State minimum auto insurance Michigan sets the stage for a complex yet crucial topic for drivers in the state. Michigan boasts a unique “no-fault” insurance system, which means that drivers are primarily covered by their own insurance, regardless of who is at fault in an accident. This system is designed to ensure quick and efficient compensation for medical expenses and lost wages. However, navigating the intricacies of this system, including understanding the minimum required coverages, can be challenging for drivers.

This guide delves into the essential aspects of state minimum auto insurance in Michigan, covering the legal requirements, the no-fault system, factors influencing insurance costs, choosing the right coverage, and resources for drivers. We aim to provide a clear and concise overview of this critical topic, empowering drivers to make informed decisions about their auto insurance needs.

Michigan’s Minimum Auto Insurance Requirements: State Minimum Auto Insurance Michigan

Michigan is a “no-fault” insurance state, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who was at fault. This unique system has its own set of minimum insurance requirements, which every driver must adhere to.

Mandatory Auto Insurance Coverages

Michigan law mandates that all drivers carry specific types of auto insurance coverage. These coverages provide financial protection in the event of an accident, ensuring that you and others involved are financially compensated for damages and injuries.

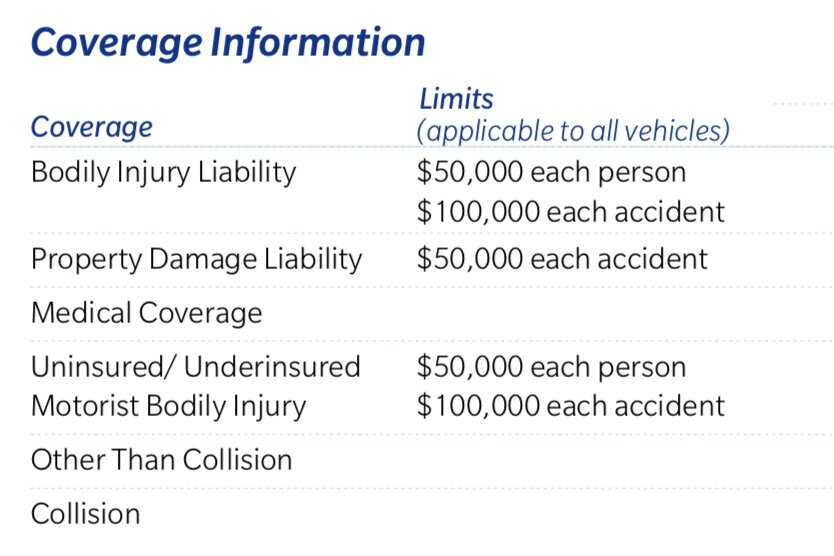

- Bodily Injury Liability: This coverage protects you financially if you cause an accident that injures another person. It covers the injured party’s medical expenses, lost wages, and pain and suffering. The minimum requirement in Michigan is $25,000 per person and $50,000 per accident. This means that you are covered for up to $25,000 for injuries to a single person and up to $50,000 for all injuries in a single accident.

- Property Damage Liability: This coverage protects you financially if you cause an accident that damages another person’s property, such as their vehicle or other belongings. The minimum requirement in Michigan is $25,000. This means that you are covered for up to $25,000 for damage to another person’s property in a single accident.

- Personal Injury Protection (PIP): This coverage is unique to Michigan’s no-fault system. It covers your own medical expenses, lost wages, and other related expenses, regardless of who was at fault in an accident. The minimum PIP coverage in Michigan is $50,000 per person, but you can choose higher limits. This coverage also includes death benefits for your dependents in case of your death in an accident.

- Uninsured Motorist Coverage: This coverage protects you financially if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and other related expenses, as well as property damage to your vehicle. The minimum requirement in Michigan is $25,000 per person and $50,000 per accident.

Financial Responsibility Laws and Penalties

Michigan has strict financial responsibility laws that require all drivers to maintain the minimum auto insurance coverage. Driving without the required insurance is illegal and can result in serious consequences.

Driving without insurance is a misdemeanor offense in Michigan.

- Penalties: The penalties for driving without insurance in Michigan can be severe. They include:

- Fines: You could face fines of up to $500.

- License Suspension: Your driver’s license could be suspended for up to one year.

