State Farm auto insurance estimate provides a quick and easy way to determine the cost of your potential insurance policy. Whether you’re a new driver, a seasoned veteran, or simply looking for a better deal, understanding your insurance options is crucial. State Farm, known for its extensive history and commitment to customer satisfaction, offers a range of coverage options and discounts, making it a popular choice for many.

Obtaining an auto insurance estimate from State Farm is straightforward. You can easily get a quote online, over the phone, or by visiting a local agent. Each method offers unique advantages and disadvantages, depending on your preferences and circumstances. No matter how you choose to obtain your estimate, State Farm ensures a transparent and informative process.

State Farm Auto Insurance

State Farm is a leading provider of auto insurance in the United States, renowned for its comprehensive coverage options, competitive pricing, and exceptional customer service. Founded in 1922, State Farm has grown into a household name, building a reputation for reliability and stability.

History and Background

State Farm was established in 1922 by George J. Mecherle in Bloomington, Illinois. The company’s initial focus was on providing affordable auto insurance to farmers, recognizing the unique needs of this demographic. Over the decades, State Farm expanded its product offerings to include a wide range of insurance products, including homeowners, life, health, and business insurance. Today, State Farm remains one of the largest insurance providers in the US, serving millions of customers across the country.

Key Features and Benefits

State Farm’s auto insurance policies offer a variety of features and benefits designed to protect policyholders and their vehicles. Some of the key aspects include:

Comprehensive Coverage

State Farm’s auto insurance policies provide comprehensive coverage, including:

- Liability Coverage: Protects you financially if you are responsible for an accident that causes injury or damage to others.

- Collision Coverage: Covers damage to your vehicle caused by an accident, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from damage caused by non-collision events such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers in the event of an accident.

Competitive Pricing

State Farm is known for offering competitive pricing on its auto insurance policies. The company uses a variety of factors to determine premiums, including driving history, vehicle type, location, and coverage levels.

Customer Service

State Farm has a long-standing reputation for providing excellent customer service. The company has a network of agents across the country who are available to provide personalized advice and assistance. State Farm also offers a variety of online and mobile tools to make it easy for customers to manage their policies.

Reputation and Customer Satisfaction

State Farm consistently ranks highly in customer satisfaction surveys. In the J.D. Power 2022 U.S. Auto Insurance Satisfaction Study, State Farm received a score of 827 out of 1,000, ranking it among the top providers in the industry. This strong reputation for customer satisfaction is a testament to State Farm’s commitment to providing excellent service and value to its policyholders.

Obtaining an Auto Insurance Estimate from State Farm

Getting an auto insurance estimate from State Farm is a straightforward process. You have multiple options to choose from, each with its own set of advantages and disadvantages.

Methods for Obtaining an Auto Insurance Estimate

State Farm offers several ways to get an auto insurance estimate, allowing you to choose the method that best suits your needs and preferences.

- Online Quote Tools: State Farm’s online quote tool provides a convenient and efficient way to get an estimate. You can access the tool directly from their website and enter your information, such as your vehicle details, driving history, and desired coverage levels. The tool will generate a personalized estimate within minutes.

- Phone Calls: You can also call State Farm directly to request an estimate. A customer service representative will guide you through the process and gather the necessary information to provide you with a quote. This method allows for personalized attention and the opportunity to ask questions.

- In-Person Visits: State Farm has a network of local agents who can provide you with an estimate in person. Visiting an agent allows for a more comprehensive discussion about your insurance needs and provides an opportunity to build a relationship with a local representative.

Advantages and Disadvantages of Each Method

- Online Quote Tools:

- Advantages: Convenient, fast, available 24/7, allows for comparison shopping.

- Disadvantages: May not be as personalized, potential for technical issues.

- Phone Calls:

- Advantages: Personalized attention, opportunity to ask questions, convenient for those who prefer phone communication.

- Disadvantages: May require waiting on hold, limited availability during off-peak hours.

- In-Person Visits:

- Advantages: Face-to-face interaction, comprehensive discussion, builds a relationship with a local agent.

- Disadvantages: Requires scheduling an appointment, may involve travel time.

Step-by-Step Guide for Obtaining an Online Quote

Here’s a step-by-step guide for obtaining an online quote from State Farm:

- Visit the State Farm website: Go to the official State Farm website (www.statefarm.com).

- Navigate to the “Get a Quote” section: Look for the “Get a Quote” button or link on the website’s homepage or navigation menu.

