Can I get insurance in a different state? It’s a question many people ask, especially those who move or spend significant time in a different location. Understanding state insurance regulations is crucial, as they vary greatly across the country. Factors like demographics, economic conditions, and political climate all play a role in shaping these laws. This can lead to differences in coverage requirements, rates, and consumer protections.

For instance, auto insurance laws are often influenced by traffic patterns and accident rates, while health insurance regulations may reflect the availability of healthcare providers and the overall health of a state’s population. This means that what’s considered standard coverage in one state might be significantly different in another.

Understanding State Insurance Regulations

Insurance regulations differ significantly from state to state. This variation arises due to several factors, including demographics, economic conditions, and political climate. Understanding these regulations is crucial for individuals seeking insurance in a different state, as they influence coverage requirements, rates, and consumer protections.

Factors Influencing State Insurance Laws

State insurance laws are shaped by a complex interplay of factors. These factors influence the regulatory environment, impacting the availability, cost, and coverage of insurance products.

- Demographics: States with a higher concentration of older residents or individuals with specific health conditions may have more stringent regulations regarding health insurance coverage.

- Economic Conditions: States with high unemployment rates or a large number of low-income residents may have regulations that prioritize affordability and access to insurance.

- Political Climate: Political ideologies and priorities influence the development and enforcement of insurance laws. For example, states with conservative political climates may favor less government intervention in the insurance market, while states with liberal climates may prioritize consumer protections and affordable coverage.

Common Areas of Variation in State Insurance Laws

State insurance laws vary significantly across different areas, impacting the insurance experience for consumers.

- Coverage Requirements: State laws dictate the minimum coverage requirements for various types of insurance, such as auto, health, and homeowners. For example, some states may require higher liability limits for auto insurance than others.

- Rates: State regulations can influence the pricing of insurance premiums. For instance, some states may restrict insurers from using certain factors, such as credit scores, when setting rates.

- Consumer Protections: States vary in their consumer protection laws, which safeguard policyholders against unfair practices by insurance companies. These laws may address issues like rate increases, claim denials, and consumer rights.

Eligibility Requirements for Out-of-State Insurance

Obtaining insurance in a state different from your current residence involves specific eligibility requirements that vary depending on the type of insurance and the state’s regulations. These requirements aim to ensure that insurance companies can adequately assess risk and manage their obligations effectively.

Understanding these requirements is crucial for individuals planning to relocate or spend an extended period in another state.

Residency Requirements

Residency requirements are a fundamental aspect of insurance eligibility. States define residency based on various factors, including:

- Physical Presence: This typically involves living in the state for a minimum period, often expressed in months or years. The exact duration may differ between states and insurance types. For instance, some states might require six months of continuous residency for auto insurance, while others may demand a year for health insurance.

- Intent to Remain: This factor assesses your intention to make the new state your permanent home. Evidence of this intent could include registering to vote, obtaining a driver’s license, owning property, or establishing employment in the state.

- Domicile: This refers to your legal residence, often established through the place you consider your permanent home. This is a crucial aspect of residency for certain insurance types, such as homeowners insurance.

Insurance companies often verify residency through documentation, such as driver’s license, voter registration, tax returns, or utility bills.

Impact of Temporary or Seasonal Residency

Temporary or seasonal residency, such as living in a state for a vacation or a short-term work assignment, generally doesn’t qualify you for insurance in that state. However, some exceptions might apply:

- Short-Term Coverage: Some insurance companies may offer short-term or temporary coverage for individuals staying in a state for a limited period. This coverage often comes with specific terms and conditions, such as a higher premium or limited benefits.

- Non-Resident Insurance: States might have provisions for non-resident insurance, which can cover individuals who don’t meet the residency requirements for full coverage but require insurance for specific purposes, like driving a vehicle in the state.

It’s crucial to consult with an insurance agent or broker to understand the specific requirements and options available in your situation.

Types of Insurance Coverage and State Variations

Insurance regulations can vary significantly from state to state, impacting the types of coverage available, the cost of premiums, and the specific requirements for policyholders. Understanding these variations is crucial when considering insurance options in a different state.

Auto Insurance

Auto insurance is a common requirement in most states, but the specific coverage mandates and limitations can differ considerably.

- Minimum Liability Coverage: States have minimum liability coverage requirements that specify the minimum amounts of coverage for bodily injury and property damage to others in case of an accident. These minimums can vary widely, for example, some states may require higher liability limits for uninsured/underinsured motorist coverage than others.

- Optional Coverages: States may also offer optional coverage options, such as comprehensive and collision coverage, which protect your own vehicle from damage due to non-collision events and collisions, respectively. The availability and cost of these options can vary depending on the state and your individual circumstances.

- No-Fault Laws: Some states have no-fault insurance laws, which require drivers to file claims with their own insurance company, regardless of fault in an accident. These laws can impact the process of seeking compensation for injuries and damages.

Health Insurance, Can i get insurance in a different state

The Affordable Care Act (ACA) has standardized some aspects of health insurance across the country, but states still have the authority to implement certain provisions and regulations.

- State Health Insurance Exchanges: States have the option to operate their own health insurance exchanges, which provide a marketplace for individuals and small businesses to purchase health insurance plans. The availability and pricing of plans can vary depending on the state exchange.

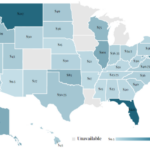

- Medicaid Expansion: Some states have expanded Medicaid eligibility under the ACA, providing health insurance coverage to more low-income individuals. States that have not expanded Medicaid may have stricter eligibility requirements.

- Essential Health Benefits: The ACA mandates that all health insurance plans cover essential health benefits, but states have some flexibility in defining these benefits. This can lead to variations in the specific coverage provided by plans in different states.

Homeowners Insurance

Homeowners insurance protects your home and belongings from various risks, such as fire, theft, and natural disasters. State regulations can impact the types of coverage available and the cost of premiums.

- Coverage Requirements: States may have specific requirements for homeowners insurance coverage, such as minimum coverage amounts for certain perils or mandatory coverage for specific risks, such as earthquakes in earthquake-prone areas.

- Exclusions: States may also have specific exclusions for homeowners insurance, such as coverage for certain types of natural disasters or specific types of property damage. It is essential to understand these exclusions when comparing policies.

- Flood Insurance: Flood insurance is typically not included in standard homeowners insurance policies. In some states, flood insurance is mandatory for properties located in high-risk flood zones.

Outcome Summary

Navigating the complexities of out-of-state insurance can be challenging, but with careful planning and research, it’s possible to find the right coverage for your needs. By understanding the eligibility requirements, comparing different options, and considering the potential benefits and drawbacks, you can make an informed decision that aligns with your individual circumstances. Remember to consult with insurance professionals to ensure you have the right coverage and are meeting all applicable state regulations.

Popular Questions: Can I Get Insurance In A Different State

What happens if I move to a new state but keep my existing insurance?

You may be able to keep your existing insurance for a grace period, but you’ll likely need to update your policy to reflect your new address and potentially adjust your coverage to meet the requirements of your new state.

Can I get insurance in a state where I don’t live full-time?

It depends on the specific state and the type of insurance. Some states may allow you to purchase insurance if you have a temporary or seasonal residence there, while others may require you to be a full-time resident. It’s important to check the requirements of the state you’re considering.

Are there any specific requirements for obtaining out-of-state health insurance?

Yes, there are often specific requirements for obtaining health insurance in a state where you don’t live full-time. You may need to demonstrate a connection to the state, such as working there or having a family member living there. It’s best to consult with an insurance broker or agent to determine the specific requirements.