Cheapest insurance washington state – Cheapest insurance in Washington State: a quest for affordable coverage amidst a complex insurance market. Washington residents face unique challenges when seeking insurance due to factors like geographic location, driving habits, and state regulations. Understanding these factors is crucial to finding the best deals and securing the coverage you need.

This guide delves into the Washington insurance landscape, exploring different types of insurance, comparing providers, and uncovering strategies for saving money. We’ll navigate the complexities of insurance pricing, highlighting key factors that influence costs and providing practical tips to help you find the most affordable options.

Understanding Washington State Insurance Market

Washington State has a unique insurance market influenced by various factors, making it crucial to understand these dynamics when searching for the most affordable coverage.

Factors Influencing Insurance Costs in Washington State

The cost of insurance in Washington is influenced by a combination of factors, including:

- Geographic Location: Insurance premiums can vary significantly depending on the region in Washington. Areas with higher population density, greater traffic congestion, and a higher risk of natural disasters tend to have higher insurance costs. For example, Seattle, with its dense urban environment and susceptibility to earthquakes, may have higher insurance premiums compared to more rural areas in Eastern Washington.

- Driving Habits: Insurance companies consider driving history, including accidents, violations, and driving experience, when calculating premiums. Drivers with a clean driving record and significant driving experience generally enjoy lower premiums compared to those with a history of accidents or violations.

- Vehicle Type: The type of vehicle you own plays a significant role in determining insurance costs. Luxury vehicles, sports cars, and vehicles with high-performance engines are typically associated with higher premiums due to their higher repair costs and potential for higher risk. Conversely, basic, fuel-efficient vehicles tend to have lower premiums.

- Insurance Coverage: The level of coverage you choose, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, impacts your premium. Higher coverage levels generally mean higher premiums.

- Credit Score: While not a factor in all states, credit score can be used in Washington to determine insurance premiums. A higher credit score is generally associated with lower premiums, as it reflects financial responsibility and a lower risk of claims.

