Car insurance rates washington state – Car insurance rates in Washington state can vary significantly depending on several factors, making it crucial to understand the intricacies of this complex system. This guide delves into the key factors that influence your car insurance premiums, offering insights into the average rates, strategies for lowering your costs, and the mandatory coverage requirements in the state.

Navigating the world of car insurance can feel overwhelming, but by understanding the nuances of rate determination and exploring available options, you can find the best coverage at a price that fits your budget.

Understanding Car Insurance Rates in Washington State

Car insurance rates in Washington state, like in other states, are influenced by a variety of factors, ensuring that drivers pay a premium that reflects their individual risk. This article will delve into the key factors that determine car insurance rates in Washington, examine the role of the Washington State Department of Insurance in regulating this industry, and provide insights into average rates based on vehicle types and driver demographics.

Factors Influencing Car Insurance Rates in Washington State

Several factors play a crucial role in determining car insurance rates in Washington state. These factors can be categorized into driver-related, vehicle-related, and location-related aspects.

- Driver-related factors include:

- Driving history: This encompasses factors like accidents, traffic violations, and DUI convictions. A clean driving record typically translates into lower premiums. For example, a driver with a recent DUI conviction might face significantly higher rates compared to a driver with no violations.

- Age and experience: Younger drivers, especially those under 25, are generally considered riskier due to their lack of experience. Conversely, older drivers with extensive driving experience often enjoy lower rates. This is because younger drivers are statistically more likely to be involved in accidents.

- Credit score: This might seem surprising, but insurance companies often use credit scores as an indicator of financial responsibility. Individuals with good credit scores may qualify for lower premiums. This is because insurance companies believe that individuals with good credit are more likely to pay their premiums on time.

- Driving habits: Factors like the number of miles driven annually, commuting distance, and driving style can influence rates. Drivers who commute long distances or frequently drive in high-traffic areas may face higher premiums due to increased exposure to potential accidents.

- Marital status: Studies have shown that married individuals tend to have lower rates than single individuals. This is often attributed to the greater financial stability and responsibility associated with marriage.

- Vehicle-related factors include:

- Vehicle make and model: Some vehicle models are known for their safety features, while others are considered more prone to accidents. Insurance companies use this information to determine the risk associated with each vehicle model and adjust premiums accordingly. For instance, a car with advanced safety features like lane departure warning and automatic emergency braking might receive a lower rate than a similar car without these features.

- Vehicle age: Newer vehicles often have more advanced safety features and are generally considered safer than older vehicles. This can lead to lower insurance rates for newer cars. For example, a brand new car with the latest safety features might have a lower rate than a five-year-old car of the same make and model.

- Vehicle value: The value of the vehicle is a significant factor in determining insurance rates. More expensive cars, especially luxury vehicles, often have higher premiums because the cost of repairs and replacement is higher.

- Anti-theft devices: Vehicles equipped with anti-theft devices, such as alarms, immobilizers, and GPS tracking systems, are less likely to be stolen. This can result in lower insurance rates for these vehicles.

- Location-related factors include:

- Zip code: Insurance rates vary significantly based on the zip code where the vehicle is garaged. Areas with high crime rates, traffic congestion, and a history of accidents tend to have higher insurance rates. This is because insurance companies assess the likelihood of claims based on the location of the vehicle.

- Climate: Areas with harsh weather conditions, such as frequent snowstorms or heavy rainfall, can increase the risk of accidents. Insurance companies may adjust rates accordingly to reflect these risks.

Washington State Department of Insurance’s Role in Regulating Car Insurance

The Washington State Department of Insurance (DOI) plays a vital role in ensuring fair and competitive car insurance rates for consumers. The DOI is responsible for:

- Licensing and regulating insurance companies: The DOI ensures that insurance companies operating in Washington meet specific financial and operational standards. This includes reviewing their financial stability, ensuring they have adequate reserves to cover potential claims, and overseeing their business practices.

- Monitoring insurance rates: The DOI has the authority to review and approve insurance rate increases. It ensures that rate increases are justified and reflect the actual costs of providing insurance. The DOI also investigates complaints from consumers regarding insurance rates and practices.

- Providing consumer education: The DOI provides resources and information to consumers about car insurance, helping them understand their rights and responsibilities. This includes guidance on choosing the right insurance policy, understanding their coverage, and filing claims.

- Promoting competition in the insurance market: The DOI encourages competition among insurance companies to ensure that consumers have access to a wide range of options and competitive rates. This is achieved through various measures, such as promoting transparency in pricing and encouraging the development of new insurance products.

