Out of state auto insurance coverage – Out-of-state auto insurance coverage is essential for drivers who venture beyond their home state. Whether you’re on a road trip, relocating, or simply commuting across state lines, having the right insurance protection is crucial. This guide explores the complexities of out-of-state coverage, from understanding legal requirements to navigating the claims process. We’ll also discuss common misconceptions and provide valuable tips for ensuring you have adequate coverage for your travels.

The need for out-of-state auto insurance arises from the fact that each state has its own set of regulations regarding minimum coverage requirements. Driving in another state without meeting those requirements could result in serious consequences, including hefty fines and even license suspension. Additionally, your home state’s insurance policy may not fully cover you in an accident that occurs outside of your state of residence.

Understanding Out-of-State Auto Insurance Coverage

When you drive your car across state lines, it’s crucial to understand how your auto insurance policy will cover you in case of an accident. While your home state’s policy may provide some coverage, it’s essential to be aware of the specific requirements and limitations of out-of-state coverage.

Out-of-State Auto Insurance Coverage Basics

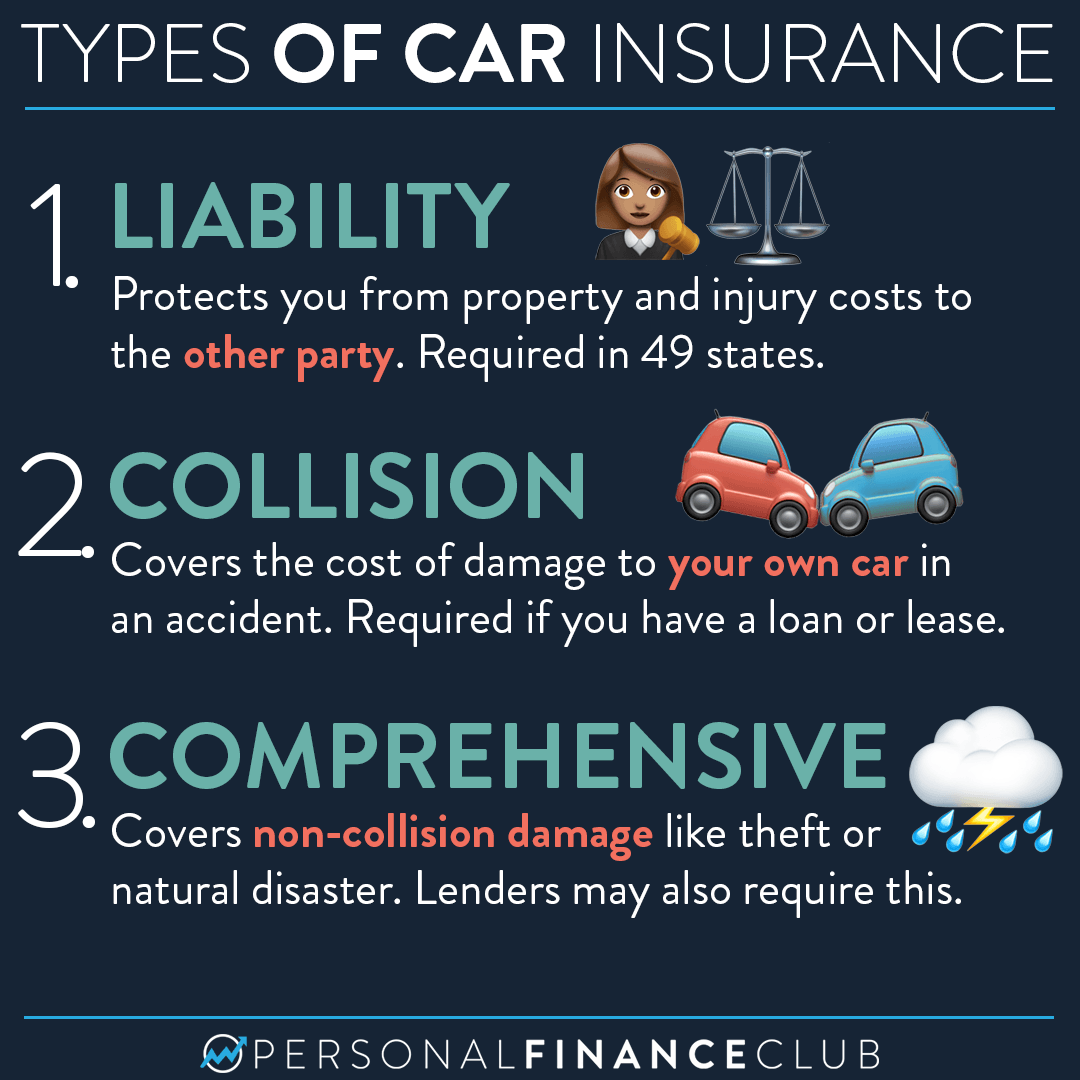

Out-of-state auto insurance coverage extends the protection of your home state policy to other states. It typically includes liability coverage, which protects you financially if you cause an accident that injures someone or damages their property. Your policy may also cover your own vehicle in case of an accident, depending on the coverage you have purchased.

