State of Florida auto insurance presents a unique landscape, characterized by high premiums and specific regulations. Florida’s no-fault system, coupled with factors like high population density and frequent severe weather, contribute to a complex insurance environment. Understanding the intricacies of Florida’s auto insurance market is crucial for drivers seeking both affordable coverage and adequate protection.

This guide delves into the essential aspects of Florida auto insurance, exploring the different coverage types, factors influencing rates, and strategies for finding affordable policies. We’ll also examine the no-fault system, the claims process, and the importance of protecting yourself against fraud. By the end, you’ll have a comprehensive understanding of Florida’s auto insurance landscape and be equipped to make informed decisions about your coverage.

Florida’s Auto Insurance Landscape

Florida’s auto insurance market is unique and complex, characterized by high premiums and a prevalence of lawsuits. Several factors contribute to this distinctive landscape, making it a subject of ongoing debate and reform efforts.

Factors Contributing to High Auto Insurance Premiums

Several factors contribute to Florida’s high auto insurance premiums.

- High Frequency of Claims: Florida experiences a high volume of auto accidents, partly due to its large population, significant tourism, and a climate prone to severe weather events. This high frequency of claims increases the cost of insurance for all drivers.

- High Cost of Healthcare: Florida has a high cost of healthcare, particularly for treating injuries sustained in auto accidents. This drives up the cost of insurance claims, ultimately leading to higher premiums.

- High Legal Costs: Florida’s legal system is known for its prevalence of lawsuits and high jury awards. This factor significantly impacts insurance costs, as insurers must factor in the potential for large payouts in claims.

- Fraudulent Claims: While not unique to Florida, fraudulent claims are a concern in the state. This type of activity increases the cost of insurance for all drivers, as insurers must account for the risk of false claims.

- State-Mandated Benefits: Florida’s auto insurance laws require certain benefits, such as Personal Injury Protection (PIP) coverage, which can contribute to higher premiums. PIP coverage pays for medical expenses and lost wages, regardless of fault, adding to the overall cost of insurance.

Comparison of Florida’s Auto Insurance Regulations with Other States

Florida’s auto insurance regulations differ significantly from other states in several key areas.

- No-Fault System: Florida operates under a no-fault system, meaning drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of fault. This differs from other states with “tort” systems, where drivers can sue the at-fault party for damages.

- PIP Coverage: Florida mandates PIP coverage, which pays for medical expenses and lost wages up to a certain limit. This contrasts with other states that may have optional or more limited PIP coverage.

- Limits on Damages: Florida limits the amount of non-economic damages (such as pain and suffering) that can be awarded in a lawsuit. This is a significant difference from other states that allow for greater recovery of non-economic damages.

Types of Auto Insurance Coverage in Florida

Auto insurance in Florida, like in other states, is designed to protect you financially in the event of an accident. It covers various aspects of potential losses, including damages to your vehicle, medical expenses, and liability claims from others.

Mandatory Coverage Requirements

Florida law mandates that all drivers carry a minimum level of auto insurance to ensure financial responsibility in case of an accident. These requirements are crucial for protecting yourself and others on the road.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. The minimum required PIP coverage is $10,000 per person.

- Property Damage Liability (PDL): This coverage protects you against financial losses if you damage another person’s property in an accident. The minimum required PDL coverage is $10,000 per accident.

Optional Coverage Options

While mandatory coverage provides a basic safety net, additional optional coverage can provide greater financial protection in various scenarios. These optional coverages can be tailored to your individual needs and circumstances.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. This coverage is typically recommended for newer vehicles or those with a high loan balance.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, natural disasters, or falling objects. It is particularly beneficial for vehicles with high value or those exposed to risks like theft or weather events.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. It can help cover your medical expenses and vehicle damages in such situations.

- Medical Payments Coverage (Med Pay): This coverage provides medical expense coverage for you and your passengers, regardless of fault. It is a supplemental coverage that can provide additional financial protection beyond PIP coverage.

