Can you get car insurance in another state sets the stage for this exploration, offering readers a glimpse into the world of out-of-state insurance, exploring its feasibility, requirements, and considerations. Whether you’re relocating, traveling, or simply seeking the best rates, understanding the intricacies of out-of-state coverage is essential. This guide delves into the key factors that influence your ability to secure insurance in a new state, highlighting the potential challenges and benefits that may arise.

The process of obtaining car insurance in a state where you’re not a resident can be complex, but it’s not impossible. Many factors play a role, including your residency status, the state’s insurance regulations, and the specific insurance provider’s policies. Understanding these factors can help you navigate the process effectively and secure the coverage you need.

Understanding State-Specific Insurance Requirements

Each state in the US has its own set of rules and regulations regarding car insurance, which are designed to ensure that drivers have adequate financial protection in case of accidents. These requirements can vary significantly from state to state, impacting the types of coverage you need and the cost of your premiums.

Minimum Coverage Levels

The minimum coverage levels required by each state are known as “financial responsibility laws” and are designed to protect other drivers and their property in the event of an accident. These requirements typically include:

- Liability Coverage: This covers bodily injury and property damage to others caused by an accident. It is usually expressed as a per-person and per-accident limit, such as 25/50/10, which means $25,000 per person, $50,000 per accident for bodily injury, and $10,000 for property damage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you and your passengers if you are involved in an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs, regardless of fault, if you are injured in an accident. This is not required in all states.

Differences in Insurance Regulations, Can you get car insurance in another state

States differ in their specific insurance regulations, such as:

- Required Coverage: Some states require additional coverage beyond the basic liability, such as PIP or uninsured motorist coverage.

- Coverage Limits: The minimum coverage limits required by each state can vary significantly, impacting the amount of protection you have in case of an accident.

- Insurance Rates: State regulations can influence insurance rates through factors like required coverage levels, regulations on how insurance companies can set rates, and the availability of discounts.

Impact on Coverage Options and Premiums

The state-specific insurance requirements can have a significant impact on your coverage options and premiums:

- Coverage Options: If a state requires certain coverage, you will be obligated to purchase it, even if you don’t believe you need it. For example, if a state requires PIP coverage, you will need to include it in your policy, even if you have other health insurance.

- Premiums: States with higher minimum coverage requirements or more stringent regulations on insurance companies may have higher average premiums.

Eligibility for Out-of-State Coverage: Can You Get Car Insurance In Another State

Generally, obtaining car insurance in a state where you are not a resident is possible but comes with specific requirements and limitations. Insurers often have criteria for determining eligibility based on factors like your residency status, the purpose of your presence in the new state, and the duration of your stay.

Common Scenarios for Out-of-State Coverage

You can typically obtain out-of-state coverage in certain situations:

- Temporary Residency: If you are relocating to a new state for a short period, such as for work or school, you may be eligible for out-of-state coverage. You might need to provide documentation of your temporary residency, such as a lease agreement or student ID.

- Travel: When traveling to another state for vacation or business, you can usually obtain temporary coverage for the duration of your trip. This is often referred to as “trip insurance” and may be included as part of your existing policy or purchased separately.

- Military Deployment: Active-duty military personnel are often eligible for out-of-state coverage while stationed in a different state. This may be facilitated through special programs or agreements between insurers and the military.

Limitations of Out-of-State Coverage

While obtaining out-of-state coverage is possible, it may come with certain limitations:

- Coverage Restrictions: Out-of-state policies may have limited coverage compared to policies issued in the state where you reside. For instance, some policies might not cover accidents in certain states or may have lower coverage limits.

- Higher Premiums: Out-of-state policies may be more expensive than policies issued in your home state. Insurers might consider out-of-state drivers as higher risks due to factors like unfamiliar roads and traffic patterns.

- Limited Coverage for Specific Situations: Some out-of-state policies may not cover certain situations, such as driving for work or operating a commercial vehicle. It is crucial to check the policy details and ensure it meets your specific needs.

Obtaining Out-of-State Insurance

Securing car insurance in a state different from your primary residence involves several steps, including researching providers, comparing quotes, and fulfilling specific requirements. It’s important to understand the nuances of out-of-state insurance to ensure you have the right coverage.

Finding Insurance Providers

Finding suitable insurance providers in a new state can be done through various resources.

- Online Platforms: Several websites allow you to compare quotes from multiple insurers in a single location. These platforms often offer features like filtering by coverage type, price range, and customer reviews, simplifying your search. Popular examples include Insurance.com, The Zebra, and Policygenius.