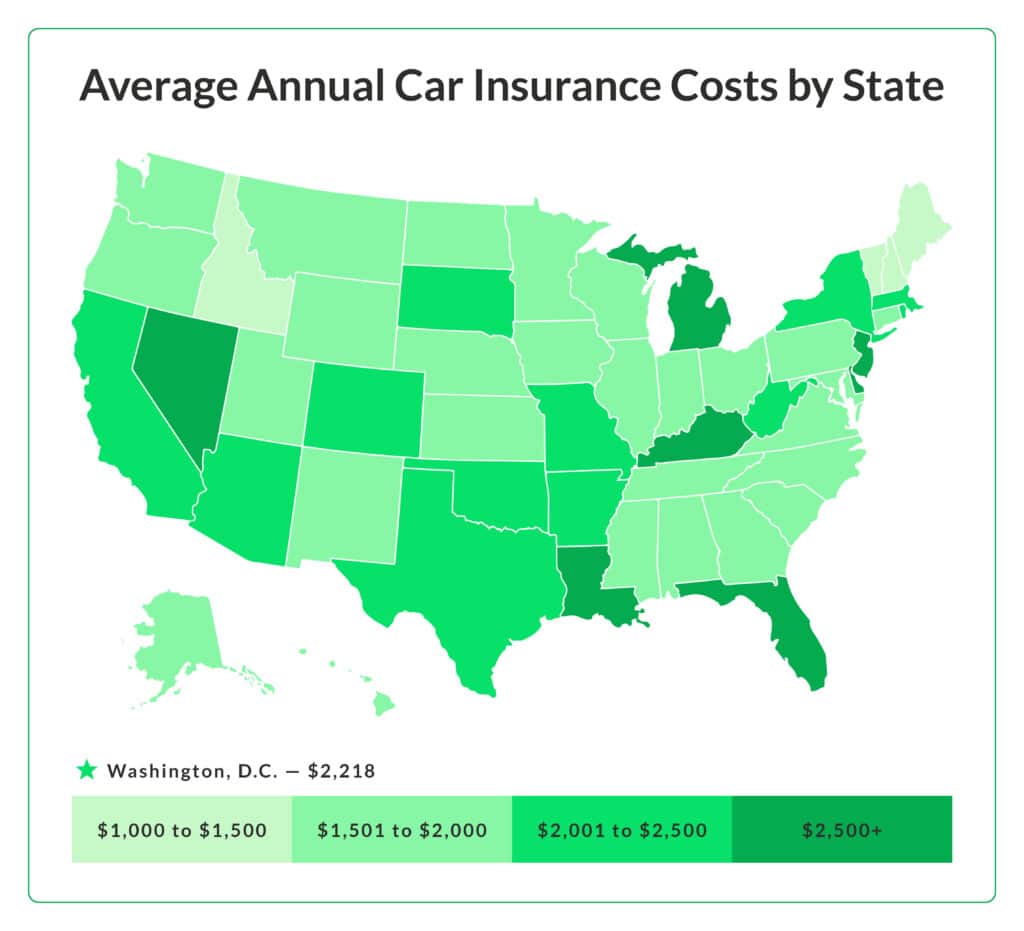

Comparison to National Averages

Insurance costs in Washington are generally in line with the national average, though variations exist based on specific factors mentioned above. However, it’s essential to note that these averages can fluctuate depending on the insurer, specific coverage, and other individual factors.

Impact of State Regulations on Insurance Pricing

Washington State has implemented regulations aimed at ensuring fair and transparent insurance pricing. These regulations can impact insurance costs by:

- Rate Regulation: Washington State has a system of rate regulation that aims to prevent excessive premium increases and ensure that rates are reasonable and fair. This regulation can impact insurance costs by setting limits on how much insurers can raise premiums.

- Consumer Protection: Washington State has strong consumer protection laws that safeguard consumers from unfair or deceptive insurance practices. These laws can impact insurance costs by requiring insurers to be transparent about their pricing and by providing consumers with recourse if they believe they have been unfairly treated.

- Mandated Coverage: Washington State mandates certain insurance coverages, such as liability and uninsured/underinsured motorist coverage. These mandated coverages can impact insurance costs by ensuring that all drivers have a minimum level of protection.

Types of Insurance in Washington

Washington state, like any other state, offers a variety of insurance options to safeguard individuals and businesses against unexpected events. These insurance types cater to different needs and risks, ensuring financial protection in various situations.

Auto Insurance, Cheapest insurance washington state

Auto insurance is a mandatory requirement in Washington state, protecting policyholders against financial losses arising from car accidents. It covers damages to your vehicle and injuries to yourself or others.

- Liability Coverage: This protects you financially if you are at fault in an accident, covering damages to other vehicles and injuries to other individuals.

- Collision Coverage: This covers repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-accident events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage.

Factors influencing the cost of auto insurance in Washington include:

- Driving history: A clean driving record with no accidents or traffic violations will typically lead to lower premiums.

- Age and experience: Younger drivers with less experience tend to pay higher premiums due to higher risk.

- Vehicle type and value: Expensive or high-performance vehicles often have higher insurance costs.

- Location: Insurance rates can vary based on the area’s crime rates and traffic congestion.

Homeowners Insurance

Homeowners insurance provides financial protection against various risks associated with your home, including damage from fire, theft, natural disasters, and liability claims.

- Dwelling Coverage: This covers the structure of your home, including the roof, walls, and foundation, against damage from covered perils.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, appliances, and clothing, against damage or theft.

- Liability Coverage: This protects you if someone is injured on your property or if you cause damage to someone else’s property.

- Additional Living Expenses Coverage: This covers temporary housing and living expenses if your home becomes uninhabitable due to a covered event.

Factors influencing the cost of homeowners insurance in Washington include:

- Location: Areas prone to natural disasters, such as earthquakes or wildfires, tend to have higher premiums.

- Home value: The value of your home influences the amount of coverage you need, impacting your premium.

- Home features: Features like security systems, fire alarms, and sprinkler systems can lower your premium.

- Credit score: A good credit score often results in lower insurance premiums.

Health Insurance

Health insurance in Washington offers coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Individual Health Insurance: This type of insurance is purchased by individuals directly from insurance companies.

- Employer-Sponsored Health Insurance: Many employers offer health insurance plans to their employees as part of their benefits package.

- Government-Sponsored Health Insurance: Programs like Medicaid and Medicare provide health insurance coverage for low-income individuals, seniors, and people with disabilities.

Factors influencing the cost of health insurance in Washington include:

- Age: Older individuals generally pay higher premiums due to a higher risk of medical expenses.

- Location: Health insurance premiums can vary based on the cost of living and healthcare providers in a particular area.

- Health status: Individuals with pre-existing health conditions may pay higher premiums.

- Plan type: Different health insurance plans offer varying levels of coverage and benefits, which can impact premiums.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It pays a death benefit to your beneficiaries, helping them cover expenses like funeral costs, debts, and living expenses.

- Term Life Insurance: This type of insurance provides coverage for a specific period, usually 10, 20, or 30 years. It’s generally more affordable than permanent life insurance.

- Permanent Life Insurance: This type of insurance provides lifelong coverage, and it often includes a cash value component that can accumulate over time.