Common Misconceptions about Out-of-State Coverage

Many drivers mistakenly believe that their home state’s auto insurance policy automatically provides full coverage in any state. However, this is not always true. It’s essential to understand the specific provisions of your policy and the legal requirements of the state you’re driving in.

Legal Requirements for Driving in Other States

Each state has its own minimum auto insurance requirements, which specify the minimum liability coverage you must carry to drive legally. These requirements can vary significantly from state to state. For instance, some states may require higher liability limits for bodily injury or property damage than others.

It’s important to note that even if your home state’s policy meets the minimum requirements of the state you’re driving in, it may not provide adequate coverage in case of a serious accident.

Situations Where Out-of-State Coverage is Necessary

There are several situations where having adequate out-of-state coverage is essential. These include:

- Traveling to a state with higher minimum insurance requirements.

- Driving in a state with a higher cost of living, where medical expenses or property damage claims could be more significant.

- Driving in a state with different traffic laws or road conditions, increasing the risk of accidents.

- Driving a rental car, as your personal auto insurance may not cover you for a rental vehicle.

Key Considerations for Out-of-State Drivers: Out Of State Auto Insurance Coverage

Hitting the road and exploring new states is exciting, but ensuring you have the right auto insurance coverage is crucial. When you drive out of state, your regular insurance policy might not offer the same level of protection, potentially leaving you vulnerable in case of an accident.

Factors Influencing Out-of-State Coverage Needs

Understanding the factors that influence your out-of-state coverage needs is essential for making informed decisions.

- Duration of the trip: If you’re just driving through a state for a short period, your existing policy might be sufficient. However, if you’re relocating or planning a long-term stay, you’ll need to consider more comprehensive coverage options.

- Purpose of the trip: If you’re driving for work, your employer might have specific insurance requirements. For recreational purposes, your needs may be different.

- State laws and regulations: Each state has its own set of auto insurance laws, including minimum coverage requirements. You need to be aware of these laws and ensure your policy meets the minimum requirements of the state you’re driving in.

- Your vehicle type: Different states have varying requirements for specific vehicle types, such as commercial vehicles or motorcycles.

Comparing and Contrasting Coverage Options for Different States

State-specific insurance laws and requirements play a significant role in determining your coverage needs.

- Minimum Coverage Requirements: Some states require only liability coverage, while others mandate more comprehensive coverage, including collision and comprehensive. Knowing the minimum requirements for the state you’re driving in is essential to avoid legal penalties and ensure you have adequate protection.

- Coverage Options: States may offer different coverage options, such as uninsured/underinsured motorist coverage, personal injury protection, and rental car coverage. Researching the available options and comparing them to your existing policy is crucial to determine if you need to adjust your coverage.

- Cost Variations: Insurance premiums can vary significantly between states. Factors like the cost of living, accident rates, and competition in the insurance market contribute to these differences. Comparing quotes from different insurers in the state you’re driving in can help you find the most affordable option.

Understanding Policy Limitations

It’s crucial to understand the limitations of your existing policy when driving out of state.

- Coverage Gaps: Your policy might not cover certain situations or events that are common in other states. For instance, some policies might not cover damage caused by natural disasters specific to a particular region. Understanding these gaps is crucial to determine if you need additional coverage.

- Exclusions: Certain activities or driving conditions might be excluded from your policy. For example, driving a vehicle for commercial purposes or driving in a high-risk area might be excluded. Reviewing your policy to understand these exclusions is vital to ensure you have adequate protection.

Potential Cost Differences for Out-of-State Coverage

Insurance premiums can fluctuate depending on the state you’re driving in.

- Higher Risk States: States with higher accident rates or higher costs of living tend to have higher insurance premiums. Factors like traffic density, road conditions, and the prevalence of certain types of accidents can contribute to these differences.

- State-Specific Discounts: Some states offer discounts for good driving records, safety features, or participation in certain programs. Researching these discounts and taking advantage of them can help you reduce your premiums.

- Comparison Shopping: Comparing quotes from different insurers in the state you’re driving in is essential to find the most competitive rates. Online comparison tools can make this process more efficient and convenient.

