Cheapest state minimum auto insurance can be a tempting option, especially for budget-conscious drivers. However, it’s crucial to understand the potential risks and limitations associated with carrying only the minimum coverage required by law. This guide will delve into the factors that influence auto insurance costs, explore state-specific minimum requirements, and provide valuable tips for finding affordable insurance options that meet your individual needs.

Each state mandates a minimum level of auto insurance coverage to protect drivers and other parties involved in accidents. These requirements vary widely, with some states having significantly higher minimums than others. Understanding these legal obligations is essential for every driver to ensure they are adequately protected and avoid potential legal consequences.

Understanding Minimum Auto Insurance Requirements

Every state in the U.S. mandates that drivers carry a minimum level of auto insurance to protect themselves and others in the event of an accident. These minimum requirements are designed to ensure financial responsibility and cover potential damages or injuries caused by an insured driver. Understanding these minimums is crucial for drivers to avoid legal penalties and ensure adequate coverage in case of an accident.

Minimum Auto Insurance Requirements by State

The minimum auto insurance requirements vary from state to state. Here’s a table outlining the minimum coverage requirements for each state:

| State | Minimum Liability Coverage | Minimum Property Damage Coverage | Minimum Uninsured/Underinsured Motorist Coverage |

|---|---|---|---|

| Alabama | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Alaska | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Arizona | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Arkansas | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| California | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Colorado | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Connecticut | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Delaware | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Florida | $10,000 per person/$20,000 per accident | $10,000 | $10,000 per person/$20,000 per accident |

| Georgia | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Hawaii | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Idaho | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Illinois | $20,000 per person/$40,000 per accident | $15,000 | $20,000 per person/$40,000 per accident |

| Indiana | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Iowa | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Kansas | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Kentucky | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Louisiana | $15,000 per person/$30,000 per accident | $10,000 | $15,000 per person/$30,000 per accident |

| Maine | $50,000 per person/$100,000 per accident | $25,000 | $50,000 per person/$100,000 per accident |

| Maryland | $30,000 per person/$60,000 per accident | $15,000 | $30,000 per person/$60,000 per accident |

| Massachusetts | $20,000 per person/$40,000 per accident | $5,000 | $20,000 per person/$40,000 per accident |

| Michigan | $20,000 per person/$40,000 per accident | $10,000 | $20,000 per person/$40,000 per accident |

| Minnesota | $30,000 per person/$60,000 per accident | $10,000 | $30,000 per person/$60,000 per accident |

| Mississippi | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Missouri | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Montana | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Nebraska | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Nevada | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New Hampshire | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| New Jersey | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| New Mexico | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| New York | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| North Carolina | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| North Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Ohio | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Oklahoma | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Oregon | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Pennsylvania | $15,000 per person/$30,000 per accident | $5,000 | $15,000 per person/$30,000 per accident |

| Rhode Island | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Carolina | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| South Dakota | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

| Tennessee | $25,000 per person/$50,000 per accident | $15,000 | $25,000 per person/$50,000 per accident |

| Texas | $30,000 per person/$60,000 per accident | $25,000 | $30,000 per person/$60,000 per accident |

| Utah | $25,000 per person/$65,000 per accident | $15,000 | $25,000 per person/$65,000 per accident |

| Vermont | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Virginia | $25,000 per person/$50,000 per accident | $20,000 | $25,000 per person/$50,000 per accident |

| Washington | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| West Virginia | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wisconsin | $25,000 per person/$50,000 per accident | $10,000 | $25,000 per person/$50,000 per accident |

| Wyoming | $25,000 per person/$50,000 per accident | $25,000 | $25,000 per person/$50,000 per accident |

Factors Influencing Auto Insurance Costs: Cheapest State Minimum Auto Insurance

Several factors contribute to the cost of your car insurance premiums. These factors can vary depending on the state you live in, the insurance company you choose, and your individual circumstances. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Driving History

Your driving history is one of the most significant factors affecting your auto insurance premiums. Insurance companies assess your risk based on your past driving behavior.

- A clean driving record with no accidents or traffic violations will generally result in lower premiums.

- Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

For instance, in states like California, a DUI conviction can significantly increase your insurance premiums for several years. In contrast, in states like Florida, insurance companies may offer discounts for safe driving records, such as a “good driver discount.”

Vehicle Type and Age, Cheapest state minimum auto insurance

The type and age of your vehicle are also crucial factors in determining your insurance premiums.

- High-performance vehicles, sports cars, and luxury cars are generally more expensive to insure due to their higher repair costs and potential for greater damage.

- Older vehicles, on the other hand, may have lower premiums because their replacement value is lower. However, older vehicles may have higher repair costs due to the availability of parts and the complexity of repairs.

For example, a brand new Tesla Model S will likely have a higher insurance premium than a 10-year-old Honda Civic.

Location

The location where you live plays a significant role in determining your insurance premiums.

- Insurance companies consider factors like the density of population, traffic volume, and the frequency of accidents in your area.

- Areas with higher crime rates or more congested traffic may have higher premiums due to the increased risk of accidents and theft.

For instance, insurance premiums in metropolitan areas like New York City are typically higher than in rural areas of Wyoming.

Credit Score

Your credit score is another factor that insurance companies may use to determine your premiums.

- A higher credit score generally indicates a lower risk to insurance companies, leading to lower premiums.

- Conversely, a lower credit score may indicate a higher risk, resulting in higher premiums.

The rationale behind this is that individuals with good credit history are generally more responsible and financially stable, which may translate to responsible driving habits. This factor is particularly relevant in states like California, where insurance companies are allowed to use credit scores to set premiums.

Age and Gender

Age and gender can also impact your insurance premiums.

- Younger drivers, especially those under 25, are generally considered higher risk due to their lack of experience and driving history.

- In some states, men may pay higher premiums than women due to historical data showing that men are statistically more likely to be involved in accidents.

For example, a 18-year-old male driver in New York City might pay significantly higher premiums than a 40-year-old female driver in a rural area.

