of income, age, and health. These factors can influence insurance premiums, as insurers consider the risk profile of their policyholders. For example, areas with higher concentrations of young drivers may see higher auto insurance rates due to the increased risk of accidents.

- Regulations: Washington has a robust system of insurance regulations designed to protect consumers and ensure fair pricing. The state’s Department of Insurance sets minimum coverage requirements for auto, health, and other insurance types, and regulates insurance rates to prevent excessive pricing.

- Economic Conditions: The state’s economy plays a role in insurance costs. During periods of economic growth, insurers may see increased demand for insurance, which could lead to higher premiums. Conversely, during economic downturns, insurers may experience lower demand and adjust their pricing accordingly.

Major Insurance Types Offered in Washington

Washington state offers a wide range of insurance products to meet the diverse needs of its residents. Some of the most common insurance types include:

- Auto Insurance: Required by law in Washington, auto insurance protects drivers and their vehicles against financial losses resulting from accidents. The state has a minimum coverage requirement, but drivers can purchase additional coverage, such as comprehensive and collision, to provide more protection.

- Health Insurance: Health insurance is essential for covering medical expenses, including doctor’s visits, hospital stays, and prescription drugs. Washington state has implemented the Affordable Care Act (ACA), which has expanded access to health insurance and created a marketplace where individuals and families can shop for plans.

- Home Insurance: Home insurance protects homeowners against financial losses resulting from damage to their property, such as fire, theft, or natural disasters. The cost of home insurance in Washington can vary depending on factors such as the location, age, and value of the home.

- Life Insurance: Life insurance provides financial protection to beneficiaries upon the death of the insured. This can be a valuable tool for families to ensure their financial security in the event of a loss. There are various types of life insurance available, including term life and whole life insurance, each with its own features and benefits.

Finding Affordable Insurance Options

Finding affordable insurance in Washington State is possible, but it requires careful planning and comparison. Understanding your insurance needs and exploring various options can help you secure the best coverage at a reasonable price.

Comparing Insurance Quotes

Before settling on an insurance provider, it’s crucial to compare quotes from different companies. This allows you to identify the best rates and coverage options that suit your needs.

- Request Quotes Online: Many insurance companies offer online quote forms, allowing you to quickly get an estimate without needing to contact them directly. This is a convenient way to compare prices and coverage details from multiple providers.

- Use Comparison Websites: Several online platforms specialize in comparing insurance quotes from various companies. These websites simplify the process by providing a centralized location to gather quotes and compare different options side by side.

- Contact Insurance Agents: While online tools are useful, consider contacting independent insurance agents. They can provide personalized advice and help you navigate the insurance market, often representing multiple companies.

Benefits of Online Insurance Comparison Tools

Online insurance comparison tools offer several benefits that can streamline the process of finding affordable coverage.

- Convenience: These tools allow you to compare quotes from various companies without leaving your home, saving time and effort.

- Transparency: Online platforms often display detailed coverage information, making it easier to understand the different options and compare apples to apples.

- Time-Saving: Comparison tools can help you quickly identify the best rates and coverage options, reducing the time spent researching and contacting individual insurance companies.

Factors Impacting Insurance Premiums

Several factors influence your insurance premiums, including your driving history, credit score, and coverage levels.

- Driving History: A clean driving record with no accidents or violations typically translates into lower premiums. Conversely, a history of accidents, speeding tickets, or DUIs can lead to higher premiums.

- Credit Score: In Washington State, insurance companies can use your credit score to assess your risk. A higher credit score generally indicates responsible financial behavior and may result in lower premiums.

- Coverage Levels: The amount of coverage you choose, such as liability limits and comprehensive and collision coverage, directly affects your premium. Higher coverage levels typically result in higher premiums.

- Vehicle Type: The type of vehicle you drive also impacts your premium. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and potential for greater risk.

- Location: Where you live can affect your insurance rates. Areas with higher rates of accidents or theft may have higher premiums.

