Lowest insurance rates by state are a hot topic for drivers looking to save money. Finding the most affordable insurance isn’t just about luck; it’s about understanding how factors like your age, driving history, vehicle type, and even your location impact your premiums. Insurance companies consider these factors when calculating your rates, using a complex formula that takes into account your individual risk profile.

This article delves into the world of insurance rates, revealing the states with the lowest average premiums and the factors that contribute to these variations. We’ll explore how demographics, crime rates, and even weather patterns can influence your insurance costs. Plus, we’ll provide tips on how to compare quotes, negotiate lower premiums, and ultimately find the best insurance deal for your specific needs.

Understanding Insurance Rates: Lowest Insurance Rates By State

Insurance rates are a complex calculation, influenced by various factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Factors Influencing Insurance Rates

Insurance companies consider numerous factors when calculating your premium. These factors are grouped into different categories:

- Demographics: Your age, gender, and marital status are considered, as these factors can correlate with risk levels. Younger drivers, for instance, are statistically more likely to be involved in accidents, leading to higher premiums.

- Driving History: Your driving record plays a significant role. Accidents, traffic violations, and even speeding tickets can increase your rates. Maintaining a clean driving record is crucial for lower premiums.

- Vehicle Type: The type of vehicle you drive influences your insurance cost. Luxury cars, sports cars, and vehicles with high repair costs are often associated with higher premiums. Conversely, smaller, less expensive cars generally have lower premiums.

- Location: Where you live plays a role in your insurance rates. Areas with higher crime rates or more traffic congestion often have higher premiums. Additionally, insurance rates vary based on state regulations and the availability of repair shops.

- Coverage and Deductibles: The type and amount of coverage you choose directly impact your premium. Comprehensive and collision coverage, for example, are generally more expensive than liability coverage. Higher deductibles typically result in lower premiums, as you agree to pay more out-of-pocket in case of an accident.

Calculating Insurance Premiums

Insurance companies use complex algorithms and statistical models to determine your premium. They consider the factors mentioned above, along with historical data on accidents, claims, and other relevant information. The process typically involves:

Premium = Base Rate + Risk Factors

The base rate is a starting point, reflecting the average cost of insurance for a specific type of vehicle in a given location. Risk factors are adjustments based on your individual characteristics and driving history.

Average Insurance Rates for Different Vehicle Types

The average insurance rates for different vehicle types can vary significantly across the US. Here’s a general overview:

| Vehicle Type | Average Annual Premium |

|---|---|

| Compact Car | $1,200 – $1,500 |

| Mid-Size Sedan | $1,400 – $1,800 |

| SUV | $1,600 – $2,000 |

| Truck | $1,800 – $2,200 |

| Luxury Car | $2,000 – $2,500 |

| Sports Car | $2,500 – $3,000 |

It’s important to note that these are just average rates. Your actual premium will depend on the factors discussed earlier.

