State of michigan auto insurance requirements – Navigating the world of auto insurance can be a confusing experience, especially in a state like Michigan, known for its unique and complex insurance system. Michigan’s auto insurance requirements are unlike any other in the country, with a focus on providing comprehensive coverage for injuries, even if you’re at fault. This system, born from a long history of legislative changes, has shaped Michigan’s auto insurance landscape, impacting drivers and insurers alike.

Understanding Michigan’s auto insurance requirements is crucial for all drivers, whether you’re a new resident or a seasoned Michigander. From mandatory coverages to the role of the Michigan Catastrophic Claims Association (MCCA), this guide will equip you with the knowledge to make informed decisions about your auto insurance.

Michigan Auto Insurance Requirements Overview

Michigan has a unique auto insurance system that differs significantly from other states. This system is characterized by its no-fault insurance framework, which has been in place for decades. Understanding the reasons behind this system and its impact on the state’s auto insurance landscape is crucial for navigating the complexities of Michigan’s auto insurance requirements.

Historical Context and Development of the No-Fault System

Michigan’s no-fault auto insurance system was enacted in 1973, aiming to simplify the process of handling car accidents and ensure prompt compensation for injured parties. The legislation was a response to concerns about rising insurance costs, lengthy legal battles, and the potential for unfair outcomes in traditional fault-based systems.

The no-fault system aimed to streamline the claims process by eliminating the need to determine fault in an accident. Instead, each driver’s own insurance policy would cover their medical expenses and lost wages, regardless of who caused the accident. The expectation was that this would reduce litigation and associated costs, ultimately leading to lower insurance premiums.

Impact of the No-Fault Law on Michigan’s Auto Insurance Landscape

The no-fault law has had a profound impact on Michigan’s auto insurance landscape. It has significantly reduced the number of lawsuits filed after accidents, contributing to a more efficient claims process. However, the system has also faced challenges, particularly in terms of rising insurance premiums.

The no-fault system has contributed to a significant increase in the cost of auto insurance in Michigan. This increase can be attributed to several factors, including:

- Unlimited Personal Injury Protection (PIP) Coverage: Michigan is the only state with unlimited PIP coverage, meaning insurers are required to pay for all medical expenses, regardless of cost. This unlimited coverage has led to higher premiums as insurers must account for the potential of significant payouts.

- High Medical Costs: Michigan has consistently ranked among states with high medical costs, further contributing to the rising cost of auto insurance.

- Fraud and Abuse: While efforts have been made to combat fraud and abuse, the system has been vulnerable to these issues, further increasing costs for insurers and ultimately, policyholders.

- Lack of Competition: Michigan’s auto insurance market has historically been less competitive than in other states, leading to higher premiums.

Mandatory Coverage Requirements: State Of Michigan Auto Insurance Requirements

Michigan law requires all drivers to carry specific types of auto insurance coverage to protect themselves and others in the event of an accident. These mandatory coverages provide financial protection for various costs associated with accidents, such as medical expenses, property damage, and lost wages.

Personal Injury Protection (PIP)

PIP coverage is a critical component of Michigan auto insurance, providing coverage for medical expenses and lost wages resulting from an accident, regardless of who is at fault.

Michigan is a no-fault state, meaning your own insurance policy will cover your injuries and losses after an accident, regardless of who is at fault.

- Medical Expenses: PIP covers medical expenses incurred due to an accident, including doctor visits, hospital stays, ambulance services, and rehabilitation.

- Lost Wages: PIP can help compensate for lost wages if you are unable to work due to injuries sustained in an accident.

- Death Benefits: In the unfortunate event of a fatal accident, PIP provides death benefits to surviving family members.

The minimum PIP coverage limit in Michigan is $1 million, although you can choose higher limits.

Property Protection (PP)

PP coverage protects you from financial liability for damage you cause to another person’s property in an accident.

- Property Damage: PP covers the cost of repairs or replacement for the other vehicle or property involved in the accident, up to the policy limit.

The minimum PP coverage limit in Michigan is $25,000.

Uninsured Motorist Coverage (UM)

UM coverage provides financial protection if you are involved in an accident with an uninsured or underinsured driver.

- Uninsured Driver: If you are hit by a driver without insurance, UM coverage will help cover your medical expenses, lost wages, and property damage.

- Underinsured Driver: If you are hit by a driver with insurance, but their coverage limits are insufficient to cover your losses, UM coverage can help bridge the gap.

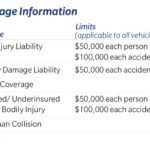

The minimum UM coverage limit in Michigan is $25,000 per person and $50,000 per accident.

Liability Coverage, State of michigan auto insurance requirements

Liability coverage protects you financially if you are found at fault for causing an accident.