Factors influencing the cost of life insurance in Washington include:

- Age: Younger individuals generally pay lower premiums for life insurance due to a lower risk of death.

- Health: Individuals with pre-existing health conditions may pay higher premiums.

- Lifestyle: Individuals who engage in risky activities, such as smoking or extreme sports, may pay higher premiums.

- Death benefit amount: The higher the death benefit, the higher the premium.

Finding Affordable Insurance Options

Finding affordable insurance in Washington can be a challenging task, but it’s not impossible. With some research and smart strategies, you can secure the coverage you need without breaking the bank.

Comparing Insurance Providers

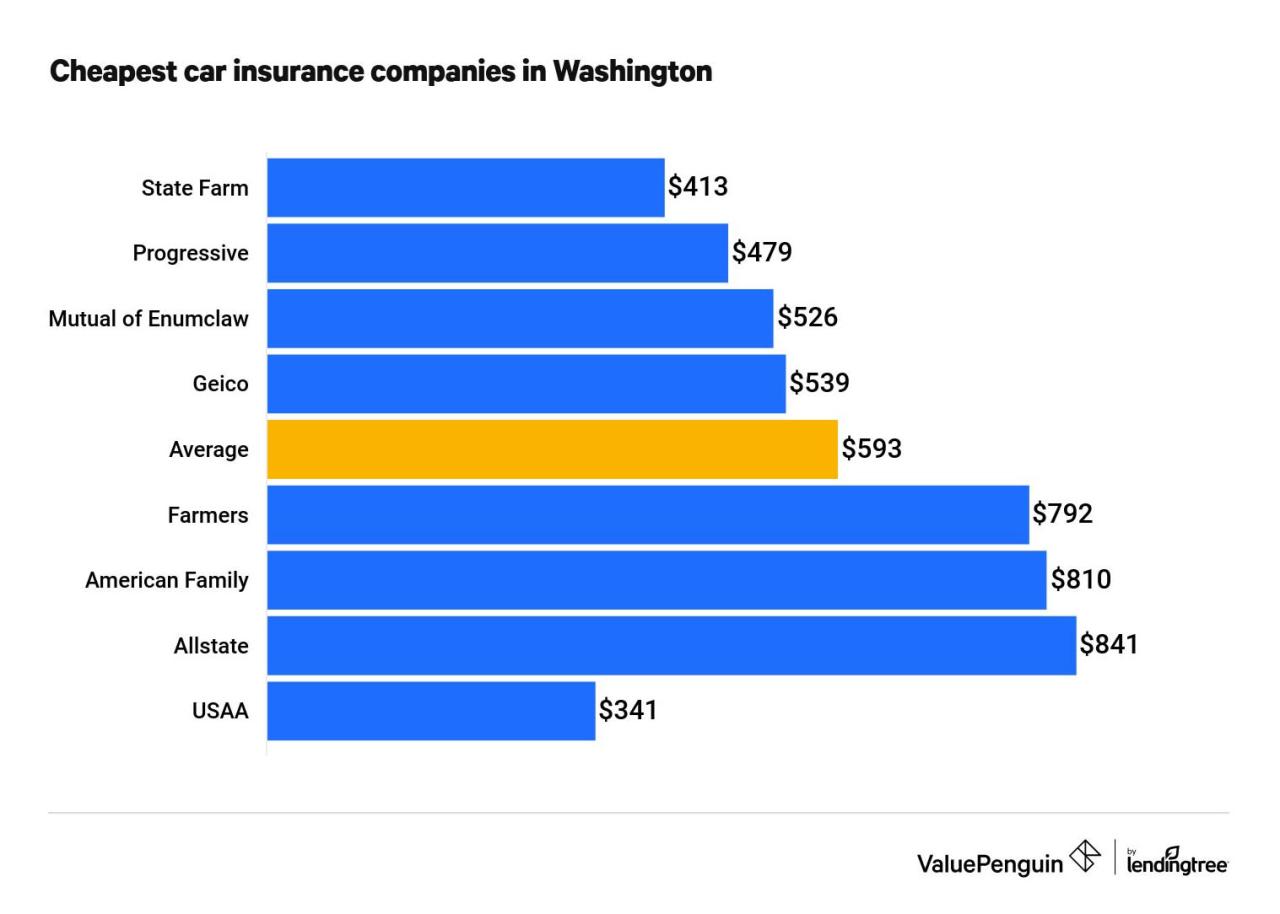

Comparing quotes from different insurance providers is crucial for finding the best deal. Here’s a table comparing the top 5 cheapest insurance providers in Washington for each type of insurance, based on average premiums and customer reviews:

| Insurance Type | Provider 1 | Provider 2 | Provider 3 | Provider 4 | Provider 5 |

|—|—|—|—|—|—|

| Auto | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] |

| Home | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] |

| Health | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] |

| Life | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] | [Provider Name] |

Note: This table is for illustrative purposes only. Actual premiums and coverage options may vary based on individual factors like age, driving history, and credit score.

