State of Michigan auto insurance is a complex and ever-evolving landscape. Michigan’s unique no-fault system, a cornerstone of its auto insurance market, has both advantages and drawbacks, impacting drivers, insurance companies, and the overall cost of coverage. Understanding the nuances of Michigan’s auto insurance system is crucial for residents seeking affordable and comprehensive protection.

This guide explores the historical context, current market dynamics, and key features of Michigan’s auto insurance policies. We delve into the no-fault system’s impact on accident rates, healthcare costs, and premiums. We also analyze recent reforms, discuss potential future trends, and provide practical tips for Michigan residents to navigate the system effectively.

Michigan Auto Insurance Landscape: State Of Michigan Auto Insurance

Michigan’s auto insurance system has a long and complex history, shaped by a unique set of factors. Understanding this history is crucial for comprehending the current state of the market and the challenges it faces.

Historical Context

Michigan’s auto insurance system was established in the early 20th century, with the first no-fault law enacted in 1973. The no-fault system aimed to simplify the claims process and reduce litigation costs by eliminating the need to prove fault in accidents. This system, however, has evolved over time, with various amendments and reforms aimed at addressing issues such as rising premiums and fraud.

Current State of the Market

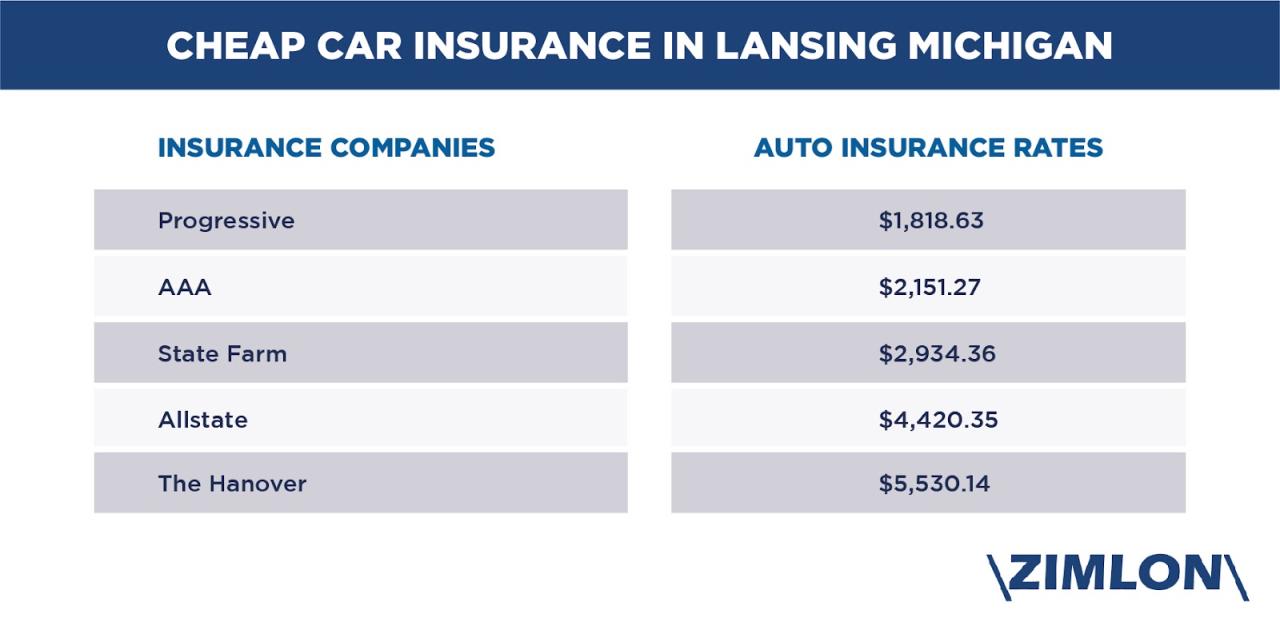

Michigan’s auto insurance market is characterized by high premiums and a complex regulatory environment. Several major players dominate the market, with varying market shares.

Major Players and Market Share

- State Farm: As the largest auto insurer in Michigan, State Farm holds a significant market share.

- AAA: Another major player, AAA, offers a wide range of insurance products and services, including auto insurance.

- Progressive: Known for its innovative marketing strategies and online tools, Progressive has gained a substantial presence in the Michigan market.

- Geico: Geico has expanded its operations in Michigan, offering competitive rates and digital convenience.

- Farmers Insurance: Farmers Insurance is a well-established insurer in Michigan, known for its personalized service and local agency network.