- Rental Reimbursement: This coverage helps pay for rental car expenses if your vehicle is damaged and unable to be driven. It can be particularly useful if you rely on your vehicle for work or daily commutes.

- Roadside Assistance: This coverage provides assistance in case of breakdowns, flat tires, or other roadside emergencies. It can include services like towing, jump-starts, and tire changes.

Factors Affecting Auto Insurance Rates in Florida

Florida’s auto insurance rates are influenced by a variety of factors, each playing a significant role in determining your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a crucial factor in determining your auto insurance rates. Insurance companies analyze your driving record to assess your risk of accidents. A clean driving record with no accidents or violations generally results in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates.

Insurance companies often use a points system to evaluate your driving history. Each violation or accident receives a specific number of points, and the total points accumulated determine your risk level.

Vehicle Type

The type of vehicle you drive also impacts your insurance rates. Some vehicles are considered riskier than others due to their safety features, repair costs, and theft susceptibility. For example, sports cars and luxury vehicles often have higher insurance premiums because they are more expensive to repair and have a higher risk of theft.

Location

Your location in Florida plays a significant role in determining your auto insurance rates. Insurance companies consider factors like population density, crime rates, and the frequency of accidents in your area. Areas with high traffic congestion and higher accident rates typically have higher insurance premiums.

Rating Systems Used by Different Insurance Companies

Different insurance companies in Florida use varying rating systems to calculate auto insurance premiums. These systems take into account the factors discussed above, but the specific weights and calculations may differ.

- Garaging Address: This refers to where your car is primarily parked. This influences your rate because of the crime rates, accident rates, and weather conditions in your area.

- Credit History: Insurance companies often consider your credit score as an indicator of your financial responsibility. A good credit score can result in lower premiums. However, it’s important to note that this practice is not allowed in California and some other states.

- Age and Gender: These factors can influence your rates, with younger and male drivers generally paying higher premiums. This is because statistics show that these groups have a higher risk of accidents.

- Marital Status: In some cases, being married can lead to lower insurance premiums. This is often attributed to the assumption that married individuals tend to have more stable driving habits.

- Driving Experience: Drivers with more experience tend to have lower premiums. This is because they are statistically less likely to be involved in accidents.

Finding Affordable Auto Insurance in Florida

Finding affordable auto insurance in Florida can feel like navigating a maze, but with some smart strategies, you can get the coverage you need without breaking the bank. This section will explore ways to find affordable auto insurance in Florida, focusing on the benefits of comparing quotes and understanding discounts and programs available to reduce premiums.

Comparing Quotes

It’s essential to compare quotes from multiple insurance companies to find the best rates. Each insurer uses different formulas to calculate premiums, so you might discover significant variations in pricing.

- Online comparison tools: Websites like Insurance.com, Policygenius, and The Zebra allow you to enter your information once and receive quotes from various insurers. This saves you time and effort compared to contacting each company individually.

- Directly contact insurance companies: Reach out to insurance companies directly to get personalized quotes. This allows you to discuss specific needs and ask questions about their policies.

- Use a local insurance broker: Brokers can help you compare quotes from several companies and provide expert advice tailored to your situation.

Discounts and Programs

Many insurers offer discounts and programs that can significantly reduce your premiums. Take advantage of these opportunities to save money on your auto insurance.

- Good driver discounts: Maintaining a clean driving record with no accidents or violations can earn you a substantial discount.

- Safe driver courses: Completing a defensive driving course can lower your premiums by demonstrating your commitment to safe driving practices.

- Multi-policy discounts: Bundling your auto insurance with other policies like homeowners or renters insurance can often lead to significant savings.

- Payment discounts: Paying your premium annually or semi-annually instead of monthly can sometimes result in a lower overall cost.

- Vehicle safety features: Cars equipped with anti-theft devices, airbags, and other safety features may qualify for discounts.