- Select “Auto Insurance”: Choose the “Auto Insurance” option from the available insurance types.

- Enter your information: The online quote tool will ask for your basic information, including:

- Your name, address, and contact details.

- Your vehicle’s make, model, year, and VIN (Vehicle Identification Number).

- Your driving history, including your driving record and any accidents or violations.

- Your desired coverage levels, such as liability, collision, and comprehensive coverage.

- Review your quote: Once you’ve entered all the required information, the online quote tool will generate a personalized estimate. Carefully review the quote, ensuring it reflects your desired coverage and meets your needs.

- Get a policy: If you’re satisfied with the quote, you can proceed with purchasing a policy online or by contacting a State Farm agent.

Factors Influencing State Farm Auto Insurance Estimates

State Farm, like most insurance companies, considers several factors when calculating your auto insurance premium. These factors help them assess your risk of being involved in an accident and determine the cost of covering potential damages. Understanding these factors can help you make informed decisions about your insurance policy and potentially lower your premium.

Driving History

Your driving history is one of the most significant factors affecting your State Farm auto insurance estimate. A clean driving record with no accidents or traffic violations will generally result in a lower premium. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase your premium. This is because a driver with a history of accidents is considered a higher risk.

Vehicle Type

The type of vehicle you drive also plays a role in determining your insurance cost. Some vehicles are more expensive to repair or replace than others. For example, a luxury car or a high-performance sports car will typically have a higher insurance premium than a basic sedan. This is because these vehicles are more likely to be stolen or involved in accidents. Additionally, the safety features of your vehicle, such as airbags and anti-lock brakes, can also influence your premium. Vehicles with advanced safety features often receive lower premiums.

Location

The location where you live also affects your auto insurance premium. Areas with higher crime rates or more congested traffic tend to have higher insurance rates. This is because there is a greater risk of accidents or theft in these areas.

Coverage Levels

The level of coverage you choose also affects your premium. More comprehensive coverage, such as collision and comprehensive, will generally result in a higher premium. However, it also provides greater financial protection in case of an accident.

Table Illustrating the Impact of Factors on Insurance Premiums

The following table illustrates how different factors can influence your State Farm auto insurance premium. These are hypothetical examples and actual premiums may vary based on individual circumstances.

| Factor | Scenario 1 | Scenario 2 | Scenario 3 |

|---|---|---|---|

| Driving History | Clean record | One accident in the past year | Two DUI convictions in the past five years |

| Vehicle Type | Basic sedan | Luxury SUV | Sports car |

| Location | Rural area with low crime rate | Urban area with high crime rate | City with heavy traffic congestion |

| Coverage Levels | Minimum liability coverage | Full coverage including collision and comprehensive | |

| Estimated Premium | $500/year | $750/year | $1200/year |

Understanding State Farm’s Coverage Options: State Farm Auto Insurance Estimate

State Farm offers a comprehensive suite of auto insurance coverage options designed to protect you and your vehicle in various situations. Understanding these options is crucial for making informed decisions about your insurance needs and securing adequate protection.

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance that protects you financially if you’re responsible for an accident that causes injury or damage to others. It covers legal costs, medical expenses, and property damage claims resulting from your negligence.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for injuries sustained by others in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damaged property, such as another vehicle or a building, if you are at fault in an accident.

Collision Coverage

Collision coverage protects your vehicle from damage caused by a collision with another vehicle or object, regardless of who is at fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums.

- Actual Cash Value (ACV): Pays the fair market value of your vehicle at the time of the accident, minus depreciation.

- Replacement Cost: Pays for the cost of replacing your vehicle with a new one, minus your deductible, typically for newer vehicles.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and falling objects. This coverage pays for repairs or replacement of your vehicle, minus your deductible.

- Deductible: The amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally results in lower premiums.

- Actual Cash Value (ACV): Pays the fair market value of your vehicle at the time of the accident, minus depreciation.

- Replacement Cost: Pays for the cost of replacing your vehicle with a new one, minus your deductible, typically for newer vehicles.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance. This coverage pays for medical expenses, lost wages, and pain and suffering.

- Uninsured Motorist Coverage: Protects you if you are hit by a driver who has no insurance.

- Underinsured Motorist Coverage: Protects you if you are hit by a driver who has insurance but not enough to cover your damages.

Other Coverage Options, State farm auto insurance estimate

State Farm also offers additional coverage options, including:

- Rental Car Coverage: Pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides help with situations like flat tires, dead batteries, and lockouts.