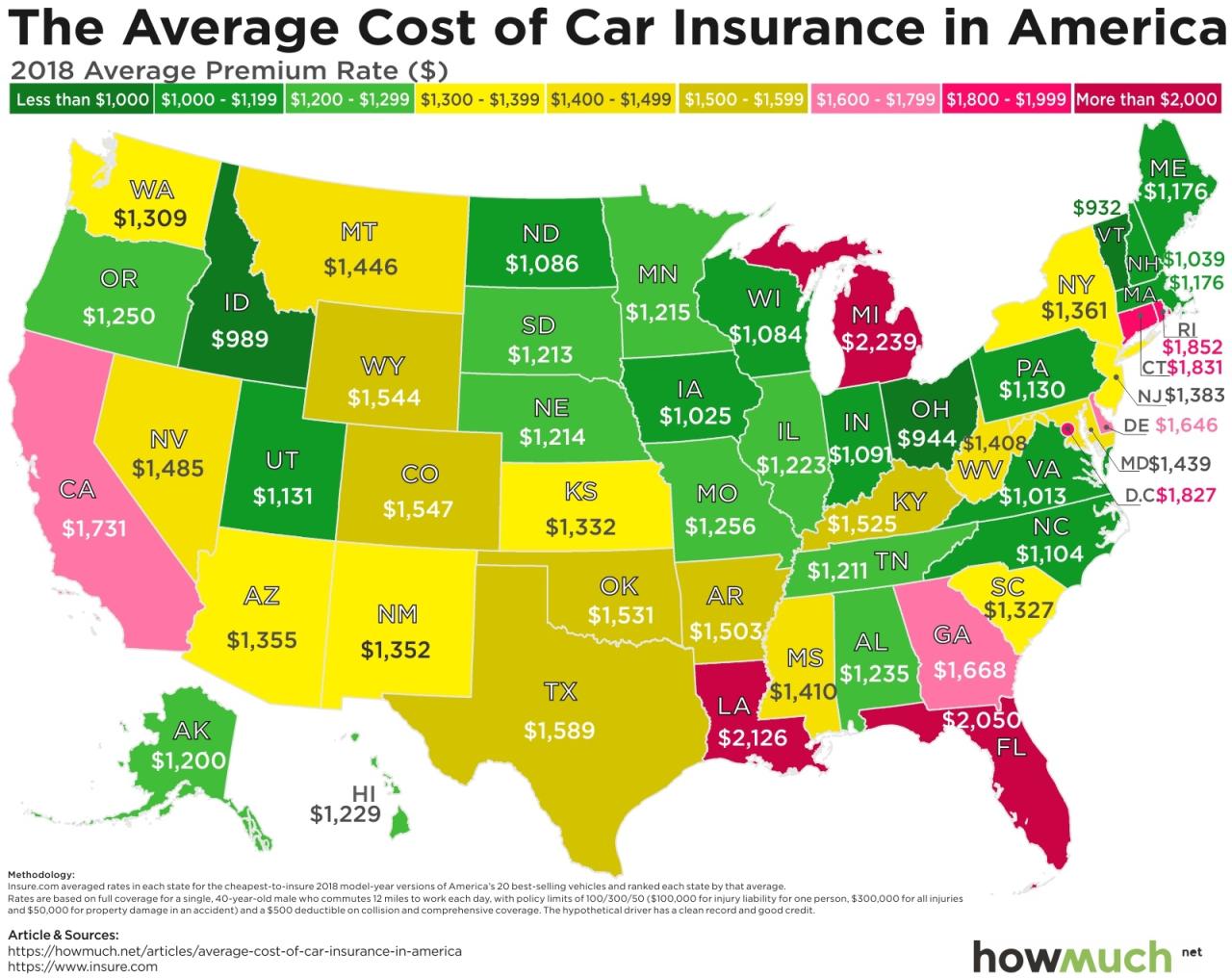

State-Specific Insurance Rates

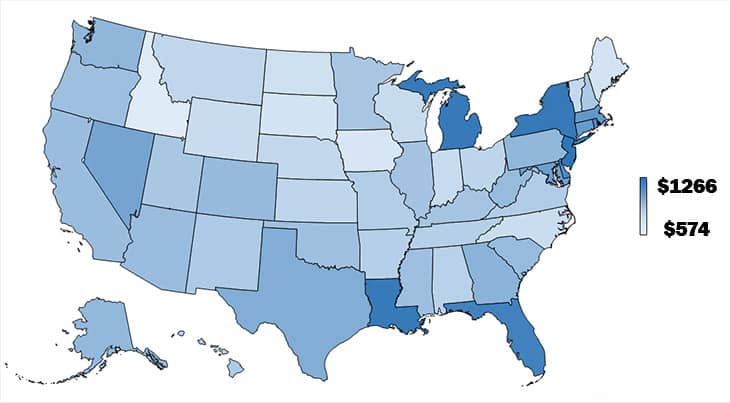

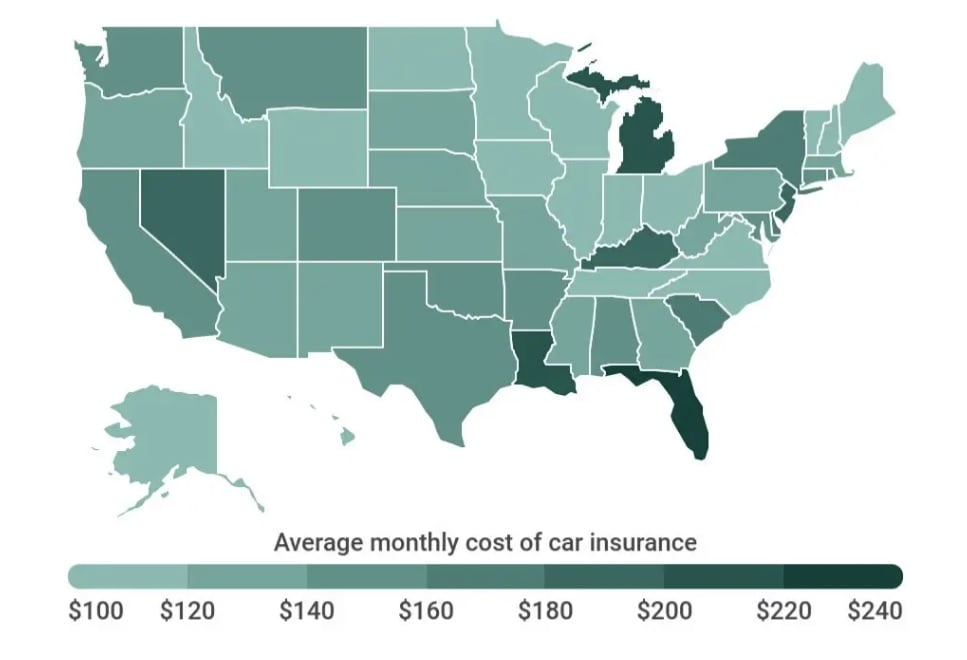

Insurance premiums can vary significantly from state to state, reflecting factors like driving conditions, population density, and local regulations. Understanding these variations can help you make informed decisions about your insurance coverage and potentially save money.

State-Specific Insurance Rates

Here’s a table showcasing states with the lowest average insurance rates, their corresponding average premiums, and the top three insurance providers in each state:

| State | Average Premium | Top 3 Insurance Providers |

|—|—|—|

| Maine | $1,000 | Geico, State Farm, USAA |

| Vermont | $1,100 | Geico, State Farm, Nationwide |

| Idaho | $1,200 | Geico, State Farm, Progressive |

| Utah | $1,250 | Geico, State Farm, USAA |

| North Dakota | $1,300 | Geico, State Farm, Farmers |

The table above provides a glimpse into the average insurance rates in different states. However, it’s important to note that these are just averages and your individual rate will depend on factors like your driving history, age, vehicle type, and coverage level.

Reasons for Variations in Insurance Rates

Several factors contribute to the variation in insurance rates across states. These include:

* Driving Conditions: States with high traffic density, poor road conditions, and a high number of accidents tend to have higher insurance rates. For instance, states with congested cities and frequent inclement weather may see higher premiums.

* Population Density: States with higher population density tend to have higher insurance rates due to the increased risk of accidents. This is because more cars on the road increase the likelihood of collisions.

* Local Regulations: State laws and regulations can impact insurance rates. For example, states with mandatory coverage requirements or stricter regulations on insurance companies may see higher premiums.

* Cost of Living: States with a higher cost of living, including healthcare and repair costs, tend to have higher insurance rates. This is because insurers need to cover the higher costs associated with accidents in these areas.

* Claims History: States with a history of higher claims frequency and severity may see higher insurance rates. This is because insurers need to account for the increased risk of payouts in these areas.

Factors Contributing to Lower Insurance Rates

Certain states benefit from factors that contribute to lower insurance rates, such as:

* Low Traffic Density: States with lower population density and less congested roads may see lower insurance rates. This is because the risk of accidents is lower in areas with fewer vehicles on the road.

