Stated value car insurance offers a unique approach to protecting your vehicle, particularly if it’s a classic, antique, or modified car. Unlike traditional car insurance, which bases coverage on the actual cash value of your car, stated value insurance allows you to set a specific value for your vehicle, which is the amount you’ll receive in the event of a total loss.

This type of insurance can be beneficial for owners of vehicles that hold sentimental or collectible value, as it ensures you’re compensated for the agreed-upon amount, regardless of market fluctuations. However, it’s essential to understand the intricacies of stated value insurance, including its benefits, drawbacks, and how to determine the appropriate stated value for your car.

What is Stated Value Car Insurance?

Stated value car insurance is a type of car insurance that covers your vehicle for a specific amount that you and your insurer agree upon, rather than the actual cash value (ACV) of the car. This means that if your car is totaled, you will receive the stated value, regardless of its market value at the time of the accident.

Stated value insurance is often used for classic cars, antique cars, and other vehicles that are difficult to value based on market data. This is because these types of cars often have a higher value than their ACV, as they may be rare, collectible, or have sentimental value.

Benefits of Stated Value Car Insurance

Stated value car insurance offers several benefits for owners of specific types of vehicles. These benefits include:

- Guaranteed Coverage: Stated value insurance ensures that you will receive the agreed-upon amount for your vehicle if it is totaled, regardless of its market value at the time of the accident. This provides peace of mind, knowing that you will be compensated fairly for your loss.

- Higher Coverage: Stated value insurance can provide higher coverage than ACV insurance for vehicles that have a higher value than their market value. This is particularly beneficial for classic cars, antique cars, and other vehicles that are difficult to value based on market data.

- Protection Against Depreciation: ACV insurance values your vehicle based on its current market value, which can depreciate over time. Stated value insurance protects you from this depreciation, ensuring that you receive the agreed-upon amount for your vehicle, regardless of its age or condition.

Potential Drawbacks of Stated Value Car Insurance

While stated value insurance offers several benefits, it also has some potential drawbacks. These drawbacks include:

- Higher Premiums: Stated value insurance premiums are typically higher than ACV insurance premiums, as the insurer is assuming a higher risk. This is because the insurer is agreeing to pay a specific amount for the vehicle, regardless of its market value at the time of the accident.

- Proof of Value: When you purchase stated value insurance, you will need to provide proof of the stated value of your vehicle. This may include documentation such as appraisals, auction results, or other relevant evidence. If you are unable to provide sufficient proof of value, the insurer may not honor your claim.

- Limited Coverage: Stated value insurance typically covers only the vehicle itself. It may not cover other expenses, such as rental car costs, lost wages, or medical expenses. This means that you may need to purchase additional coverage to protect yourself from these costs.

How Does Stated Value Car Insurance Work?

Stated value car insurance works differently than traditional car insurance policies. It’s designed for classic, antique, or modified vehicles that may not be accurately valued by standard methods. Here’s how it works:

Determining the Stated Value

When you purchase stated value insurance, you and your insurer agree on a specific dollar amount that represents the value of your vehicle. This amount is usually based on a professional appraisal, market research, or a combination of both. The stated value is crucial because it determines the maximum amount your insurer will pay if your car is totaled or stolen.

Calculating Premiums

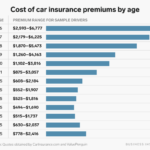

Stated value insurance premiums are calculated based on several factors, including:

* The stated value of your vehicle: Higher stated values generally lead to higher premiums.

* Your driving history: A clean driving record typically results in lower premiums.

* The age and condition of your vehicle: Older and more valuable vehicles often have higher premiums.

* Your location: Premiums may vary based on the risk of theft and accidents in your area.

The Claims Process

If your stated value car is damaged or stolen, the claims process is relatively straightforward:

* File a claim with your insurer: You’ll need to provide details about the incident and any supporting documentation.

* Your insurer will assess the damage or loss: If your car is totaled or stolen, your insurer will pay you the agreed-upon stated value, minus any deductible.

* You’ll receive your payout: The payment will be made directly to you or to the lienholder, if applicable.

It’s important to note that stated value insurance typically doesn’t cover comprehensive or collision coverage. This means you’ll be responsible for paying for repairs or replacement if your car is damaged in an accident.

When is Stated Value Car Insurance a Good Choice?

Stated value car insurance is a specialized type of coverage that can be a good fit for certain types of vehicles and situations. It offers a unique approach to determining the value of your car, making it an attractive option for some car owners.

This type of insurance is most advantageous when the standard market value of your car doesn’t accurately reflect its true worth. This is often the case with classic cars, collector cars, and other vehicles that have sentimental value or unique features.

Vehicles Well-Suited for Stated Value Insurance

- Classic Cars: These vehicles often appreciate in value over time, and their market value can be difficult to determine accurately. Stated value insurance allows you to set a specific value for your car, ensuring you receive adequate compensation in the event of a total loss.

- Collector Cars: Similar to classic cars, collector cars can be rare and valuable. Their unique features and limited production runs contribute to their high value, which may not be reflected in standard market valuations. Stated value insurance provides a way to protect this investment.

