Can you have insurance from another state? This question often arises when individuals move, travel frequently, or seek more affordable coverage options. Understanding state residency requirements is crucial for navigating the complexities of insurance across state lines. State laws and regulations can vary significantly, influencing everything from eligibility and coverage to the availability of specific insurance products.

This article explores the nuances of obtaining insurance from a state different from your primary residence, delving into factors like residency requirements, insurance types, regulatory bodies, and practical considerations. Whether you’re relocating, pursuing temporary work in another state, or simply seeking better insurance rates, this guide provides valuable insights to help you make informed decisions.

State Residency Requirements

Insurance companies generally require policyholders to be residents of the state where they purchase insurance. This requirement is based on the principle that insurance is regulated at the state level, and each state has its own laws and regulations governing insurance.

State residency requirements for insurance ensure that insurers are able to accurately assess risk and price policies appropriately. These requirements also help to prevent fraud and ensure that insurers are able to comply with state regulations.

Defining State Residency

Insurance policies typically define state residency using a combination of factors, such as:

- Physical Address: The primary address listed on the insurance application should be within the state where the policy is being purchased.

- Driver’s License: The driver’s license should be issued by the state where the policy is being purchased.

- Voter Registration: The policyholder should be registered to vote in the state where the policy is being purchased.

- Tax Returns: The policyholder should file their state income tax returns in the state where the policy is being purchased.

- Length of Stay: Policyholders are often required to have lived in the state for a minimum period of time, typically 30 days or more.

Scenarios Where Residency Might Be Questioned

Insurance companies may question a policyholder’s residency in several scenarios, including:

- Recent Move: If a policyholder has recently moved to a new state, the insurance company may require documentation to verify their residency.

- Multiple Residences: If a policyholder maintains residences in multiple states, the insurance company may need to determine their primary residence for insurance purposes.

- Military Service: If a policyholder is serving in the military and is stationed outside of their home state, the insurance company may need to determine their residency for insurance purposes.

- College Students: If a college student is attending school in a state different from their home state, the insurance company may need to determine their residency for insurance purposes.

Consequences of Misrepresenting Residency

Misrepresenting residency for insurance purposes can have serious consequences, including:

- Policy Cancellation: The insurance company may cancel the policy if they discover that the policyholder misrepresented their residency.

- Denial of Claims: The insurance company may deny claims if they discover that the policyholder misrepresented their residency.

- Fines and Penalties: Policyholders who misrepresent their residency may face fines and penalties from both the insurance company and the state.

- Criminal Charges: In some cases, misrepresenting residency for insurance purposes may be considered fraud and could result in criminal charges.

Types of Insurance and State Residency

State residency plays a significant role in determining your eligibility for various insurance products and coverage options. It affects the availability of insurance, coverage options, and even the cost of premiums. Understanding how state residency impacts different insurance types is crucial for making informed decisions about your coverage.

Auto Insurance and State Residency

Auto insurance requirements vary widely across states. State residency determines the minimum coverage requirements you must have, including liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

- For instance, some states may require higher liability limits than others.

- Some states offer optional coverage like collision and comprehensive coverage, while others mandate them.

If you move to a new state, you’ll need to update your auto insurance policy to comply with the new state’s requirements.