- Medical Payments Coverage: Pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Comparing Coverage Options

| Coverage | Purpose | Benefits | Limitations |

|---|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures others or damages their property. | Covers legal costs, medical expenses, and property damage claims. | Does not cover damage to your own vehicle. |

| Collision Coverage | Protects your vehicle from damage caused by a collision. | Pays for repairs or replacement of your vehicle, minus your deductible. | Does not cover damage caused by events other than collisions. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than collisions. | Pays for repairs or replacement of your vehicle, minus your deductible. | Does not cover damage caused by collisions. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you are involved in an accident with an uninsured or underinsured driver. | Pays for medical expenses, lost wages, and pain and suffering. | Does not cover damage to your own vehicle. |

State Farm’s Customer Service and Claims Process

State Farm prioritizes customer service and aims to provide a smooth and efficient claims process. They offer a variety of channels for customers to access support and information, and their claims process is designed to be straightforward and fair.

Customer Service Channels and Resources

State Farm provides multiple channels for customers to access support and information, ensuring convenience and accessibility.

- Online Portal: State Farm’s online portal allows policyholders to manage their accounts, view policy details, make payments, and access various resources.

- Phone Support: Customers can reach State Farm’s customer service representatives through a dedicated phone line available 24/7.

- Mobile App: The State Farm mobile app provides a convenient way for policyholders to manage their insurance needs on the go. Features include viewing policy details, filing claims, accessing roadside assistance, and finding nearby agents.

- Agent Network: State Farm has a vast network of agents across the country, providing personalized support and guidance to customers.

State Farm’s Claims Process

State Farm’s claims process is designed to be efficient and straightforward, with a focus on providing prompt and fair compensation to policyholders.

- Report the Accident: Policyholders can report an accident through the State Farm mobile app, online portal, or by phone.

- Initial Investigation: Once a claim is reported, State Farm will begin an investigation to gather information about the accident and assess the damages.

- Damage Assessment: State Farm will arrange for an independent appraisal of the damages to determine the cost of repairs or replacement.

- Claim Settlement: After the investigation and damage assessment are complete, State Farm will review the claim and issue a settlement offer.

- Payment: Once the settlement offer is accepted, State Farm will issue payment to the policyholder or the repair shop.

State Farm’s Claims Handling Reputation

State Farm has a reputation for handling claims effectively and fairly. The company consistently ranks high in customer satisfaction surveys for claims handling, and its commitment to customer service is evident in its efforts to resolve claims promptly and amicably.

“State Farm has been a great insurance company for me. I recently had to file a claim after an accident, and the process was smooth and efficient. The claims adjuster was very helpful and professional, and I was happy with the settlement I received.” – Anonymous Customer Review

Comparing State Farm Auto Insurance to Competitors

Choosing the right auto insurance provider can be a daunting task, as many companies offer a wide range of coverage options and pricing structures. To help you make an informed decision, this section will compare State Farm’s auto insurance rates and coverage options to those of its major competitors, including Geico, Progressive, and Allstate.

Key Areas of Comparison

It’s crucial to understand the key areas where State Farm excels or falls short compared to its competitors. These areas include pricing, coverage options, customer service, and claims handling processes.

Pricing Comparisons

State Farm is known for its competitive pricing, but it’s important to compare rates across different providers to find the best deal. Online tools like insurance comparison websites can help you get quotes from multiple companies simultaneously. Factors like your driving history, vehicle type, location, and coverage options will significantly influence the final premium.

Coverage Options Comparison

Each insurance provider offers a unique set of coverage options. State Farm offers a wide range of coverage options, including:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

- Rental Car Coverage

While State Farm offers a comprehensive range of coverage options, other providers might offer unique features or discounts. For example, Geico is known for its “Drive Safe & Save” program, which rewards safe drivers with discounts. Progressive offers a “Name Your Price” tool that allows customers to set a budget and find the best coverage options within that price range. Allstate offers a “Drive Safe & Save” program and a “Accident Forgiveness” program that waives the first accident on your record.

Customer Service and Claims Process

Customer service and claims handling processes are crucial aspects to consider when choosing an insurance provider. State Farm is generally known for its excellent customer service and efficient claims processing. However, it’s important to compare customer satisfaction ratings and claims handling experiences across different companies.

For example, J.D. Power ranks State Farm highly in customer satisfaction, while other companies like Geico and Progressive have also received positive feedback. It’s essential to research and compare customer reviews and experiences to get a comprehensive understanding of each provider’s customer service and claims handling capabilities.