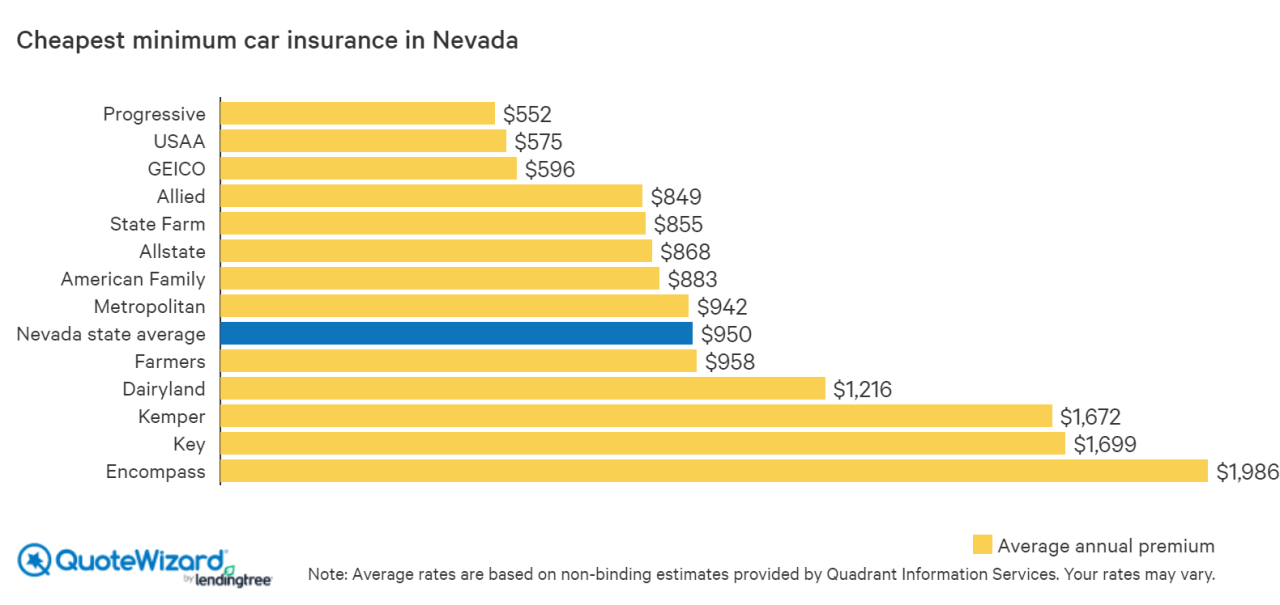

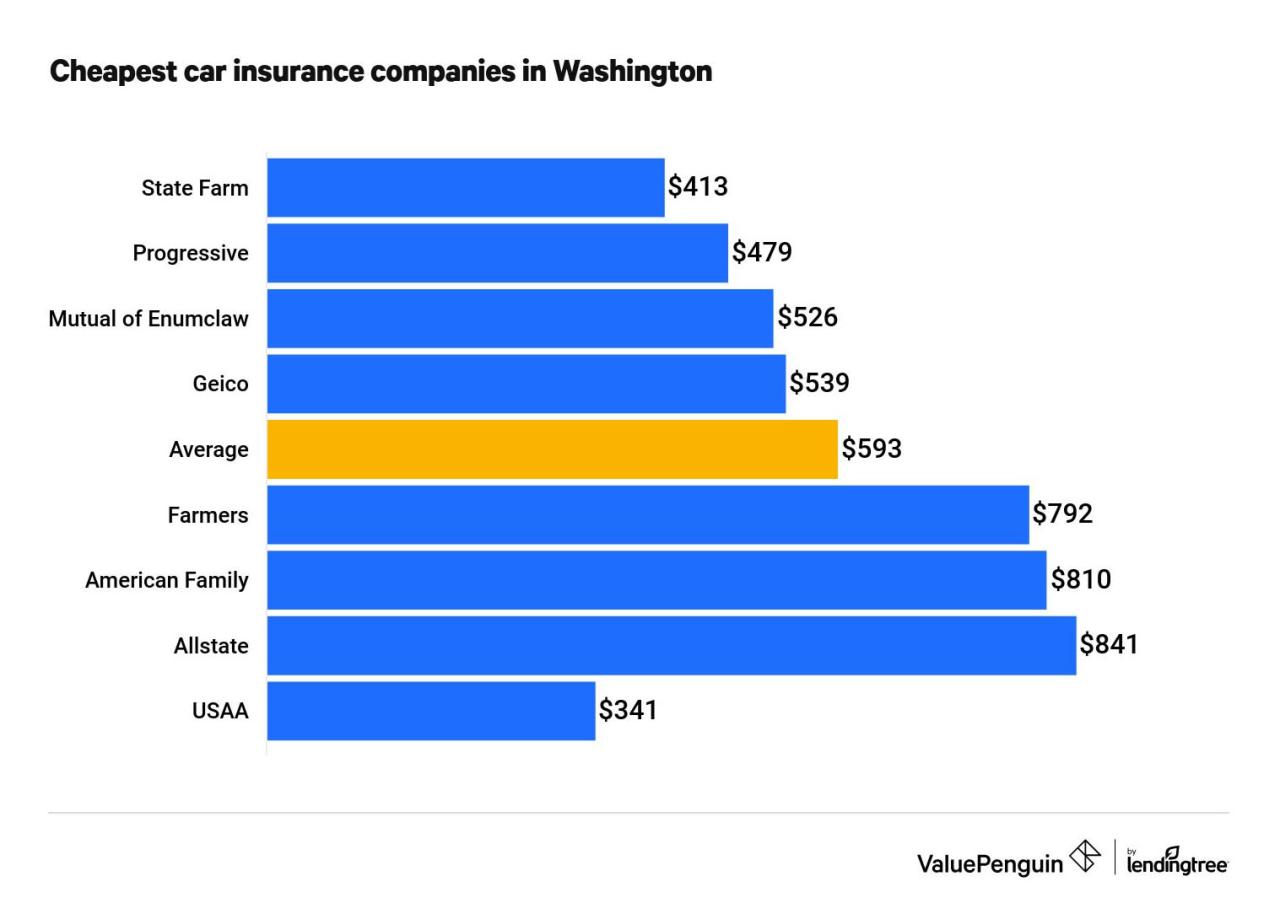

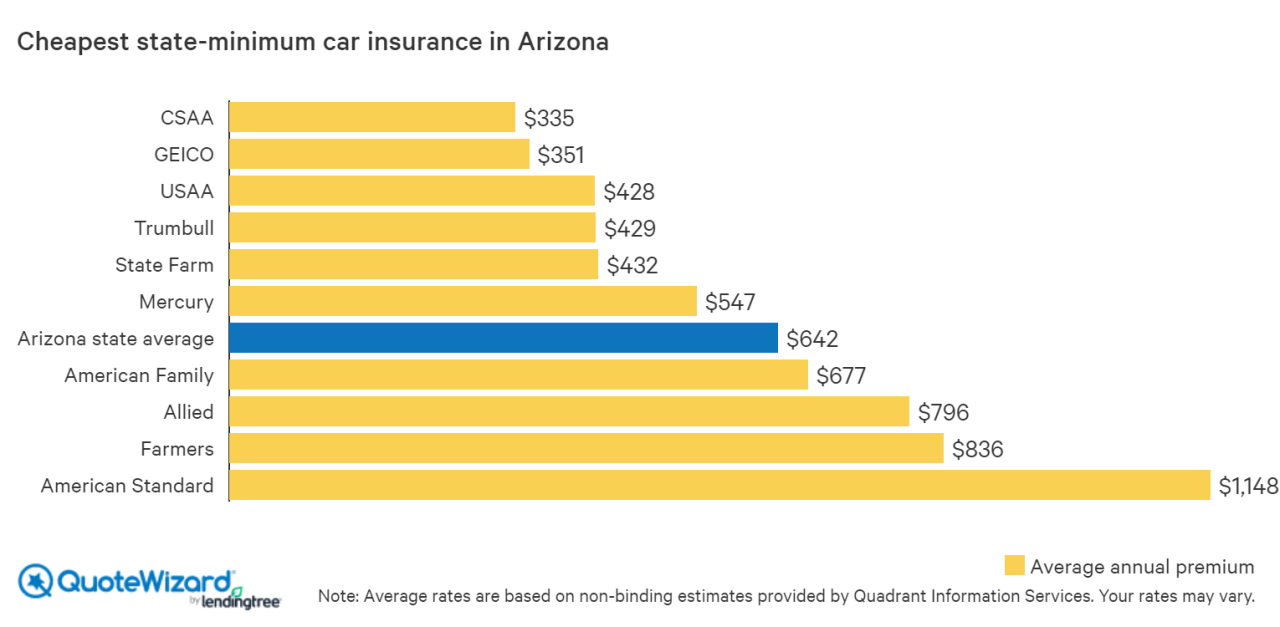

State-Specific Considerations for Cheapest Minimum Coverage

Finding the cheapest minimum auto insurance can be a challenge, and state-specific factors significantly influence the cost of coverage. Understanding these variations can help you find the most affordable option for your needs.

States with the Lowest Minimum Auto Insurance Premiums

Here is a list of states with the lowest average minimum auto insurance premiums, offering insights into the factors contributing to their affordability:

- Idaho: With an average minimum premium of $450 per year, Idaho stands out as one of the most affordable states for minimum auto insurance. Factors contributing to this include a lower population density, fewer accidents, and a robust economy.

- Iowa: With an average minimum premium of $475 per year, Iowa benefits from a strong economy, low traffic density, and relatively safe driving conditions.

- Maine: Maine’s average minimum premium of $500 per year is attributed to its low population density, a well-maintained road system, and a relatively low number of accidents.

- Mississippi: Mississippi has an average minimum premium of $525 per year, driven by a lower cost of living, less congestion, and a relatively lower number of accidents.

- North Dakota: With an average minimum premium of $550 per year, North Dakota boasts a strong economy, low traffic density, and a relatively safe driving environment.

Choosing the Right Coverage

While minimum coverage is the cheapest option, it’s crucial to understand that it might not provide adequate protection in case of an accident. Opting for minimum coverage could leave you financially vulnerable if you’re involved in a serious accident, especially if you’re at fault.

