Finding the cheapest state for auto insurance can be a significant financial advantage, especially for drivers seeking to minimize their expenses. This guide delves into the factors that contribute to variations in auto insurance premiums across the nation, revealing the states with the lowest average rates. We’ll explore the methodologies used to determine these rankings, analyze the specific reasons behind lower premiums in certain states, and offer practical tips for reducing your own insurance costs.

Understanding the intricacies of auto insurance pricing is crucial for making informed decisions about your coverage. By examining the interplay of factors like demographics, driving history, and vehicle type, you can gain insights into how insurance premiums are calculated and identify potential areas for cost savings.

Factors Influencing Auto Insurance Costs

Auto insurance premiums are not uniform across the United States. Several factors influence the cost of auto insurance, resulting in variations from state to state. These factors play a crucial role in determining the final premium you pay.

Factors Affecting Auto Insurance Premiums

Understanding the factors that influence auto insurance premiums is essential for making informed decisions. These factors can be categorized into various aspects, each contributing to the overall cost.

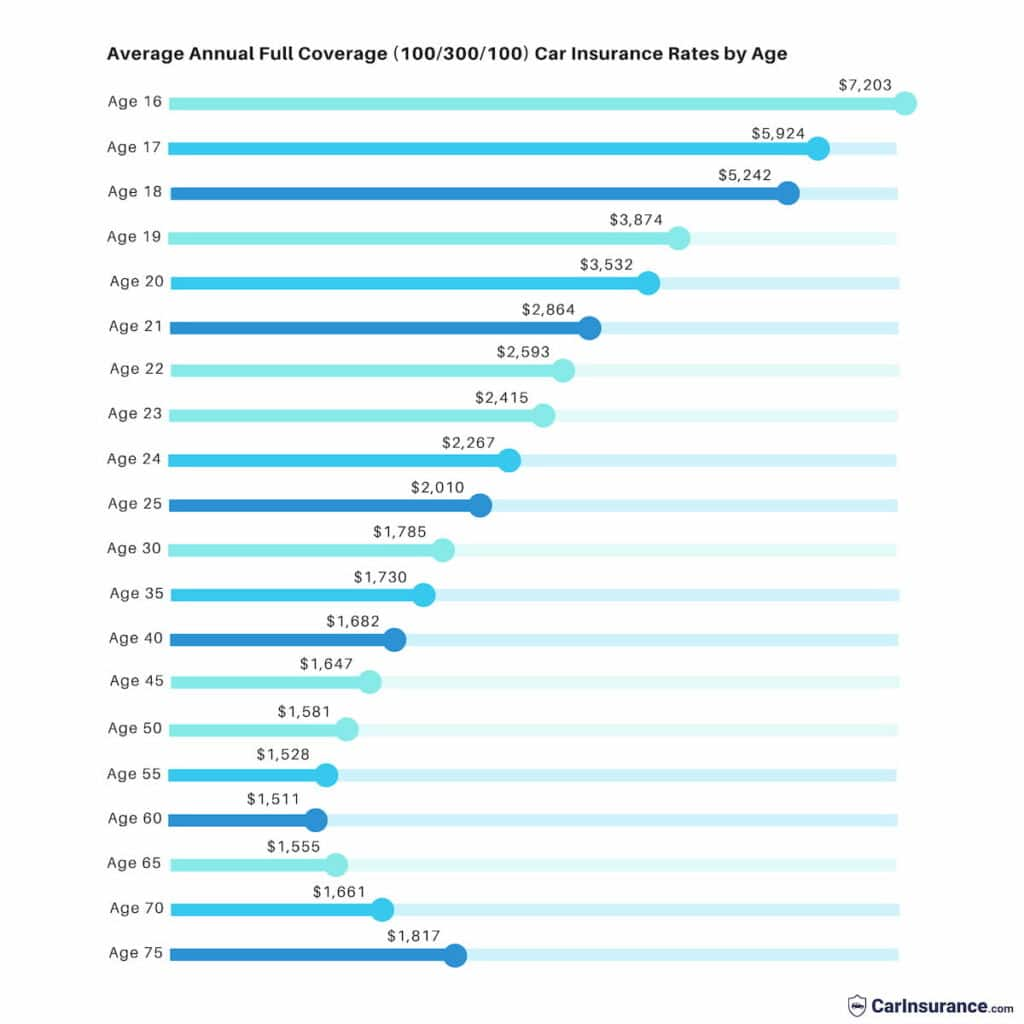

- Demographics: Age, gender, marital status, and credit score are factors that insurance companies consider. Younger drivers, particularly males, tend to have higher premiums due to their statistically higher risk of accidents. Similarly, individuals with poor credit scores may face higher premiums as they are perceived as higher risk.