- Modified Cars: Vehicles with extensive modifications or custom upgrades may not be accurately valued by standard market value assessments. Stated value insurance allows you to account for these modifications and ensure you receive fair compensation for your investment.

- Antique Cars: Antique cars often have historical significance and may be irreplaceable. Stated value insurance allows you to set a value that reflects their historical importance and potential collector’s value.

Situations Where Stated Value Insurance is Advantageous, Stated value car insurance

- High-Value Vehicles: If your car is worth significantly more than its standard market value, stated value insurance can provide more comprehensive coverage. This is particularly true for classic cars, collector cars, and modified vehicles.

- Limited Market Data: When there is limited market data available for your car, standard market value assessments can be unreliable. Stated value insurance eliminates this uncertainty by allowing you to set the value yourself.

- Sentimental Value: If your car holds significant sentimental value, stated value insurance can ensure you receive adequate compensation in the event of a total loss. This type of insurance recognizes the unique value of your vehicle beyond its standard market value.

Factors to Consider When Choosing Stated Value Insurance

- Cost: Stated value insurance premiums are typically higher than standard car insurance premiums. This is because the insurer is assuming a higher risk by agreeing to pay a specific value for your car.

- Documentation: To support your stated value, you may need to provide documentation such as appraisals, restoration records, and other evidence of your car’s value. Be prepared to provide this documentation to your insurer.

- Appraisal: You may need to obtain an appraisal from a qualified professional to determine the fair market value of your car. This is especially important for classic cars and other vehicles with unique features.

- Insurer Requirements: Each insurer has its own specific requirements for stated value insurance. Make sure you understand the insurer’s requirements before you purchase this type of coverage.

Stated Value Insurance vs. Actual Cash Value Insurance

Stated value and actual cash value (ACV) are two different approaches to determining the value of your vehicle for insurance purposes. Understanding the key differences between these methods is crucial for making an informed decision about the right type of coverage for your needs.

Comparison of Stated Value and Actual Cash Value Insurance

Stated value and ACV insurance differ significantly in how they calculate the value of your vehicle in the event of a total loss or damage. Here’s a detailed comparison:

Coverage

- Stated Value Insurance: This type of insurance allows you to set a specific value for your vehicle, which is typically based on its market value or the amount you paid for it. The insurance company agrees to pay this stated value if the vehicle is totaled or damaged beyond repair.

- Actual Cash Value (ACV) Insurance: This type of insurance uses the vehicle’s fair market value at the time of the loss to determine the payout. The fair market value is typically calculated by considering the vehicle’s age, mileage, condition, and comparable vehicles in the market.

Claims Processing

- Stated Value Insurance: Claims processing is generally straightforward. If your vehicle is totaled or damaged beyond repair, the insurance company will pay the agreed-upon stated value, minus any deductible.

- Actual Cash Value (ACV) Insurance: Claims processing may involve more complexity, as the insurance company needs to determine the vehicle’s fair market value. This typically involves researching comparable vehicles and considering factors like depreciation.

Situations Where Each Type of Insurance is More Suitable

- Stated Value Insurance: Stated value insurance is generally a better choice for vehicles that are considered to be classic, antique, or collectible, as these vehicles may have a value that is significantly higher than their actual cash value. It is also a good option for vehicles that have been modified or customized, as these modifications may not be reflected in the vehicle’s actual cash value.

- Actual Cash Value (ACV) Insurance: Actual cash value insurance is typically a more affordable option, as the premiums are generally lower than stated value insurance. It is a good choice for newer vehicles or vehicles that have a lower value, as the fair market value is likely to be closer to the actual value of the vehicle.

Finding Stated Value Car Insurance

Finding stated value car insurance can be a bit trickier than finding standard car insurance. This is because not all insurance companies offer this type of coverage. However, there are a number of companies that do offer stated value car insurance, and it’s important to shop around to find the best deal.

Companies Offering Stated Value Car Insurance

The following are some insurance companies that offer stated value car insurance:

- Hagerty: Hagerty is a well-known provider of insurance for classic and collector cars, and they are a great option for stated value insurance. They offer a variety of coverage options, including comprehensive and collision coverage, and they are known for their excellent customer service.

- American Collectors Insurance: American Collectors Insurance is another popular choice for stated value insurance. They offer a variety of coverage options, including agreed value coverage, and they are known for their competitive rates.

- Grundy: Grundy is a specialized insurance company that focuses on classic and collector cars. They offer a variety of coverage options, including stated value insurance, and they are known for their expertise in insuring these types of vehicles.

- AAA: Some AAA chapters offer stated value car insurance. However, coverage options and availability vary depending on your location and the specific AAA chapter.

- Nationwide: Nationwide is a large insurance company that offers stated value car insurance for classic and collector cars. They have a variety of coverage options and are known for their strong financial stability.

- State Farm: State Farm is another large insurance company that offers stated value car insurance. They offer a variety of coverage options and are known for their excellent customer service.

