Why did my insurance go up State Farm? It’s a question many policyholders find themselves asking, especially when faced with an unexpected increase in premiums. Several factors can contribute to this, from changes in your driving record to rising repair costs. Understanding these factors can help you navigate the process of addressing your premium increase effectively.

This guide explores the common reasons behind rising State Farm insurance premiums, providing insights into how these factors impact different types of insurance policies. We’ll delve into the importance of understanding your policy coverage and offer practical advice for communicating with State Farm about your premium increase. Additionally, we’ll discuss alternative insurance providers and explore strategies for negotiating rates and seeking discounts.

Common Reasons for Increased Insurance Premiums

It’s frustrating to see your State Farm insurance premiums go up. But there are several common reasons why this might happen. Understanding these factors can help you make informed decisions about your coverage and potentially even lower your premiums in the future.

Insurance premiums are calculated based on a variety of factors that assess your individual risk. State Farm, like most insurance companies, adjusts premiums to reflect changes in risk. These changes can be related to your driving record, your home’s location and value, or even the overall claims history in your area.

Changes in Driving Record

Your driving record is a significant factor in determining your auto insurance premiums. A clean driving record generally translates to lower premiums, while a history of accidents, traffic violations, or even speeding tickets can lead to an increase.

- Accidents: Even a minor accident can lead to an increase in your premiums, as it indicates a higher risk of future accidents. The severity of the accident and your level of fault play a role in the premium increase.

- Traffic Violations: Getting a ticket for speeding, running a red light, or other traffic violations can result in higher premiums. The type of violation and the frequency of violations will affect the increase.

- Driving Record Review: State Farm regularly reviews your driving record to ensure that your premiums reflect your current risk. If they find any changes that indicate a higher risk, your premiums may increase.

Changes in Home Value

Your home insurance premiums are directly linked to the value of your property. If the value of your home increases, for example, due to renovations or rising property values in your area, your premiums may go up to reflect the increased coverage you need.

- Property Improvements: Adding a new room, renovating your kitchen, or upgrading your landscaping can increase the value of your home, which may result in higher premiums.

- Market Fluctuations: Rising property values in your neighborhood, due to factors like strong local economy or increased demand, can also lead to higher home insurance premiums.

- Appraisals: State Farm may periodically require a home appraisal to determine its current market value. If the appraisal shows a significant increase in value, your premiums may be adjusted accordingly.

Changes in Coverage

If you increase your coverage limits, for example, by adding more comprehensive coverage or increasing your liability limits, your premiums will likely increase to reflect the additional protection you’re purchasing.

- Adding Coverage: Opting for additional coverage, such as collision or comprehensive coverage for your car, or increasing your liability limits, can lead to higher premiums.

- Changing Deductibles: Lowering your deductible, the amount you pay out-of-pocket before your insurance kicks in, will typically result in higher premiums. Conversely, raising your deductible can lead to lower premiums.

Claims Filed

Filing a claim, even for a minor incident, can often lead to an increase in your premiums. This is because claims indicate a higher risk of future claims.

- Claim History: State Farm keeps track of your claim history. Multiple claims within a short period, even for minor incidents, can lead to a significant increase in premiums.

- Claim Severity: The severity of the claim also plays a role. Larger claims, such as those involving major accidents or extensive property damage, can have a greater impact on your premiums.

Changes in Location

Your location can significantly impact your insurance premiums, especially for home and renters insurance. Areas with a higher risk of natural disasters, such as hurricanes, earthquakes, or wildfires, generally have higher premiums.

- Natural Disaster Risk: Living in areas prone to hurricanes, earthquakes, or wildfires will likely result in higher premiums due to the increased risk of damage.

- Crime Rates: Areas with higher crime rates may have higher premiums for both home and renters insurance due to the increased risk of theft or vandalism.

- Local Claims History: State Farm considers the overall claims history in your area. If there’s a high number of claims in your neighborhood, it could lead to higher premiums for everyone in the area.

Understanding Your Policy and Coverage

It’s crucial to understand your insurance policy and coverage, especially when you’re experiencing a premium increase. By carefully reviewing your policy, you can identify the specific factors influencing your premium adjustments and make informed decisions.

Understanding your policy is vital because it Artikels the terms and conditions of your insurance coverage. This document details the coverage you’re entitled to, the limits of that coverage, and the circumstances under which your insurance company will pay claims. It also Artikels the factors that can influence your premiums, such as your driving history, vehicle type, and location.

Examining Your Policy for Premium Adjustments

The specific sections of your policy that address premium adjustments can vary depending on your insurance company and the type of insurance you have. However, common sections to look for include:

- Coverage Details: This section describes the specific types of coverage you have, such as liability, collision, comprehensive, and uninsured motorist coverage. It will also Artikel the limits of each coverage, which are the maximum amounts your insurer will pay for a claim.

- Premium Factors: This section Artikels the factors that can influence your premiums. This can include your driving history, vehicle type, location, and credit score.

- Rate Adjustments: This section may Artikel the specific rate adjustments that your insurer applies, such as discounts for safe driving or for bundling multiple policies. It may also explain how your premium can increase based on factors such as accidents or claims.

