The State of Nebraska Insurance presents a diverse landscape, shaping the lives of individuals and businesses alike. From health and auto to home and life insurance, Nebraska’s insurance market offers a wide range of options, catering to the unique needs of its residents. This guide delves into the intricacies of the Nebraska insurance industry, exploring its regulations, key players, and the consumer issues that shape the market.

Nebraska’s insurance market is characterized by a balance of established players and emerging trends. The state’s Department of Insurance plays a vital role in regulating the industry, ensuring consumer protection and fair market practices. This dynamic environment fosters innovation and competition, driving the development of new products and services that meet the evolving needs of Nebraska’s population.

Nebraska Insurance Market Overview

Nebraska’s insurance market is a dynamic and diverse landscape, shaped by factors such as population growth, economic activity, and regulatory policies. Understanding the key characteristics of this market is crucial for insurance companies seeking to expand their operations in the state or for individuals and businesses seeking insurance solutions.

Size and Key Players

The Nebraska insurance market is relatively small compared to larger states but boasts a diverse range of players, including national insurance giants, regional insurance companies, and local insurance brokers. According to the Nebraska Department of Insurance, the total direct written premium in Nebraska in 2022 was estimated to be over $8 billion, highlighting the significance of the insurance sector in the state’s economy. Key players in the Nebraska insurance market include companies like Blue Cross Blue Shield of Nebraska, Mutual of Omaha, and American Family Insurance, among others.

Competitive Landscape, State of nebraska insurance

The competitive landscape in Nebraska’s insurance market is characterized by a mix of established players and new entrants, vying for market share across various insurance segments. While national insurance companies often dominate in terms of market share, regional and local insurance companies are gaining traction by offering tailored products and services to meet the specific needs of Nebraska residents and businesses. This competitive environment fosters innovation and ensures that consumers have a wide range of options to choose from.

Major Insurance Segments

Nebraska’s insurance market encompasses a broad spectrum of insurance segments, each catering to distinct needs and risks.

- Health Insurance: The health insurance market in Nebraska is characterized by a mix of private and public insurance plans, with a significant presence of managed care organizations (MCOs). The Affordable Care Act (ACA) has played a significant role in expanding health insurance coverage in Nebraska, particularly for low- and middle-income individuals and families.

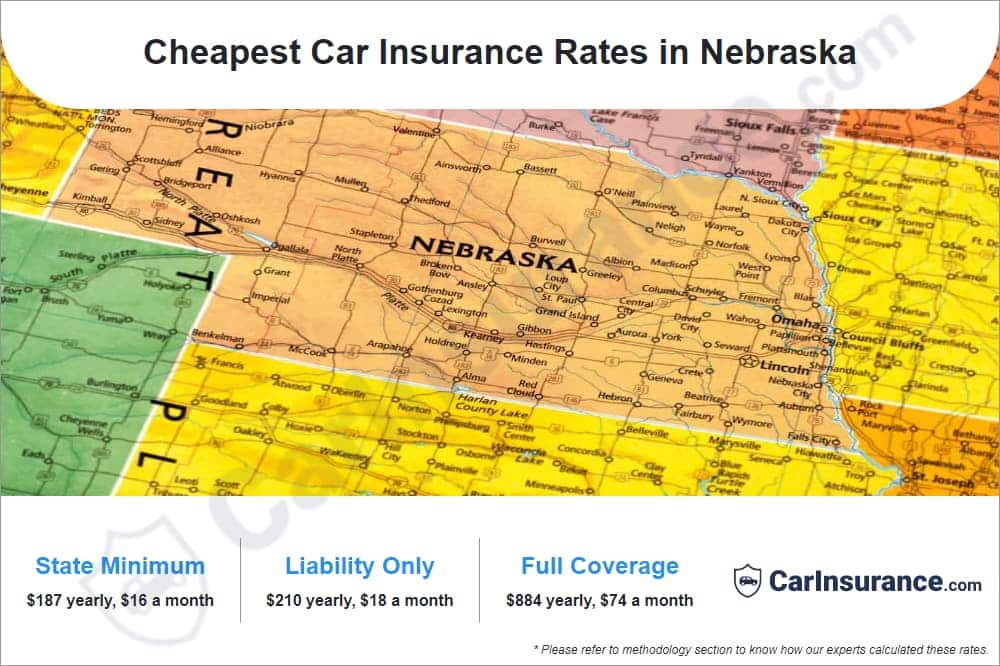

- Auto Insurance: Auto insurance is a major segment of the Nebraska insurance market, driven by the state’s reliance on personal vehicles for transportation. Nebraska’s auto insurance market is highly competitive, with a wide range of coverage options and pricing strategies available to consumers.

- Home Insurance: Home insurance is another significant segment in Nebraska, driven by the state’s strong housing market. Home insurance premiums in Nebraska are influenced by factors such as property value, location, and risk of natural disasters, such as tornadoes and hailstorms.

- Life Insurance: Life insurance plays a vital role in providing financial protection to families in the event of the death of a loved one. Nebraska’s life insurance market is diverse, offering a wide range of life insurance products, including term life insurance, whole life insurance, and universal life insurance.