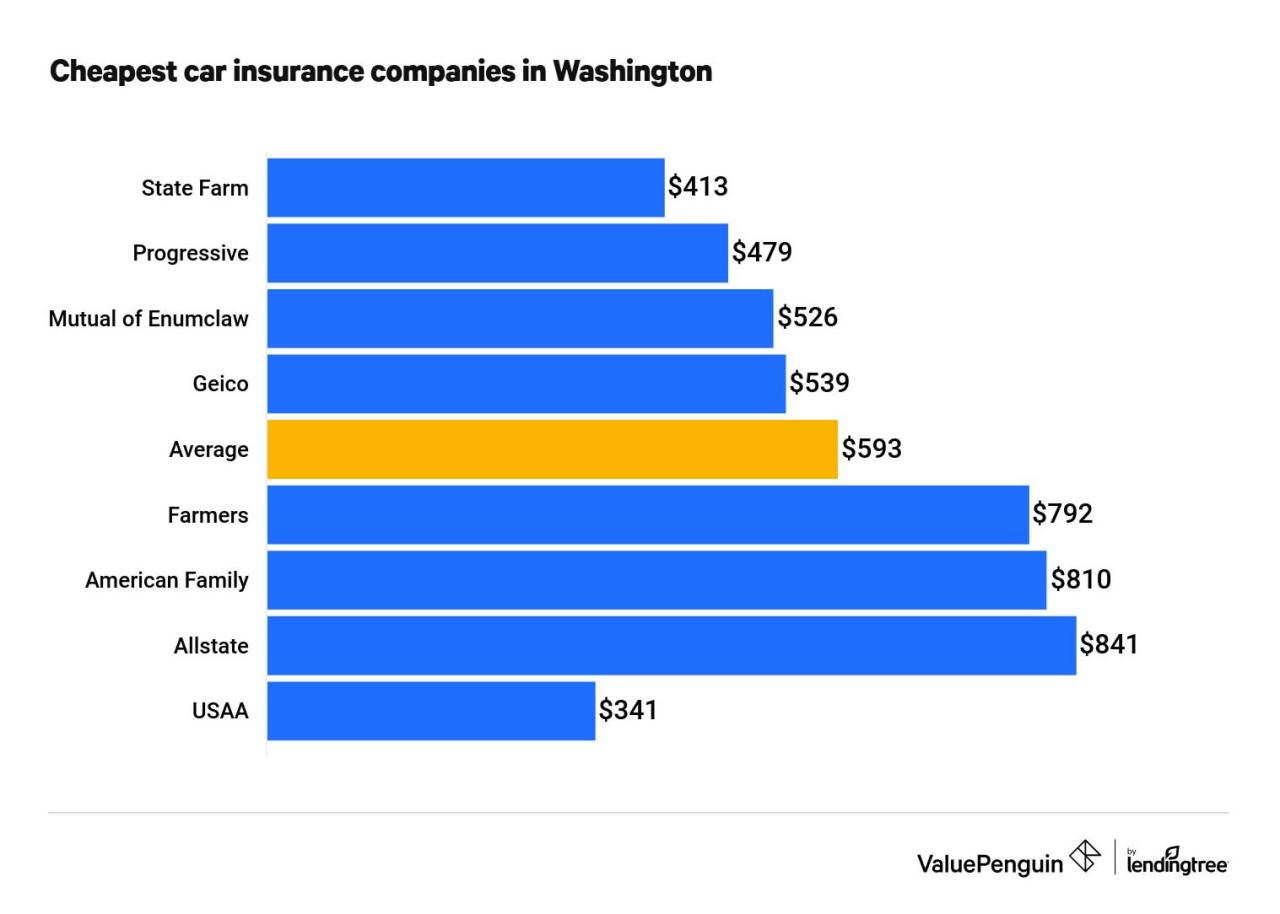

Average Car Insurance Rates in Washington State

Average car insurance rates in Washington state can vary depending on various factors, including vehicle type, driver demographics, and coverage levels. However, here’s a general overview of average rates based on different vehicle types and driver demographics:

- Vehicle Type:

- Sedans: These typically have the lowest average rates due to their relatively low risk profile and common availability of parts.

- SUVs and Trucks: These vehicles tend to have higher rates due to their larger size, weight, and potential for greater damage in accidents.

- Sports Cars: These are often associated with higher risk due to their performance capabilities and potential for reckless driving. Consequently, they often have the highest average rates.

- Driver Demographics:

- Age: Younger drivers typically face higher rates due to their lack of experience, while older drivers with extensive experience may enjoy lower rates.

- Gender: Historically, men have had higher rates than women, but this gap has narrowed in recent years. This is partly due to changes in driving patterns and risk factors.