Understanding Florida’s No-Fault System

Florida operates under a no-fault auto insurance system, a unique approach that differs significantly from the traditional fault-based systems found in most other states. This system aims to simplify the claims process and expedite compensation for injuries, regardless of who is at fault in an accident.

Principles of Florida’s No-Fault System

Under Florida’s no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses, lost wages, and other related costs incurred by the policyholder, regardless of who caused the accident. This means that after an accident, drivers typically file a claim with their own insurance company, not the insurance company of the other driver involved.

Limitations and Benefits of the No-Fault System

While Florida’s no-fault system aims to simplify the claims process, it does have certain limitations. For instance, drivers are limited in their ability to sue for pain and suffering unless their injuries meet specific criteria, such as a permanent injury or significant medical expenses. However, the system also offers benefits, such as quicker access to compensation and reduced litigation costs.

Examples of PIP Claims

Here are some examples of situations where a driver may need to file a PIP claim:

- Medical expenses incurred due to injuries sustained in an accident, including doctor’s visits, hospital stays, and rehabilitation.

- Lost wages due to an inability to work as a result of injuries sustained in an accident.

- Other related expenses, such as transportation costs to medical appointments or home health care services.

Filing a Claim in Florida

If you’re involved in a car accident in Florida, navigating the claims process can feel overwhelming. Understanding the steps involved and the role of the Florida Department of Financial Services (DFS) can make the process smoother.

Steps Involved in Filing a Claim

It’s essential to act quickly and follow the right steps to ensure your claim is processed efficiently.

- Contact Your Insurance Company: Immediately report the accident to your insurance company. Provide them with all the details, including the date, time, location, and any injuries sustained.

- File a Police Report: In most cases, filing a police report is crucial, especially if there’s an injury or property damage exceeding a certain threshold.

- Gather Evidence: Collect as much evidence as possible to support your claim. This includes taking photos of the damage, getting contact information from witnesses, and obtaining medical documentation if needed.

- Complete the Claim Form: Your insurance company will provide you with a claim form. Fill it out accurately and completely, providing all the necessary information.

- Cooperate with Your Insurance Company: Be responsive to your insurance company’s requests for information and be prepared to answer their questions.

Role of the Florida Department of Financial Services

The DFS plays a vital role in overseeing the insurance industry in Florida.

- Consumer Protection: The DFS works to protect consumers by investigating complaints and ensuring insurance companies comply with state laws.

- Claims Assistance: If you encounter problems with your insurance company, the DFS can provide guidance and assistance in resolving the issue.

- Information and Resources: The DFS offers various resources and information on auto insurance, including consumer guides and FAQs.

Tips for a Smooth Claims Process

Here are some tips to ensure a smooth and successful claims process:

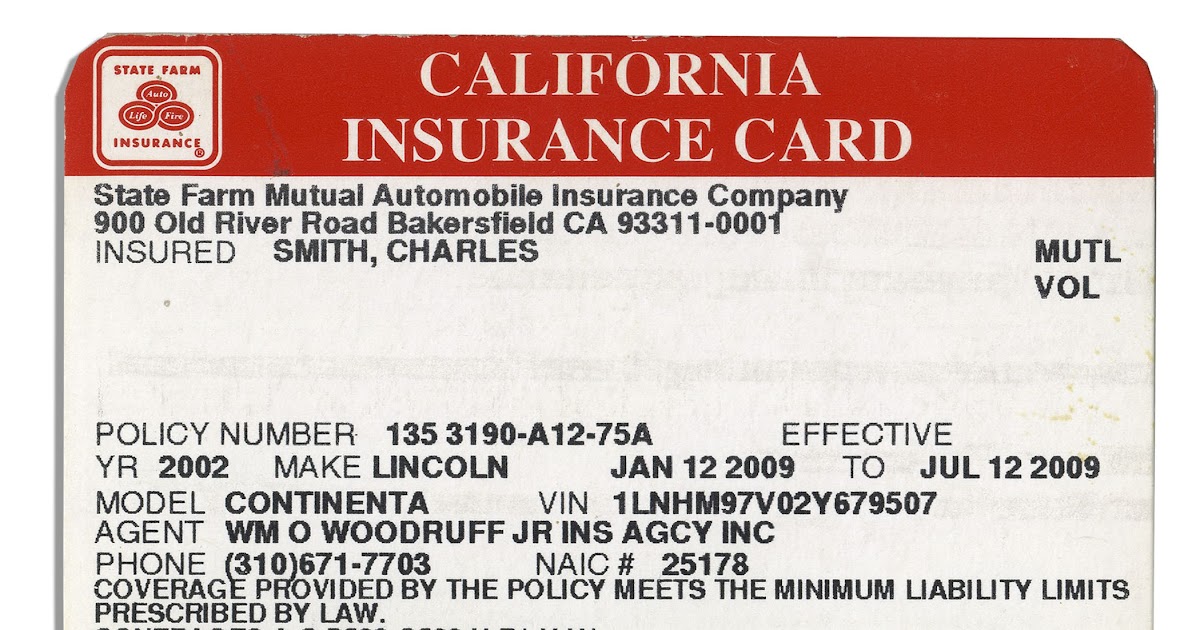

- Be Prepared: Keep your insurance information readily available, including policy numbers and contact details.

- Be Honest: Provide accurate information to your insurance company and avoid making false statements.

- Be Patient: The claims process can take time, so be patient and persistent.

- Keep Records: Maintain a file of all documents related to your claim, including correspondence, medical records, and repair estimates.

- Know Your Rights: Familiarize yourself with your rights as an insured person under Florida law.

Florida’s Personal Injury Protection (PIP) Coverage: State Of Florida Auto Insurance

Florida’s Personal Injury Protection (PIP) coverage is a mandatory insurance component that covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident. It’s designed to help you recover from injuries and get back on your feet after a car accident.

PIP Coverage Benefits

PIP coverage provides financial assistance for medical expenses and lost wages following a car accident. Here’s a breakdown of the benefits:

- Medical Expenses: PIP coverage pays for medical expenses, including doctor visits, hospital stays, surgeries, medications, and rehabilitation. This coverage is capped at $10,000 per person, per accident.

- Lost Wages: If you’re unable to work due to injuries sustained in an accident, PIP coverage can help cover lost wages. This benefit is limited to 80% of your average weekly wage, up to a maximum of $2,000 per month, for a total of 26 weeks.

PIP Coverage Limits and Restrictions

PIP coverage comes with certain limitations and restrictions:

- Coverage Limit: The maximum benefit for medical expenses is $10,000 per person, per accident. If your medical expenses exceed this limit, you’ll be responsible for the remaining costs.

- Deductible: You may have to pay a deductible before PIP coverage kicks in. The deductible amount is determined by your insurance policy and can vary depending on your chosen coverage level.

- Treatment Limitations: PIP coverage may have limitations on the types of medical treatments it covers. For example, some policies may exclude coverage for alternative therapies or treatments that are not considered medically necessary.

- Time Limits: PIP coverage has a time limit for claiming benefits. You must seek medical treatment within 14 days of the accident and file a claim within 2 years of the accident.

- Choice of Provider: While you’re generally free to choose your own healthcare provider, your insurance company may require you to seek treatment from a specific network of providers.

PIP Coverage and Other Types of Auto Insurance

PIP coverage works in conjunction with other types of auto insurance to provide comprehensive protection. Here’s how it interacts:

- Collision Coverage: If you have collision coverage, it will pay for damages to your vehicle, regardless of who caused the accident. PIP coverage will cover your medical expenses and lost wages.