- Bodily Injury Liability: This coverage pays for medical expenses and other damages incurred by the other driver or passengers in your accident, up to the policy limit.

- Property Damage Liability: This coverage pays for damage you cause to the other driver’s vehicle or property, up to the policy limit.

The minimum liability coverage limits in Michigan are $25,000 per person and $50,000 per accident for bodily injury liability, and $25,000 for property damage liability.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage is a mandatory component of Michigan auto insurance that pays for medical expenses, lost wages, and other related costs incurred by you and your passengers in the event of an accident, regardless of who is at fault. PIP coverage plays a vital role in providing financial protection and ensuring access to necessary medical care after an accident.

PIP Coverage Options

Michigan offers various PIP coverage options, allowing drivers to choose the level of protection that best suits their needs and budget. The different options are categorized based on the amount of coverage they provide. Here’s a closer look at the available PIP coverage options:

- Unlimited Coverage: This option provides unlimited coverage for medical expenses, lost wages, and other related costs. It offers the highest level of protection, ensuring that you and your passengers receive the necessary medical care and financial support regardless of the severity of the accident.

- $1 Million Coverage: This option provides coverage up to $1 million for medical expenses, lost wages, and other related costs. While it offers a significant level of protection, it may not be sufficient for all situations, particularly those involving severe injuries and extensive medical treatment.

- $500,000 Coverage: This option provides coverage up to $500,000 for medical expenses, lost wages, and other related costs. It offers a moderate level of protection, but it may not be enough to cover the full cost of treatment and rehabilitation in cases of serious injuries.

- $250,000 Coverage: This option provides coverage up to $250,000 for medical expenses, lost wages, and other related costs. It offers the lowest level of protection and may not be sufficient for all situations, especially those involving long-term care or rehabilitation.

Coverage for Other Drivers

Michigan auto insurance law requires drivers to carry uninsured/underinsured motorist (UM/UIM) coverage. This coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Uninsured/Underinsured Motorist Coverage Limits and Benefits

UM/UIM coverage helps pay for medical expenses, lost wages, and other damages if you’re injured in an accident caused by an uninsured or underinsured driver. The amount of coverage you choose determines the maximum amount your insurance company will pay for your losses.

- Uninsured Motorist (UM) Coverage: This coverage applies when the at-fault driver doesn’t have any insurance.

- Underinsured Motorist (UIM) Coverage: This coverage applies when the at-fault driver has insurance, but it’s not enough to cover your losses. For example, if the other driver has $25,000 in liability coverage, and your damages exceed that amount, your UIM coverage can help pay the difference.

Michigan law requires drivers to carry UM/UIM coverage at least equal to their bodily injury liability limits.

Situations Where Uninsured/Underinsured Motorist Coverage Would Apply

Here are some examples of situations where UM/UIM coverage would be helpful:

- You’re hit by a driver who doesn’t have insurance.

- You’re hit by a driver whose insurance policy is canceled or expired.

- You’re hit by a driver whose insurance policy has insufficient coverage to cover your damages.

- You’re injured by a hit-and-run driver.

Factors Affecting Insurance Costs

Michigan’s auto insurance system is unique and complex, and as a result, several factors contribute to the cost of your insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your costs.

Driving Record

Your driving record plays a significant role in determining your auto insurance premiums. A clean driving record with no accidents or violations typically leads to lower premiums. Conversely, a record with accidents, speeding tickets, or DUI convictions will likely result in higher premiums. Insurance companies consider your driving history as a measure of your risk.

Vehicle Type

The type of vehicle you drive also influences your insurance costs. Generally, newer, more expensive vehicles tend to have higher premiums due to their higher repair costs. The safety features of your vehicle also play a role. Cars with advanced safety features like anti-lock brakes, airbags, and stability control are often considered safer and may qualify for lower premiums.

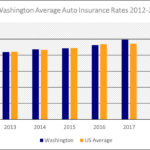

Location

The location where you live can also impact your auto insurance premiums. Areas with higher rates of accidents or crime tend to have higher insurance costs. Insurance companies use data about accident rates, theft rates, and other factors to determine premiums in specific areas.

Michigan Catastrophic Claims Association (MCCA)

The MCCA is a state-run organization that helps cover the costs of catastrophic injuries from car accidents. All Michigan drivers are required to pay a portion of their auto insurance premiums to the MCCA. This contribution helps ensure that victims of severe accidents have access to necessary medical care and rehabilitation services. The MCCA’s assessments contribute significantly to the overall cost of auto insurance in Michigan.

Obtaining and Maintaining Coverage

In Michigan, obtaining auto insurance is a crucial step for all vehicle owners. Understanding the process and available options can help you secure the right coverage at a reasonable price.

