State Farm homeowners insurance cost is a crucial factor to consider when protecting your most valuable asset: your home. As one of the leading homeowners insurance providers in the United States, State Farm offers a comprehensive range of coverage options tailored to individual needs. However, understanding the factors that influence premiums and comparing rates with other providers is essential to securing the best possible value.

This guide delves into the intricacies of State Farm homeowners insurance cost, providing insights into pricing structure, coverage options, and tips for obtaining competitive quotes. Whether you’re a first-time homeowner or seeking to review your current policy, this information will empower you to make informed decisions about your insurance coverage.

State Farm Homeowners Insurance Overview

State Farm is a leading provider of homeowners insurance in the United States, known for its wide range of coverage options, competitive pricing, and excellent customer service. Founded in 1922, State Farm has grown to become one of the largest insurance companies in the world, with a strong reputation for reliability and financial stability.

State Farm homeowners insurance offers comprehensive protection for your home and belongings against a variety of risks, including fire, theft, vandalism, and natural disasters. The company also provides a variety of additional coverage options, such as personal liability insurance, medical payments coverage, and identity theft protection.

Reputation and Customer Satisfaction

State Farm has consistently received high marks for customer satisfaction and financial strength. The company has been recognized by J.D. Power for its excellent customer service and has received an A++ rating from A.M. Best, a leading insurance rating agency. This strong reputation reflects State Farm’s commitment to providing its customers with exceptional service and financial security.

Factors Influencing State Farm Homeowners Insurance Costs

Understanding the factors that influence your State Farm homeowners insurance costs is crucial for making informed decisions about your coverage and budget. Several factors play a role in determining your premiums, and it’s important to be aware of them to ensure you’re getting the right coverage at the right price.

Factors Affecting State Farm Homeowners Insurance Costs

Several factors can impact your State Farm homeowners insurance premiums. Understanding these factors can help you make informed decisions about your coverage and budget.

| Factor | Description | Impact on Cost | Example |

|---|---|---|---|

| Location | Your home’s location, including its proximity to natural disaster zones, crime rates, and the cost of construction materials. | Homes in areas with higher risks of natural disasters, such as hurricanes, earthquakes, or wildfires, typically have higher premiums. | A home located in a coastal area with a high risk of hurricanes will likely have a higher premium than a home located in a more inland area with lower risks. |

| Home Value | The estimated market value of your home, which is typically determined by an appraisal. | Higher home values generally result in higher premiums, as the insurer’s potential payout in case of a claim is greater. | A home valued at $500,000 will likely have a higher premium than a home valued at $250,000. |

| Coverage Levels | The amount of coverage you choose for your home and personal belongings. | Higher coverage levels typically result in higher premiums, as you are protected for a greater amount of potential losses. | Choosing a higher coverage limit for your dwelling and personal property will result in a higher premium than choosing a lower coverage limit. |

| Deductibles | The amount you agree to pay out of pocket for covered losses before your insurance coverage kicks in. | Higher deductibles generally result in lower premiums, as you are taking on more financial responsibility for smaller claims. | A deductible of $1,000 will typically result in a lower premium than a deductible of $500. |

| Home Features | Features that can enhance your home’s safety and security, such as security systems, fire suppression systems, and impact-resistant windows. | These features can lower your premiums, as they can reduce the risk of damage and claims. | Installing a security system or fire suppression system may qualify you for a discount on your premiums. |

| Claims History | Your past claims history, including the number and types of claims you have filed. | Frequent or large claims can lead to higher premiums, as they indicate a higher risk of future claims. | A homeowner with a history of multiple claims may be charged a higher premium than a homeowner with a clean claims history. |

Understanding State Farm’s Pricing Structure

State Farm, like other insurance companies, uses a complex system to determine homeowners insurance premiums. The final cost is influenced by a variety of factors, and understanding how these elements are considered can help you better understand your premium.

Factors Contributing to Premium Calculation

State Farm uses a combination of factors to calculate homeowners insurance premiums. These factors are categorized into several key areas:

- Property characteristics: The most significant factor in determining your premium is the value of your home. State Farm will assess the size, age, construction materials, and other features of your property to estimate its replacement cost. Other factors include the roof type, the presence of a security system, and the overall condition of the home.