- Comprehensive Coverage: Comprehensive coverage protects you from damages to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. PIP coverage still applies to your medical expenses and lost wages.

- Liability Coverage: Liability coverage protects you from financial responsibility if you cause an accident and injure someone else or damage their property. PIP coverage will cover your own medical expenses and lost wages, regardless of who caused the accident.

Florida’s Uninsured/Underinsured Motorist Coverage

In Florida, uninsured/underinsured motorist (UM/UIM) coverage is a vital component of your auto insurance policy. It acts as a safety net, protecting you financially if you’re involved in an accident with a driver who lacks adequate insurance or no insurance at all.

Importance of UM/UIM Coverage in Florida

UM/UIM coverage is crucial in Florida because it safeguards you against potential financial burdens stemming from accidents caused by uninsured or underinsured drivers. Florida law requires all insurance companies to offer UM/UIM coverage, but it’s not mandatory to purchase it. However, it’s highly recommended, especially considering the high number of uninsured drivers in the state.

Situations Where UM/UIM Coverage Is Essential

UM/UIM coverage is particularly valuable in these scenarios:

- Hit-and-Run Accidents: When the driver responsible for an accident flees the scene, leaving you with damages and injuries, UM/UIM coverage can help you recover your losses.

- Accidents Involving Drivers with Insufficient Coverage: If the other driver has liability insurance, but it’s not enough to cover your medical bills, lost wages, and property damage, UM/UIM coverage can bridge the gap.

- Accidents with Drivers Who Are Uninsured: If the other driver doesn’t have any insurance at all, UM/UIM coverage can be your sole source of financial protection.

Examples of UM/UIM Coverage Protection

- Scenario 1: You’re stopped at a red light when a driver runs a red light and crashes into your car. The other driver admits fault but reveals they have no insurance. Your UM/UIM coverage will cover your medical bills, lost wages, and property damage up to your policy limits.

- Scenario 2: You’re involved in a multi-car accident. The driver who caused the accident has liability coverage, but it’s only $10,000. Your medical bills exceed this amount. Your UM/UIM coverage will pay the difference, ensuring you’re not left with significant out-of-pocket expenses.

Auto Insurance Fraud in Florida

Auto insurance fraud is a serious issue in Florida, costing insurance companies and policyholders millions of dollars each year. It’s important to understand the different types of fraud that occur, the consequences of committing these acts, and how to protect yourself from becoming a victim.

Types of Auto Insurance Fraud in Florida

Auto insurance fraud can take many forms, but some of the most common types include:

- Staged Accidents: These involve individuals intentionally causing accidents to file false claims for injuries and property damage. This can involve staged collisions, where drivers deliberately crash into each other, or staged hit-and-runs, where someone pretends to be hit by a vehicle that never existed.

- Fake Injury Claims: Individuals may exaggerate or fabricate injuries after an accident to receive higher insurance payouts. This can involve claiming injuries that didn’t occur, exaggerating the severity of existing injuries, or seeking treatment for injuries that aren’t related to the accident.

- Ghost Vehicles: This involves insuring a vehicle that doesn’t exist or has been sold but is still listed on an insurance policy. This allows the insured to collect premiums on a non-existent vehicle or file false claims for a vehicle that has already been sold.

- Stolen Vehicle Claims: Individuals may file false claims for stolen vehicles, claiming their car was stolen when it was actually sold or disposed of. This allows them to receive insurance payouts for a vehicle they no longer own.

- Inflated Repair Costs: Individuals may inflate the cost of repairs for their vehicle after an accident, submitting fake receipts or invoices for work that wasn’t done. This allows them to receive higher insurance payouts for repairs.

Consequences of Committing Auto Insurance Fraud

Committing auto insurance fraud is a serious crime in Florida with severe consequences. The penalties for committing auto insurance fraud can include:

- Criminal Charges: Individuals convicted of auto insurance fraud can face felony charges, resulting in prison sentences and fines. The severity of the charges and penalties depends on the nature and extent of the fraud.