Tips for Finding Cheap Insurance

Several strategies can help you find the cheapest insurance options in Washington.

- Shop Around: Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to find the best rates. You can use online comparison tools or contact providers directly.

- Bundle Policies: Combining your auto and home insurance policies with the same provider can often result in significant discounts. Bundling can save you money on both policies.

- Improve Your Credit Score: Insurance companies often consider your credit score when setting premiums. A higher credit score can lead to lower rates. Focus on improving your credit history by paying bills on time and managing your debt.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident or claim. However, it can also lead to lower premiums. Consider increasing your deductible if you’re comfortable with a higher out-of-pocket expense.

- Take Advantage of Discounts: Many insurance providers offer discounts for various factors, such as safe driving records, good grades, and home security systems. Ask your provider about available discounts and make sure you’re taking advantage of all eligible ones.

- Review Your Coverage Regularly: Insurance needs can change over time. Review your coverage annually to ensure you’re not paying for unnecessary protection or missing out on important coverage.

Factors Affecting Insurance Costs

Insurance premiums in Washington state, like in other states, are determined by a complex interplay of factors. These factors help insurers assess the risk associated with insuring a particular individual or vehicle, and they directly impact the cost of insurance. Understanding these factors can help you make informed decisions about your insurance choices and potentially lower your premiums.

Age

The age of the insured is a significant factor influencing insurance costs. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behaviors. Therefore, insurers often charge higher premiums for younger drivers. As drivers age and gain experience, their risk profile typically decreases, leading to lower premiums.

Driving Record

A clean driving record is crucial for obtaining affordable insurance. Any incidents like accidents, traffic violations, or DUI convictions can significantly increase your premiums. Insurance companies view these incidents as indicators of higher risk and adjust premiums accordingly. For instance, a speeding ticket or an at-fault accident can lead to a substantial increase in your insurance costs. Maintaining a clean driving record is essential to keep your insurance premiums low.

Credit Score

Surprisingly, your credit score can also affect your insurance premiums. Insurance companies have found a correlation between credit score and insurance claims behavior. Individuals with lower credit scores tend to have higher claims frequency and severity. This correlation, though not universally accepted, is used by some insurers to assess risk and adjust premiums accordingly.

Location

The location where you reside plays a crucial role in determining your insurance costs. Factors such as population density, traffic volume, crime rates, and the frequency of weather-related events in your area can influence the likelihood of accidents. For example, urban areas with heavy traffic and high crime rates may have higher insurance premiums compared to rural areas with lower traffic volumes and crime rates.

Driving Habits

Your driving habits can significantly impact your insurance premiums. For instance, driving fewer miles annually can lead to lower premiums as you are less likely to be involved in an accident. Similarly, avoiding risky driving behaviors like speeding, aggressive driving, or driving under the influence can significantly reduce your insurance costs.

Safety Features

Vehicles equipped with advanced safety features like anti-lock brakes, electronic stability control, and airbags are often associated with lower insurance premiums. These features can mitigate the severity of accidents and reduce the likelihood of claims, making the vehicle a lower risk for insurers.

Saving Money on Insurance: Cheapest Insurance Washington State

Finding affordable insurance in Washington is a priority for many residents. Fortunately, there are several ways to save money on your insurance premiums. By understanding available discounts, implementing proactive measures, and exploring alternative insurance providers, you can significantly reduce your insurance costs.

Discounts Available to Policyholders

Insurance companies in Washington offer various discounts to their policyholders. These discounts can be substantial, so it’s crucial to inquire about them when obtaining a quote.

- Good Driver Discounts: Maintaining a clean driving record with no accidents or traffic violations can qualify you for a significant discount.

- Safe Driver Courses: Completing a defensive driving course can demonstrate your commitment to safe driving and result in a discount.

- Multi-Policy Discounts: Bundling your car, home, or other insurance policies with the same provider often leads to substantial savings.

- Loyalty Discounts: Staying with the same insurance company for an extended period can earn you a loyalty discount.

- Payment Discounts: Paying your premiums annually or semi-annually can sometimes result in a discount compared to monthly payments.

- Home Security Discounts: Installing security systems, such as alarms or cameras, can deter theft and earn you a discount on your homeowners insurance.