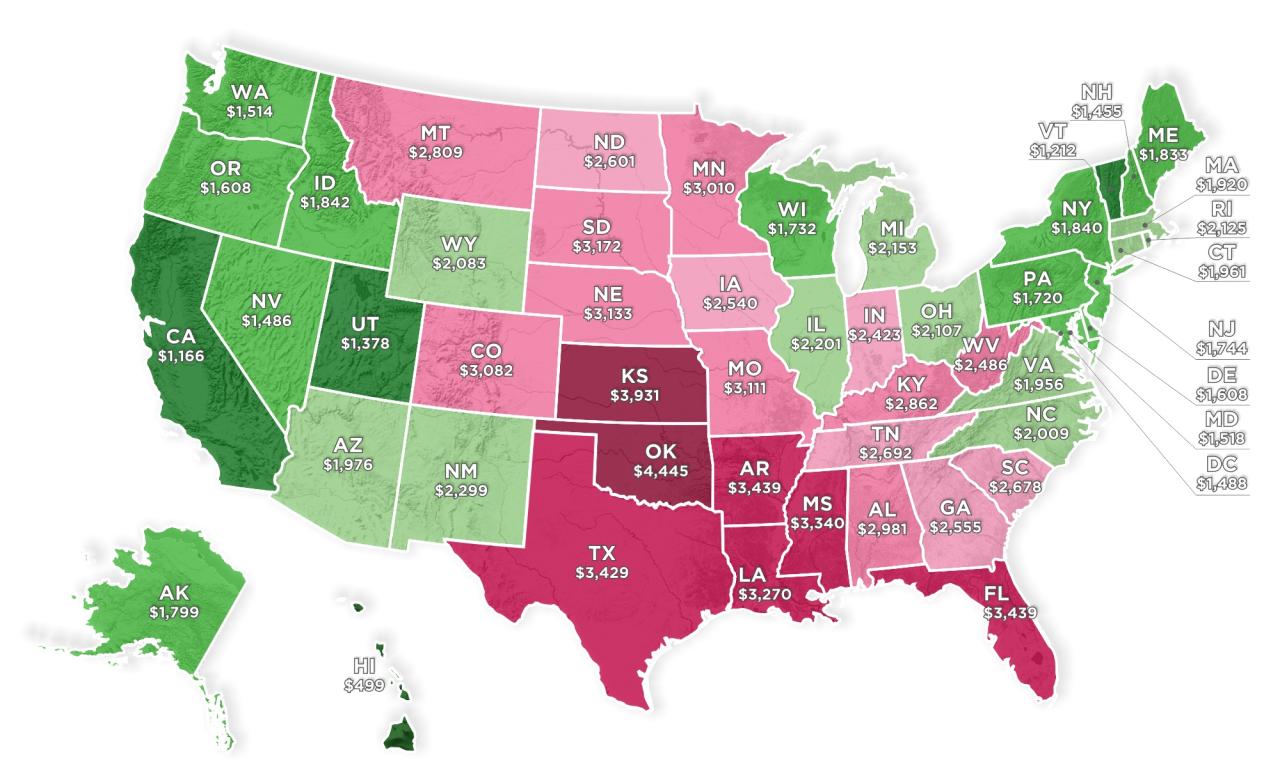

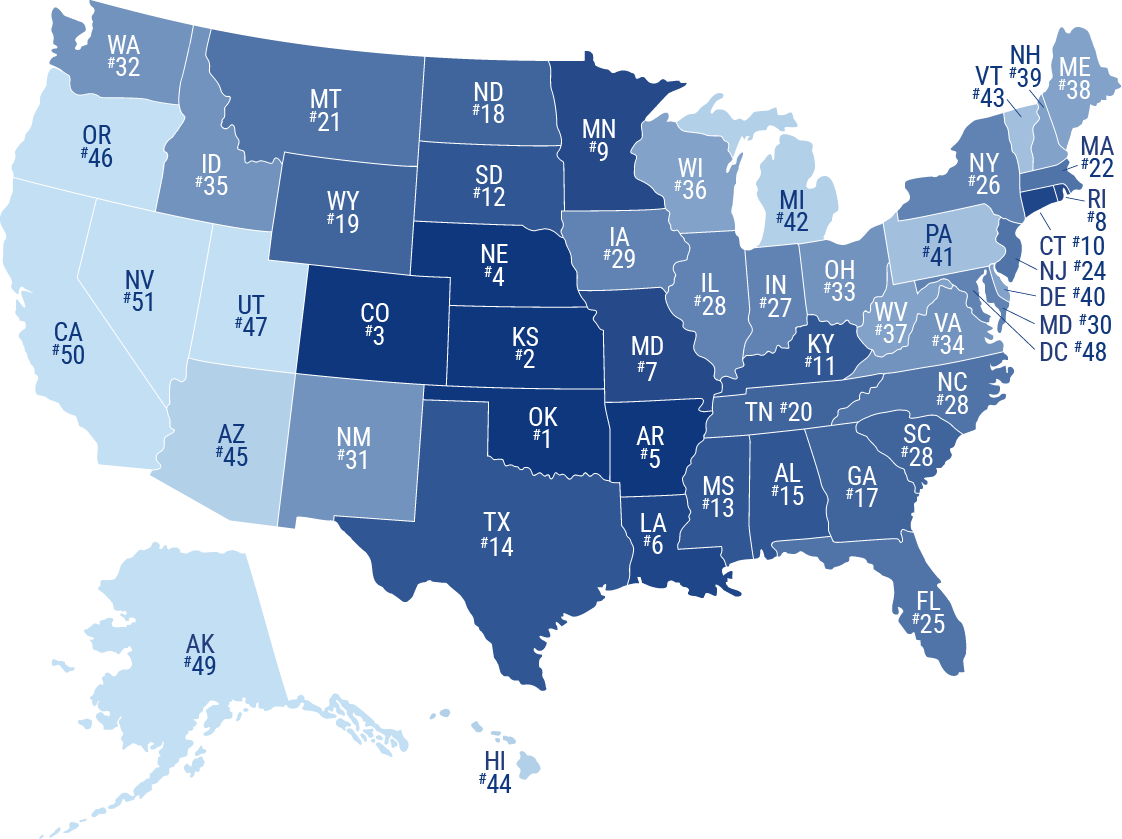

- Location: The location of your home significantly impacts your premium. State Farm considers factors like the risk of natural disasters, crime rates, and proximity to fire stations. Homes in areas prone to hurricanes, earthquakes, or wildfires may have higher premiums.

- Coverage and deductibles: The amount of coverage you choose and the deductible you select also influence your premium. Higher coverage levels generally result in higher premiums, while a higher deductible can lead to lower premiums.

- Your personal risk profile: State Farm also considers your individual risk profile, which includes factors like your credit score, claims history, and safety precautions. A good credit score and a clean claims history can lead to lower premiums, while a poor credit score or frequent claims can increase your cost.

Components of Homeowners Insurance Premiums

State Farm’s homeowners insurance premiums are made up of several components:

| Component | Description | Example | Impact on Premium |

|---|---|---|---|

| Coverage for dwelling | Covers the cost of rebuilding or repairing your home in case of damage from covered perils, such as fire, wind, or hail. | A $300,000 home with coverage for dwelling would pay for rebuilding or repairing the home up to $300,000 in case of a covered event. | Higher coverage levels increase the premium, while lower coverage levels decrease the premium. |

| Coverage for other structures | Covers detached structures on your property, such as garages, sheds, or fences, in case of damage from covered perils. | A detached garage valued at $10,000 would be covered for damage up to $10,000. | Higher coverage levels increase the premium, while lower coverage levels decrease the premium. |