Obtaining Auto Insurance

To obtain auto insurance in Michigan, you will need to contact an insurance company or agent and provide them with certain information. This typically includes:

- Your driver’s license information

- Your vehicle’s identification number (VIN)

- Your driving history

- Your desired coverage levels

- Your contact information

Based on this information, the insurance company will assess your risk and provide you with a quote. You can then compare quotes from multiple insurers to find the best deal.

Comparing Insurance Quotes

When comparing insurance quotes, consider the following factors:

- Coverage levels: Make sure the quotes you compare offer the same coverage levels, such as PIP, liability, and collision.

- Deductibles: Higher deductibles generally lead to lower premiums, but you will pay more out-of-pocket in case of an accident.

- Discounts: Ask about available discounts, such as good driver, safe vehicle, and multi-policy discounts.

- Customer service: Consider the insurer’s reputation for customer service and claims handling.

Renewing Auto Insurance Policies

When your current auto insurance policy is about to expire, your insurance company will typically send you a renewal notice. This notice will include your current premium and coverage details.

- You can choose to renew your policy with the same coverage and premium.

- You can also request changes to your coverage or explore other insurance options.

Making Changes to Coverage

You can make changes to your auto insurance coverage at any time. For example, you may want to increase your PIP coverage, add a new vehicle, or change your deductible.

- Contact your insurance company or agent to discuss the desired changes.

- They will update your policy and provide you with a new premium quote.

Penalties for Non-Compliance

Driving without the required auto insurance in Michigan is a serious offense with significant consequences. Failure to maintain the minimum coverage requirements can result in hefty fines, license suspension, and even jail time.

Consequences of Driving Without Insurance

The state of Michigan takes auto insurance compliance seriously, and drivers who operate vehicles without the required coverage face a range of penalties. These penalties are designed to deter drivers from operating vehicles without insurance and to ensure that victims of accidents have access to compensation for their injuries and damages.

- Fines: Drivers caught driving without insurance can face fines ranging from $200 to $500, depending on the circumstances. The fine may be higher for repeat offenses.

- License Suspension: In addition to fines, the state can also suspend the driver’s license for a period of time. The suspension period can vary depending on the severity of the offense and the driver’s prior driving record.

- Vehicle Impoundment: In some cases, the vehicle may be impounded until the driver provides proof of insurance. This can be a significant inconvenience and expense, as the driver will have to pay storage fees and other costs associated with retrieving their vehicle.

- Jail Time: In extreme cases, drivers who repeatedly violate insurance requirements may face jail time. For instance, if a driver is involved in an accident without insurance and is found guilty of driving without insurance, they may be sentenced to jail.

- Financial Responsibility: If a driver without insurance is involved in an accident, they will be personally responsible for all damages and injuries caused. This can lead to significant financial hardship, as the driver will be required to pay for medical bills, property damage, and other expenses out of pocket.

Consequences of Failing to Maintain Minimum Coverage

Even if a driver has insurance, they may face penalties if they fail to maintain the minimum coverage requirements. This can happen if a driver allows their insurance policy to lapse, cancels their policy, or reduces their coverage below the required minimums.

- Fines: Drivers who fail to maintain minimum coverage can face fines similar to those imposed on drivers without insurance.

- License Suspension: The state can also suspend the driver’s license for failing to maintain minimum coverage.

- Vehicle Impoundment: The vehicle may be impounded until the driver provides proof of insurance that meets the minimum coverage requirements.

- Increased Insurance Premiums: Drivers who have their insurance canceled or lapse may face difficulty obtaining new insurance or may be charged higher premiums due to their history of non-compliance.

Examples of How Non-Compliance Can Impact Drivers

It’s important to understand the real-world consequences of driving without insurance or failing to maintain minimum coverage. Here are some examples:

- Accident with Injuries: A driver without insurance is involved in an accident that results in serious injuries to another driver. The uninsured driver is responsible for all medical bills, lost wages, and other expenses incurred by the injured driver. The uninsured driver may also face criminal charges and a lengthy prison sentence.

- Hit-and-Run: A driver without insurance hits a parked car and flees the scene. The driver is later identified and charged with leaving the scene of an accident, driving without insurance, and property damage. The driver faces fines, license suspension, and potential jail time.

- Lapse in Coverage: A driver’s insurance policy lapses due to non-payment of premiums. The driver is involved in an accident while driving without insurance. The driver faces fines, license suspension, and is responsible for all damages and injuries caused by the accident.

Recent Changes and Future Trends

Michigan’s auto insurance landscape has undergone significant transformations in recent years, driven by a combination of legislative changes and evolving consumer demands. These changes have brought about both benefits and challenges, reshaping the way Michiganders approach and experience auto insurance.