Comparison with Other States

Michigan’s auto insurance system differs significantly from those in other states, primarily due to its no-fault structure and the inclusion of unlimited personal injury protection (PIP) coverage.

Key Differences

- No-Fault System: Unlike many states, Michigan’s no-fault system requires drivers to be insured for personal injury protection (PIP), regardless of who is at fault in an accident.

- Unlimited PIP Coverage: Michigan is one of only a few states that mandates unlimited PIP coverage, meaning insurers must cover all medical expenses, lost wages, and other related costs, without any limits. This aspect contributes to the high premiums in Michigan.

- Limited Tort System: Michigan’s limited tort system restricts the ability of drivers to sue for pain and suffering unless they meet certain criteria, such as a serious injury or significant economic loss.

No-Fault System and its Impact

Michigan’s auto insurance system is unique in the United States, as it operates on a no-fault basis. This system, established in 1973, fundamentally shifts the responsibility for covering accident-related costs from the at-fault driver to the individual’s own insurance company.

Key Principles of the No-Fault System

The core principles of Michigan’s no-fault system are:

* Personal Injury Protection (PIP): This coverage is mandatory and pays for medical expenses, lost wages, and other related costs incurred due to an accident, regardless of who was at fault.

* No-Fault Benefits: Individuals can access PIP benefits from their own insurance company, regardless of who caused the accident.

* Limited Tort System: This system restricts the ability to sue for non-economic damages (pain and suffering) unless certain thresholds are met, such as a serious injury or death.

Benefits of the No-Fault System

The no-fault system has several benefits for both drivers and insurance companies:

* Faster Claims Processing: Claims are typically processed more quickly as they are handled by the individual’s own insurance company.

* Reduced Litigation: The limited tort system reduces the number of lawsuits, which can save time and money for both parties.

* Guaranteed Benefits: Individuals are guaranteed to receive benefits for their injuries, regardless of who was at fault.

Drawbacks of the No-Fault System

While the no-fault system has advantages, it also presents certain drawbacks:

* Higher Premiums: Michigan’s no-fault system has been associated with higher auto insurance premiums compared to other states.

* Fraud and Abuse: The system has been susceptible to fraud and abuse, with some individuals seeking unnecessary medical treatment or exaggerating their injuries.

* Limited Compensation: The limited tort system restricts the ability to sue for non-economic damages, potentially limiting compensation for serious injuries.

Impact of the No-Fault System

The no-fault system has had a significant impact on various aspects of Michigan’s auto insurance landscape:

* Accident Rates: Studies have shown mixed results regarding the impact of the no-fault system on accident rates. Some argue that it may lead to increased accident rates due to the lack of financial consequences for at-fault drivers. Others suggest that it may actually decrease accident rates by reducing the incentive to sue.

* Healthcare Costs: The no-fault system has been linked to higher healthcare costs, as individuals may seek more medical treatment due to the availability of PIP benefits.

* Insurance Premiums: Michigan’s no-fault system is a major contributor to the state’s high auto insurance premiums. The mandatory PIP coverage, the unlimited medical benefits, and the potential for fraud and abuse all contribute to these high costs.

Key Features and Considerations

Michigan auto insurance policies offer a range of coverage options, each with its own set of features and considerations. Understanding these features and how they impact premiums is crucial for choosing the right policy for your needs.

Coverage Types

Michigan auto insurance policies typically include several mandatory coverages, along with optional ones. Here’s a breakdown of the most common coverage types:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. It’s a mandatory coverage in Michigan, and you can choose different levels of PIP coverage, with higher limits providing more financial protection.

- Property Protection (Property Damage Liability): This coverage pays for damages to other people’s vehicles or property if you are at fault in an accident. It’s also a mandatory coverage in Michigan.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. It’s an optional coverage, but highly recommended.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s an optional coverage.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than an accident, such as theft, vandalism, or natural disasters. It’s an optional coverage.

Deductibles and Limits

Deductibles and limits are important aspects of auto insurance policies that directly affect your out-of-pocket costs.

- Deductibles: This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums.

- Limits: These are the maximum amounts your insurance company will pay for specific types of coverage. For example, your PIP coverage may have a limit on the amount of medical expenses it will cover. Higher limits typically result in higher premiums.

Factors Influencing Premiums

Several factors influence the cost of auto insurance in Michigan. These include:

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, plays a significant role in determining your premium. A clean driving record generally leads to lower premiums.

- Vehicle Type: The type of vehicle you drive, including its make, model, and year, influences your premium. Sports cars and luxury vehicles often have higher premiums than standard vehicles.