| Personal property coverage | Covers your belongings, such as furniture, clothing, electronics, and jewelry, in case of damage or theft. | Coverage for personal property might include a $100,000 limit for belongings within the home and a $5,000 limit for belongings outside the home. | Higher coverage levels increase the premium, while lower coverage levels decrease the premium. |

| Liability coverage | Protects you from financial liability if someone is injured on your property or if you cause damage to someone else’s property. | Liability coverage of $100,000 would protect you from financial losses up to $100,000 if someone sues you for injuries sustained on your property. | Higher coverage levels increase the premium, while lower coverage levels decrease the premium. |

| Additional living expenses | Covers the cost of temporary housing and other expenses if your home is uninhabitable due to a covered event. | If your home is damaged by fire and you need to stay in a hotel for a month, additional living expenses coverage would help pay for the hotel costs. | Higher coverage levels increase the premium, while lower coverage levels decrease the premium. |

| Deductible | The amount you agree to pay out of pocket before your insurance coverage kicks in. | A $1,000 deductible means you would pay the first $1,000 of any claim, and your insurance would cover the rest. | Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums. |

| Discounts | State Farm offers various discounts that can reduce your premium. These discounts are based on factors such as safety features, bundling policies, and loyalty. | Discounts for safety features include having a security system, smoke detectors, and fire extinguishers. Bundling policies can provide discounts for combining homeowners and auto insurance. | Discounts can significantly reduce your premium. |