Exploring Discount Opportunities

In Washington State, many insurance companies offer various discounts to help policyholders save money. These discounts can significantly reduce your premium, making insurance more affordable. Understanding these discounts and how to qualify for them is essential in finding the most cost-effective insurance policy.

Common Insurance Discounts

Here are some common insurance discounts available in Washington state:

| Discount Type | Description | Qualifying Criteria | Example Providers |

|---|---|---|---|

| Safe Driver Discount | Rewarding drivers with a clean driving record. | No accidents or traffic violations within a specific period (usually 3-5 years). | State Farm, Geico, Liberty Mutual |

| Bundling Discount | Combining multiple insurance policies with the same provider (e.g., car and home insurance). | Having more than one insurance policy with the same company. | Progressive, Allstate, USAA |

| Good Student Discount | Offered to students with good academic performance. | Maintaining a certain GPA (usually 3.0 or higher). | Farmers, Nationwide, Travelers |

Navigating Insurance Regulations

Understanding the insurance regulations in Washington state is crucial for finding the right coverage at a reasonable price. These regulations set minimum coverage requirements, protect consumers from unfair practices, and ensure that insurers operate responsibly.

Role of the Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) plays a vital role in safeguarding the interests of policyholders. The OIC is responsible for enforcing insurance laws, investigating complaints, and ensuring that insurers comply with regulations.

Key Insurance Regulations in Washington State, Cheap insurance washington state

The OIC enforces a variety of regulations to protect consumers and ensure a fair insurance market. Here are some key regulations:

- Minimum Coverage Requirements: Washington state mandates minimum liability coverage for all drivers. This coverage protects others in case of an accident caused by the insured driver. The minimum coverage requirements are:

- Liability Coverage: $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: $25,000 per person, $50,000 per accident.

- Consumer Protection Laws: Washington state has strong consumer protection laws that aim to prevent unfair or deceptive insurance practices. These laws cover areas such as:

- Rate Setting: Insurers must justify their rates and cannot discriminate based on factors like race, religion, or gender.

- Claims Handling: Insurers are required to handle claims fairly and promptly.

- Policy Renewal: Insurers cannot arbitrarily cancel or refuse to renew a policy without a valid reason.

Impact of Regulations on Insurance Costs and Coverage Options

While regulations aim to protect consumers, they can also impact insurance costs and coverage options. For instance, minimum coverage requirements ensure that all drivers have a basic level of protection, but they also increase the cost of insurance. Similarly, consumer protection laws prevent insurers from engaging in unfair practices, which can lead to higher premiums. However, these regulations also ensure a fair and transparent insurance market, ultimately benefiting consumers.

Last Word: Cheap Insurance Washington State

Finding cheap insurance in Washington state is a journey that requires careful consideration and proactive steps. By understanding the market dynamics, exploring discount opportunities, and utilizing available resources, you can secure affordable coverage that provides peace of mind. Remember, your insurance needs are unique, so don’t hesitate to seek professional guidance from licensed insurance agents to tailor your policy and ensure adequate protection.

FAQ Resource

What are the minimum insurance requirements in Washington state?

Washington state requires drivers to carry a minimum amount of liability insurance, including bodily injury liability, property damage liability, and uninsured motorist coverage. Specific coverage amounts are Artikeld by state law.

How can I find out if my insurance provider offers discounts?

Contact your insurance provider directly or visit their website to inquire about available discounts. Many providers offer discounts for safe driving, bundling policies, good student records, and more.

What is the role of the Washington State Office of the Insurance Commissioner?

The Washington State Office of the Insurance Commissioner is responsible for regulating the insurance industry, protecting policyholders, and ensuring fair and competitive practices.

How often should I review my insurance policies?

It’s recommended to review your insurance policies at least annually, or whenever there are significant life changes, such as a new vehicle, marriage, or a change in your driving record.