Get a State Farm car insurance quote today and secure the peace of mind that comes with knowing you’re protected on the road. State Farm, a leading insurance provider with a long history of reliability, offers a variety of coverage options tailored to your individual needs. From comprehensive and collision coverage to liability and uninsured motorist protection, State Farm provides a comprehensive suite of insurance solutions designed to safeguard you and your vehicle.

Obtaining a quote is a simple and straightforward process, whether you prefer to do it online, over the phone, or in person. State Farm’s user-friendly online platform allows you to receive a personalized quote in minutes, while their dedicated agents are available to answer your questions and guide you through the process. State Farm takes into account factors such as your driving history, vehicle details, and location to provide you with a fair and accurate quote.

Understanding the Need for Car Insurance

Owning a car is a significant investment, and it’s essential to protect that investment with comprehensive car insurance. Car insurance provides financial protection in case of accidents, theft, or other unforeseen events that could damage your vehicle or cause injuries. It offers peace of mind knowing you’re covered against potential financial burdens.

Types of Car Insurance Coverage

Car insurance policies typically include various coverage options, each designed to address specific risks. Understanding these options allows you to choose the right coverage for your needs and budget.

- Liability Coverage: This is the most basic type of car insurance, and it’s usually required by law. It covers damages to other people’s property or injuries caused by you in an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your car if you’re involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your car against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage provides benefits for lost wages and medical expenses for you and your passengers, regardless of fault.

Common Car Insurance Scenarios

Car insurance plays a vital role in various situations, protecting you from significant financial losses.

- Accident: If you’re involved in an accident, liability coverage helps pay for damages to other vehicles or injuries to other people. Collision coverage covers repairs or replacement of your own vehicle.

- Theft: If your car is stolen, comprehensive coverage pays for the replacement or repair of your vehicle.

- Natural Disaster: If your car is damaged by a natural disaster like a flood or hurricane, comprehensive coverage can help with repairs or replacement.

- Hit-and-Run: If you’re hit by an uninsured driver, uninsured/underinsured motorist coverage can help cover your damages.

- Medical Expenses: If you or your passengers are injured in an accident, medical payments coverage or personal injury protection (PIP) can help pay for medical bills.

State Farm as a Car Insurance Provider

State Farm is a household name in the United States, synonymous with reliable and affordable car insurance. With a rich history spanning over a century, State Farm has established itself as a leading force in the insurance industry.

State Farm’s History and Size

State Farm was founded in 1922 by George J. Mecherle, a farmer in Bloomington, Illinois. Initially focusing on auto insurance, State Farm quickly expanded its offerings to include other insurance products like home, life, and health insurance. Today, State Farm is the largest provider of auto insurance in the United States, with over 83 million policies in force. Its widespread presence across the country is a testament to its enduring popularity and trust among customers.

State Farm’s Unique Selling Propositions

State Farm distinguishes itself from other car insurance providers through its commitment to customer satisfaction and its comprehensive range of services. Here are some of State Farm’s key USPs:

- Strong Financial Stability: State Farm is known for its financial strength and stability. With an A++ rating from A.M. Best, a leading insurance rating agency, State Farm demonstrates its ability to meet its financial obligations and provide reliable coverage to its policyholders. This financial strength is a significant factor for many customers when choosing an insurance provider.

- Wide Range of Coverage Options: State Farm offers a comprehensive range of car insurance coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. This allows customers to tailor their policies to their specific needs and budget.

- Competitive Pricing: State Farm is known for its competitive pricing on car insurance. The company leverages its size and expertise to negotiate favorable rates with its insurance partners, which ultimately benefits its customers. State Farm also offers various discounts and promotions to help customers save money on their premiums.

- Excellent Customer Service: State Farm is renowned for its excellent customer service. The company employs a vast network of agents across the country, providing customers with personalized support and guidance. State Farm also offers convenient online and mobile tools to manage policies and file claims.