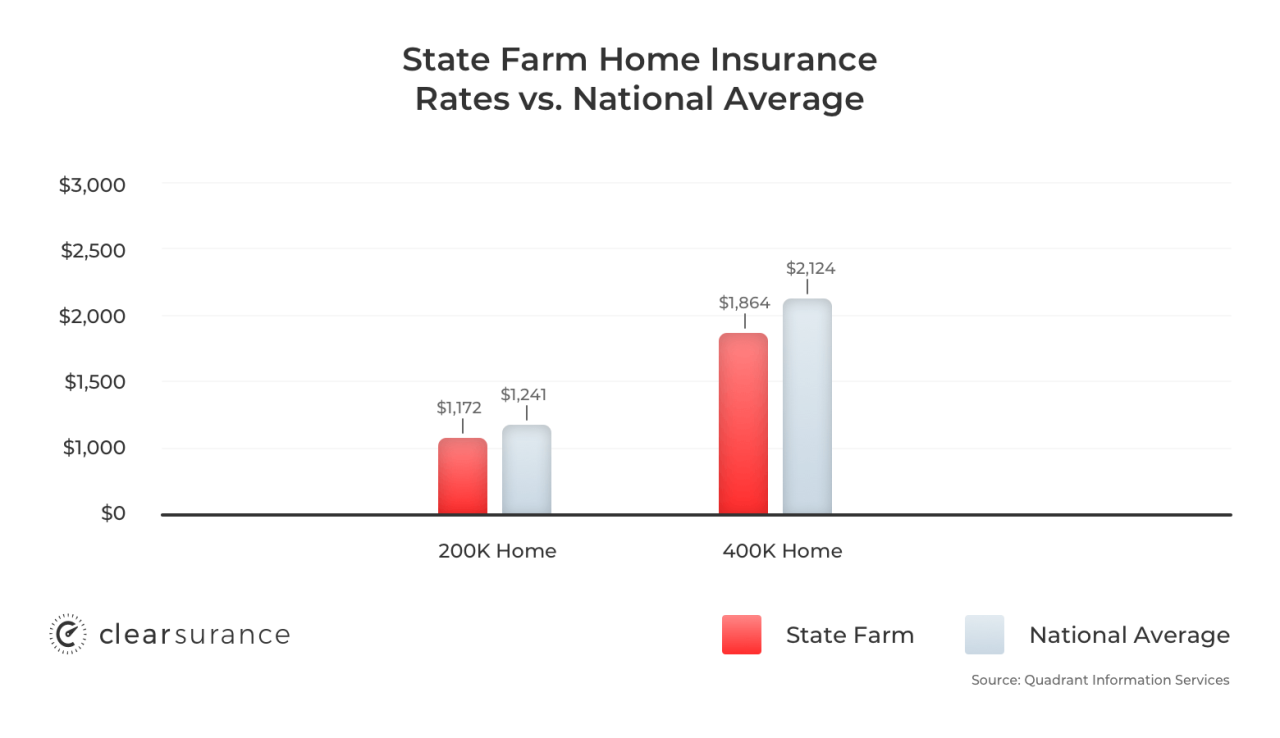

Comparing State Farm Homeowners Insurance Costs

It’s important to compare State Farm’s homeowners insurance rates with those of other major providers to find the best value for your needs. While State Farm is a well-known and reputable company, other insurers may offer more competitive rates or more comprehensive coverage options.

Comparing State Farm to Other Providers

This section explores key differences in coverage, pricing, and customer service among major homeowners insurance providers.

Coverage Differences

Each insurer offers different coverage options, with varying levels of protection for your home and belongings. Some insurers may offer additional coverage for specific perils, such as earthquakes or floods, while others may have limitations.

Pricing Variations

Insurance premiums vary based on factors such as location, home value, coverage levels, and risk profile. It’s essential to compare quotes from multiple insurers to find the most affordable option that meets your specific needs.

Customer Service Experiences

Customer satisfaction ratings can provide insights into an insurer’s responsiveness, claim handling processes, and overall customer experience.