- Location: Drivers in urban areas with higher traffic density and crime rates may face higher rates compared to those in rural areas.

Key Factors Influencing Car Insurance Rates: Car Insurance Rates Washington State

Your driving history plays a significant role in determining your car insurance rates. Insurance companies assess your risk based on your driving record, and a clean record translates to lower premiums.

Driving History

Your driving history is a key factor in determining your car insurance rates. Insurance companies use this information to assess your risk as a driver. A clean driving record with no accidents, violations, or claims will typically result in lower premiums. Conversely, a history of accidents, violations, or claims will likely lead to higher premiums.

- Accidents: Each accident, regardless of fault, is typically reported to your insurance company. The severity of the accident, the number of accidents you’ve been involved in, and the time since your last accident all influence your rates. For example, a minor fender bender might result in a small increase in your premiums, while a serious accident with injuries could lead to a significant increase.

- Violations: Traffic violations, such as speeding tickets, running red lights, and driving under the influence, can also increase your car insurance premiums. The severity of the violation and the number of violations you’ve received will influence the impact on your rates. For example, a speeding ticket for exceeding the speed limit by a few miles per hour might have a smaller impact than a DUI.

- Claims: Any claims you’ve filed with your insurance company, regardless of fault, will be considered when determining your rates. The number of claims you’ve filed, the amount of money paid out on each claim, and the time since your last claim will all influence your premiums.

Vehicle Type, Make, and Model

The type, make, and model of your vehicle also significantly impact your car insurance rates. Insurance companies consider factors such as the vehicle’s safety features, repair costs, theft risk, and overall value.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and may result in lower premiums. These features can help reduce the severity of accidents and potentially lower your insurance costs.

- Repair Costs: Vehicles with expensive parts and labor costs for repairs will typically have higher insurance premiums. Insurance companies factor in the cost of repairs when calculating your premiums. For example, a luxury car with high-end parts and specialized labor may have higher insurance costs than a more basic vehicle.

- Theft Risk: Certain vehicles are more prone to theft than others. For example, popular models or vehicles with high resale value may be more attractive to thieves. Insurance companies consider the theft risk of your vehicle when determining your rates. Vehicles with higher theft risk may have higher insurance premiums.

- Overall Value: The overall value of your vehicle also plays a role in determining your insurance premiums. Vehicles with higher values will generally have higher premiums because the cost to replace or repair them is greater. For example, a new luxury car will likely have higher insurance costs than an older, less expensive vehicle.

Credit Score

Your credit score can also affect your car insurance rates in Washington State. Insurance companies may use your credit score as a proxy for risk assessment. A higher credit score generally indicates a lower risk to the insurer, which may result in lower premiums. Conversely, a lower credit score may lead to higher premiums.

“While your credit score may not be the most significant factor in determining your car insurance rates, it can play a role in some cases. It’s essential to maintain a good credit score for various reasons, including potentially lowering your car insurance premiums.”

Location and Zip Code

Your location and zip code can also influence your car insurance rates. Insurance companies consider factors such as the density of traffic, the rate of accidents, and the prevalence of crime in your area. Areas with higher traffic density, more accidents, and higher crime rates may have higher insurance premiums.

- Traffic Density: Areas with high traffic density are more likely to have accidents, which can increase the risk for insurance companies. This increased risk may result in higher premiums for drivers in these areas.

- Accident Rates: Areas with high accident rates are also considered higher risk by insurance companies. The higher the accident rate, the higher the likelihood of claims, which can increase premiums for drivers in these areas.

- Crime Rates: Areas with high crime rates may have higher car insurance premiums due to an increased risk of theft and vandalism. Insurance companies may consider the crime rate in your area when determining your rates.

Coverage Levels

The level of coverage you choose will also significantly impact your car insurance premiums. Higher levels of coverage provide greater protection but will typically result in higher premiums.

- Liability Coverage: Liability coverage protects you financially if you’re at fault in an accident. This coverage pays for the other driver’s medical expenses, property damage, and lost wages. Higher liability limits provide more financial protection but will typically result in higher premiums.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This coverage is optional but is often required if you have a loan or lease on your vehicle. Higher deductibles will typically result in lower premiums.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, and natural disasters. This coverage is optional but is often required if you have a loan or lease on your vehicle. Higher deductibles will typically result in lower premiums.

- Uninsured/Underinsured Motorist Coverage: Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. This coverage is optional but is highly recommended. Higher limits will typically result in higher premiums.