Understanding Coverage Types and Premium Factors

| Coverage Type | Factors Affecting Premium | Example Scenarios |

|---|---|---|

| Liability Coverage | Driving history, age, location | A driver with a clean driving record and a good credit score may pay lower premiums than a driver with a history of accidents or traffic violations. |

| Collision Coverage | Vehicle type, age, safety features | A newer vehicle with advanced safety features will typically have lower collision coverage premiums than an older vehicle with fewer safety features. |

| Comprehensive Coverage | Vehicle type, location, theft risk | A vehicle parked in a high-crime area may have higher comprehensive coverage premiums than a vehicle parked in a safe neighborhood. |

| Uninsured/Underinsured Motorist Coverage | State requirements, individual choices | Drivers in states with mandatory uninsured motorist coverage will have this coverage included in their policy, while drivers in other states may choose to add it as an optional coverage. |

Communication with State Farm

Understanding why your State Farm insurance premium has increased is important, but it’s equally crucial to know how to effectively communicate with them about it. Reaching out to State Farm can help you clarify the reasons for the increase, explore potential options for lowering your premium, and ensure you’re receiving the coverage you need.

Contacting State Farm

You can contact State Farm through various channels, including phone, email, and online chat. The method you choose will depend on your preference and the urgency of your inquiry.

- Phone: You can call State Farm’s customer service line, which is available 24/7. This option is particularly useful for immediate assistance or if you prefer a more personal interaction.

- Email: State Farm provides an online form for submitting inquiries via email. This method is suitable for non-urgent requests or if you need a written record of your communication.

- Online Chat: State Farm offers a live chat feature on their website, allowing you to communicate with a representative in real-time. This is a convenient option for quick questions or if you prefer a more visual interaction.

Information to Provide

When contacting State Farm, be prepared to provide certain information to facilitate a smooth and efficient conversation. This includes:

- Policy Number: This is your unique identifier for your insurance policy, allowing State Farm to quickly access your account details.

- Contact Information: Ensure you have your phone number, email address, and mailing address readily available.

- Details of the Premium Increase: Be specific about the amount of the increase, the effective date, and the type of insurance policy affected.

- Any Relevant Changes: If you’ve recently experienced any changes that might have impacted your premium, such as a change in your driving record, vehicle, or address, mention them.

Sample Dialogue

Here’s an example of a conversation between a customer and a State Farm representative regarding a premium increase:

Customer: “Hello, I’m calling to inquire about a recent increase in my auto insurance premium. My policy number is [Policy Number]. The increase is for [amount] and took effect on [date].”

Representative: “Thank you for contacting us. I can certainly help you with that. Could you please confirm your name and address for verification purposes?”

Customer: “My name is [Name] and my address is [Address].”

Representative: “Okay, [Name]. I see that your premium has increased due to [reason for increase]. This is because [explanation of the reason]. Is there anything else I can help you with today?”

Customer: “I understand. I’m also curious about any potential discounts or options to help lower my premium. Are there any available?”

Representative: “Yes, we offer a variety of discounts based on factors such as your driving record, safety features in your vehicle, and bundling multiple insurance policies with us. We can explore those options with you and see what might apply to your situation.”

Exploring Alternative Options: Why Did My Insurance Go Up State Farm

It’s understandable that you might feel frustrated if your State Farm insurance premium has increased. Fortunately, you’re not limited to just one insurer. Shopping around for better rates is a smart move, and exploring other insurance providers can potentially save you money.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is crucial for finding the best deal. You can use online comparison websites or contact insurers directly to get quotes.

- Online Comparison Websites: These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously. Popular options include QuoteWizard, Insurance.com, and The Zebra.

- Direct Contact: You can also contact insurers directly to request quotes. This gives you the opportunity to discuss your specific needs and ask questions about their policies.

When comparing quotes, make sure you’re comparing apples to apples. Ensure that the coverage options and limits are the same across all quotes. For example, you wouldn’t want to compare a quote with $100,000 liability coverage to another with $250,000 coverage.

Example: Imagine you’re currently paying $100 per month for car insurance with State Farm. After comparing quotes from three other insurers, you find that Insurer A offers the same coverage for $85 per month, Insurer B for $90 per month, and Insurer C for $95 per month. By switching to Insurer A, you could potentially save $15 per month, or $180 per year.

Negotiating Insurance Rates and Seeking Discounts, Why did my insurance go up state farm

Once you’ve gathered quotes from multiple insurers, you can use them to negotiate a better rate with your current insurer.

- Highlight your loyalty: Remind them of your long-standing relationship and the fact that you’ve never filed a claim.

- Mention competing offers: Inform them about the lower rates you’ve received from other insurers.

- Ask about discounts: Inquire about any discounts they offer for safe driving, good grades, bundling policies, or other factors.

If your current insurer isn’t willing to match or beat the lower rates you’ve found, consider switching to a different provider.

