State farm auto insurance qoute – State Farm auto insurance quotes are a popular choice for many drivers, and for good reason. State Farm is one of the largest and most reputable insurance companies in the United States, known for its financial stability and customer service. Whether you’re a new driver or a seasoned veteran, understanding how State Farm’s auto insurance quotes work can help you save money and find the best coverage for your needs.

To obtain a quote, you can choose from several methods, including online, over the phone, or through a local agent. Each method has its advantages and disadvantages, so it’s important to consider which option best suits your preferences and circumstances. Once you’ve chosen a method, you’ll need to provide some basic information about yourself, your vehicle, and your driving history. This information will be used to calculate your personalized quote, taking into account factors like your age, driving record, and the type of vehicle you drive.

State Farm Auto Insurance Overview

State Farm is a well-established and prominent name in the auto insurance industry, known for its comprehensive coverage options and customer-centric approach. Founded in 1922, the company has grown to become the largest auto insurer in the United States, boasting a loyal customer base and a strong reputation for reliability.

State Farm’s Reputation and Customer Satisfaction

State Farm’s reputation is built on a foundation of trust and customer satisfaction. The company consistently ranks highly in customer satisfaction surveys and has received numerous awards for its exceptional service. This positive reputation is attributed to factors such as:

- Strong financial stability: State Farm’s financial strength provides customers with peace of mind, knowing that the company is well-equipped to handle claims and fulfill its commitments.

- Wide range of coverage options: State Farm offers a variety of insurance policies to meet the diverse needs of its customers, including comprehensive, collision, liability, and uninsured motorist coverage.

- Excellent claims handling process: State Farm is known for its efficient and responsive claims handling process, ensuring that customers receive timely assistance and support when they need it most.

- Competitive pricing: State Farm strives to offer competitive rates while maintaining high-quality coverage, making its insurance products accessible to a wide range of customers.

State Farm’s Financial Stability

State Farm’s financial stability is a testament to its long-standing commitment to providing reliable insurance products and services. The company has consistently maintained a strong financial position, with a high A.M. Best rating of A++ (Superior). This rating reflects State Farm’s ability to meet its financial obligations and its robust risk management practices.

State Farm’s Claims Handling Process

State Farm prioritizes a smooth and efficient claims handling process, ensuring that customers receive prompt assistance and support when they need it. The company’s claims handling process involves the following steps:

- Reporting the claim: Customers can report claims online, over the phone, or through a mobile app.

- Initial assessment: State Farm representatives will gather information about the claim and assess the damage.

- Damage inspection: If necessary, a qualified inspector will assess the damage and provide an estimate.

- Claim processing: State Farm will review the claim and determine the amount of coverage.

- Payment processing: Once the claim is approved, State Farm will process the payment to the customer or the repair facility.

Obtaining a Quote from State Farm

Getting a quote from State Farm is straightforward and can be done through various methods, each with its own set of advantages and disadvantages.

Methods for Obtaining a Quote

State Farm offers multiple ways to obtain a quote, each catering to different preferences and needs.

- Online: The online method allows you to obtain a quote quickly and conveniently from the comfort of your home or on the go. You can access the State Farm website or mobile app, enter your information, and receive an instant quote.

- Phone: Calling State Farm’s customer service line provides a direct connection with a representative who can guide you through the quote process. You can ask questions and receive personalized assistance, making it a good option for those who prefer a more personal touch.

- Agent: Visiting a local State Farm agent’s office offers a face-to-face interaction, allowing you to discuss your insurance needs in detail and receive tailored advice. Agents can provide personalized recommendations and answer any specific questions you may have.

Comparing the Methods

Each method has its own advantages and disadvantages:

| Method | Advantages | Disadvantages |

|---|---|---|

| Online |

|

|

| Phone |

|

|

| Agent |

|

|

Obtaining a Quote Online

The online method offers a quick and convenient way to get a quote. Here’s a step-by-step guide:

- Visit the State Farm website or mobile app: Start by navigating to the State Farm website or opening the mobile app.

- Select “Get a Quote”: Look for the “Get a Quote” button or link on the website or app.

- Enter your information: You’ll need to provide basic information, such as your name, address, date of birth, and driving history.

- Provide details about your vehicle: Enter details about your vehicle, including the make, model, year, and VIN.