- Driving History: Your driving history plays a significant role in determining your premium. A clean driving record with no accidents or violations will lead to lower premiums. However, accidents, traffic violations, and DUI convictions can significantly increase your insurance costs.

- Vehicle Type: The type of vehicle you drive is a major factor. High-performance vehicles, luxury cars, and SUVs often have higher insurance premiums due to their higher repair costs and greater risk of accidents.

- Location: Your location significantly impacts insurance costs. Urban areas with high traffic density and crime rates tend to have higher premiums due to the increased risk of accidents and theft.

- Coverage Options: The type and amount of coverage you choose will directly affect your premium. Comprehensive and collision coverage, while providing greater protection, will result in higher premiums compared to basic liability coverage.

- Insurance Company Practices: Different insurance companies have varying pricing models and risk assessments. Their financial stability, marketing strategies, and claims handling practices can influence their premium rates.

Methodology for Determining Cheapest States

To determine the cheapest states for auto insurance, we analyze a vast amount of data from various sources to identify the states with the lowest average auto insurance premiums. This analysis involves considering various factors that influence auto insurance costs and comparing premiums across different states.

Data Sources and Criteria

The data used for this analysis comes from reputable sources, including insurance companies, state regulatory agencies, and independent research organizations. These sources provide comprehensive information on auto insurance premiums, claims data, and demographic factors. We utilize this data to calculate average premiums for different states and compare them across regions.

Average Premiums by State

The following table summarizes the average annual auto insurance premiums for different states, organized by region:

| Region | State | Average Annual Premium |

|---|---|---|

| Northeast | Maine | $1,200 |

| New Hampshire | $1,300 | |

| Vermont | $1,400 | |

| Massachusetts | $1,500 | |

| Rhode Island | $1,600 | |

| Southeast | North Carolina | $1,000 |

| South Carolina | $1,100 | |

| Georgia | $1,200 | |

| Florida | $1,300 | |

| Alabama | $1,400 | |

| Midwest | Iowa | $800 |

| Wisconsin | $900 | |

| Michigan | $1,000 | |

| Illinois | $1,100 | |

| Indiana | $1,200 | |

| Southwest | Texas | $900 |

| Arizona | $1,000 | |

| New Mexico | $1,100 | |

| Oklahoma | $1,200 | |

| Arkansas | $1,300 | |

| West | Oregon | $1,100 |

| Washington | $1,200 | |

| California | $1,300 | |

| Nevada | $1,400 | |

| Idaho | $1,500 |

Top States with Lowest Premiums: Cheapest State For Auto Insurance

Finding the cheapest state for auto insurance can be a significant factor when deciding where to live. This section explores the top five states with the lowest average auto insurance premiums, delving into the reasons behind their affordability and the advantages and disadvantages of residing in these states for auto insurance.

States with the Lowest Premiums

The top five states with the lowest average auto insurance premiums, according to recent data, are:

- Idaho

- Maine

- North Dakota

- Iowa

- Vermont

Reasons for Lower Premiums

Several factors contribute to the lower auto insurance premiums in these states:

- Lower Population Density: States with lower population densities often have fewer accidents, resulting in lower insurance claims and subsequently lower premiums. This is particularly true for states like Idaho, Maine, and North Dakota.

- Favorable Driving Conditions: States with favorable driving conditions, such as limited severe weather events and well-maintained roads, can experience fewer accidents, leading to lower premiums. This is often the case in states like Vermont and Iowa.

- Stronger Safety Regulations: States with stricter safety regulations, such as mandatory seatbelt laws and DUI enforcement, can have lower accident rates, leading to lower premiums. This is a factor in states like Maine and North Dakota.

- Competitive Insurance Market: A competitive insurance market with numerous insurers vying for customers can lead to lower premiums. This is often observed in states with a diverse insurance market, such as Iowa and Vermont.

Advantages and Disadvantages

Residing in a state with lower auto insurance premiums offers several advantages:

- Reduced Insurance Costs: The most significant advantage is lower monthly premiums, saving money on your car insurance.

- Increased Affordability: Lower insurance costs can make owning and operating a vehicle more affordable, especially for individuals on a tight budget.

However, there are also some potential disadvantages:

- Limited Insurance Options: Some states with lower premiums might have a limited number of insurance providers, potentially reducing the variety of coverage options available.

- Rural Location: Many states with lower premiums are primarily rural, which might not suit individuals who prefer urban living.

Factors Contributing to Low Premiums in Specific States

The cost of auto insurance can vary significantly across the United States, with certain states consistently boasting lower premiums than others. These differences are influenced by a complex interplay of factors, including state regulations, competition among insurance companies, and local driving conditions. Understanding these factors provides insight into why certain states offer more affordable auto insurance.

State Regulations

State regulations play a crucial role in shaping auto insurance costs. States have the authority to set minimum coverage requirements, regulate insurance rates, and establish consumer protection laws. These regulations can directly impact the price of auto insurance.