- Innovative Technology: State Farm embraces technology to enhance its customer experience. The company offers a variety of digital tools, including online quotes, policy management, and claims reporting, making it easier for customers to interact with the company. State Farm’s mobile app is also highly rated for its user-friendliness and functionality.

Comparing State Farm with Other Major Insurance Providers

While State Farm is a prominent player in the car insurance market, it faces competition from other major insurance providers. Here’s a comparison of State Farm’s offerings with those of some of its key competitors:

- Geico: Geico is known for its low rates and its focus on online convenience. However, Geico’s customer service ratings are generally lower than State Farm’s. While Geico may offer slightly lower premiums in some cases, State Farm often provides a wider range of coverage options and a more personalized customer experience.

- Progressive: Progressive is known for its innovative features, such as its “Name Your Price” tool and its “Snapshot” program, which rewards safe driving habits. However, Progressive’s rates can vary significantly depending on individual factors, and its customer service ratings are mixed. State Farm offers a more consistent and predictable pricing structure, and its customer service is generally more highly regarded.

- Allstate: Allstate is a well-established insurance provider known for its “Good Hands” advertising campaign. Allstate offers a variety of insurance products, including car insurance, but its rates are often higher than State Farm’s. State Farm typically provides a more competitive price for car insurance while offering a similar level of coverage and customer service.

The Process of Obtaining a Quote

Getting a car insurance quote from State Farm is straightforward and can be done online, over the phone, or in person. This section will guide you through the process, outlining the steps involved and the information required for a personalized quote.

Getting a Quote Online

The online process is designed to be user-friendly and efficient. It allows you to get a quote in minutes without needing to contact an agent directly.

- Visit the State Farm website and navigate to the car insurance quote section.

- Enter your zip code to find local rates and coverage options.

- Provide basic information about yourself, including your name, address, and date of birth.

- Enter details about your vehicle, such as make, model, year, and VIN.

- Provide information about your driving history, including your driving record, license type, and any accidents or violations.

- Select your desired coverage levels and any additional options you want, such as roadside assistance or rental car coverage.

- Review your quote and compare it to other options. If you’re satisfied, you can proceed to purchase the policy online.

Getting a Quote Over the Phone or In Person

You can also request a car insurance quote by phone or in person. This allows you to speak directly with a State Farm agent who can answer your questions and provide personalized recommendations.

- Call the State Farm customer service line or find a local agent’s contact information on the State Farm website.

- Be prepared to provide the same information as you would online, including your personal details, vehicle information, and driving history.

- The agent will ask you about your coverage needs and preferences, and provide you with a personalized quote based on your specific situation.

Information Required for a Quote

To provide you with an accurate and personalized quote, State Farm will need specific information about you, your vehicle, and your driving history.

- Personal Information: Your name, address, date of birth, and contact information.

- Vehicle Information: Make, model, year, VIN, mileage, and whether the vehicle is financed or leased.

- Driving History: Your driving record, license type, any accidents or violations, and your years of driving experience.

- Coverage Needs: Your preferred coverage levels, including liability, collision, comprehensive, and uninsured motorist coverage.

Factors Influencing Car Insurance Rates

Your car insurance premium is a reflection of your individual risk profile, and several factors contribute to its determination. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history is a significant factor in determining your car insurance rates. Insurance companies assess your driving record to understand your risk of being involved in an accident.

- Accidents: A history of accidents, especially at-fault accidents, will generally increase your premium. The severity of the accident, such as injuries or property damage, also plays a role.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI/DWI convictions, indicate a higher risk of future accidents and can lead to higher premiums.

- Years of Driving Experience: Drivers with more years of experience tend to have lower premiums than newer drivers. This is because experienced drivers have a lower risk of accidents due to their accumulated knowledge and skills.

Age

Age is another significant factor in determining car insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to their higher risk of accidents.

- Inexperience: Younger drivers have less experience on the road, leading to a higher risk of accidents.

- Risk-Taking Behavior: Young drivers are more likely to engage in risky driving behaviors, such as speeding or driving under the influence.