Comparative Table

The following table compares State Farm to other major homeowners insurance providers, highlighting key differences in coverage, pricing, and customer service:

| Provider | Coverage Levels | Average Premium | Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | Standard, Plus, Premier | $1,200 – $1,800 per year | 4.5 out of 5 stars |

| Allstate | Essential, Preferred, Platinum | $1,100 – $1,700 per year | 4.2 out of 5 stars |

| Geico | Basic, Standard, Deluxe | $1,000 – $1,600 per year | 4.0 out of 5 stars |

| Liberty Mutual | Essential, Preferred, Premier | $1,050 – $1,650 per year | 4.3 out of 5 stars |

Note: Average premiums are estimates and can vary based on individual circumstances. Customer satisfaction ratings are based on independent surveys and may differ depending on the source.

Getting a State Farm Homeowners Insurance Quote

Obtaining a personalized quote from State Farm is a straightforward process that involves providing them with specific information about your property and your insurance needs. This information allows State Farm to accurately assess your risk and generate a customized quote tailored to your unique situation.

Getting a Quote Online

State Farm offers a convenient online quoting tool that allows you to obtain an estimate for your homeowners insurance in just a few minutes. To start, visit the State Farm website and navigate to the “Get a Quote” section. You’ll be asked to provide basic information about your property, including its location, size, age, and construction type. Additionally, you’ll need to provide details about your coverage preferences, such as the amount of coverage you desire for your dwelling, personal property, and liability. Once you’ve entered all the required information, the online quoting tool will generate an estimated price for your homeowners insurance.

Getting a Quote Over the Phone

If you prefer to speak with a State Farm representative directly, you can call their customer service line. They’ll ask you the same questions as the online quoting tool, and you can discuss your coverage needs in detail. This option is particularly helpful if you have complex insurance requirements or need assistance with understanding your policy options.

Getting a Quote in Person

You can also visit a local State Farm agent to obtain a quote in person. This allows you to meet with a representative face-to-face and discuss your insurance needs in a personalized setting. This option is particularly useful if you prefer a more hands-on approach or have specific questions about your insurance policy.

Tips for Securing the Best Possible Rates

- Improve Your Home’s Security: Implementing security measures such as installing alarm systems, smoke detectors, and deadbolt locks can demonstrate to State Farm that your home is less risky to insure, potentially leading to lower premiums.

- Consider a Higher Deductible: Choosing a higher deductible means you’ll pay more out of pocket in the event of a claim, but it can also lower your premium. This option can be particularly beneficial if you have a good financial cushion and are confident in your ability to cover a larger deductible.

- Bundle Your Policies: Combining your homeowners insurance with other policies, such as auto insurance, can result in significant discounts. This strategy allows State Farm to offer you a lower rate because they are insuring multiple aspects of your life with a single company.

- Shop Around and Compare Quotes: Obtaining quotes from multiple insurance providers, including State Farm, is crucial for finding the most competitive rates. Comparing quotes allows you to identify the best value for your insurance needs.

State Farm Homeowners Insurance Coverage Options

State Farm offers a comprehensive range of homeowners insurance coverage options designed to protect your home and belongings from various risks. Understanding these coverage options and their limitations is crucial in selecting the right policy for your needs.

Coverage Options

| Coverage Type | Description | Benefits | Limitations |

|---|---|---|---|

| Dwelling Coverage | Covers the structure of your home, including the attached structures like a garage or porch. | Protects against damage from covered perils, such as fire, windstorm, hail, and theft. | Excludes damage caused by floods, earthquakes, or other perils not included in the policy. |

| Other Structures Coverage | Covers detached structures on your property, such as sheds, fences, and swimming pools. | Provides financial protection for these structures against covered perils. | Usually has a lower coverage limit than dwelling coverage. |

| Personal Property Coverage | Covers your belongings inside your home, such as furniture, appliances, electronics, and clothing. | Protects against loss or damage to your personal property due to covered perils. | May have limitations on specific items, such as jewelry or fine art. |

| Loss of Use Coverage | Covers additional living expenses if your home becomes uninhabitable due to a covered event. | Provides financial assistance for temporary housing, meals, and other essential expenses. | Has a coverage limit and may require you to stay within a certain distance from your home. |

| Liability Coverage | Protects you from financial liability if someone is injured on your property or you cause damage to someone else’s property. | Provides legal defense and financial compensation for covered claims. | May have limits on the amount of coverage and may not cover all types of liability claims. |

| Medical Payments Coverage | Covers medical expenses for injuries sustained by guests on your property, regardless of fault. | Provides peace of mind and protects you from potential legal action. | Usually has a lower coverage limit than liability coverage. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your family members if you are injured in an accident on your property. | Provides essential financial support during recovery. | May have limitations on coverage and may not cover all types of injuries. |