Strategies for Lowering Car Insurance Rates

Lowering your car insurance rates in Washington State is possible with some strategic planning and proactive steps. By understanding the factors influencing your premiums and implementing effective strategies, you can potentially save a significant amount of money on your car insurance.

Obtaining Multiple Car Insurance Quotes

Getting multiple car insurance quotes from different providers is a crucial first step in finding the best rates. This allows you to compare prices, coverage options, and discounts offered by various companies.

- Gather Your Information: Before contacting insurance companies, gather all necessary information, including your driver’s license details, vehicle information (make, model, year), and any relevant driving history records.

- Use Online Comparison Tools: Many websites and apps offer free car insurance quote comparison tools. These tools allow you to enter your information once and receive quotes from multiple insurers simultaneously, simplifying the process.

- Contact Insurance Companies Directly: Reach out to insurance companies directly to request personalized quotes. This allows you to discuss specific coverage needs and ask questions about their policies.

- Compare Quotes Thoroughly: Once you have received quotes from different providers, carefully compare the rates, coverage options, and discounts offered. Look beyond the lowest price and ensure the chosen policy provides adequate coverage for your needs.

Improving Driving History and Reducing Accident Risk

Maintaining a clean driving record and adopting safe driving practices can significantly impact your car insurance premiums.

- Avoid Traffic Violations: Traffic violations, such as speeding tickets or reckless driving citations, can significantly increase your insurance rates. Drive responsibly and follow traffic laws to maintain a clean driving record.

- Take Defensive Driving Courses: Defensive driving courses teach safe driving techniques and strategies for avoiding accidents. Completing such courses can demonstrate your commitment to safe driving and potentially earn you a discount on your insurance.

- Practice Safe Driving Habits: Always wear your seatbelt, avoid distractions while driving, and be aware of your surroundings. Safe driving habits reduce the risk of accidents, which can lower your insurance premiums.

- Maintain a Good Credit Score: While not a direct factor in Washington State, some insurance companies may consider your credit score when determining your rates. Maintaining a good credit score can potentially help you secure lower premiums.

Benefits of Defensive Driving Courses

Defensive driving courses offer numerous benefits, including:

- Reduced Insurance Premiums: Many insurance companies offer discounts to drivers who complete defensive driving courses, demonstrating their commitment to safe driving practices.

- Improved Driving Skills: These courses provide valuable knowledge and techniques for safe driving, helping you become a more confident and skilled driver.

- Enhanced Awareness: Defensive driving courses emphasize awareness of potential hazards and teach strategies for avoiding accidents. This increased awareness can contribute to safer driving habits.

- Potential for Accident Avoidance: By learning safe driving practices and strategies, you can potentially reduce the risk of accidents, leading to lower insurance costs and a safer driving experience.

Exploring Discounts Offered by Car Insurance Companies, Car insurance rates washington state

Car insurance companies offer various discounts to help lower premiums.

- Safe Driver Discount: This discount is typically awarded to drivers with a clean driving record, demonstrating responsible driving habits.

- Good Student Discount: Many insurers offer discounts to students who maintain a good academic standing, reflecting their responsible nature and potential for safe driving.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount, which can significantly reduce your overall premiums.

- Other Discounts: Insurance companies may offer additional discounts for features like anti-theft devices, safety features in your car, or for being a member of certain organizations.

Bundling Car Insurance with Other Insurance Types

Bundling your car insurance with other types of insurance, such as home or renters insurance, can often result in significant cost savings.

- Convenience: Bundling your policies simplifies your insurance management, providing a single point of contact for all your insurance needs.

- Discounts: Insurance companies often offer substantial discounts for bundling multiple policies. These discounts can be significant, making bundling a financially advantageous option.

- Improved Customer Service: Bundling your policies can lead to improved customer service, as you have a dedicated representative handling all your insurance needs.

Car Insurance Requirements in Washington State

Driving a car in Washington state requires you to have car insurance, as mandated by law. This ensures financial protection for yourself and others in case of an accident. The state has specific requirements for minimum coverage limits that all drivers must meet.

Mandatory Car Insurance Coverage

The Washington state Department of Licensing (DOL) requires all drivers to have the following minimum liability coverage:

- Bodily Injury Liability: This coverage protects you financially if you injure someone else in an accident. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damages to another person’s property if you cause an accident. The minimum requirement is $10,000 per accident.

Uninsured/Underinsured Motorist Coverage

This coverage is crucial for protecting yourself in the event of an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage if the other driver is at fault and does not have sufficient insurance. While not mandatory in Washington state, it is highly recommended to purchase this coverage.

Financial Responsibility Law

The financial responsibility law in Washington state is designed to ensure that drivers have adequate financial resources to cover the costs of accidents they cause. It requires drivers to:

- Maintain the minimum liability insurance coverage required by law.