- Statistical Data: Insurance companies rely on statistical data that shows a higher accident rate among younger drivers.

Location

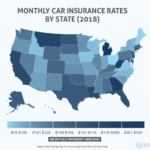

The location where you live significantly influences your car insurance rates.

- Population Density: Areas with higher population density tend to have more traffic and a higher risk of accidents, leading to higher premiums.

- Crime Rates: Locations with higher crime rates can result in increased car theft or vandalism, which can lead to higher premiums.

- Weather Conditions: Areas prone to severe weather conditions, such as hurricanes, tornadoes, or heavy snow, may have higher premiums due to the increased risk of accidents or damage.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your car insurance rates.

- Vehicle Value: More expensive vehicles, such as luxury cars or high-performance sports cars, typically have higher premiums because they cost more to repair or replace in case of an accident.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts and lower premiums due to their reduced risk of accidents.

- Repair Costs: Vehicles with complex or expensive parts may have higher premiums due to the higher cost of repairs in case of an accident.

Discounts

Many car insurance companies offer discounts to lower your premiums.

- Good Student Discount: This discount is available to students who maintain a good academic record.

- Safe Driver Discount: Drivers with a clean driving record, free of accidents or violations, can qualify for this discount.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company can lead to a discount on your premiums.

- Bundling Discount: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can result in a discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can reduce your premium due to the lower risk of theft.

Understanding Your Quote

Once you’ve provided all the necessary information, State Farm will generate a car insurance quote. This quote is a detailed breakdown of the estimated cost of your insurance policy based on your individual circumstances.

Understanding the components of your quote is crucial for making informed decisions about your coverage and ensuring you get the best value for your money.

Breakdown of a State Farm Car Insurance Quote, Get a state farm car insurance quote

The State Farm car insurance quote is divided into several sections, each representing a different aspect of your coverage:

- Liability Coverage: This covers damage or injuries you cause to other people or their property in an accident. It’s typically divided into bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses and lost wages if you’re injured in an accident, regardless of fault.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault.

- Deductible: This is the amount you pay out-of-pocket for repairs or replacements before your insurance coverage kicks in.

- Premium: This is the amount you pay for your car insurance policy.

Coverage Options and Costs

Here’s a sample table illustrating how different coverage options and their associated costs might appear in your quote:

| Coverage | Coverage Limit | Deductible | Estimated Cost |

|---|---|---|---|

| Liability | $100,000/$300,000 | N/A | $300 |

| Collision | Actual Cash Value | $500 | $250 |

| Comprehensive | Actual Cash Value | $500 | $150 |

| Uninsured/Underinsured Motorist | $100,000/$300,000 | N/A | $100 |

| PIP | $10,000 | N/A | $75 |

| Med Pay | $5,000 | N/A | $50 |

Interpreting and Analyzing Your Quote

To make informed decisions, carefully review your quote and consider the following:

- Coverage Limits: Make sure the coverage limits are adequate to protect you financially in case of an accident. Higher limits generally mean higher premiums but offer greater protection.

- Deductibles: A higher deductible means you pay more out-of-pocket in case of an accident but results in lower premiums. Choose a deductible you can comfortably afford.

- Discounts: State Farm offers various discounts, such as safe driving discounts, good student discounts, and multi-policy discounts. Ask your agent about available discounts and ensure you’re taking advantage of all applicable ones.

- Compare Quotes: It’s always a good idea to compare quotes from multiple insurance companies to ensure you’re getting the best possible rate.

The Benefits of State Farm Car Insurance

Beyond just providing coverage, State Farm goes the extra mile to ensure a smooth and positive experience for its customers. They’re known for their commitment to customer satisfaction, offering a range of benefits that extend beyond the standard insurance policy.

State Farm’s Customer Service

State Farm is renowned for its exceptional customer service, readily available through various channels. They understand that dealing with car insurance can be stressful, and they strive to make the process as easy and hassle-free as possible.