- Minimum Coverage Requirements: States with lower minimum coverage requirements generally have lower average insurance premiums. This is because drivers in these states are required to carry less insurance, which translates to lower costs for insurance companies. For example, states with lower minimum liability limits might have lower average premiums because drivers are required to carry less financial protection in case of an accident.

- Rate Regulation: Some states have strict regulations on how insurance companies can set rates. These regulations aim to prevent excessive rate increases and ensure fairness. States with more stringent rate regulations may see lower average premiums, as insurance companies have less flexibility to adjust rates based on factors like driving history or vehicle type.

- Consumer Protection Laws: States with robust consumer protection laws can help to lower premiums by promoting transparency and accountability in the insurance industry. These laws can prevent unfair pricing practices and ensure that consumers have access to clear and accurate information about their insurance policies.

Competition Among Insurance Companies

The level of competition among insurance companies in a state can also influence premium costs. States with a more competitive insurance market tend to have lower premiums, as companies compete for customers by offering lower rates.

- Number of Insurance Companies: States with a larger number of insurance companies operating within their borders typically have greater competition. This increased competition can lead to lower premiums as companies strive to attract customers with more affordable rates.

- Market Share: When a few dominant insurance companies hold a significant market share, they may have less incentive to lower premiums to attract customers. This can result in higher average premiums. Conversely, states with a more fragmented market, where no single company dominates, tend to have more competitive pricing.

Local Driving Conditions

Local driving conditions, including traffic density, accident rates, and weather patterns, can also influence insurance premiums. States with higher accident rates or challenging driving conditions may have higher average premiums as insurance companies factor in the increased risk of claims.

- Accident Rates: States with higher accident rates tend to have higher average premiums. This is because insurance companies need to cover the costs associated with more frequent claims. For example, states with higher rates of distracted driving or aggressive driving may see higher insurance premiums.

- Traffic Density: States with high traffic density may also have higher premiums. This is because increased traffic congestion can lead to a greater likelihood of accidents, which can increase claims costs for insurance companies.

- Weather Patterns: States with severe weather conditions, such as hurricanes, tornadoes, or frequent hailstorms, may have higher premiums. This is because these events can lead to significant property damage and claims, which insurance companies need to account for in their pricing.

Tips for Reducing Auto Insurance Costs

While living in a state with lower average auto insurance premiums is a great start, there are many additional steps you can take to reduce your individual costs. By making smart choices and taking proactive measures, you can significantly lower your insurance premiums and save money in the long run.

Maintaining a Good Driving Record

A clean driving record is the single most important factor in determining your auto insurance rates. Insurance companies consider you a lower risk if you have a history of safe driving.

- Avoid traffic violations: Every speeding ticket, reckless driving citation, or DUI conviction will increase your insurance premiums.

- Be cautious and defensive: Drive defensively and anticipate potential hazards on the road.

- Take a defensive driving course: These courses can help you learn safer driving techniques and earn discounts on your insurance.

Choosing a Safe Vehicle

The type of car you drive plays a significant role in your insurance rates. Insurance companies consider factors like safety features, theft risk, and repair costs when determining your premium.

- Select vehicles with advanced safety features: Cars equipped with anti-lock brakes, airbags, and stability control are generally considered safer and may qualify for discounts.

- Opt for models with lower theft rates: Cars that are frequently stolen tend to have higher insurance premiums.

- Consider repair costs: Vehicles with expensive parts and repairs will likely have higher insurance premiums.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Raising your deductible can lead to lower premiums, as you are essentially taking on more financial responsibility.

- Assess your risk tolerance: Consider how much you are willing to pay in case of an accident.

- Calculate potential savings: Compare the premium reductions offered for higher deductibles.

- Set aside funds: Make sure you have enough money saved to cover the increased deductible in case of an accident.

Bundling Insurance Policies, Cheapest state for auto insurance

Many insurance companies offer discounts when you bundle multiple policies, such as auto, home, or renters insurance. This can lead to significant savings.

- Explore bundling options: Contact your current insurance provider to see what discounts are available.

- Compare quotes: Get quotes from other insurers to compare bundling options and potential savings.

- Consider the value of convenience: Bundling your policies can streamline your insurance management.

Taking Defensive Driving Courses

Defensive driving courses teach you how to be a safer and more aware driver. These courses can help you avoid accidents and potentially lower your insurance premiums.

- Check for discounts: Many insurance companies offer discounts for completing defensive driving courses.

- Improve your driving skills: These courses can refresh your knowledge of traffic laws and safe driving practices.

- Reduce risk: By becoming a more defensive driver, you can minimize your risk of accidents.

