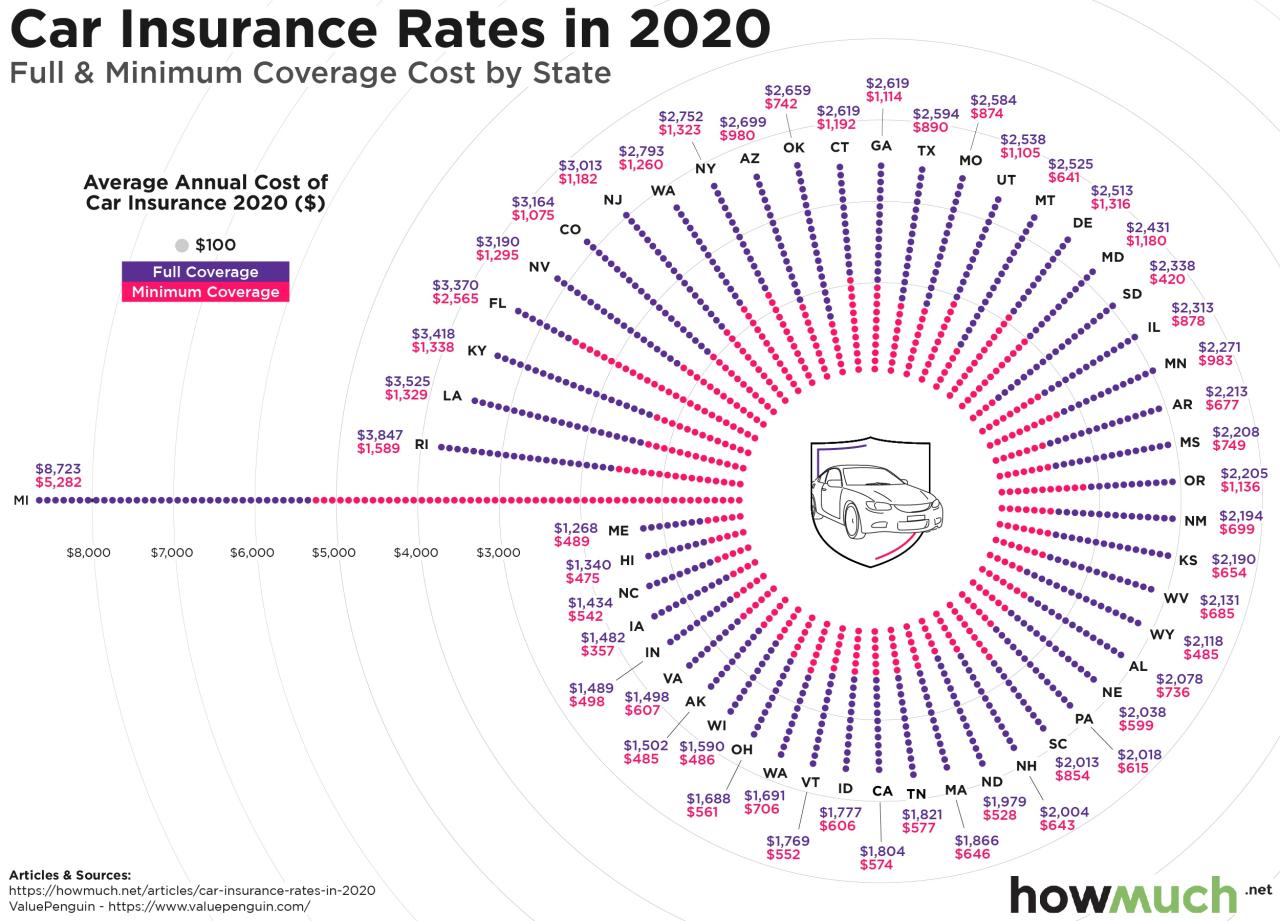

Car insurance comparison by state is crucial for finding the most affordable and comprehensive coverage. Every state has unique regulations, driving habits, and risk factors that influence insurance costs. By comparing rates across different insurers and states, you can potentially save hundreds of dollars on your annual premiums.