- 24/7 Customer Support: State Farm offers 24/7 customer support, allowing you to reach out anytime, day or night, for assistance with any questions or concerns. This is particularly helpful in emergency situations or when you need immediate support.

- Multiple Contact Options: You can connect with State Farm through phone, email, online chat, or even their mobile app. This flexibility ensures you can choose the communication method that best suits your preferences.

- Dedicated Agents: State Farm agents are trained to provide personalized guidance and support. They’re there to answer your questions, explain your policy, and assist you with any claims or policy adjustments.

State Farm’s Claims Handling Process

When it comes to claims, State Farm prioritizes a smooth and efficient process. They aim to make the experience as stress-free as possible for their customers, recognizing the inconvenience and potential hardship associated with car accidents.

- Streamlined Process: State Farm’s claims process is designed to be simple and straightforward. You can report a claim online, through their mobile app, or by phone. They’ll guide you through each step, providing clear instructions and support.

- Fast and Fair Settlements: State Farm is committed to resolving claims promptly and fairly. They strive to process claims quickly and efficiently, minimizing any delays or inconveniences.

- Customer Satisfaction: State Farm prioritizes customer satisfaction throughout the claims process. They actively seek feedback and strive to ensure a positive experience, even in challenging situations.

Real-Life Examples of State Farm’s Support

State Farm has a long history of providing exceptional customer support. Here are a few real-life examples of how they’ve assisted customers in car insurance situations:

- Emergency Roadside Assistance: Imagine being stranded on the side of the road with a flat tire late at night. State Farm’s roadside assistance program provided a tow truck to get the car to a nearby repair shop, ensuring the customer’s safety and peace of mind.

- Personalized Claim Support: A customer was involved in a minor accident and was unsure about the claims process. Their State Farm agent patiently guided them through each step, explaining their coverage and options, ensuring they understood the process and felt confident throughout.

- Compensation for Lost Wages: A customer was unable to work after a serious accident due to injuries. State Farm’s coverage included lost wages, helping the customer financially during their recovery period.

Considerations Before Purchasing

Before committing to State Farm car insurance, it’s crucial to consider various factors to ensure you make an informed decision that aligns with your individual needs and budget.

Comparing State Farm’s Rates and Coverage with Other Providers

It’s always wise to compare quotes from multiple insurance providers before making a final decision. This allows you to evaluate different coverage options, rates, and customer service offerings. You can use online comparison tools or contact insurance agents directly to gather quotes from various companies, including State Farm.

- Consider the overall cost of the insurance policy, taking into account factors like deductibles, coverage limits, and discounts.

- Compare the scope of coverage offered by different providers, ensuring that you understand the specific benefits included in each policy.

- Read customer reviews and ratings to get insights into the experiences of others with different insurance providers.

Understanding Your Individual Insurance Needs and Priorities

The best car insurance policy is the one that meets your specific needs and priorities.

- Consider your driving history, the value of your car, your driving habits, and your risk tolerance.

- Determine the level of coverage you require, factoring in your financial situation and potential risks.

- Evaluate the importance of specific features like roadside assistance, rental car coverage, or accident forgiveness.

Final Thoughts

With a State Farm car insurance quote, you gain access to a trusted and reliable insurance partner committed to providing exceptional customer service and support. State Farm’s reputation for handling claims efficiently and fairly, coupled with their wide range of coverage options, makes them a top choice for drivers seeking comprehensive and affordable insurance protection. Take the first step towards securing your peace of mind on the road and get a State Farm car insurance quote today.

Clarifying Questions: Get A State Farm Car Insurance Quote

How long does it take to get a State Farm car insurance quote?

You can usually get a quote online in just a few minutes. If you prefer to speak with an agent, the process may take a bit longer.

What information do I need to get a quote?

You’ll need your driver’s license information, vehicle details, and some basic personal information.

Can I get a quote without providing my personal information?

You can get a general idea of rates by entering some basic information, but a personalized quote will require your personal details.

How often should I review my car insurance rates?

It’s a good idea to review your rates at least once a year, as your needs and driving history may change.