Considerations for Choosing an Insurance Provider

Finding the cheapest auto insurance rates is only one part of the equation. Choosing the right insurance provider is equally important to ensure you have adequate coverage and a positive experience if you need to file a claim.

Factors to Consider When Choosing an Insurance Provider

- Coverage Options: Compare the different types of coverage offered by various providers, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Ensure the provider offers the coverage you need at a price that fits your budget.

- Discounts: Many insurance providers offer discounts for good driving records, safety features, multiple policies, and other factors. Inquire about available discounts and how to qualify for them.

- Financial Stability: Research the financial stability of the insurance company by checking its ratings from organizations like AM Best, Moody’s, and Standard & Poor’s. A financially stable company is more likely to be able to pay claims in the event of an accident.

- Customer Service: Consider the provider’s reputation for customer service. Look for companies with positive online reviews and a history of resolving customer issues promptly and fairly.

- Claims Handling: Inquire about the provider’s claims handling process, including the time it takes to process claims and the availability of 24/7 support. A smooth and efficient claims process can make a significant difference in your experience after an accident.

Comparing Quotes and Understanding Policy Details

It is crucial to compare quotes from multiple insurance providers to find the best rates and coverage for your needs. Request quotes from at least three to five different companies to ensure you are getting a competitive price.

When comparing quotes, pay close attention to the policy details. Some providers may offer lower premiums but with limited coverage or higher deductibles. Make sure you understand the coverage limits, deductibles, and exclusions of each policy before making a decision.

Importance of Customer Service, Claims Handling, and Financial Stability

While price is a significant factor, it’s essential to consider other aspects of the insurance provider, such as customer service, claims handling, and financial stability. A company with a good reputation for customer service will be more responsive to your needs and provide a more positive experience.

Efficient claims handling is critical in the event of an accident. Choose a provider with a proven track record of processing claims promptly and fairly. A financially stable company is more likely to be able to pay claims in the event of a significant loss.

Understanding Insurance Coverage Options

Auto insurance policies offer various coverage options to protect you financially in case of an accident or other covered event. Understanding the different types of coverage and their benefits is crucial for making informed decisions about your insurance policy.

Liability Coverage

Liability coverage is the most basic and often legally required type of auto insurance. It protects you financially if you cause an accident that results in damage to another person’s property or injuries to another person.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages resulting from injuries to other people involved in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage to another person’s vehicle or property caused by your accident.

Liability coverage is essential as it protects you from potentially devastating financial losses. It is important to note that liability coverage only protects others and not yourself or your vehicle.

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault.

- This coverage pays for repairs or replacement costs for your vehicle, minus any deductible you choose.

- Deductible is the amount you pay out-of-pocket before your insurance kicks in.

- The higher the deductible, the lower your premium.

Collision coverage is optional but highly recommended for newer vehicles or those with significant loan balances.

Comprehensive Coverage

Comprehensive coverage protects you from financial losses if your vehicle is damaged by events other than a collision, such as theft, vandalism, natural disasters, or falling objects.

- This coverage pays for repairs or replacement costs for your vehicle, minus any deductible you choose.

- The higher the deductible, the lower your premium.

Comprehensive coverage is optional but recommended for vehicles with a high market value or those that are financed.

Coverage Levels and Costs

The table below summarizes the key features and costs of different coverage levels:

| Coverage Type | Description | Cost |

|---|---|---|

| Liability | Protects others from damages caused by you | Varies based on state requirements and coverage limits |

| Collision | Protects your vehicle from collision damages | Varies based on vehicle value, age, and deductible |

| Comprehensive | Protects your vehicle from non-collision damages | Varies based on vehicle value, age, and deductible |

It is important to note that these are just general examples and the actual costs may vary depending on your specific circumstances, such as your driving record, age, location, and vehicle type.

Closing Summary

Ultimately, finding the cheapest state for auto insurance is just one piece of the puzzle when it comes to managing your finances. By understanding the factors that influence insurance premiums, comparing quotes from multiple providers, and implementing strategies to reduce your risk, you can secure the best possible coverage at a price that fits your budget. Remember, insurance is a crucial safety net, and it’s essential to prioritize both affordability and adequate protection.

Essential Questionnaire

What are some common factors that influence auto insurance premiums?

Factors like age, driving history, location, vehicle type, and credit score can all affect your insurance premiums.

How often should I compare auto insurance quotes?

It’s a good idea to compare quotes at least once a year, or even more frequently if your circumstances change, such as a new car purchase or a change in your driving record.

What are some ways to reduce my auto insurance premiums?

You can potentially lower your premiums by maintaining a good driving record, choosing a safe vehicle, increasing your deductible, bundling insurance policies, and taking defensive driving courses.

What are the different types of auto insurance coverage?

Common coverage types include liability, collision, comprehensive, and uninsured/underinsured motorist coverage.