- Provide proof of insurance to the DOL.

- Pay for damages caused by an accident.

Choosing the Right Car Insurance Provider

Finding the right car insurance provider in Washington state can be a daunting task, as many companies offer a wide range of coverage options and prices. To make an informed decision, it’s crucial to compare different providers, understand their strengths and weaknesses, and consider factors that align with your individual needs.

Factors to Consider When Choosing a Car Insurance Provider

Choosing the right car insurance provider is a crucial decision that requires careful consideration of various factors. Here are some key aspects to evaluate when selecting an insurance company:

- Coverage Options: Each provider offers different types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist. Ensure the provider offers the coverage you need and at a price you can afford.

- Customer Service: Good customer service is essential, especially when you need to file a claim. Research the provider’s reputation for handling claims efficiently and fairly. Check online reviews and ratings to gauge customer satisfaction with their claims handling process.

- Financial Stability: Choose a provider with a strong financial rating, indicating their ability to pay claims even in challenging economic times. Reputable rating agencies like AM Best and Standard & Poor’s provide independent assessments of insurance companies’ financial stability.

- Discounts: Many providers offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Explore these discounts and see if you qualify.

- Price: While price is an important factor, don’t solely focus on the cheapest option. Compare quotes from multiple providers, taking into account the coverage offered and the provider’s overall reputation. Remember, the cheapest option may not always be the best value.

Researching and Understanding Insurance Companies

It’s important to research and understand the reputation and claims handling process of different insurance companies before making a decision. This involves:

- Reading Reviews and Ratings: Check online platforms like Consumer Reports, J.D. Power, and the Better Business Bureau for customer reviews and ratings of different insurance companies. These platforms provide valuable insights into the company’s customer service, claims handling, and overall satisfaction.

- Checking Financial Ratings: Assess the financial stability of the company by checking its rating from independent agencies like AM Best and Standard & Poor’s. A high rating indicates a strong financial position, ensuring the company can pay claims even during challenging economic times.

- Contacting the Insurance Department: The Washington State Office of the Insurance Commissioner provides information about insurance companies, including complaints filed against them and any disciplinary actions taken. This information can help you gauge the company’s track record and its commitment to fair and ethical practices.

Comparing Car Insurance Providers in Washington State

Here’s a table comparing some of the major car insurance providers in Washington state, highlighting their key features and benefits:

| Provider | Key Features | Benefits |

|---|---|---|

| State Farm | Wide range of coverage options, strong financial rating, discounts for good driving records and bundling policies. | Excellent customer service, efficient claims handling, and a vast network of agents across the state. |

| Geico | Competitive rates, easy online quoting and policy management, discounts for good drivers and military personnel. | 24/7 customer support, quick and convenient claims process, and a strong reputation for value. |

| Progressive | Personalized coverage options, innovative features like Name Your Price tool, and discounts for good drivers and safe vehicles. | Excellent customer service, a wide range of coverage options, and a strong focus on technology and innovation. |

| Allstate | Comprehensive coverage options, discounts for good drivers and bundling policies, and a strong commitment to customer satisfaction. | Reliable claims handling, a vast network of agents, and a focus on personalized insurance solutions. |

| Farmers Insurance | Strong financial rating, discounts for good drivers and safe vehicles, and a focus on personalized service. | Experienced agents, a wide range of coverage options, and a strong reputation for reliability. |

Final Conclusion

Armed with knowledge about car insurance rates in Washington state, you can make informed decisions to secure the right coverage at a competitive price. From understanding the factors that influence your premiums to exploring strategies for lowering your costs, this guide provides a comprehensive overview to help you navigate the complexities of car insurance in Washington. By taking a proactive approach and comparing different providers, you can find a policy that meets your needs and provides peace of mind on the road.

Question Bank

How often do car insurance rates change in Washington state?

Car insurance rates in Washington state can change periodically, often due to factors like changes in legislation, claims frequency, and market conditions. It’s a good idea to review your policy and compare rates from different providers at least annually to ensure you’re getting the best value.

What are the consequences of driving without car insurance in Washington state?

Driving without car insurance in Washington state is illegal and can result in serious consequences, including fines, license suspension, and even vehicle impoundment. It’s essential to maintain valid car insurance coverage at all times to avoid these penalties.

Are there any discounts available for car insurance in Washington state?

Yes, many car insurance companies in Washington state offer discounts for various factors, such as safe driving records, good student status, multiple vehicle policies, and bundling with other insurance products. Be sure to inquire about available discounts when obtaining quotes.