Nebraska Insurance Regulations and Laws

Nebraska’s insurance industry is governed by a comprehensive set of regulations and laws designed to protect consumers and ensure the stability of the insurance market. The Nebraska Department of Insurance plays a crucial role in overseeing this regulatory framework.

Role of the Nebraska Department of Insurance

The Nebraska Department of Insurance (NDOI) is the primary regulatory body responsible for overseeing the insurance industry in the state. The NDOI’s mission is to protect consumers, ensure the solvency of insurance companies, and maintain a fair and competitive insurance market.

The NDOI performs a variety of functions to fulfill its regulatory mandate, including:

- Licensing and regulating insurance companies, agents, and brokers.

- Examining insurance companies to ensure their financial solvency.

- Enforcing insurance laws and regulations.

- Investigating consumer complaints and resolving disputes.

- Educating consumers about insurance products and their rights.

Licensing Requirements for Insurance Agents and Brokers

To operate as an insurance agent or broker in Nebraska, individuals must meet specific licensing requirements. These requirements ensure that agents and brokers possess the necessary knowledge and skills to provide competent and ethical insurance services.

The NDOI sets forth the following licensing requirements:

- Eligibility: Applicants must be at least 18 years old, meet character and fitness standards, and pass a licensing examination.

- Education and Training: Applicants must complete a pre-licensing education course approved by the NDOI. The course covers the principles of insurance, Nebraska insurance laws and regulations, and ethical practices.

- Examination: Applicants must pass a written examination administered by the NDOI. The examination tests knowledge of insurance principles, Nebraska insurance laws, and ethical conduct.

- Background Check: Applicants must undergo a background check to verify their criminal history and financial standing.

- Continuing Education: Licensed insurance agents and brokers must complete continuing education courses to maintain their licenses. These courses ensure that agents and brokers stay current with changes in insurance laws, regulations, and industry practices.

Nebraska Insurance Companies and Products

Nebraska’s insurance market is served by a diverse range of companies offering a wide variety of products to meet the needs of individuals and businesses. Understanding the key players and the products they offer is crucial for making informed insurance decisions.

Major Insurance Companies in Nebraska

Nebraska’s insurance market is characterized by a mix of national, regional, and local insurance companies. These companies compete to provide a range of insurance products, including health, auto, homeowners, and business insurance.

- Blue Cross Blue Shield of Nebraska: A leading health insurance provider in the state, offering individual and group health plans, as well as dental and vision coverage. It holds a significant market share in the health insurance sector.

- Mutual of Omaha: Known for its life insurance products, Mutual of Omaha also offers a range of other insurance products, including health, disability, and long-term care insurance. It is a well-established and reputable company with a strong presence in Nebraska.

- State Farm: A national insurance giant, State Farm offers a comprehensive suite of insurance products in Nebraska, including auto, homeowners, renters, life, and health insurance. It is known for its strong customer service and extensive network of agents.

- Progressive: A major auto insurance provider, Progressive offers a variety of auto insurance policies, including coverage for liability, collision, comprehensive, and uninsured motorist protection. It is known for its innovative products and online services.

- Allstate: Another national insurance company, Allstate offers a wide range of insurance products, including auto, homeowners, renters, life, and business insurance. It is known for its financial stability and strong customer service.

Types of Insurance Products in Nebraska

Nebraska residents have access to a wide array of insurance products designed to protect them against various risks.

Health Insurance

Health insurance is crucial for individuals and families in Nebraska. It provides financial protection against the high costs of medical care. Nebraska offers a range of health insurance plans, including:

- Individual Health Insurance: These plans are purchased by individuals or families directly from insurance companies. They offer a variety of coverage options and benefit packages.

- Employer-Sponsored Health Insurance: Many employers in Nebraska offer health insurance plans to their employees. These plans typically provide comprehensive coverage and often offer lower premiums than individual plans.

- Medicare: A federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities. It provides coverage for a range of medical expenses, including hospital stays, doctor visits, and prescription drugs.

- Medicaid: A state and federal health insurance program for low-income individuals and families. It provides coverage for a range of medical expenses, including hospital stays, doctor visits, and prescription drugs.

Auto Insurance

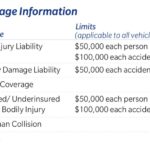

Auto insurance is required by law in Nebraska. It provides financial protection against losses resulting from accidents, theft, or other incidents involving your vehicle. Nebraska’s auto insurance policies typically include coverage for:

- Liability Coverage: This covers damages to other people’s property or injuries caused by an accident for which you are at fault.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your vehicle resulting from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses.

Homeowners Insurance

Homeowners insurance protects your home and belongings against various risks, including fire, theft, vandalism, and natural disasters. It also provides liability coverage if someone is injured on your property.

- Dwelling Coverage: This covers the structure of your home, including the walls, roof, and foundation.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, appliances, and clothing.

- Liability Coverage: This protects you from financial losses if someone is injured on your property or if you are sued for negligence.