This guide delves into the key factors that affect car insurance rates in each state, providing insights into how state-specific regulations, demographics, driving history, and vehicle type impact your premiums. We’ll explore the best tools and resources for comparing quotes, offering tips to understand the components of a quote and negotiate the best price.

Introduction to Car Insurance Comparison by State

Finding the best car insurance rates can be a challenging task, especially when considering the vast differences in insurance costs across different states. Comparing car insurance rates by state is crucial to ensure you are getting the most competitive price for your coverage needs.

This guide will delve into the reasons why comparing car insurance rates by state is important and provide an overview of the factors that influence car insurance costs. We will also explore the potential benefits of comparing rates across different states.

Factors Influencing Car Insurance Costs

Understanding the factors that influence car insurance costs is essential for making informed decisions about your coverage. These factors can vary significantly from state to state, leading to substantial differences in insurance premiums.

Here are some key factors that contribute to car insurance costs in different states:

- Number of Drivers and Vehicles: States with higher populations and more vehicles on the road tend to have higher insurance rates due to increased risk of accidents.

- Traffic Density and Congestion: Areas with heavy traffic and congestion often have higher accident rates, leading to higher insurance premiums.

- Cost of Living and Medical Expenses: States with higher costs of living and medical expenses generally have higher insurance premiums, as insurance companies need to cover these costs.

- Severity of Accidents: States with a history of severe accidents, such as those with high speeds or mountainous terrain, tend to have higher insurance rates.

- State Regulations and Laws: State regulations and laws governing car insurance, such as minimum coverage requirements and no-fault insurance laws, can impact insurance costs.

- Natural Disasters and Weather Patterns: States prone to natural disasters, such as hurricanes, earthquakes, or tornadoes, may have higher insurance premiums due to increased risk.

Benefits of Comparing Car Insurance Rates by State

Comparing car insurance rates by state offers numerous benefits, allowing you to find the most affordable and comprehensive coverage for your needs.

- Lower Premiums: By comparing rates across different states, you can identify insurers offering lower premiums for the same coverage level.

- Wider Range of Coverage Options: Different insurers may offer different coverage options and discounts, providing a wider range of choices to suit your individual needs.

- Improved Negotiation Power: Knowing the average insurance rates in your state and surrounding areas can give you leverage when negotiating with insurers for better rates.

- Enhanced Financial Security: Finding the most affordable coverage ensures you are adequately protected while minimizing your insurance expenses.

Key Factors Affecting Car Insurance Rates

Car insurance premiums are influenced by various factors, some of which are specific to each state. Understanding these factors can help you make informed decisions when comparing car insurance quotes and potentially reduce your overall costs.

State Regulations and Laws

State regulations play a significant role in shaping car insurance rates. Each state has its own set of laws and regulations governing insurance practices, including minimum coverage requirements, rate setting methods, and the availability of certain insurance options. For example, some states allow insurers to use credit scores as a factor in determining rates, while others prohibit this practice.

- Minimum Coverage Requirements: States mandate minimum liability coverage levels, which can impact premiums. States with higher minimum coverage requirements typically have higher average insurance premiums.

- Rate Setting Methods: Different states employ various methods for setting insurance rates, including using a “file and use” system where insurers submit their rates for approval or a “competitive rating” system where insurers are free to set their rates based on market competition. These methods can influence the overall rate landscape in a state.

- Availability of Insurance Options: Some states offer unique insurance options, such as low-cost insurance programs for low-income drivers or programs for drivers with clean driving records. The availability of such programs can affect the average insurance costs in a state.

Demographics and Driving History

Demographics and driving history are key factors that insurers consider when calculating premiums. These factors reflect the likelihood of an individual driver being involved in an accident, and insurers use them to differentiate risk levels and adjust rates accordingly.