- Insurance Agents: Independent insurance agents can provide personalized advice and help you navigate the process. They represent multiple insurance companies, allowing them to offer a wider range of options and potentially better rates. You can find agents through online directories, referrals, or by contacting your current insurer.

- Direct Insurers: Some insurance companies operate directly, offering policies through their websites or call centers. These companies often have competitive rates and streamlined application processes. Examples include Geico, Progressive, and State Farm.

Required Documentation

When applying for out-of-state insurance, you’ll need to provide certain documentation to verify your identity and driving history.

- Driver’s License: Your current driver’s license, issued by your state of residence, is essential for identification and verification of your driving record.

- Proof of Residency: You’ll likely need to provide evidence of your new state residency, such as a utility bill, lease agreement, or voter registration card. This demonstrates your connection to the state and helps determine the appropriate coverage and rates.

- Vehicle Registration: You’ll need to provide your vehicle registration information, including the vehicle identification number (VIN), to ensure accurate coverage and ensure your car is properly insured in the new state.

- Previous Insurance Information: Your current insurance provider’s contact information and policy details, including coverage limits and renewal dates, may be requested to assess your driving history and risk profile.

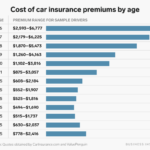

Factors Affecting Out-of-State Premiums

Getting car insurance in another state can lead to changes in your premium. A variety of factors influence how much you’ll pay for coverage. Understanding these factors can help you make informed decisions about your insurance needs.

Factors Affecting Out-of-State Premiums

Several factors can influence the cost of car insurance when obtained in a different state. Here’s a breakdown of the key factors and their impact:

- State-Specific Insurance Regulations: Each state has its own unique set of regulations governing car insurance. These regulations cover minimum coverage requirements, coverage options, and pricing practices. For example, some states have higher minimum liability limits than others, which can affect the cost of your insurance.

- Driving History: Your driving record is a significant factor in determining your premium. States may weigh specific violations differently, such as speeding tickets or accidents. A clean driving record generally leads to lower premiums, while a history of accidents or violations can increase your cost.

- Vehicle Type: The type of vehicle you drive also plays a role in your premium. Factors such as the vehicle’s make, model, year, and safety features can affect how much you pay. For example, high-performance sports cars typically have higher insurance premiums due to their higher risk of accidents.

- Coverage Options: The specific coverage options you choose can significantly impact your premium. Higher coverage limits for liability, collision, and comprehensive coverage generally result in higher premiums.

- Demographics: Your age, gender, and location can also influence your premium. Younger drivers, for instance, are statistically more likely to be involved in accidents, which can lead to higher premiums. Similarly, urban areas often have higher accident rates than rural areas, which can also affect your premium.

- Insurance Provider Pricing Strategies: Different insurance providers have different pricing strategies. Some providers may offer lower premiums in certain states based on their risk assessments and market competition. It’s essential to compare quotes from multiple providers to find the best rates for your situation.

Potential Challenges and Considerations

While obtaining car insurance in another state can be a convenient option, it’s important to be aware of potential challenges and considerations that may arise. These challenges can range from administrative complexities to financial implications.

Understanding Policy Coverage and Limitations

It’s crucial to carefully review the terms and conditions of your out-of-state insurance policy to ensure that it provides adequate coverage for your needs. For example, you should confirm whether your policy covers accidents in your home state and the other state where you’re insured. You should also check if there are any limitations on coverage, such as specific exclusions or deductibles that apply in the other state.

Final Review

In conclusion, securing car insurance in a state other than your primary residence is achievable, but it involves navigating a web of regulations, requirements, and potential challenges. Understanding the specific rules and factors that influence out-of-state coverage can empower you to make informed decisions and secure the right insurance for your needs. Whether you’re a temporary resident, a frequent traveler, or considering a permanent move, this guide has equipped you with the knowledge to navigate the complexities of out-of-state insurance with confidence.

FAQ Corner

What are the common reasons for needing car insurance in another state?

People often need out-of-state insurance for relocation, temporary residency, travel, or if they own a second home in another state.

Can I get car insurance in another state if I’m only visiting?

It might be possible, but you’ll likely need to demonstrate a valid reason for needing insurance in that state, such as a car rental or a planned extended stay.

What are the potential downsides of getting out-of-state car insurance?

You may face higher premiums, limited coverage options, or potential difficulties with claims processing due to being outside your primary state of residence.

How do I find insurance providers that offer out-of-state coverage?

You can search online insurance marketplaces, contact insurance agents directly, or check with your current provider to see if they offer out-of-state coverage.