- Location: Where you live can affect your premium, as insurance companies consider factors such as the frequency of accidents and the cost of repairs in different areas.

- Age and Gender: Younger drivers and males generally have higher premiums than older drivers and females, as they are statistically more likely to be involved in accidents.

- Credit Score: In some states, including Michigan, insurance companies use credit scores to assess risk. Drivers with good credit scores often receive lower premiums.

Choosing the Right Policy

Selecting the best auto insurance policy for your needs involves considering several factors:

- Your Budget: Determine how much you can afford to spend on premiums.

- Your Driving Habits: If you drive frequently, drive long distances, or drive in high-risk areas, you may need higher coverage limits.

- Your Vehicle’s Value: If you have a new or expensive vehicle, you may want to consider comprehensive and collision coverage.

- Your Risk Tolerance: If you are comfortable taking on more risk, you may opt for higher deductibles and lower coverage limits.

- Comparison Shopping: Get quotes from multiple insurance companies to compare rates and coverage options.

Recent Reforms and Future Trends

Michigan’s auto insurance system has undergone significant changes in recent years, aimed at addressing concerns about affordability and complexity. These reforms have introduced new regulations and options for consumers, shaping the landscape of the state’s auto insurance market.

Key Provisions of Recent Auto Insurance Reforms

The 2019 auto insurance reforms in Michigan introduced several key provisions, including:

- Choice of Coverage Levels: Drivers now have the option to choose different coverage levels for personal injury protection (PIP), allowing them to customize their coverage based on their individual needs and risk tolerance. This choice allows drivers to potentially lower their premiums by opting for lower PIP coverage.

- Increased Transparency and Competition: The reforms aim to increase transparency in pricing and encourage competition among insurers, potentially leading to lower premiums for consumers. This includes requirements for insurers to disclose their pricing methodologies and allow consumers to compare rates easily.

- Restrictions on Unnecessary Medical Treatment: The reforms implemented stricter regulations on the use of medical services after an accident, aiming to reduce unnecessary treatment and curb fraudulent claims. This could potentially lower insurance costs, as insurers face fewer claims for unnecessary medical expenses.

- New Fee Structure for Insurers: The reforms introduced a new fee structure for insurers, which is intended to promote competition and potentially lower premiums.

Impact of Recent Auto Insurance Reforms

The impact of these reforms is still unfolding, but some early trends are emerging. The reforms have resulted in a significant decrease in average premiums for many drivers, particularly those who opted for lower PIP coverage levels. However, some drivers have experienced increases in premiums, particularly those who need higher levels of coverage.

Ongoing Debate Surrounding Auto Insurance Reform

The reforms have been met with mixed reactions, with some praising them for lowering costs and increasing consumer choice, while others criticize them for potentially limiting access to essential medical care and creating confusion for consumers.

- Supporters of the reforms argue that they are necessary to address the high cost of auto insurance in Michigan and make it more affordable for consumers. They believe that the reforms will lead to increased competition and transparency, ultimately benefiting drivers.

- Critics of the reforms argue that they will limit access to essential medical care, particularly for those who need extensive treatment after an accident. They also worry that the reforms will create confusion for consumers and make it more difficult to navigate the insurance system.

Potential Future Trends in Michigan’s Auto Insurance Market

The auto insurance landscape in Michigan is likely to continue evolving in the coming years, driven by several factors:

- Technological Advancements: The increasing use of telematics and other technologies could further impact auto insurance pricing and coverage options. Insurers may use telematics data to assess driving behavior and offer personalized premiums based on individual driving habits.

- Consumer Behavior Changes: Consumer preferences and expectations are also changing. Consumers are increasingly demanding transparency, personalization, and digital convenience in their insurance experiences. Insurers will need to adapt to these evolving demands to remain competitive.

- Focus on Prevention and Safety: The industry is likely to see a greater emphasis on preventing accidents and promoting safety. This could involve initiatives such as driver education programs, advanced safety features in vehicles, and investments in infrastructure improvements.

Consumer Tips and Resources

Navigating Michigan’s auto insurance landscape can be complex, but understanding your options and available resources can help you make informed decisions and potentially save money. This section provides practical tips for Michigan residents to save on their auto insurance premiums and Artikels resources for resolving insurance disputes or obtaining information about their rights.

Saving Money on Auto Insurance

Michigan residents have several options to potentially lower their auto insurance premiums. Here are some practical tips:

- Shop around and compare quotes: Obtaining quotes from multiple insurance companies is crucial to find the best rates. Online comparison websites and independent insurance agents can assist in this process.