Comparison Table

The following table summarizes the key differences between State Farm and its major competitors, focusing on pricing, coverage, and customer service:

| Feature | State Farm | Geico | Progressive | Allstate |

|---|---|---|---|---|

| Pricing | Competitive, but varies based on factors like location, driving history, and coverage options. | Known for its competitive pricing, especially for younger drivers. | Offers a “Name Your Price” tool, allowing customers to set a budget and find the best coverage options within that price range. | Offers a “Drive Safe & Save” program and a “Accident Forgiveness” program. |

| Coverage Options | Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, personal injury protection, and rental car coverage. | Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection. | Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, and personal injury protection. | Offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist coverage, personal injury protection, and rental car coverage. |

| Customer Service | Generally known for its excellent customer service and efficient claims processing. | Known for its quick and easy online quoting process and claims handling. | Offers a “Name Your Price” tool and a “Snapshot” program that monitors your driving habits and provides discounts. | Offers a “Drive Safe & Save” program and a “Accident Forgiveness” program. |

Tips for Getting the Best State Farm Auto Insurance Estimate

Getting the most favorable auto insurance estimate from State Farm involves a combination of proactive steps and strategic choices. By understanding the factors that influence your premium and leveraging available resources, you can potentially lower your costs and secure a competitive policy.

Improving Your Driving Record

A clean driving record is a significant factor in determining your auto insurance premiums. Maintaining a safe driving history can lead to lower rates and better insurance options.

- Avoid Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI offenses, can significantly increase your insurance premiums. Drive cautiously and obey traffic laws to maintain a clean driving record.

- Complete Defensive Driving Courses: Defensive driving courses teach safe driving techniques and can help you avoid accidents. Completing such courses can sometimes earn you a discount on your insurance premiums.

- Maintain a Safe Driving History: By avoiding accidents and maintaining a safe driving record, you demonstrate your responsible driving habits, which can lead to lower insurance rates.

Leveraging State Farm Discounts and Promotions

State Farm offers a range of discounts and promotions that can help you save on your auto insurance premiums. Taking advantage of these offers can significantly reduce your overall costs.

- Bundling Policies: Combining your auto insurance with other insurance policies, such as homeowners or renters insurance, can often qualify you for a multi-policy discount. This can be a substantial cost-saving strategy.

- Good Student Discount: If you have a student in your household with good grades, you may be eligible for a good student discount. This discount recognizes academic achievement and responsible behavior.

- Safe Driver Discount: Many insurance companies, including State Farm, offer discounts for drivers with a clean driving record. Maintaining a safe driving history can qualify you for this discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce the risk of theft and qualify you for a discount on your insurance premiums.

Negotiating Your State Farm Auto Insurance Estimate

Negotiating with your insurance agent can help you secure a more favorable auto insurance estimate. By understanding your needs and options, you can advocate for yourself and potentially lower your premiums.

- Shop Around and Compare Quotes: Getting quotes from multiple insurance companies, including State Farm, allows you to compare prices and coverage options. This process can help you identify the most competitive rates.

- Discuss Your Driving History: Explain your clean driving record and any defensive driving courses you’ve completed to highlight your responsible driving habits. This can help demonstrate your low-risk profile and potentially lead to lower premiums.

- Explore Available Discounts: Ask your agent about all available discounts, including those related to bundling policies, good student status, safe driving, and anti-theft devices. Ensure you’re taking advantage of all eligible discounts.

- Consider Higher Deductibles: Increasing your deductible, the amount you pay out of pocket before insurance coverage kicks in, can often lower your premiums. Carefully consider your financial situation and risk tolerance before increasing your deductible.

Other Tips for Obtaining a Favorable Estimate

- Review Your Coverage Needs: Carefully evaluate your current coverage and consider whether you need all the included options. You may be able to reduce your premiums by eliminating unnecessary coverage.

- Pay Your Premiums on Time: Maintaining a good payment history can sometimes earn you discounts or avoid late payment fees, which can save you money in the long run.

- Contact Your Agent Regularly: Stay in touch with your State Farm agent to discuss any changes in your driving habits, vehicle usage, or insurance needs. This proactive approach can help you secure the most favorable rates.

Ultimate Conclusion

Navigating the world of auto insurance can feel overwhelming, but State Farm strives to simplify the process. By understanding the factors that influence your insurance estimate, exploring coverage options, and utilizing available resources, you can make informed decisions that best suit your needs. With a focus on customer service and a commitment to fairness, State Farm aims to provide peace of mind and protection for your vehicle and your future.