- Review and submit your quote request: Once you’ve entered all the necessary information, review your details carefully and submit your quote request.

- Receive your quote: You’ll receive your personalized quote instantly, either on the screen or via email.

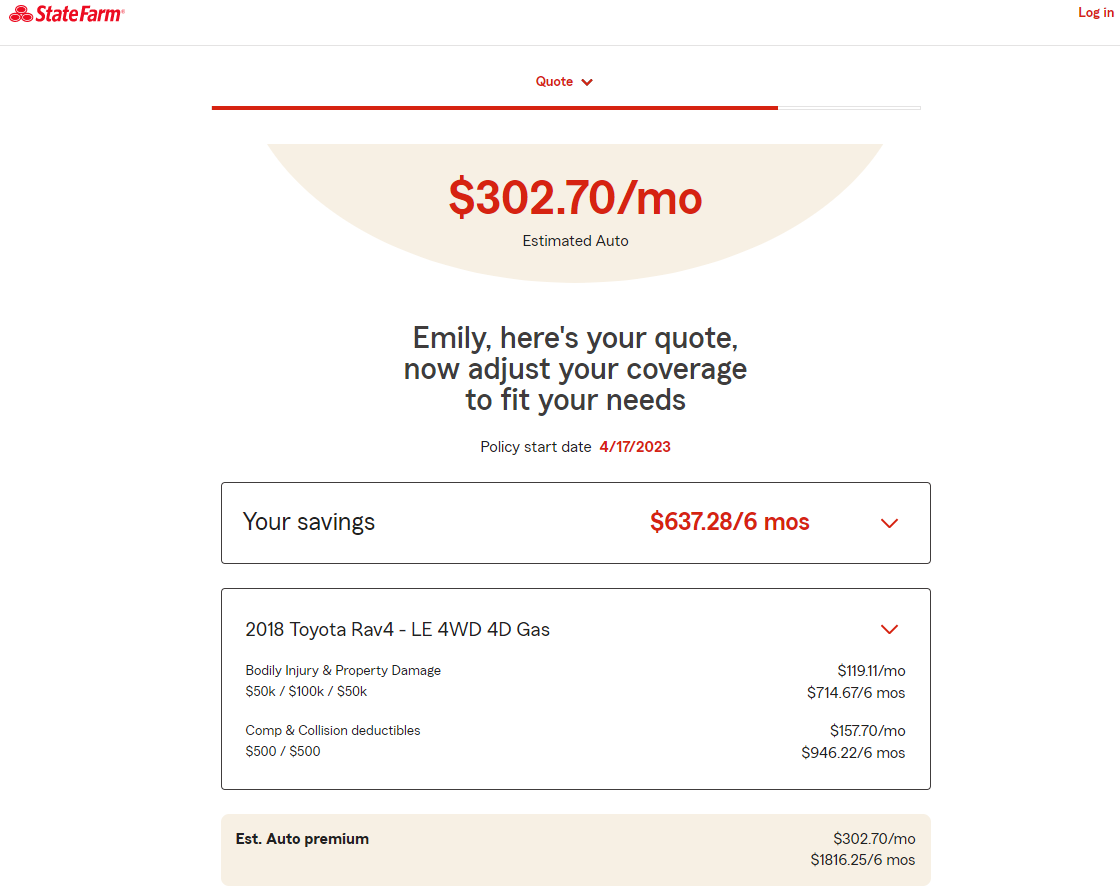

Factors Influencing Auto Insurance Quotes

Your auto insurance premium is calculated based on several factors, including your driving history, vehicle type, location, and age. These factors are used to assess your risk of being involved in an accident, and the higher your risk, the higher your premium will be.

Age

Your age is a significant factor in determining your auto insurance premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This is because they have less experience behind the wheel and are more likely to engage in risky driving behaviors. As you age and gain more experience, your premium is likely to decrease. For instance, a 20-year-old driver with a clean driving record might pay a higher premium than a 40-year-old driver with a similar record.

Driving History

Your driving history is another crucial factor in determining your auto insurance premium. A clean driving record with no accidents or traffic violations will result in a lower premium. However, if you have a history of accidents, speeding tickets, or other traffic violations, your premium will be significantly higher. For example, a driver with multiple speeding tickets might face a premium increase of 20% or more compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive also plays a role in your auto insurance premium. Some vehicles are more expensive to repair or replace than others, and they are also more likely to be involved in accidents. For instance, a high-performance sports car will typically have a higher premium than a compact sedan. This is because sports cars are often associated with higher speeds and more aggressive driving, which can increase the risk of accidents.