- Increase your deductible: Choosing a higher deductible can lead to lower premiums. However, it’s important to ensure you can afford the deductible in case of an accident.

- Improve your driving record: Maintaining a clean driving record is essential. Avoiding traffic violations and accidents can significantly impact your premium.

- Bundle your insurance policies: Combining your auto insurance with other policies, such as home or renters insurance, can often result in discounts.

- Consider your coverage needs: Evaluate your current coverage levels and determine if you can reduce them without compromising your protection. For example, if you have an older vehicle, you may not need full collision and comprehensive coverage.

- Take advantage of discounts: Many insurance companies offer discounts for good students, safe drivers, and those who install safety features in their vehicles. Inquire about available discounts and ensure you qualify.

- Maintain a good credit score: While not directly related to driving, a good credit score can positively impact your insurance rates in some cases.

Resolving Insurance Disputes and Obtaining Information

Michigan residents have resources available to help them resolve insurance disputes or obtain information about their rights. Here are some important resources:

- Michigan Department of Insurance and Financial Services (DIFS): The DIFS regulates insurance companies in Michigan and provides consumer protection. You can contact the DIFS to file complaints, obtain information about your rights, or seek assistance with insurance disputes. Their website, https://www.michigan.gov/dfi, offers valuable resources and guidance.

- Michigan Office of Insurance and Financial Services (OIFS): The OIFS is a division of the DIFS that provides consumer education and assistance. They offer resources on various insurance topics, including auto insurance. You can reach them by phone at 1-877-999-6442 or visit their website, https://www.michigan.gov/dfi/0,4631,7-124-42004—,00.html, for additional information.

- Michigan Association for Justice (MAJ): The MAJ is a professional organization representing lawyers who advocate for the rights of injured individuals. They provide resources and information about personal injury law, including auto accidents. Their website, https://www.maj.org/, offers valuable insights and guidance.

Common Auto Insurance Scams and How to Avoid Them, State of michigan auto insurance

It’s important to be aware of common auto insurance scams to protect yourself from fraud. The following table Artikels some common scams and provides tips for avoiding them:

| Scam | Description | How to Avoid |

|---|---|---|

| Staged Accidents | Individuals intentionally cause accidents to file fraudulent insurance claims. | Be cautious when driving and avoid unnecessary risks. Report any suspicious behavior to the police. |

| Fake Injuries | Individuals claim injuries that did not occur or exaggerate existing injuries to inflate claims. | Be honest and transparent with your insurance company about your injuries. Seek medical attention from reputable healthcare providers. |

| Ghost Cars | Individuals file claims for nonexistent vehicles or accidents. | Ensure your insurance policy accurately reflects your vehicles and their details. Report any suspicious activity to your insurance company. |

| Phantom Passengers | Individuals claim passengers were in their vehicle during an accident to increase their payout. | Only list actual passengers in your claim and provide accurate information. |

| Inflated Repair Costs | Individuals submit inflated repair bills for vehicle damage. | Obtain multiple quotes for repairs from reputable mechanics. Review repair estimates carefully and question any excessive charges. |

Outcome Summary

Michigan’s auto insurance landscape is dynamic, shaped by a unique no-fault system, ongoing reforms, and evolving consumer needs. Navigating this complex environment requires a clear understanding of the available options, the factors influencing premiums, and the resources available to consumers. By staying informed and utilizing the insights provided in this guide, Michigan residents can make informed decisions about their auto insurance, ensuring they have the coverage they need at a price that fits their budget.

FAQ Guide

What is the difference between Michigan’s no-fault system and other states’ auto insurance systems?

Michigan’s no-fault system differs from other states by allowing drivers to choose their own medical provider and receive coverage for their own injuries, regardless of fault in an accident. Many other states have fault-based systems where the at-fault driver’s insurance is responsible for the other driver’s injuries and damages.

How do I choose the best auto insurance policy for my needs in Michigan?

To find the best policy, consider your individual needs, including your driving history, vehicle type, location, and budget. Compare quotes from multiple insurers, review coverage options, and ensure you understand the key features and limitations of each policy. It’s also wise to consult with an insurance agent or broker for personalized advice.

What are some common auto insurance scams in Michigan and how can I avoid them?

Common scams include fake insurance cards, fraudulent claims, and identity theft. Be wary of unsolicited offers, verify the legitimacy of any insurance provider, and never share your personal information with unknown individuals or websites. If you suspect a scam, contact the Michigan Department of Insurance and Financial Services for assistance.