Obtaining Out-of-State Auto Insurance

Securing out-of-state auto insurance is a crucial step when relocating or planning to drive in another state. Understanding the process, available options, and key considerations can help you find the right coverage to meet your needs.

The Process of Obtaining Out-of-State Coverage

Obtaining out-of-state auto insurance typically involves contacting an insurance provider, providing necessary information, and completing the application process. The steps usually include:

- Contacting an insurance provider: Start by contacting insurance companies that operate in the state where you plan to drive. You can do this online, over the phone, or by visiting an insurance agent’s office.

- Providing information: You will be asked to provide personal information, such as your name, address, driving history, and details about your vehicle. Be prepared to share your driver’s license number, Social Security number, and vehicle identification number (VIN).

- Getting a quote: Based on the information you provide, the insurance company will generate a quote for your coverage. This quote will include the estimated premium you will pay for the policy.

- Choosing a policy: Once you have received quotes from different providers, compare them carefully. Consider factors such as coverage limits, deductibles, and premium costs.

- Paying your premium: After selecting a policy, you will need to pay your premium. You can typically pay online, by phone, or by mail.

- Receiving your insurance card: Once your payment is processed, you will receive your insurance card, which you must carry with you while driving.

The Role of Insurance Brokers and Agents, Out of state auto insurance coverage

Insurance brokers and agents play a crucial role in helping you find the right out-of-state auto insurance policy. They act as intermediaries between you and insurance companies, providing guidance and support throughout the process.

- Insurance agents: Typically represent a single insurance company. They can help you understand the different coverage options available and provide personalized recommendations based on your specific needs.

- Insurance brokers: Represent multiple insurance companies. They can compare quotes from various providers and help you find the best policy for your situation.

Comparing Insurance Providers and Coverage Options

Here’s a table comparing some popular insurance providers and their out-of-state coverage options:

| Insurance Provider | Out-of-State Coverage Options | Key Features |

|---|---|---|

| Provider A | Comprehensive, Collision, Liability, Personal Injury Protection (PIP) | Wide coverage options, competitive pricing, excellent customer service |

| Provider B | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist (UM/UIM) | Strong financial stability, high customer satisfaction ratings, discounts for safe driving |

| Provider C | Liability, Collision, Comprehensive, Roadside Assistance | Convenient online tools, 24/7 customer support, flexible payment options |

Tips for Finding the Best Out-of-State Insurance Policy

Here are some tips to help you find the best out-of-state auto insurance policy:

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Get quotes from at least three different insurance companies to compare prices and coverage options.

- Consider your individual needs: Think about your driving habits, the type of vehicle you drive, and the amount of coverage you require.

- Look for discounts: Many insurance companies offer discounts for safe drivers, good students, and multiple vehicle policies. Ask about available discounts when you are getting quotes.

- Read the policy carefully: Before you sign up for a policy, make sure you understand all the terms and conditions. Pay close attention to coverage limits, deductibles, and exclusions.

Filing a Claim with Out-of-State Coverage

When you’re involved in an accident while driving in another state, it’s crucial to know how to file a claim with your out-of-state insurance provider. The process might differ slightly from filing a claim in your home state, but the core steps remain the same.

Contacting Your Insurance Provider

It’s essential to contact your insurance provider as soon as possible after an accident. They will guide you through the claim process and provide any necessary instructions.

Here are some ways to contact your insurance provider:

- Call the customer service number on your insurance card.

- Use the online portal on your insurance company’s website.

- Visit a local branch of your insurance company.

Documenting the Accident

After contacting your insurance provider, you’ll need to gather essential documents to support your claim. These documents will help your insurance company assess the damages and determine the coverage.

Here’s a checklist of necessary documents:

- Police report: The police report provides an official account of the accident, including details about the location, date, time, and involved parties.

- Photos and videos: Visual evidence of the accident scene, damage to your vehicle, and any injuries sustained can be crucial.

- Witness statements: Statements from any witnesses present at the accident can provide valuable information about what happened.

- Medical records: If you or any passengers sustained injuries, medical records will document the extent of the injuries and treatment received.

- Repair estimates: Obtain estimates from reputable repair shops for the cost of repairing your vehicle.

Potential Challenges

Filing a claim with out-of-state coverage might present some challenges.

Here are some potential challenges:

- Different state laws: Each state has its own set of laws governing auto insurance and claims. Your insurance provider might need to navigate these different laws when processing your claim.

- Communication barriers: Communicating with your insurance provider might be more challenging if you’re in a state with a different language or dialect.