- Impoundment: Your vehicle could be impounded until you provide proof of insurance.

- Jail Time: In some cases, you could face jail time.

- Accident Costs: If you are involved in an accident without insurance, you will be personally responsible for all costs associated with the accident, including:

- Medical expenses: Your own medical bills and those of anyone you injure.

- Property damage: The cost of repairs or replacement of any damaged property.

- Lost wages: Your own lost wages and those of anyone you injure.

- Legal fees: If you are sued by the other party.

Understanding Michigan’s No-Fault System

Michigan’s no-fault auto insurance system is a unique approach to handling car accident claims. Unlike traditional fault-based systems, where drivers are held responsible for damages, Michigan’s no-fault system focuses on compensating injured individuals regardless of who caused the accident.

Personal Injury Protection (PIP) Coverage

PIP coverage is a crucial component of Michigan’s no-fault system. It provides financial protection for medical expenses and lost wages resulting from a car accident, regardless of who is at fault.

How PIP Coverage Works

PIP coverage operates as follows:

* Medical Expenses: PIP covers reasonable and necessary medical expenses incurred due to a car accident, including doctor visits, hospital stays, physical therapy, and prescription medications.

* Lost Wages: PIP also provides compensation for lost wages, helping individuals maintain financial stability while recovering from injuries. This benefit is typically limited to a specific amount per week and a total amount for the entire claim.

PIP Coverage Limits

Michigan law requires all drivers to carry a minimum amount of PIP coverage, but drivers can choose higher limits to provide greater financial protection.

The “Threshold” Concept

The “threshold” is a significant aspect of Michigan’s no-fault system, determining when an injured individual can sue for pain and suffering. The threshold concept is designed to limit frivolous lawsuits and encourage the use of PIP benefits.

Threshold Types

There are two primary threshold types in Michigan:

* The “Serious Impairment of Body Function” Threshold: This threshold requires the injured individual to prove that their injuries have caused a “serious impairment of body function.” This standard is generally high and requires significant medical evidence.

* The “Permanent Serious Disfigurement” Threshold: This threshold applies when the injured individual has suffered a permanent disfigurement that is objectively serious.

Suing for Pain and Suffering

If the injured individual meets the “serious impairment of body function” or “permanent serious disfigurement” threshold, they can sue the at-fault driver for pain and suffering. However, if they do not meet the threshold, they are generally limited to recovering economic damages through PIP coverage.

Factors Influencing Minimum Insurance Costs

In Michigan, the minimum auto insurance requirements are set by law, but the actual cost of your insurance can vary significantly depending on a number of factors. Understanding these factors can help you make informed decisions about your coverage and potentially save money on your premiums.

Factors Affecting Minimum Insurance Rates

Several key factors influence the minimum auto insurance rates you pay in Michigan. These include:

- Age and Driving Experience: Younger drivers with less experience are statistically more likely to be involved in accidents, which leads to higher premiums. As you gain experience and age, your rates typically decrease.

- Driving History: Your driving record plays a significant role in determining your insurance rates. Accidents, traffic violations, and DUI convictions can all lead to higher premiums. Maintaining a clean driving record is crucial for keeping your rates low.

- Vehicle Type: The type of vehicle you drive also influences your insurance costs. Sports cars and luxury vehicles are often more expensive to repair or replace, resulting in higher premiums. Conversely, older, less expensive cars generally have lower premiums.

- Location: Your geographic location impacts insurance rates due to factors such as traffic density, crime rates, and the frequency of accidents in your area. Urban areas with high traffic and congestion tend to have higher premiums compared to rural areas with lower traffic volumes.

- Credit Score: While not directly related to driving, your credit score can influence your insurance premiums. Some insurance companies use credit scores as a proxy for risk assessment, believing that individuals with good credit are more responsible and less likely to file claims.

Insurance Company Pricing Strategies, State minimum auto insurance michigan

Insurance companies employ various pricing strategies to determine your minimum auto insurance rates. These strategies can vary significantly between companies:

- Risk-Based Pricing: Most companies use risk-based pricing models, which consider factors like your age, driving history, vehicle type, and location to assess your risk of being involved in an accident. Individuals deemed higher risk are charged higher premiums.