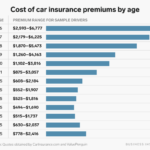

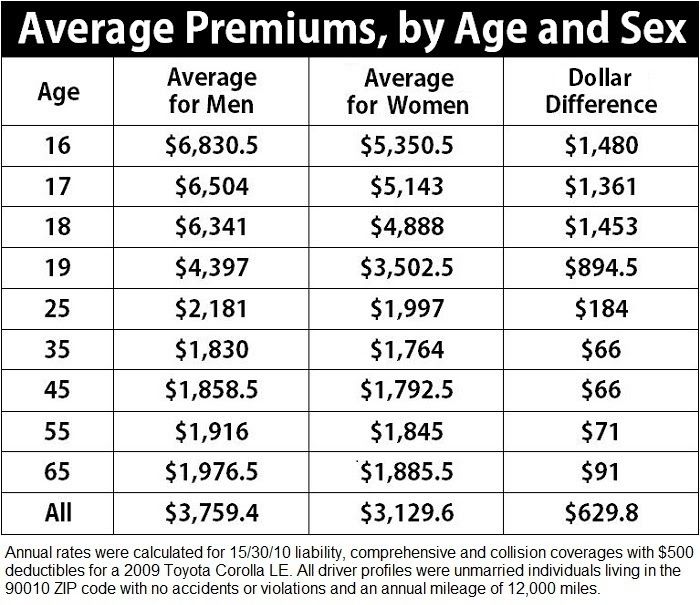

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurers often charge higher premiums for young drivers, reflecting this increased risk. Similarly, gender can also be a factor in some states, with males historically having higher accident rates than females.

- Driving History: Drivers with a history of accidents, speeding tickets, or other traffic violations are considered higher risk and typically face higher premiums. Conversely, drivers with clean driving records often qualify for discounts.

- Credit Score: In some states, insurers may use credit scores as a proxy for risk assessment. Drivers with good credit scores may be eligible for lower premiums, while those with poor credit scores may face higher rates. This practice is controversial and not universally accepted.

Vehicle Type and Features

The type of vehicle you drive and its features significantly impact insurance premiums. Insurers consider factors like the vehicle’s safety ratings, repair costs, and theft risk to determine the associated risk and adjust premiums accordingly.

- Vehicle Safety Ratings: Cars with high safety ratings, as determined by organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA), are generally associated with lower insurance costs. These vehicles are less likely to be involved in severe accidents, resulting in lower repair costs and potential claims for insurers.

- Repair Costs: Vehicles with expensive parts or complex repair procedures tend to have higher insurance premiums. Insurers factor in the potential cost of repairs in case of an accident, and vehicles with higher repair costs reflect a greater financial risk for insurers.

- Theft Risk: Vehicles with high theft rates are more likely to be stolen, resulting in higher insurance premiums. Insurers consider the vehicle’s theft history and market value to determine the associated theft risk.

Other Factors, Car insurance comparison by state

Besides the major factors mentioned above, other factors can influence car insurance rates. These include:

- Location: Rates can vary significantly based on your geographic location. Areas with higher traffic density, crime rates, or a history of severe weather events may have higher premiums.

- Driving Distance: The amount you drive can also impact your premiums. Drivers who commute long distances or frequently drive in congested areas may face higher rates due to increased exposure to potential accidents.

- Usage: The purpose for which you use your vehicle can affect your insurance rates. Drivers who use their cars primarily for commuting may pay lower premiums than those who use their cars for business purposes or for frequent long-distance trips.

State-Specific Car Insurance Regulations

Each state in the United States has its own set of car insurance regulations, which can significantly impact the cost and coverage of your insurance policy. These regulations are designed to protect drivers and ensure that they have adequate financial coverage in case of an accident.

Mandatory Coverage Requirements

State regulations define the minimum amount of car insurance coverage that drivers must carry. These requirements vary widely from state to state, with some states requiring more coverage than others.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It typically includes bodily injury liability (BIL) and property damage liability (PDL).

- Personal Injury Protection (PIP): Some states require PIP coverage, which covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured. It helps cover your medical expenses, lost wages, and property damage.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. It is usually optional but can be required if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, or natural disasters. It is typically optional but may be required if you have a loan or lease on your vehicle.

Impact of State-Specific Regulations on Insurance Rates

State regulations can have a significant impact on car insurance rates. States with higher minimum coverage requirements generally have higher insurance premiums, as insurers have to cover more potential costs.