Health Insurance and State Residency

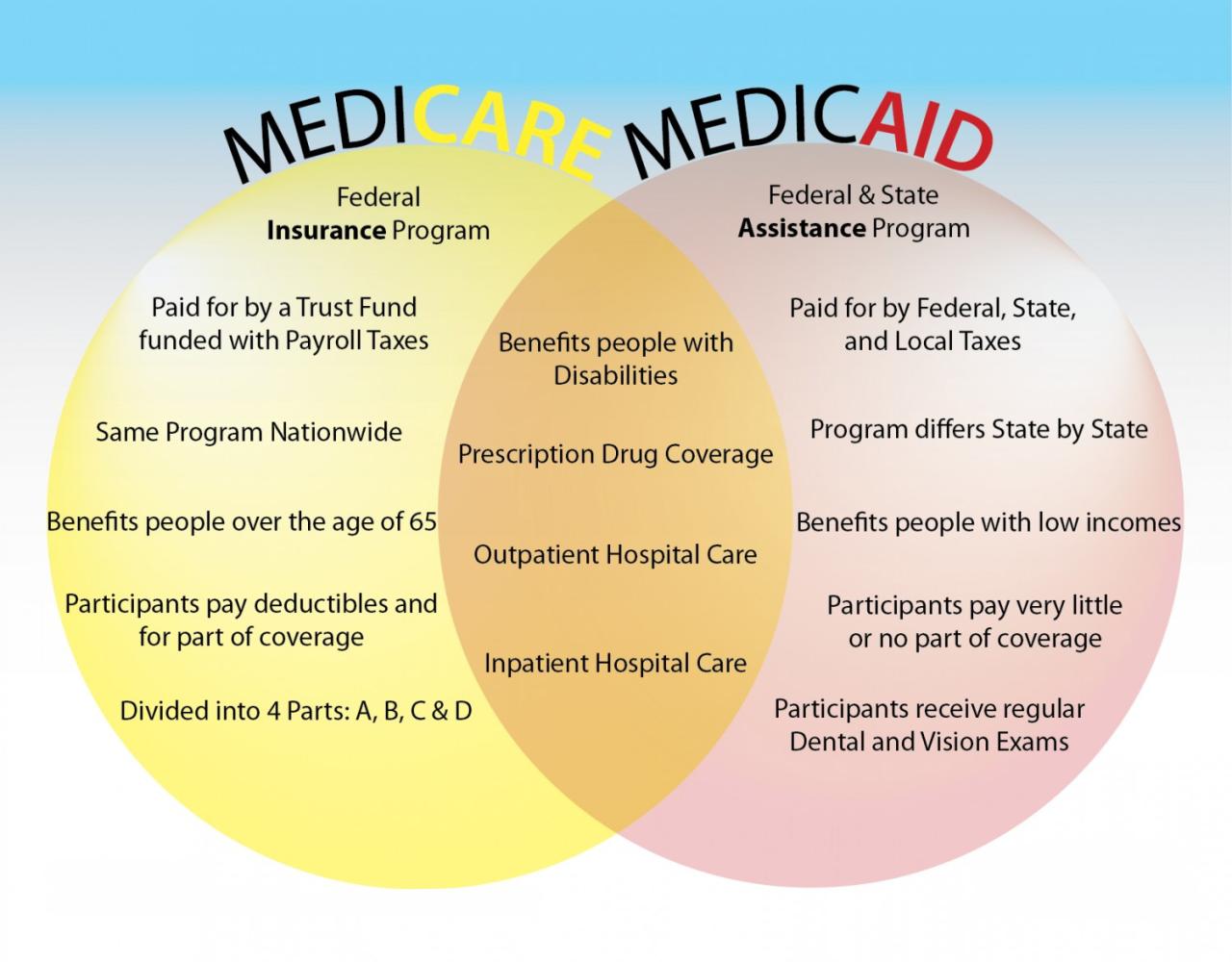

Health insurance is closely tied to state residency. The Affordable Care Act (ACA) allows individuals to obtain health insurance through state-based marketplaces or federal marketplaces.

- State residency determines your eligibility for subsidies and tax credits available through these marketplaces.

- It also impacts the availability of specific health insurance plans offered in your area.

When moving to a new state, you’ll need to update your health insurance coverage to reflect your new residency. You may need to re-enroll in a new plan through the marketplace or find a new insurer in your new state.

Homeowners Insurance and State Residency

Homeowners insurance is another type of insurance where state residency plays a crucial role.

- State regulations dictate the minimum coverage requirements for homeowners insurance, including dwelling coverage, liability coverage, and personal property coverage.