- Usage-Based Insurance (UBI): Some companies offer UBI programs that track your driving habits using telematics devices or smartphone apps. These programs can reward safe driving behavior with discounts, while penalizing risky driving habits like speeding or hard braking.

- Bundling Discounts: Many insurance companies offer discounts for bundling multiple insurance policies, such as auto, home, and renters insurance, under one provider. These discounts can significantly reduce your overall insurance costs.

Examples of How Specific Factors Impact Premiums

- Age and Driving Experience: A 18-year-old driver with a clean record might pay significantly higher premiums than a 40-year-old driver with 20 years of accident-free driving experience.

- Driving History: A driver with a recent DUI conviction can expect to pay significantly higher premiums than a driver with a clean driving record.

- Vehicle Type: A new, high-performance sports car will typically have a higher premium than a used, mid-sized sedan.

- Location: A driver living in a densely populated urban area with high traffic volumes might pay higher premiums than a driver living in a rural area with lower traffic congestion.

Choosing the Right Coverage for Your Needs

Michigan’s minimum auto insurance requirements are designed to provide basic protection in case of an accident. However, they may not be sufficient for everyone’s needs. Choosing the right auto insurance coverage goes beyond simply meeting the minimum requirements. It involves carefully considering your individual circumstances and ensuring you have adequate protection in case of an accident.

Factors to Consider When Choosing Coverage

- Your driving history: A clean driving record with no accidents or violations typically results in lower insurance premiums. Conversely, a history of accidents or violations can lead to higher premiums.

- The type of vehicle you drive: The make, model, and year of your vehicle can significantly impact your insurance costs. Newer, more expensive vehicles tend to have higher insurance premiums due to their replacement value and repair costs.

- Your driving habits: Factors such as the number of miles you drive annually, your commute distance, and whether you use your vehicle for business purposes can affect your insurance premiums.

- Your financial situation: Your ability to pay for potential accident-related expenses, such as medical bills or property damage, should be considered. Higher coverage limits provide more financial protection but also come with higher premiums.

- Your personal risk tolerance: Some individuals are comfortable with minimal coverage, while others prefer greater protection. Assessing your risk tolerance helps determine the appropriate level of coverage for your needs.

Benefits of Exceeding Minimum Requirements

Exceeding Michigan’s minimum auto insurance requirements can provide significant benefits, such as:

- Higher Liability Limits: Liability coverage protects you financially if you are at fault in an accident. Higher liability limits provide greater financial protection, covering more significant damages and potential legal expenses.

- Additional Coverage Options: Exceeding minimum requirements allows you to purchase additional coverage options, such as:

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): Provides coverage for medical expenses, lost wages, and other related expenses in case of an accident, regardless of fault.

- Peace of Mind: Having adequate insurance coverage provides peace of mind knowing that you are financially protected in case of an accident.

Finding Affordable Insurance with Adequate Protection

- Compare Quotes: Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Bundle Your Policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to discounts.

- Consider Deductibles: Higher deductibles can lower your premiums but require you to pay more out-of-pocket in case of an accident.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to maintain a good driving record, which can lead to lower premiums.

- Ask About Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

Closure

Navigating the world of auto insurance in Michigan can be complex, but understanding the state’s minimum requirements and the nuances of its no-fault system is essential. By carefully considering your individual needs and exploring available options, you can ensure you have adequate protection while finding affordable insurance. Remember, resources are available to assist you in understanding your rights and responsibilities, making the process less daunting.

Query Resolution

What happens if I get into an accident and don’t have the minimum required insurance?

You could face serious consequences, including fines, license suspension, and even jail time. It’s crucial to have the minimum required insurance to avoid these penalties.

Can I choose to have more coverage than the state minimum?

Absolutely! It’s highly recommended to consider higher liability limits and additional coverage options, such as collision and comprehensive, to ensure you are adequately protected in case of a major accident.

How can I compare insurance quotes from different companies?

You can use online comparison websites or contact insurance agents directly to obtain quotes. It’s wise to compare quotes from several companies to find the best rates and coverage options.

Where can I find more information about Michigan’s no-fault insurance system?

The Michigan Department of Insurance and Financial Services (DIFS) is an excellent resource for comprehensive information about auto insurance in the state. You can visit their website or contact them directly for assistance.