For example, states like New Jersey and Pennsylvania have some of the highest minimum liability coverage requirements in the country, which contributes to higher insurance rates in those states.

States with more lenient regulations or those that allow drivers to opt out of certain coverage types, such as PIP, may have lower average insurance premiums.

For instance, states like Florida and Texas have more flexible car insurance laws, which can result in lower average insurance rates compared to states with stricter regulations.

Car Insurance Comparison Tools and Resources

Finding the best car insurance policy can be a daunting task, especially with the wide array of options and varying rates available. Fortunately, numerous car insurance comparison tools and resources exist to simplify the process and help you find the most suitable coverage at the best price. These tools provide a convenient platform to compare quotes from multiple insurers, saving you time and effort.

Popular Car Insurance Comparison Websites and Tools

Car insurance comparison websites and tools are designed to streamline the process of finding the best insurance policy for your needs. They aggregate quotes from multiple insurers, allowing you to compare prices and coverage options side-by-side. Some of the popular websites and tools include:

- Insurify: Insurify is a comprehensive platform that compares quotes from over 20 top-rated insurance companies. It offers features like personalized recommendations, coverage insights, and policy reviews, making it a valuable resource for finding the right insurance.

- QuoteWizard: QuoteWizard is another popular comparison website that allows you to compare quotes from a wide range of insurers. It also provides helpful information about car insurance, such as coverage options and factors that affect rates.

- Policygenius: Policygenius is a website that compares quotes for various insurance products, including car insurance. It offers a user-friendly interface and provides personalized recommendations based on your individual needs.

- The Zebra: The Zebra is a comparison website that focuses on car insurance. It allows you to compare quotes from over 100 insurers and offers insights into coverage options and discounts.

Advantages of Using Car Insurance Comparison Tools

Utilizing car insurance comparison tools offers several advantages:

- Convenience: These tools allow you to compare quotes from multiple insurers without having to contact each company individually. This saves you time and effort, especially if you are comparing quotes from a large number of insurers.

- Transparency: Comparison websites provide a transparent view of insurance quotes, allowing you to easily compare prices and coverage options. This helps you make an informed decision based on your specific needs and budget.

- Access to a Wide Range of Insurers: Most comparison websites have partnerships with a wide range of insurers, giving you access to a diverse pool of options. This increases your chances of finding the best policy for your situation.

- Potential for Savings: By comparing quotes from multiple insurers, you are more likely to find a policy that fits your budget and offers competitive rates. This can result in significant savings on your car insurance premiums.

Disadvantages of Using Car Insurance Comparison Tools

While comparison tools offer numerous benefits, they also have some potential drawbacks:

- Limited Information: Some comparison websites may not provide comprehensive information about all coverage options or discounts offered by insurers. It is important to carefully review the details of each quote and contact the insurer directly for any clarification.

- Bias: Some comparison websites may have partnerships with specific insurers, which could influence the order in which quotes are displayed. It is crucial to compare quotes from multiple websites to ensure you are getting a comprehensive overview.

- Potential for Errors: While comparison websites strive for accuracy, errors can occur. It is essential to double-check the information provided by the website and contact the insurer directly to confirm any details before making a decision.

Tips for Effectively Using Car Insurance Comparison Resources

To maximize the effectiveness of car insurance comparison resources, follow these tips:

- Be Accurate with Your Information: Provide accurate information about your driving history, vehicle details, and other relevant factors to ensure you receive accurate quotes.

- Compare Quotes from Multiple Websites: Do not rely on just one comparison website. Compare quotes from multiple websites to get a comprehensive overview of available options.

- Read the Fine Print: Carefully review the details of each quote, including coverage options, deductibles, and exclusions. This will help you understand the terms and conditions of each policy.

- Contact Insurers Directly: If you have any questions or need clarification, contact the insurer directly. This allows you to discuss specific details and ensure you fully understand the policy before making a decision.

- Consider Discounts: Many insurers offer discounts for safe driving, good student status, and other factors. Be sure to inquire about available discounts to potentially lower your premiums.