- Insurance Policy Cancellation: Insurance companies have the right to cancel the policy of anyone convicted of auto insurance fraud. This means the individual will be left without coverage and may have difficulty obtaining new insurance in the future.

- Civil Suits: Victims of auto insurance fraud can file civil lawsuits against the perpetrator to recover their losses. This can result in significant financial penalties for the perpetrator.

- Driver’s License Suspension: Individuals convicted of auto insurance fraud may have their driver’s license suspended or revoked.

Protecting Yourself from Auto Insurance Fraud, State of florida auto insurance

It’s important to be aware of the signs of auto insurance fraud and take steps to protect yourself from becoming a victim. Here are some tips:

- Be Cautious of Unusually Low Premiums: If you’re offered an auto insurance policy with a premium that seems too good to be true, it may be a sign of fraud. Be sure to compare rates from multiple insurers and ask questions about the coverage offered.

- Be Wary of High-Pressure Sales Tactics: If an insurance agent is pressuring you to sign up for a policy quickly or without thoroughly reviewing the terms, it may be a red flag. Take your time and carefully read through the policy before signing anything.

- Report Suspicious Activity: If you suspect someone is committing auto insurance fraud, report it to your insurance company or the Florida Department of Financial Services.

- Maintain Accurate Records: Keep detailed records of your auto insurance policy, including premiums paid, coverage details, and any claims filed. This can help you identify any discrepancies or fraudulent activity.

Resources for Florida Drivers

Navigating Florida’s auto insurance landscape can be complex. Fortunately, various resources are available to help drivers understand their rights, options, and responsibilities. These resources can provide valuable information and support, empowering drivers to make informed decisions about their insurance coverage.

Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is the primary regulatory body for the insurance industry in the state. It plays a crucial role in protecting consumers’ interests and ensuring fair and competitive insurance markets. The DFS website offers a wealth of information about auto insurance, including:

- Consumer guides and brochures on auto insurance topics.

- Information about filing complaints against insurance companies.

- Access to the Florida Insurance Guaranty Association (FIGA), which provides coverage for claims when an insurance company becomes insolvent.

- Resources for understanding Florida’s no-fault system and personal injury protection (PIP) coverage.

Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation (OIR) is responsible for overseeing the insurance industry in the state. It sets rates, approves insurance policies, and ensures compliance with state laws. The OIR website provides information on:

- Auto insurance rates and filings.

- Consumer protection regulations.

- Information about insurance companies operating in Florida.

Consumer Advocacy Groups

Several consumer advocacy groups are dedicated to protecting the rights of consumers in Florida. These groups can provide valuable information, support, and advocacy to drivers facing insurance-related issues.

- The Florida Consumer Action Network (FCAN) is a non-profit organization that advocates for consumer rights and protection. It provides resources and information on various consumer issues, including insurance.

- The Florida Public Interest Research Group (PIRG) is a non-profit organization that conducts research and advocacy on consumer issues, including insurance.

- The National Association of Insurance Commissioners (NAIC) is a national organization that represents state insurance regulators. The NAIC website provides information on insurance issues and consumer protection.