Location

Your location is also a factor in determining your auto insurance premium. Areas with higher crime rates and more traffic congestion tend to have higher accident rates, leading to higher premiums. For example, a driver living in a major metropolitan area might pay a higher premium than a driver living in a rural area with less traffic and lower crime rates.

State Farm’s Coverage Options: State Farm Auto Insurance Qoute

State Farm offers a variety of coverage options to cater to different needs and driving situations. These options are designed to protect you financially in case of an accident or other covered events. Understanding the different coverage options available is crucial for choosing the right protection for your vehicle and yourself.

Liability Coverage, State farm auto insurance qoute

Liability coverage is a fundamental part of any auto insurance policy. It provides financial protection if you cause an accident that results in injury or damage to another person or their property.

Liability coverage is divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damage you cause in an accident.

The amount of liability coverage you need depends on several factors, including your state’s minimum requirements, your financial situation, and your risk tolerance.

For example, if you live in a state with a high cost of living, you may need higher liability limits to cover potential medical expenses.

“Liability coverage is crucial for protecting yourself from significant financial consequences in case of an accident.”

Collision Coverage

Collision coverage protects you from financial losses if your vehicle is damaged in an accident, regardless of who is at fault. It pays for repairs or replacement of your vehicle, minus any deductible you have chosen.

“Collision coverage is especially beneficial if you have a newer car with a high value.”

Comprehensive Coverage

Comprehensive coverage protects you from losses due to events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. It pays for repairs or replacement of your vehicle, minus any deductible you have chosen.

“Comprehensive coverage is essential if your vehicle is financed or leased, as lenders typically require it.”

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. This coverage can help pay for your medical expenses, lost wages, and other damages, even if the other driver is at fault.

“UM/UIM coverage is particularly important in states with a high percentage of uninsured drivers.”

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. This coverage is typically required in some states.

“PIP coverage can be helpful for covering your medical expenses and lost wages, even if you are at fault in an accident.”

Discounts and Savings

State Farm offers a variety of discounts to help you save money on your auto insurance. These discounts can significantly reduce your premium, making State Farm a more affordable option. Let’s explore some of the most common discounts available.

Discounts Offered by State Farm

- Good Driver Discount: This discount is available to drivers with a clean driving record. State Farm rewards safe driving by offering lower premiums to those who have not been involved in accidents or received traffic violations.

- Multi-Policy Discount: Bundling your auto insurance with other State Farm policies, such as homeowners or renters insurance, can result in significant savings. This discount reflects the loyalty and trust you place in State Farm by insuring multiple aspects of your life with them.

- Safe Vehicle Discount: State Farm offers discounts for vehicles equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes. These features contribute to a safer driving experience, which in turn justifies a lower premium.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices. State Farm recognizes this effort and often provides discounts to drivers who have taken such courses.

- Student Discount: Good grades can be rewarded with lower insurance premiums. State Farm offers discounts to students who maintain a certain GPA, recognizing their academic achievements and responsible behavior.

- Other Discounts: State Farm may offer additional discounts based on your individual circumstances, such as being a member of certain organizations or professions. It’s always worth inquiring about any potential discounts that might apply to your situation.

Examples of Savings

- Good Driver Discount: A driver with a clean driving record could save up to 20% on their auto insurance premium compared to a driver with a history of accidents or violations.

- Multi-Policy Discount: Bundling auto and homeowners insurance can result in savings of up to 15% or more on your overall premium.

- Safe Vehicle Discount: A vehicle equipped with anti-theft devices and advanced safety features could qualify for a discount of up to 10% on your insurance premium.

Special Programs and Promotions

State Farm occasionally offers special programs and promotions that can further reduce your insurance costs. These programs may vary depending on your location and the time of year. It’s a good idea to check with your local State Farm agent for any current promotions or discounts that might be available to you.

Customer Service and Claims Process

State Farm is known for its customer-centric approach, providing various channels for assistance and a straightforward claims process. This section will delve into State Farm’s customer service channels, outlining the steps involved in filing a claim, and highlighting real-life experiences to illustrate the claim handling process.