Understanding Car Insurance Quotes

A car insurance quote is an estimate of how much you’ll pay for coverage. It’s a crucial step in the car insurance buying process, allowing you to compare different insurers and policies. Understanding the components of a quote helps you make informed decisions about your coverage.

Components of a Car Insurance Quote

A car insurance quote typically includes several key components:

- Premium: The amount you’ll pay for your insurance coverage. This is often broken down into monthly or annual installments.

- Deductible: The amount you’ll pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to a lower premium, while a lower deductible means you’ll pay less out of pocket in case of an accident.

- Coverage Limits: The maximum amount your insurer will pay for covered losses, such as bodily injury liability, property damage liability, collision coverage, and comprehensive coverage.

- Discounts: Various discounts may be available based on your driving record, vehicle safety features, or other factors. These discounts can significantly reduce your premium.

Interpreting and Comparing Quotes

Once you receive quotes from different insurers, it’s essential to compare them carefully. Consider the following:

- Coverage: Make sure the coverage offered by each insurer is comparable. Pay attention to the limits and deductibles, as they can vary significantly.

- Price: Compare the premiums for similar coverage levels. Don’t just focus on the lowest price; consider the overall value and reputation of the insurer.

- Discounts: See if all applicable discounts have been applied to your quote. Some insurers may offer more discounts than others.

- Customer Service: Research the insurer’s customer service reputation. Look for reviews and ratings to gauge their responsiveness and ability to handle claims efficiently.

Factors Affecting Quote Accuracy

Car insurance quotes are estimates, and several factors can influence their accuracy. These include:

- Personal Information: Your age, driving history, credit score, and other personal factors can significantly impact your premium.

- Vehicle Information: The make, model, year, and safety features of your vehicle all play a role in determining your insurance cost.

- Location: Your state of residence, ZIP code, and the overall risk level of your area can affect your premium.

- Coverage Choices: The specific coverage levels and deductibles you choose will influence your quote.

- Data Accuracy: Inaccurate or incomplete information provided during the quoting process can lead to inaccurate estimates.

Tips for Finding Affordable Car Insurance

Finding the right car insurance policy can be a daunting task, especially if you’re looking to keep premiums low. Luckily, there are a number of strategies you can use to make your car insurance more affordable.

Improving Your Driving Record

A clean driving record is one of the most significant factors influencing your car insurance rates. A history of accidents, traffic violations, or driving under the influence can lead to higher premiums. Here are some tips to improve your driving record:

- Avoid Traffic Violations: Even minor traffic violations can lead to higher insurance rates. Pay attention to speed limits, stop signs, and other traffic regulations.

- Drive Defensively: Practice defensive driving techniques, such as maintaining a safe distance from other vehicles, scanning for potential hazards, and anticipating the actions of other drivers.

- Take a Defensive Driving Course: Many insurance companies offer discounts for completing a defensive driving course. These courses can teach you valuable driving skills and help you avoid accidents.

Choosing the Right Coverage

The type of coverage you choose can significantly impact your premiums. While comprehensive and collision coverage are essential for protecting yourself financially in the event of an accident, they can also be expensive.

- Consider Dropping Collision and Comprehensive Coverage: If your car is older or has a low value, you may be able to save money by dropping collision and comprehensive coverage. These coverages are designed to repair or replace your car in the event of an accident or damage from other events, such as theft or hail.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket if you file a claim, but it can also result in lower premiums. Consider how much you can afford to pay in the event of an accident and choose a deductible that balances your budget with your insurance costs.

- Review Your Coverage Regularly: As your life and financial situation change, it’s essential to review your insurance coverage to ensure you have the right amount of protection and avoid paying for unnecessary coverage.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings.

- Explore Bundling Options: Contact your insurance company to see if they offer discounts for bundling multiple policies.

- Compare Quotes from Different Companies: It’s a good idea to get quotes from multiple insurance companies to see if you can find a better deal by bundling with a different provider.

Negotiating with Your Insurance Company

Don’t be afraid to negotiate with your insurance company to try to get a lower rate.