Detailed FAQs

What factors influence my State Farm auto insurance estimate?

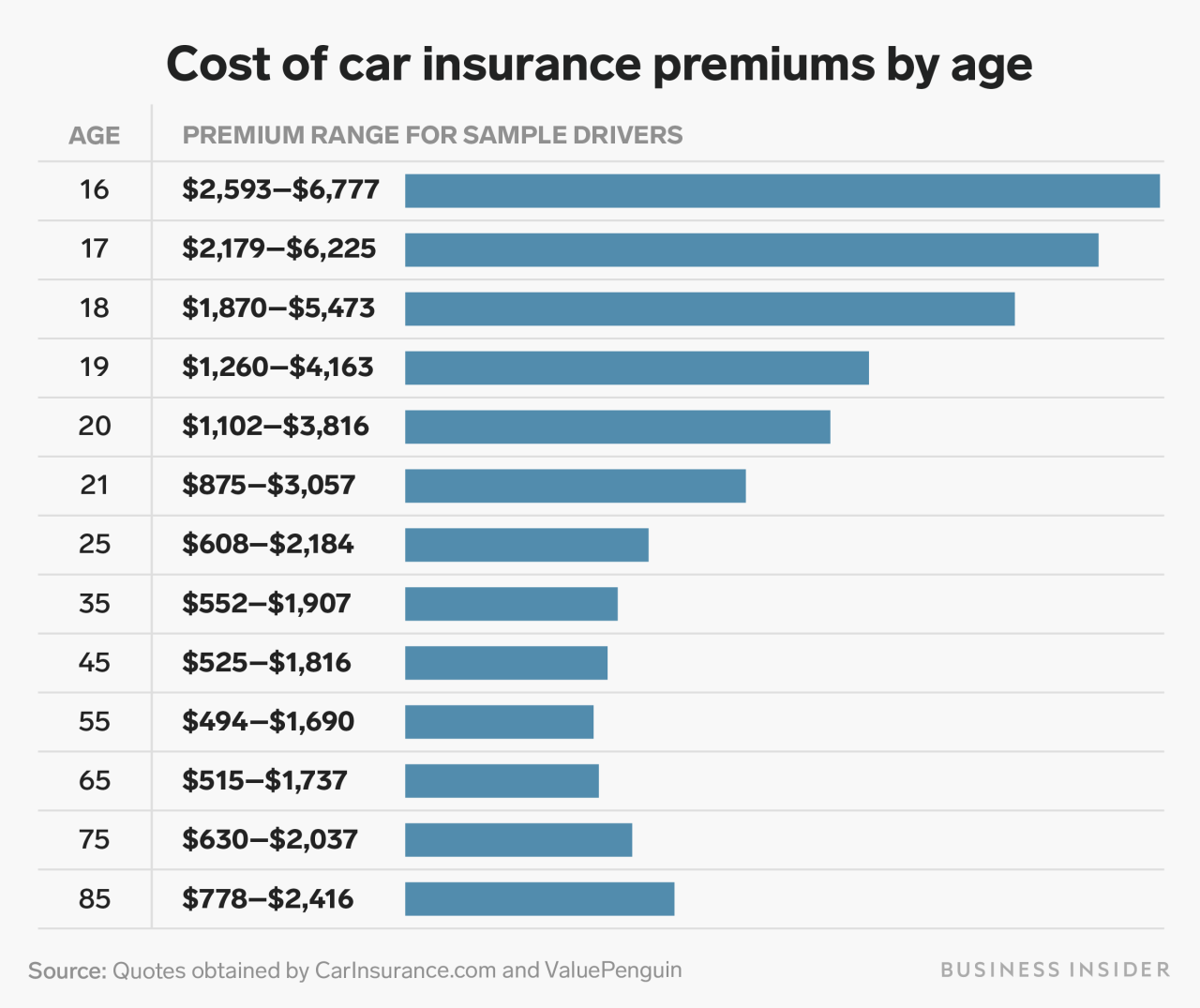

Your driving history, vehicle type, location, coverage levels, and other factors like age and credit score can affect your estimate.

How can I lower my State Farm auto insurance premium?

Consider bundling your insurance policies, maintaining a clean driving record, and taking advantage of discounts for safety features or good student status.

What coverage options does State Farm offer?

State Farm provides various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

What if I need to file a claim?

State Farm offers a straightforward claims process. You can report an accident online, through their mobile app, or by calling their customer service line.