- State residency also impacts the availability of specific coverage options, such as flood insurance or earthquake insurance, depending on the state’s natural disaster risks.

If you move to a new state, you’ll need to update your homeowners insurance policy to meet the new state’s requirements and ensure you have adequate coverage for your property.

Obtaining Insurance in a Different State While Maintaining Residency in Another

In some cases, you may need to obtain insurance in a different state while maintaining residency in another. This might occur if you work in a different state or own property in a different state.

- In such situations, you’ll need to contact insurance companies in the state where you need coverage and provide proof of your residency in the other state.

- Insurance companies may have specific requirements for non-resident coverage, such as proof of vehicle registration in the state where you need insurance or proof of property ownership in the state where you need homeowners insurance.

It’s essential to be aware of the potential implications of obtaining insurance in a different state while maintaining residency in another.

Navigating State Insurance Regulations: Can You Have Insurance From Another State

Navigating the complex world of insurance regulations can be challenging, especially when dealing with interstate transactions. Understanding the specific rules and requirements for each state is crucial for both insurance companies and individuals seeking coverage.

State Insurance Regulatory Bodies, Can you have insurance from another state

Each state has a dedicated regulatory body responsible for overseeing the insurance industry within its jurisdiction. These bodies, typically known as Departments of Insurance or Insurance Commissions, play a vital role in ensuring consumer protection, maintaining market stability, and enforcing compliance with state laws.

- Licensing and Registration Requirements: The licensing and registration requirements for insurance agents and brokers vary significantly across states. Some states may have more stringent requirements than others, including specific education, experience, and examination prerequisites.

- Insurance Product Approval: State regulators have the authority to approve new insurance products offered within their jurisdictions. This process involves reviewing the product’s terms and conditions, ensuring they meet specific standards and consumer protection requirements.

- Rate Regulation: States may implement different approaches to regulating insurance rates. Some states allow insurers to set rates based on market forces, while others may have more stringent rate review processes to ensure affordability and prevent excessive price increases.

- Consumer Protection: State insurance regulators have a mandate to protect consumers from unfair or deceptive insurance practices. This includes investigating consumer complaints, enforcing compliance with insurance laws, and providing information and resources to consumers.

Licensing and Registration Requirements for Insurance Agents and Brokers

The table below Artikels the licensing and registration requirements for insurance agents and brokers in several states:

| State | Agent Requirements | Broker Requirements |

|---|---|---|

| California | Pre-licensing education, exam, and licensing fee. | Pre-licensing education, exam, and licensing fee. Must also be licensed as an agent. |

| Texas | Pre-licensing education, exam, and licensing fee. | Pre-licensing education, exam, and licensing fee. Must also be licensed as an agent. |

| New York | Pre-licensing education, exam, and licensing fee. | Pre-licensing education, exam, and licensing fee. Must also be licensed as an agent. |

| Florida | Pre-licensing education, exam, and licensing fee. | Pre-licensing education, exam, and licensing fee. Must also be licensed as an agent. |

Key Differences in Insurance Laws and Regulations

The table below highlights some major differences in insurance laws and regulations across various states:

| State | Key Differences |

|---|---|

| California | Strong consumer protection laws, including a “fair claims practice” regulation. |

| Texas | More lenient regulations regarding rate setting and insurance product approval. |

| New York | Stricter regulations on insurance advertising and marketing practices. |

| Florida | Specific requirements for insurance coverage related to hurricanes and other natural disasters. |

Practical Considerations

Deciding whether to obtain insurance from another state involves weighing the potential benefits against the drawbacks. While it might seem appealing to explore options beyond your primary state of residence, it’s crucial to understand the intricacies and potential complications that could arise.

Potential Benefits

Obtaining insurance from another state can offer advantages in specific situations, especially when seeking:

- Lower Premiums: Insurance rates vary significantly across states due to factors like competition, regulatory environments, and risk profiles. You might find more affordable premiums in a state with a lower cost of living or less stringent regulations.