- Ask for Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and memberships in certain organizations. Ask your insurer about any discounts you may qualify for.

- Shop Around: Get quotes from multiple insurance companies and use them as leverage to negotiate a better rate with your current insurer.

- Be Prepared to Switch Providers: If you can’t get the rate you want from your current insurer, be prepared to switch to a different company.

Other Tips for Saving Money on Car Insurance

- Choose a Safe Car: Certain car models are considered safer than others, and insurance companies often offer lower rates for these vehicles.

- Park in a Garage: Parking your car in a garage can reduce the risk of theft or damage, which can lead to lower insurance premiums.

- Maintain a Good Credit Score: Your credit score can affect your insurance rates in some states.

State-Specific Car Insurance Trends

The car insurance landscape is constantly evolving, driven by technological advancements, changing consumer behavior, and evolving regulatory frameworks. Understanding these trends is crucial for drivers seeking the most affordable and comprehensive coverage.

Impact of Technology on Car Insurance

Technological advancements are significantly impacting car insurance. These innovations are influencing pricing, coverage, and the overall customer experience.

- Telematics: Telematics devices and smartphone apps track driving behavior, such as speed, braking, and mileage. This data allows insurers to offer personalized rates based on individual driving habits. This can lead to significant discounts for safe drivers and potentially higher premiums for those exhibiting risky behavior.

- Usage-Based Insurance (UBI): UBI programs use telematics data to tailor premiums to actual driving patterns. Drivers who drive less or more safely often pay lower premiums. UBI is becoming increasingly popular as it offers greater fairness and transparency in pricing.

- Autonomous Vehicles: The emergence of autonomous vehicles (AVs) presents both challenges and opportunities for the car insurance industry. While AVs are expected to significantly reduce accidents, the liability for accidents involving AVs is still under debate. Insurers are adapting their policies and developing new coverage options for AVs.

Emerging Trends in Car Insurance

Several emerging trends are shaping the future of car insurance in different states.

- Increased Competition: The car insurance market is becoming increasingly competitive, with new entrants and innovative products challenging traditional insurers. This competition benefits consumers with more choices and potentially lower premiums.

- Focus on Customer Experience: Insurers are prioritizing customer experience, offering online platforms, mobile apps, and personalized services to enhance convenience and satisfaction. This trend is driven by consumer demand for digital-first experiences.

- Data-Driven Pricing: Insurers are leveraging data analytics to personalize pricing and offer more accurate risk assessments. This includes using factors like credit score, driving history, and location to determine premiums.

Future of Car Insurance

The future of car insurance is likely to be driven by technological advancements, evolving consumer expectations, and regulatory changes.

- Increased Automation: Automation will play a larger role in claims processing, underwriting, and customer service. This will lead to faster and more efficient service for policyholders.

- Personalized Coverage: Car insurance policies will become increasingly personalized, with coverage options tailored to individual needs and driving habits. This could include coverage for specific features like driver assistance systems or connected car technologies.

- Emphasis on Prevention: Insurers are focusing on preventive measures to reduce accidents and claims. This includes promoting safe driving practices, offering telematics-based discounts, and partnering with organizations to improve road safety.

Final Summary

Armed with the knowledge of how car insurance rates vary across states and the tools to effectively compare quotes, you can confidently navigate the insurance market and find the best coverage at the most competitive price. Remember, a little research and comparison can go a long way in securing affordable and reliable car insurance.

Answers to Common Questions: Car Insurance Comparison By State

How often should I compare car insurance rates?

It’s recommended to compare rates at least annually, or even more frequently if you experience significant life changes like a new car, a move to a different state, or a change in your driving record.

What information do I need to get a car insurance quote?

Insurers typically require your personal information, vehicle details, driving history, and coverage preferences to generate an accurate quote.

Can I bundle my car insurance with other policies?

Yes, bundling your car insurance with other policies like home or renters insurance can often lead to significant discounts.

What are some tips for negotiating car insurance premiums?

Consider asking for discounts based on your driving history, safety features in your car, and loyalty to the insurer. You can also try negotiating with multiple insurers to find the best deal.