Customer Service Channels

State Farm offers a comprehensive range of customer service channels to cater to diverse preferences.

- Phone Support: State Farm maintains a dedicated customer service line, accessible 24/7. This option is ideal for immediate assistance or inquiries requiring personalized guidance.

- Email: For non-urgent inquiries or follow-up questions, customers can utilize State Farm’s email service. This channel allows for detailed communication and documentation.

- Online Portal: State Farm’s online portal provides a convenient platform for managing policies, accessing account information, and submitting certain requests. The portal offers a secure and accessible platform for policyholders.

Filing a Claim with State Farm

The process for filing a claim with State Farm is designed to be user-friendly and efficient.

- Report the Incident: Immediately report the incident to State Farm, either through their phone line or online portal. Provide detailed information about the incident, including the date, time, location, and any relevant parties involved.

- Gather Documentation: Collect essential documentation related to the claim, such as police reports, medical records, repair estimates, and photos of the damage.

- Submit the Claim: Submit the claim through the designated online portal or by mail. State Farm may require specific forms for different claim types.

- Claim Review and Processing: State Farm will review the claim and gather additional information if necessary. The company will assess the damage and determine the appropriate coverage.

- Resolution: State Farm will communicate the outcome of the claim review and Artikel the next steps, such as payment for repairs or medical expenses.

Claim Handling Experiences

“After my car accident, I was surprised by how smoothly the claim process went with State Farm. Their customer service representatives were helpful and responsive. They kept me updated throughout the process, and the claim was settled promptly. I highly recommend State Farm for their excellent claim handling.” – Sarah M., satisfied State Farm customer.

“When I filed a claim for a windshield replacement, I was impressed by the speed and efficiency of State Farm’s process. I received a quote for the repair within a few hours, and the replacement was scheduled within a day. The whole process was seamless and stress-free.” – John B., satisfied State Farm customer.

Comparing State Farm to Competitors

Choosing the right auto insurance provider can be a daunting task, especially when considering the vast array of options available. Comparing State Farm’s offerings to those of its competitors can help you make an informed decision. This section will delve into State Farm’s pricing, coverage options, and overall strengths and weaknesses compared to other major auto insurance providers.

Pricing Comparison

Understanding the pricing structure of different insurance providers is crucial for making a sound financial decision. State Farm generally offers competitive pricing, but its rates can vary depending on factors such as your driving history, location, and the type of vehicle you own. Comparing State Farm’s rates to those of other major providers like Geico, Progressive, and Allstate can help you determine the best value for your specific needs.

- Geico: Often known for its competitive rates, Geico frequently ranks among the most affordable auto insurance providers. However, its coverage options might be limited compared to State Farm.

- Progressive: Progressive offers a wide range of coverage options and is known for its innovative features, such as its “Name Your Price” tool that allows you to set your desired premium and find coverage options that fit your budget. However, Progressive’s rates can be higher than those of Geico or State Farm in some cases.

- Allstate: Allstate is another major provider known for its comprehensive coverage options and customer service. However, Allstate’s rates tend to be higher than those of Geico or State Farm, particularly for drivers with a less-than-perfect driving history.

Coverage Options Comparison

The coverage options offered by different insurers can vary significantly. State Farm provides a comprehensive range of coverage, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Geico: Geico offers a standard set of coverage options, but it might not have as many specialized coverage choices as State Farm, such as rental car reimbursement or accident forgiveness.

- Progressive: Progressive offers a wide range of coverage options, including unique features like “Drive Safe & Save” that rewards safe driving with discounts and “Custom Coverage” that allows you to personalize your coverage to meet your specific needs.

- Allstate: Allstate provides a robust set of coverage options, including “Accident Forgiveness” that waives your first accident if you have a clean driving record and “Drive Safe & Save” that rewards safe driving with discounts.

Strengths and Weaknesses of State Farm

State Farm is a well-established and reputable insurance provider with a strong track record. However, it’s important to consider both its strengths and weaknesses when making your decision.

Strengths

- Wide Coverage Options: State Farm offers a comprehensive range of coverage options, ensuring you have adequate protection for various scenarios.

- Strong Financial Stability: As a large and financially sound company, State Farm has a strong reputation for paying claims promptly and fairly.