- Group Discounts: Belonging to certain organizations, like professional associations or alumni groups, may qualify you for a discount.

- Student Discounts: If you’re a full-time student with good grades, you may be eligible for a discount on your car insurance.

- Military Discounts: Active military personnel and veterans often qualify for special discounts on insurance policies.

Reducing Insurance Costs Through Proactive Measures

Taking proactive steps can lower your insurance costs beyond simply qualifying for discounts.

- Driver Training: Completing a defensive driving course can improve your driving skills and potentially lower your insurance premiums.

- Home Security Upgrades: Installing security systems, such as alarms, motion detectors, or cameras, can deter theft and reduce your homeowners insurance costs.

- Maintaining a Good Credit Score: A good credit score can positively impact your insurance premiums, as insurers use it to assess your risk profile.

- Increasing Your Deductible: Opting for a higher deductible can lower your monthly premiums. However, ensure you can afford to pay the deductible in case of an accident or claim.

Switching Insurance Providers

Comparing quotes from different insurance providers is essential to find the most affordable options. Switching providers can lead to significant savings, especially if your current insurer doesn’t offer competitive rates or discounts.

- Online Comparison Tools: Several websites allow you to compare quotes from multiple insurance providers simultaneously. This can save you time and effort in the research process.

- Direct Quotes: Contact insurance companies directly to obtain personalized quotes and discuss available discounts.

- Insurance Brokers: Consider working with an independent insurance broker who can compare quotes from various providers and recommend the best option for your needs.

Insurance Resources in Washington

Navigating the world of insurance can be daunting, especially when seeking affordable options. Fortunately, Washington State offers various resources to guide you through the process and find the best coverage for your needs. These resources provide valuable information, assistance, and support to ensure you make informed decisions and secure the insurance you deserve.

State Insurance Commissioner’s Website

The Washington State Office of the Insurance Commissioner (OIC) is a crucial resource for consumers seeking insurance information and assistance. The OIC website offers a wealth of information, including:

- Insurance company licensing and regulation: The OIC licenses and regulates insurance companies operating in Washington, ensuring they comply with state laws and regulations.

- Consumer complaint resolution: The OIC helps resolve consumer complaints against insurance companies and provides guidance on filing complaints.

- Information on different types of insurance: The website provides comprehensive information on various insurance products, including auto, health, home, and life insurance.

- Insurance fraud prevention tips: The OIC offers tips on how to protect yourself from insurance fraud and provides resources for reporting suspected fraud.

The OIC website also provides access to online resources like the Insurance Marketplace, where you can compare insurance quotes from different companies and find the best deals.

The OIC’s website is: [website address]

Consumer Protection Agencies

Consumer protection agencies, such as the Washington State Attorney General’s Office and the Better Business Bureau (BBB), play a vital role in safeguarding consumer rights and addressing insurance-related issues.

- Attorney General’s Office: The Attorney General’s Office investigates and prosecutes insurance fraud and enforces consumer protection laws related to insurance.

- Better Business Bureau: The BBB provides information on insurance companies, including their business practices, customer complaints, and ratings. The BBB also offers resources for resolving consumer disputes with insurance companies.

Nonprofit Organizations Offering Insurance Assistance

Several nonprofit organizations in Washington offer insurance assistance and support to low-income individuals and families. These organizations can help with:

- Navigating the insurance market: Providing guidance on choosing the right insurance plan and understanding insurance terms and conditions.

- Applying for insurance subsidies: Assisting with applications for government-funded insurance subsidies, such as the Affordable Care Act (ACA) marketplace.

- Advocating for consumer rights: Representing consumers in disputes with insurance companies and ensuring their rights are protected.

These organizations can be invaluable resources for individuals seeking affordable insurance options.

End of Discussion

Securing affordable insurance in Washington State requires research, comparison, and proactive measures. By understanding the market, leveraging available resources, and taking advantage of discounts, you can significantly reduce your insurance costs. Remember, the cheapest option isn’t always the best, so prioritize comprehensive coverage that meets your specific needs while staying within your budget. With a little effort and the right information, you can find the insurance protection you deserve at a price that fits your wallet.

FAQ Compilation

What are the most common types of insurance in Washington?

The most common types of insurance in Washington include auto insurance, homeowners insurance, health insurance, and life insurance.

How do I find the cheapest insurance provider in Washington?

To find the cheapest insurance provider, compare quotes from multiple insurers, consider bundling policies, and explore available discounts.

What factors affect my insurance rates in Washington?

Factors like age, driving record, credit score, location, vehicle type, and coverage options can significantly impact your insurance rates.