Recent Changes and Their Impact

Michigan’s auto insurance laws have been significantly reformed in recent years, aiming to address concerns about high insurance costs and limited consumer choice. These changes have had a notable impact on the state’s auto insurance market.

- No-Fault Reform: The most significant change was the reform of the state’s no-fault system. This reform aimed to reduce insurance premiums by offering consumers more options and control over their coverage. Key changes included the introduction of tiered coverage levels for personal injury protection (PIP), allowing drivers to choose coverage based on their needs and risk tolerance. This reform aimed to make auto insurance more affordable by allowing drivers to choose coverage that better reflects their individual circumstances.

- Increased Competition: The reforms also aimed to foster greater competition among insurers, potentially leading to more competitive pricing and better service. This increased competition is intended to drive innovation and create a more consumer-friendly market, with insurers striving to offer attractive rates and services to attract customers.

- Reduced Premiums: The reforms were designed to lower auto insurance premiums for many Michiganders. By offering more options and reducing the cost of mandatory coverage, the goal was to make insurance more affordable for a wider range of drivers. While some drivers have seen reductions in their premiums, others have experienced increases, depending on their coverage choices and individual circumstances.

Ongoing Debate on Auto Insurance Reform

The debate surrounding auto insurance reform in Michigan continues, with various stakeholders voicing their opinions on the effectiveness and fairness of the changes. This debate reflects the complex nature of auto insurance and the need to balance affordability with access to necessary coverage.

- Affordability vs. Coverage: One key point of contention is the balance between affordability and access to adequate coverage. Some argue that the reforms have made insurance more affordable for many, while others express concerns that reduced coverage options could leave some drivers vulnerable in the event of an accident.

- Consumer Choice and Transparency: Another area of discussion is the level of consumer choice and transparency provided by the reformed system. Some argue that the tiered coverage options are confusing and that drivers may not fully understand the implications of their coverage choices. Others believe that the reforms have empowered consumers by giving them more control over their insurance decisions.

- Impact on the Insurance Market: The long-term impact of the reforms on the insurance market is also being debated. Some argue that the reforms have created a more competitive market, while others express concerns about potential consolidation and reduced choice for consumers. The full effects of the reforms on the insurance landscape are still unfolding and require further observation and analysis.

Potential Future Trends in Michigan’s Auto Insurance Landscape

The ongoing debate and the evolving needs of consumers suggest several potential future trends in Michigan’s auto insurance landscape. These trends are likely to be shaped by technological advancements, changing driving habits, and ongoing policy discussions.

- Increased Use of Telematics: Telematics, the use of technology to track driving behavior, is expected to play a growing role in auto insurance. Insurers may use telematics data to personalize rates based on individual driving habits, potentially leading to lower premiums for safe drivers. This trend could incentivize safer driving practices and further personalize insurance offerings.

- Expansion of Usage-Based Insurance: Usage-based insurance, which bases premiums on actual driving habits, is likely to become more prevalent. This approach allows insurers to tailor premiums to individual driving patterns, potentially offering discounts to drivers who demonstrate safe driving behaviors. This trend could further incentivize safe driving practices and promote a more equitable pricing structure.

- Growth of Autonomous Vehicles: The emergence of autonomous vehicles is expected to have a significant impact on auto insurance. As self-driving cars become more commonplace, the role of human error in accidents will diminish, potentially leading to lower insurance premiums. However, new challenges related to liability and data security will need to be addressed as autonomous vehicles become more prevalent.

Closing Notes

In conclusion, understanding Michigan’s auto insurance requirements is essential for safe and responsible driving. From the mandatory coverages to the factors that influence your premiums, navigating this complex system can be challenging. However, by carefully considering your coverage options, comparing quotes, and staying informed about recent changes, you can ensure you have the protection you need while managing your insurance costs effectively.

Top FAQs

How often do I need to renew my auto insurance in Michigan?

Auto insurance policies in Michigan typically renew annually. You’ll receive a renewal notice from your insurance company before your policy expires.

What happens if I get into an accident and the other driver doesn’t have insurance?

If you’re involved in an accident with an uninsured driver, your own uninsured motorist coverage will help cover your medical expenses and property damage.

Can I choose my own doctor after an accident in Michigan?

Yes, under Michigan’s no-fault law, you have the right to choose your own doctor for treatment following an accident.

What is the Michigan Catastrophic Claims Association (MCCA) and how does it affect my premiums?

The MCCA is a state-run entity that helps cover the costs of catastrophic injuries from auto accidents. Your auto insurance premiums include a portion that goes towards the MCCA.