- Additional Living Expenses Coverage: This covers temporary housing and other expenses if you are unable to live in your home due to a covered event.

Consumer Insurance Issues in Nebraska: State Of Nebraska Insurance

Navigating the insurance landscape can be complex, and Nebraska residents are not immune to common insurance-related challenges. From disputes over claims to coverage denials and high premiums, consumers may encounter a range of issues that require careful attention and understanding.

Insurance Claims Disputes

Disputes over insurance claims are a frequent source of frustration for consumers. These disputes can arise from various factors, including disagreements over the extent of coverage, the amount of compensation, or the process for handling the claim.

- Delayed or Denied Claims: Consumers may face delays or denials of their claims due to various reasons, such as insufficient documentation, lack of clarity in policy terms, or the insurer’s interpretation of the claim.

- Unfair Settlement Offers: Insurers may offer settlements that are significantly lower than the actual value of the loss, leaving consumers feeling shortchanged.

- Communication Breakdown: Miscommunication between the consumer and the insurer can lead to misunderstandings and disputes.

The Future of Insurance in Nebraska

Nebraska’s insurance landscape is undergoing a transformation, driven by technological advancements and evolving consumer preferences. The state’s insurance market is poised for significant change, with emerging trends shaping the industry’s future.

The Rise of Digital Insurance Platforms

Digital insurance platforms are revolutionizing the way consumers purchase and manage insurance. These platforms offer a convenient and efficient alternative to traditional insurance brokers, allowing customers to compare quotes, purchase policies, and manage their coverage online. The increasing adoption of digital insurance platforms in Nebraska is driven by several factors, including:

- Convenience: Digital platforms provide 24/7 access to insurance services, eliminating the need for in-person appointments or phone calls. This convenience is particularly appealing to younger generations who are accustomed to digital interactions.

- Transparency: Digital platforms often provide more transparency into insurance policies, allowing customers to compare quotes and coverage options easily. This transparency empowers consumers to make informed decisions about their insurance needs.

- Personalized experiences: Digital platforms leverage data analytics to personalize insurance recommendations and pricing, tailoring coverage to individual needs and risk profiles. This personalization enhances customer satisfaction and loyalty.

The Increasing Importance of Data Analytics

Data analytics is becoming increasingly important in the insurance industry, enabling insurers to make better decisions, improve efficiency, and personalize customer experiences. In Nebraska, insurers are utilizing data analytics to:

- Assess risk: Data analytics helps insurers to better assess risk by analyzing factors such as demographics, driving history, and claims history. This allows insurers to offer more accurate and competitive pricing.

- Detect fraud: Data analytics can help identify potential insurance fraud by detecting patterns and anomalies in claims data. This helps insurers to reduce fraudulent claims and protect their financial interests.

- Improve customer service: Data analytics can be used to understand customer preferences and behaviors, allowing insurers to personalize communication and provide more tailored customer service.

The Impact of Emerging Trends on the Nebraska Insurance Market

The rise of digital insurance platforms and the increasing importance of data analytics are having a significant impact on the Nebraska insurance market. These trends are leading to:

- Increased competition: Digital insurance platforms are increasing competition in the insurance market, offering consumers more choices and driving down prices.

- Shifting customer expectations: Consumers are increasingly demanding convenient, transparent, and personalized insurance experiences, which traditional insurers are struggling to meet.

- Innovation in product development: Insurers are developing new products and services to meet the evolving needs of consumers, such as telematics-based insurance and usage-based pricing.

The Future Outlook for the Insurance Industry in Nebraska

The future of insurance in Nebraska is bright, with significant opportunities for growth and innovation. The state’s insurance market is expected to continue to evolve, driven by technological advancements and changing consumer preferences.

- Continued growth of digital insurance platforms: Digital insurance platforms are expected to continue to gain popularity in Nebraska, as consumers embrace the convenience and transparency they offer.

- Increased use of data analytics: Insurers will continue to invest in data analytics to improve risk assessment, fraud detection, and customer service.

- Focus on customer experience: Insurers will prioritize customer experience, offering personalized products and services to meet the evolving needs of consumers.

Closing Summary

Navigating the complexities of insurance in Nebraska can be challenging, but understanding the market and its regulations is essential for making informed decisions. Whether you’re seeking coverage for your health, vehicle, or home, or simply seeking to learn more about the insurance landscape in Nebraska, this guide provides valuable insights and resources to empower you in your journey.

Helpful Answers

What are the main types of insurance available in Nebraska?

Nebraska offers a variety of insurance products, including health, auto, home, life, and commercial insurance. You can find specific information on these types of insurance on the Nebraska Department of Insurance website.

How can I find a reputable insurance agent or broker in Nebraska?

The Nebraska Department of Insurance website provides a directory of licensed insurance agents and brokers. You can also ask for recommendations from friends, family, or your financial advisor.

What are some common insurance scams in Nebraska?

Be wary of unsolicited calls or emails offering insurance at a very low price. Always research the company and verify their legitimacy before providing any personal information.