- Extensive Agent Network: State Farm has a vast network of agents across the country, providing convenient access to personalized service and assistance.

- Customer Satisfaction: State Farm consistently ranks high in customer satisfaction surveys, demonstrating its commitment to providing a positive customer experience.

Weaknesses

- Pricing: While State Farm offers competitive pricing, its rates can be higher than those of some other providers, particularly for drivers with a less-than-perfect driving history.

- Limited Online Features: State Farm’s online platform is less advanced compared to some competitors, such as Progressive, which offers more online tools and features.

Key Differences in a Table

| Feature | State Farm | Geico | Progressive | Allstate |

|---|---|---|---|---|

| Pricing | Competitive, but can be higher for some drivers | Often the most affordable | Can be higher than Geico or State Farm in some cases | Generally higher than Geico or State Farm |

| Coverage Options | Comprehensive range, including specialized options | Standard coverage options, but limited specialized choices | Wide range, including unique features like “Name Your Price” and “Drive Safe & Save” | Robust coverage options, including “Accident Forgiveness” and “Drive Safe & Save” |

| Customer Service | High customer satisfaction ratings, strong agent network | Generally good customer service | Good customer service, with online tools and features | High customer satisfaction ratings, known for its customer service |

| Financial Stability | Strong financial stability, reputable claims handling | Strong financial stability | Strong financial stability | Strong financial stability |

Tips for Saving on Auto Insurance

Lowering your auto insurance costs can be a significant financial benefit. By implementing smart strategies and understanding the factors influencing your premiums, you can potentially save a substantial amount of money over time.

Good Driving Habits

Maintaining a clean driving record is crucial for securing lower insurance premiums. Insurance companies reward safe drivers with discounted rates.

- Avoid traffic violations: Speeding tickets, reckless driving citations, and DUI convictions can significantly increase your insurance costs.

- Practice defensive driving: Anticipating potential hazards and being aware of your surroundings can help prevent accidents.

- Maintain a safe driving history: Avoid accidents and claims, as they can impact your insurance premiums for several years.

Bundling Policies

Insurance companies often offer discounts when you bundle multiple policies, such as your auto and home insurance. This can be a significant way to save money on your overall insurance costs.

- Bundle your auto and home insurance: Many insurance companies offer discounts for bundling your auto and homeowners or renters insurance policies.

- Consider bundling other policies: Some insurers offer discounts for bundling additional policies, such as life insurance or health insurance.

Shopping Around and Comparing Quotes

Getting quotes from multiple insurance companies is essential to ensure you are getting the best possible rate.

- Compare quotes from at least three different insurers: This allows you to see a range of prices and coverage options.

- Use online comparison tools: Many websites allow you to enter your information and compare quotes from multiple insurers simultaneously.

- Contact insurance agents directly: Talking to agents can help you understand different coverage options and find discounts you may not be aware of.

Negotiating with Insurance Agents

While insurance rates are typically set by the insurer, you may still have some room for negotiation.

- Ask about discounts: Inquire about potential discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

- Negotiate your deductible: A higher deductible can result in lower premiums, but ensure you can afford to pay the deductible in case of an accident.

- Be prepared to switch insurers: Letting the agent know you are shopping around can sometimes encourage them to offer a more competitive rate.

Concluding Remarks

Ultimately, finding the best State Farm auto insurance quote requires a little research and effort. By understanding the factors that influence quotes, comparing different coverage options, and taking advantage of discounts, you can secure the most affordable and comprehensive protection for your vehicle. Remember to shop around and compare quotes from multiple insurers to ensure you’re getting the best value for your money.

FAQ Summary

What is the average State Farm auto insurance quote?

The average State Farm auto insurance quote varies widely depending on factors like your location, driving history, and vehicle type. It’s best to get a personalized quote from State Farm to determine your specific rate.

How often should I get a State Farm auto insurance quote?

It’s recommended to get a new quote from State Farm at least once a year, or whenever you experience a significant life change, such as moving to a new location, getting married, or adding a new driver to your policy.

What are some tips for getting a lower State Farm auto insurance quote?

To lower your State Farm auto insurance quote, consider maintaining a good driving record, bundling your auto insurance with other policies like homeowners or renters insurance, and taking advantage of discounts offered by State Farm.