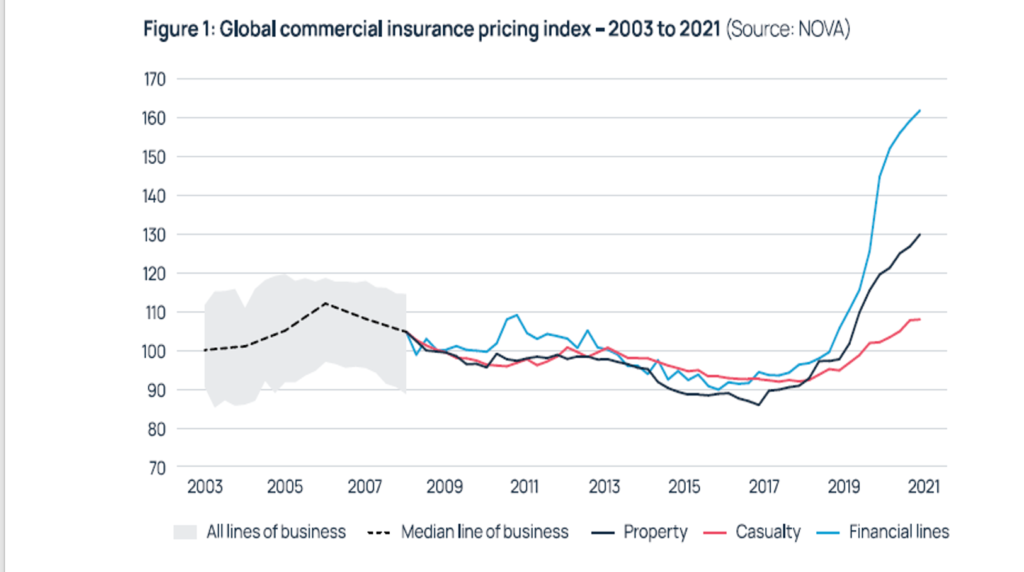

Insurance Premium Trends and Market Factors

Insurance premiums are not static and fluctuate based on various factors. Understanding these trends and market forces can provide insights into why your State Farm insurance may have increased.

Economic Factors and Inflation

Economic conditions significantly influence insurance premiums. Inflation, particularly in the cost of materials and labor, directly impacts repair costs. As prices for parts, labor, and other resources rise, insurance companies need to adjust premiums to cover these increased expenses.

For example, the cost of car repairs has risen significantly in recent years due to the rising price of automotive parts and labor. This increase in repair costs has led insurance companies to raise premiums to ensure they can cover the cost of claims.

Regulatory Changes and Claims Patterns

Insurance premiums are also affected by regulatory changes and claims patterns. New regulations, such as those related to environmental protection or consumer rights, can influence insurance costs. Similarly, changes in claims patterns, such as an increase in the frequency or severity of accidents, can lead to higher premiums.

For example, the implementation of stricter safety regulations for vehicles can lead to higher repair costs, which in turn can drive up insurance premiums. Similarly, an increase in the number of accidents due to distracted driving can also lead to higher premiums as insurance companies need to cover the increased cost of claims.

Impact of Inflation and Rising Repair Costs

Inflation plays a significant role in insurance premium trends. As the cost of goods and services rises, insurance companies need to adjust their premiums to reflect these increased costs. This is particularly true for insurance lines such as auto and home insurance, where the cost of repairs and replacements has been increasing rapidly.

For example, the average cost of a new car has increased significantly in recent years. This means that insurance companies need to charge higher premiums to cover the cost of replacing a damaged car.

Key Factors Influencing Insurance Premium Trends

The following table summarizes the key factors that have influenced insurance premium trends over the past few years:

| Factor | Impact |

|—|—|

| Inflation | Increased cost of repairs, replacements, and other expenses |

| Rising Repair Costs | Higher premiums to cover the increased cost of claims |

| Regulatory Changes | New regulations can impact insurance costs |

| Claims Patterns | Changes in the frequency or severity of claims can lead to higher premiums |

| Economic Conditions | Overall economic health can impact insurance premiums |

| Natural Disasters | Increased frequency or severity of natural disasters can lead to higher premiums |

| Technological Advancements | New technologies can impact insurance costs, such as driver assistance systems or telematics |

| Competition | Competition among insurance companies can impact premiums |

| Investment Returns | Insurance companies’ investment returns can influence premiums |

Wrap-Up

Navigating a State Farm insurance premium increase can feel overwhelming, but understanding the underlying factors and taking proactive steps can help you manage the situation effectively. By reviewing your policy, communicating with State Farm, and exploring alternative options, you can ensure you have the coverage you need at a price that fits your budget.

General Inquiries

How often does State Farm review my insurance premiums?

State Farm typically reviews insurance premiums annually, but they may adjust rates more frequently based on changes in your driving record, claims history, or other factors.

Can I dispute a State Farm premium increase?

Yes, you can contact State Farm to discuss the reasons for the increase and potentially negotiate a lower rate. Be prepared to provide information about your driving record, claims history, and any changes in your coverage needs.

What if I’m unhappy with my State Farm insurance rates?

You can always shop around for insurance quotes from other providers to see if you can find a better rate. Make sure to compare coverage options carefully to ensure you’re getting the protection you need.