- Wider Coverage Options: Some states offer more comprehensive coverage options or unique insurance products that might not be available in your home state. This could be particularly relevant for specialized needs like high-risk occupations or unique assets.

- Flexibility for Travelers: If you frequently travel or relocate temporarily, obtaining insurance from a state where you spend a significant amount of time can simplify your coverage and reduce the need for multiple policies.

Potential Drawbacks

While there are potential benefits, obtaining insurance from another state also comes with potential drawbacks:

- State Residency Requirements: Insurance companies typically require proof of residency in the state where you’re obtaining coverage. Meeting these requirements can be challenging, especially if you don’t have a permanent address or spend most of your time in another state.

- Limited Access to Local Services: If you experience a claim, you might face difficulties accessing local services like roadside assistance or emergency medical care, especially if the insurer doesn’t have a strong presence in your primary state of residence.

- Navigating Out-of-State Regulations: Understanding the legal implications of obtaining insurance from another state can be complex. You need to ensure that the policy complies with the regulations of both your home state and the state where you’re obtaining coverage.

- Potential for Disputes: If a dispute arises, you might find yourself navigating a legal and regulatory framework that’s unfamiliar to you, potentially increasing the complexity and cost of resolving the issue.

Examples of Advantageous Situations

Obtaining insurance from another state can be advantageous in specific situations, such as:

- Relocation: If you’re planning a permanent move to another state, obtaining insurance from your new state of residence can ensure seamless coverage and potentially lower premiums.

- Second Home or Vacation Property: If you own a second home or vacation property in another state, obtaining insurance from that state can provide tailored coverage for your specific needs and potentially lower premiums.

- Working Remotely: If you work remotely and spend a significant amount of time in a different state, obtaining insurance from that state can ensure you have adequate coverage while working and living there.

Potential Challenges and Complications

Obtaining insurance from another state can present challenges and complications, including:

- Proof of Residency: Insurance companies require proof of residency in the state where you’re obtaining coverage. This can involve providing documentation like utility bills, driver’s license, voter registration, or lease agreements. If you’re not a permanent resident, meeting these requirements can be difficult.

- Limited Local Support: Insurance companies might have limited local support in your primary state of residence, making it challenging to access services like roadside assistance, claims processing, or emergency medical care.

- Regulatory Compliance: Navigating the regulations of both your home state and the state where you’re obtaining coverage can be complex and time-consuming. You need to ensure that the policy complies with all applicable laws and regulations.

- Potential for Disputes: If a dispute arises, you might find yourself navigating unfamiliar legal and regulatory frameworks, potentially increasing the complexity and cost of resolving the issue.

Last Point

Navigating insurance across state lines can be a complex endeavor. While obtaining insurance from another state might seem appealing for cost savings or broader coverage options, it’s essential to understand the potential implications. Thoroughly researching state regulations, considering your specific circumstances, and consulting with insurance professionals can help you make informed decisions that align with your needs and protect your interests. Remember, transparency and accuracy are crucial when dealing with insurance, as misrepresenting your residency can lead to serious consequences.

Query Resolution

What happens if I move to a new state but keep my old insurance?

It’s generally advisable to notify your insurance company about your move and update your policy. Failing to do so could lead to coverage gaps or issues in the event of a claim. Your insurance company might also adjust your rates based on the new state’s regulations.

Can I get insurance from a different state if I’m only there for a short period?

It depends on the specific insurance type and the length of your stay. For short-term stays, you might be able to maintain your current insurance or purchase temporary coverage in the new state. However, it’s best to contact your insurance company to clarify the options and requirements.

What if I’m working remotely but live in a different state from where I’m employed?

This situation can be complex, and it’s essential to consult with your insurance company and a legal professional to understand the implications for your insurance coverage. Factors like your primary residence, work location, and state regulations can all influence your insurance options.