| Additional Living Expenses Coverage | Covers the additional costs of living away from your home if it becomes uninhabitable due to a covered event. | Helps you maintain a similar standard of living while your home is being repaired or rebuilt. | May have a limit on the amount of coverage and may not cover all types of expenses. |

| Personal Property Replacement Cost Coverage | Replaces damaged or destroyed personal property at its current market value, not its depreciated value. | Ensures you receive full compensation for your belongings, even if they are old. | May require you to provide proof of purchase or replacement cost. |

| Guaranteed Replacement Cost Coverage | Guarantees that you will receive enough coverage to rebuild your home, even if the cost of construction increases significantly. | Provides peace of mind knowing that you will be able to rebuild your home to the same standard. | May have a higher premium than standard replacement cost coverage. |

| Coverage for Specific Items | Offers additional coverage for valuable items, such as jewelry, art, and collectibles. | Provides extra protection for your most prized possessions. | May require you to schedule these items on your policy and provide appraisals. |

Additional Resources for State Farm Homeowners Insurance

Navigating the world of homeowners insurance can feel overwhelming, especially when you’re dealing with a large and reputable company like State Farm. Thankfully, they offer various resources to help you understand your policy, manage your coverage, and resolve any issues that may arise. This section provides a comprehensive guide to these resources, empowering you to confidently handle your State Farm homeowners insurance.

Accessing State Farm’s Official Website and Relevant Resources, State farm homeowners insurance cost

The State Farm website serves as a central hub for all your insurance needs. Here, you can access various resources to gain insights into your policy, manage your account, and connect with customer support.

- Policy Information and Management: You can access your policy documents, review coverage details, and make changes to your policy online. The website also provides tools to calculate your estimated premium and explore different coverage options.

- Customer Support and Claims Assistance: The website offers a comprehensive FAQ section addressing common inquiries about homeowners insurance. You can also find contact information for customer support and claims assistance, including phone numbers, email addresses, and online chat options.

- Educational Resources: State Farm provides various educational resources, such as articles, videos, and infographics, covering essential aspects of homeowners insurance. These resources can help you understand the different types of coverage, common insurance terms, and tips for protecting your home.

Contacting State Farm Customer Support and Claims Assistance

State Farm provides multiple channels for contacting customer support and claims assistance, ensuring you can get help when you need it.

- Phone: You can reach State Farm’s customer support team by calling their toll-free number, which is available 24/7.

- Online: The State Farm website offers a secure online portal where you can submit inquiries, manage your policy, and report claims.

- Mobile App: State Farm’s mobile app allows you to access your policy information, manage payments, and report claims from your smartphone or tablet.

Finding a Local State Farm Agent

State Farm has a vast network of local agents across the country, providing personalized service and guidance. You can easily locate a State Farm agent near you through their website or mobile app.

- State Farm Website: The State Farm website allows you to search for agents by zip code, city, or state. You can also filter your search by language, specialty, and other criteria.

- Mobile App: The State Farm mobile app includes a built-in agent locator, enabling you to find nearby agents with a few taps on your screen.

Final Summary

Ultimately, the cost of State Farm homeowners insurance is influenced by a multitude of factors, including location, home value, coverage levels, and individual risk profiles. By understanding these factors and utilizing the resources available, you can navigate the insurance landscape effectively and secure the coverage that best suits your needs and budget. Remember to compare quotes from multiple providers, explore various coverage options, and leverage the expertise of a local State Farm agent to ensure you’re getting the most out of your homeowners insurance policy.

FAQ Compilation

What is the average cost of State Farm homeowners insurance?

The average cost of State Farm homeowners insurance varies depending on several factors, including location, home value, coverage levels, and individual risk profiles. It’s best to obtain a personalized quote from State Farm to determine your specific premium.

How can I lower my State Farm homeowners insurance premium?

You can potentially lower your premium by increasing your deductible, installing safety features like smoke detectors and security systems, and maintaining a good claims history.

What are the main coverage options offered by State Farm homeowners insurance?

State Farm offers various coverage options, including dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. The specific coverage options available and their limits will vary depending on your individual needs and policy.

What are the benefits of choosing State Farm homeowners insurance?

State Farm is known for its strong financial stability, extensive network of agents, and comprehensive coverage options. The company also offers excellent customer service and claims handling processes.