Texas state minimum coverage auto insurance is a crucial requirement for all drivers in the Lone Star State. It provides essential financial protection in case of an accident, but understanding its limitations and implications is vital. While meeting the minimum coverage requirements may seem straightforward, there are nuances and potential risks associated with driving with only the bare minimum insurance.

This guide delves into the details of Texas’s minimum coverage requirements, explaining the different types of coverage, their financial limits, and the potential consequences of driving without adequate insurance. We’ll also explore factors that influence the cost of insurance, tips for finding affordable coverage, and the importance of considering higher coverage levels to ensure comprehensive protection.

Texas Minimum Coverage Requirements

In Texas, driving without the legally mandated minimum auto insurance coverage is against the law. To ensure you’re compliant, it’s crucial to understand the specific requirements and the coverage types they encompass.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical bills, lost wages, and property repairs.

Minimum Financial Responsibility Limits

- Bodily Injury Liability: $30,000 per person, $60,000 per accident. This limit applies to the total amount of coverage for injuries sustained by a single person in an accident. In the event of multiple injuries in a single accident, the total coverage limit is $60,000.

- Property Damage Liability: $25,000 per accident. This limit covers the total amount of damage to another person’s property, including vehicles, buildings, and other assets.

Medical Payments Coverage

Medical payments coverage, also known as “Med Pay,” covers your medical expenses, regardless of who caused the accident. It applies to you, your passengers, and even pedestrians involved in the accident.

Minimum Financial Responsibility Limits

- Medical Payments Coverage: $2,500 per person. This limit applies to the total amount of coverage for medical expenses incurred by a single person in an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It covers your medical expenses, lost wages, and property damage.

Minimum Financial Responsibility Limits

- Uninsured/Underinsured Motorist Coverage: $30,000 per person, $60,000 per accident. This limit applies to the total amount of coverage for injuries sustained by a single person in an accident. In the event of multiple injuries in a single accident, the total coverage limit is $60,000.

Property Damage Coverage

Property damage coverage protects you if you cause an accident that damages another person’s property. It covers the cost of repairs or replacement of the damaged property.

Minimum Financial Responsibility Limits

- Property Damage Coverage: $25,000 per accident. This limit applies to the total amount of coverage for damage to another person’s property, including vehicles, buildings, and other assets.

Understanding Texas Minimum Coverage

Driving with only the minimum required auto insurance in Texas might seem like a way to save money, but it can lead to significant financial risks and potential legal issues. Understanding the implications of minimum coverage is crucial to making informed decisions about your insurance needs.

The Implications of Minimum Coverage in Texas

Driving with only minimum coverage in Texas can leave you financially vulnerable in the event of an accident. It might not cover all your losses, including medical bills, property damage, and legal fees. This can result in substantial out-of-pocket expenses, potentially leading to financial hardship.

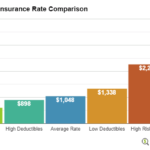

Factors Influencing Coverage Costs

Understanding the factors that influence the cost of your auto insurance in Texas is crucial for making informed decisions about your coverage. These factors play a significant role in determining your minimum coverage premiums.

Age

Your age is a key factor in determining your insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies often consider younger drivers as higher risk, leading to higher premiums. However, as you age and gain more driving experience, your premiums may decrease.

Driving History, Texas state minimum coverage auto insurance

Your driving history is a major factor in determining your insurance premiums. A clean driving record with no accidents, violations, or tickets will generally result in lower premiums. On the other hand, a history of accidents, traffic violations, or DUI convictions will significantly increase your premiums. Insurance companies view these events as indicators of higher risk, making you a more expensive customer to insure.

Vehicle Type

The type of vehicle you drive is another important factor that influences your insurance premiums. Some vehicles are considered more expensive to repair or replace than others. For example, sports cars or luxury vehicles are often associated with higher repair costs and insurance premiums. Additionally, vehicles with advanced safety features may qualify for discounts, leading to lower premiums.

Location

The location where you live can also impact your auto insurance premiums. Insurance companies consider the risk of accidents and theft in different areas. Areas with higher crime rates or a higher density of traffic may have higher insurance premiums.

Discounts

Several discounts can help reduce your auto insurance costs. Some common discounts include:

- Good Student Discount: This discount is available to students who maintain good grades.

- Safe Driver Discount: Drivers with a clean driving record and no accidents or violations may qualify for this discount.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a discount.

- Anti-theft Device Discount: Vehicles equipped with anti-theft devices, such as alarms or immobilizers, may qualify for a discount.

Conclusion

Navigating the complexities of auto insurance in Texas can be daunting, but understanding the state’s minimum coverage requirements is essential for all drivers. By familiarizing yourself with the legal obligations, potential risks, and factors influencing coverage costs, you can make informed decisions to ensure adequate protection on the road. Remember, while minimum coverage fulfills legal requirements, it may not be enough to cover all potential expenses in the event of an accident. Consider your individual needs and circumstances when choosing insurance coverage to protect yourself and your finances.

Common Queries: Texas State Minimum Coverage Auto Insurance

What happens if I get into an accident with only minimum coverage?

If you cause an accident and only have minimum coverage, your insurance will only cover the minimum amounts for liability, medical payments, and property damage. You may be personally responsible for any costs exceeding those limits.

Is it cheaper to drive with only minimum coverage?

While minimum coverage premiums are typically lower, it’s essential to consider the potential risks and financial consequences of inadequate coverage. Higher coverage levels provide greater protection in case of a serious accident.

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or whenever you experience a significant life change, such as a new car, a change in your driving record, or a move to a new location.