Insurance Companies

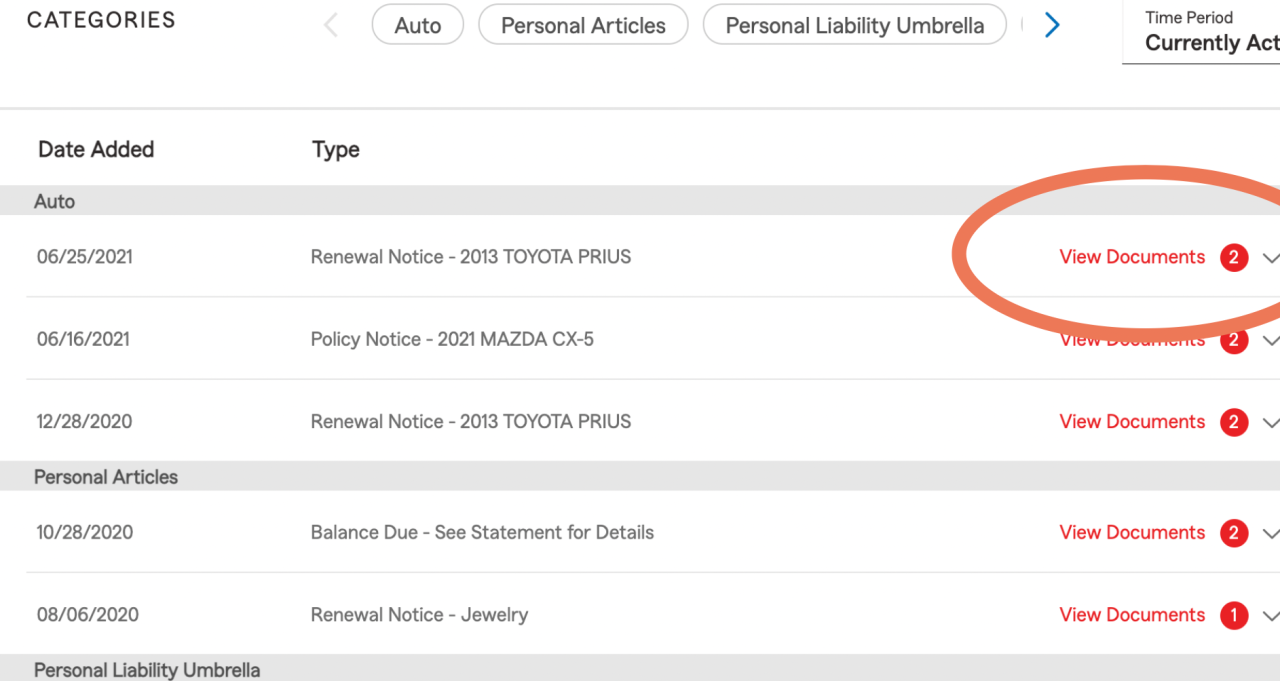

Insurance companies themselves offer resources to help drivers understand their policies and coverage. This can include:

- Policy summaries and explanations.

- Online portals for managing policies and making payments.

- Customer service representatives who can answer questions about coverage.

Other Resources

In addition to the resources listed above, several other organizations can provide valuable information and support to Florida drivers.

- The Florida Bar provides resources for consumers who are facing legal issues, including insurance disputes.

- The Florida Highway Safety and Motor Vehicles (FLHSMV) website offers information on driver licensing, vehicle registration, and other transportation-related issues.

- The National Highway Traffic Safety Administration (NHTSA) website provides information on vehicle safety, including safety ratings and recalls.

End of Discussion

Navigating Florida’s auto insurance market can be a challenging but rewarding endeavor. By understanding the unique characteristics of the state’s insurance landscape, comparing quotes from multiple insurers, and taking advantage of available discounts, drivers can find affordable coverage that meets their individual needs. Remember, being proactive and knowledgeable about your insurance options empowers you to secure the best possible protection for yourself and your loved ones.

FAQ Explained

What are the minimum auto insurance requirements in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

How do I get a discount on my auto insurance in Florida?

Many insurance companies offer discounts for safe driving records, good grades, multiple policies, and safety features in your vehicle. It’s always a good idea to ask your insurer about available discounts.

What is the role of the Florida Department of Financial Services (DFS) in auto insurance?

The DFS regulates the insurance industry in Florida, ensuring fair practices and protecting consumers. They investigate complaints, handle disputes, and provide resources for consumers.

What are some common auto insurance scams in Florida?

Common scams include staged accidents, fraudulent claims, and identity theft. Be cautious about suspicious offers or requests for personal information.