- Limited access to services: You might have limited access to your insurance company’s services, such as local branch offices or roadside assistance, while you’re out of state.

Maintaining Out-of-State Coverage

Keeping your out-of-state auto insurance coverage current is crucial for protecting yourself financially and legally while driving in another state. Ensuring continuous coverage involves a few key steps, and failing to do so can lead to significant consequences.

Keeping Insurance Information Updated

Maintaining accurate and up-to-date insurance information is vital for seamless coverage. This includes notifying your insurance provider about any changes in your driving situation, such as:

- A change in your address, as this impacts your coverage area and potential discounts.

- Adding a new driver to your policy, as this alters the risk profile and premium.

- Purchasing a new vehicle, as this requires updating the coverage details and possibly adjusting the premium.

- Changes in your driving habits, such as driving less frequently or using your vehicle for business purposes, which may affect the type of coverage you need.

Promptly updating your insurance information ensures that your coverage remains valid and reflects your current circumstances.

Ensuring Continuous Coverage While Driving Out-of-State

Maintaining continuous coverage while driving out-of-state requires careful planning and adherence to certain practices:

- Confirm your policy’s coverage limits and restrictions for out-of-state driving. Some policies might have specific limitations or require additional coverage for driving outside your home state.

- Contact your insurance provider to inform them about your travel plans, especially if you’re driving for an extended period or to a different region. This allows them to adjust your coverage as needed.

- Consider purchasing additional coverage, such as non-resident motorist coverage, which provides protection in case of accidents in states where you don’t have primary insurance.

- Carry your insurance card and proof of coverage while driving. This documentation is crucial for verification purposes in case of accidents or traffic stops.

Potential Consequences of Driving Without Valid Insurance

Driving without valid auto insurance can have serious consequences, including:

- Fines and penalties: Most states impose hefty fines for driving without insurance, ranging from hundreds to thousands of dollars, depending on the severity of the offense and the state’s laws.

- License suspension: Driving without insurance can lead to license suspension, making it illegal to drive in the state until the suspension is lifted. This can significantly disrupt your daily life and impact your ability to commute, work, and participate in other activities.

- Vehicle impoundment: In some cases, authorities may impound your vehicle if you’re caught driving without insurance. This can involve additional fees and complicate the process of getting your vehicle back.

- Financial hardship: In case of an accident, driving without insurance leaves you responsible for all costs, including repairs, medical bills, and legal fees. This can lead to significant financial hardship, especially if you’re involved in a serious accident.

- Legal issues: Driving without insurance can escalate into legal problems, particularly if you’re involved in an accident. You may face lawsuits from injured parties or face criminal charges for driving without insurance.

Maintaining Out-of-State Coverage: A Flowchart

| Step | Action | Outcome |

| 1 | Contact your insurance provider | Confirm out-of-state coverage limits and restrictions. |

| 2 | Inform your insurance provider of travel plans | Ensure coverage adjustments are made for out-of-state driving. |

| 3 | Consider purchasing additional coverage (non-resident motorist) | Gain extra protection in case of accidents in states where you don’t have primary insurance. |

| 4 | Carry your insurance card and proof of coverage | Provide documentation for verification in case of accidents or traffic stops. |

| 5 | Update your insurance information promptly | Maintain valid and accurate coverage based on your current circumstances. |

Closing Notes

Navigating out-of-state auto insurance can be a complex process, but understanding the basics is essential for any driver who travels beyond their home state. By carefully considering your coverage needs, comparing insurance options, and staying informed about legal requirements, you can ensure that you have the right protection for your travels. Remember, having the right insurance can make all the difference in the event of an accident, giving you peace of mind and financial security on the road.

Frequently Asked Questions

What happens if I get into an accident in another state?

If you get into an accident in another state, your insurance company will handle the claim according to the terms of your policy. However, you should be aware of the differences in coverage requirements and limits between states. It’s important to have adequate coverage to protect yourself financially in the event of an accident.

Do I need to notify my insurance company if I’m driving out of state?

It’s generally a good idea to inform your insurance company if you’re driving out of state for an extended period. This allows them to assess your coverage needs and make any necessary adjustments to your policy.

Can I get a temporary out-of-state insurance policy?

Some insurance companies offer temporary out-of-state insurance policies for short trips. These policies provide basic coverage for a limited time and can be a good option if you’re only driving out of state for a few days.

How do I find out the minimum insurance requirements for a particular state?

You can find information about minimum insurance requirements for each state on the website of your state’s Department of Motor Vehicles (DMV). You can also contact your insurance agent or broker for guidance.