Comparing Coverage Options

Choosing the right coverage is a personal decision that depends on your individual circumstances, risk tolerance, and financial situation. It’s important to carefully consider the potential consequences of opting for minimum coverage versus higher coverage options.

- Minimum coverage, while the cheapest, offers limited protection and could leave you responsible for significant out-of-pocket expenses in case of an accident.

- Higher coverage options, such as comprehensive and collision, provide greater financial protection but come at a higher cost.

Here’s a table comparing different coverage options, their costs, and potential benefits:

| Coverage Option | Cost | Potential Benefits |

|---|---|---|

| Minimum Coverage | Lowest | Least expensive, meets legal requirements |

| Liability Coverage | Higher than minimum | Covers damages to other people’s property and injuries |

| Collision Coverage | Higher than liability | Covers repairs or replacement of your vehicle in case of an accident |

| Comprehensive Coverage | Higher than collision | Covers damages to your vehicle due to theft, vandalism, natural disasters, etc. |

| Uninsured/Underinsured Motorist Coverage | Higher than comprehensive | Covers damages if you’re hit by an uninsured or underinsured driver |

Choosing the right coverage is a personal decision that requires careful consideration of your individual needs and financial situation.

Finding Affordable Insurance Options

You’ve learned about the minimum auto insurance requirements in your state and the factors that affect insurance costs. Now, let’s delve into practical strategies for finding affordable insurance options.

Shopping Around for Quotes

Comparing quotes from multiple insurance providers is crucial for finding the best deal. Here’s how to do it effectively:

- Use online comparison websites: Websites like Policygenius, Insurance.com, and The Zebra allow you to enter your information once and receive quotes from multiple insurers.

- Contact insurers directly: Reach out to insurance companies directly to request quotes. This gives you a chance to ask specific questions and discuss your needs.

- Consider local insurers: Local insurance agents often have access to unique discounts and policies not offered by national companies.

Maintaining a Good Driving Record

Your driving history is a significant factor in determining your insurance premiums. A clean record translates into lower rates.

- Avoid traffic violations: Speeding tickets, reckless driving, and DUI convictions can significantly increase your insurance costs.

- Practice safe driving: Defensive driving courses can help you learn safe driving habits and potentially earn discounts.

- Maintain a clean driving record: Avoid accidents, as even minor incidents can impact your premiums.

Exploring Discounts

Insurance companies offer various discounts to lower premiums.

- Good student discounts: Students with good grades often qualify for discounts.

- Safe driver discounts: Drivers with a clean driving record for a specified period can receive discounts.

- Multi-car discounts: If you insure multiple vehicles with the same company, you can get a discount.

- Loyalty discounts: Some insurers reward long-term customers with discounts.

- Bundling discounts: Combining your auto insurance with other policies like homeowners or renters insurance can lead to savings.

- Anti-theft device discounts: Installing anti-theft devices like alarms or GPS trackers can qualify you for discounts.

- Pay-in-full discounts: Paying your premium in full upfront can sometimes earn you a discount.

- Telematics discounts: Using telematics devices that track your driving habits can earn you discounts based on safe driving.

Bundling Insurance Policies

Combining multiple insurance policies, like auto, homeowners, renters, or life insurance, with the same company can often lead to significant discounts.

Ending Remarks

Navigating the complex world of auto insurance can be daunting, but understanding the basics of state minimum requirements and exploring various coverage options can empower you to make informed decisions. By carefully considering your individual needs, comparing quotes, and taking advantage of available discounts, you can find affordable insurance that provides the necessary protection without breaking the bank. Remember, choosing the right auto insurance coverage is not just about saving money; it’s about safeguarding yourself, your loved ones, and your financial well-being.

Essential FAQs

What are the consequences of driving with only minimum coverage?

If you are involved in an accident and only carry minimum coverage, you could be personally liable for any damages exceeding your coverage limits. This can lead to significant financial hardship and legal complications.

How can I find out the minimum insurance requirements in my state?

You can easily find this information on your state’s Department of Motor Vehicles website or by contacting your insurance agent.

Are there any discounts available for minimum coverage?

While some discounts might apply to minimum coverage, they are typically limited compared to those offered for higher coverage options.