Obtaining a Quote for Stated Value Insurance

The process of obtaining a quote for stated value insurance is similar to the process of obtaining a quote for standard car insurance. You will need to provide the insurance company with information about your car, including:

- Year, make, and model

- Vehicle identification number (VIN)

- Mileage

- Condition

- Value

You will also need to provide information about your driving history, including:

- Your age

- Your driving record

- Your address

Once you have provided this information, the insurance company will be able to provide you with a quote for stated value insurance.

Factors Considered in Evaluating Applications for Stated Value Insurance

When evaluating applications for stated value insurance, insurance companies will consider a number of factors, including:

- The age and condition of the vehicle: Older and more rare vehicles are generally more expensive to insure, as they are more likely to be damaged or stolen.

- The value of the vehicle: The higher the value of the vehicle, the higher the premium will be.

- The driving history of the insured: Drivers with a history of accidents or traffic violations are more likely to be charged higher premiums.

- The location of the vehicle: Vehicles that are stored in high-crime areas are more likely to be stolen or damaged, and may be charged higher premiums.

Insurance companies may also require you to provide documentation to support the value of your vehicle, such as:

- An appraisal from a qualified appraiser

- A recent auction result for a similar vehicle

- A sales invoice for the vehicle

It is important to note that insurance companies may not approve stated value insurance for all vehicles. They may also have certain limitations on the amount of coverage they will provide. It is important to carefully review the policy terms and conditions before purchasing stated value insurance.

Considerations for Stated Value Car Insurance

Choosing the right stated value for your vehicle is crucial for ensuring you receive adequate coverage in the event of a total loss. If you undervalue your car, you might not receive enough compensation to replace it. On the other hand, overvaluing your vehicle could lead to higher premiums.

Accurately Valuing Your Vehicle

Accurately valuing your vehicle is essential for obtaining the right level of coverage. Stated value insurance requires you to provide a specific value for your car, which becomes the amount you’ll receive in the event of a total loss. It’s important to be realistic about your car’s worth, considering its age, condition, mileage, and market value.

- Research comparable vehicles: Check online marketplaces, auto classifieds, and auction sites to find similar vehicles that have recently sold. This will give you a good idea of what your car is worth.

- Consider any modifications or upgrades: If you’ve made any modifications or upgrades to your car, these should be factored into its value. Obtain receipts and documentation to support your claims.

- Get a professional appraisal: If you’re unsure about your car’s value, it’s a good idea to get a professional appraisal from a qualified appraiser. This will provide an objective assessment of your car’s worth.

Risks of Under- or Over-Valuing

Under- or over-valuing your vehicle can have significant consequences.

Under-Valuing

- Insufficient coverage: If you undervalue your car, you may not receive enough compensation to replace it after a total loss. This could leave you out of pocket for the difference.

- Financial hardship: The under-valuation could result in significant financial hardship if you need to replace your car and don’t have enough insurance proceeds to cover the cost.

Over-Valuing

- Higher premiums: Overvaluing your vehicle could lead to higher insurance premiums, as you’ll be paying for coverage based on a higher value than your car is actually worth.

- Potential for disputes: If you overvalue your car, the insurance company might dispute your claim and refuse to pay the full stated value. This could lead to a lengthy and costly legal battle.

Common Misconceptions

There are several common misconceptions about stated value insurance.

Misconception: Stated value insurance is always cheaper than actual cash value insurance.

- Clarification: While stated value insurance can sometimes be cheaper, it’s not always the case. The cost of stated value insurance will depend on several factors, including the value of your vehicle, your driving record, and your location. It’s important to get quotes from multiple insurers to compare rates.

Misconception: Stated value insurance is only for classic cars.

- Clarification: Stated value insurance can be a good option for any vehicle that you want to insure for a specific value. This includes classic cars, collector cars, motorcycles, and even newer vehicles that have been modified or upgraded.

Misconception: Stated value insurance will always cover the full value of your vehicle.

- Clarification: Stated value insurance will only cover the value you’ve stated for your vehicle. If you undervalue your car, you may not receive enough compensation to replace it. It’s important to be realistic about your car’s worth and choose a stated value that reflects its true market value.

Closing Summary

Stated value car insurance provides a tailored solution for owners of unique and valuable vehicles. By understanding the intricacies of this type of insurance, you can make an informed decision about whether it’s the right fit for your needs. While it offers the advantage of guaranteed coverage for your chosen value, it’s crucial to carefully assess your individual circumstances and ensure you’re comfortable with the potential risks and limitations associated with this type of policy.

Essential FAQs

What is the difference between stated value and actual cash value insurance?

Stated value insurance allows you to set a specific value for your vehicle, while actual cash value insurance bases coverage on the current market value of your car, which can be significantly lower than the original purchase price.

How do I determine the stated value of my vehicle?

You can use a variety of resources to determine the stated value of your vehicle, including appraisals from qualified professionals, online valuation tools, and historical sales data for similar vehicles.

Is stated value insurance more expensive than actual cash value insurance?

The cost of stated value insurance can vary depending on factors such as the age, make, and model of your vehicle, as well as your driving history and location. However, it’s generally more expensive than actual cash value insurance.