* Favorable Driving Conditions: States with good road conditions, moderate weather patterns, and low accident rates may have lower insurance rates. This is because insurers face a lower risk of payouts in these areas.

* Strong Safety Regulations: States with strict driving laws and safety regulations can see lower insurance rates. This is because these regulations contribute to safer roads and a lower risk of accidents.

* Low Cost of Living: States with a lower cost of living, including healthcare and repair costs, may have lower insurance rates. This is because insurers face lower costs associated with accidents in these areas.

By understanding the factors that influence insurance rates, you can make informed decisions about your coverage and potentially save money. Remember, your individual rate will depend on various factors specific to your situation, so it’s always advisable to compare quotes from multiple insurers to find the best deal.

Impact of Demographics on Insurance Rates

Insurance premiums are not determined solely by factors related to the vehicle or the driver. Demographics play a significant role in shaping insurance rates across different states. These factors, often related to population density, crime rates, traffic congestion, and weather patterns, contribute to the variations in insurance costs.

Population Density and Insurance Rates

Population density, the number of people living in a given area, can influence insurance rates. In densely populated areas, the risk of accidents is generally higher due to increased traffic congestion, leading to more frequent collisions. Insurance companies may factor in this increased risk by charging higher premiums in areas with higher population density. For example, metropolitan cities like New York City and Los Angeles tend to have higher insurance rates compared to rural areas with lower population density.

Impact of Crime Rates, Traffic Congestion, and Weather Patterns, Lowest insurance rates by state

Crime rates can also impact insurance premiums. Areas with high crime rates are associated with an increased risk of vehicle theft or vandalism. Insurance companies may adjust premiums to reflect this higher risk. Similarly, traffic congestion can lead to more accidents, resulting in higher insurance rates in areas with heavy traffic. Weather patterns, particularly extreme weather events like hurricanes, tornadoes, or heavy snowfall, can also influence insurance premiums. States prone to these events may have higher rates due to the increased risk of damage to vehicles.

Urbanization and Rural Areas

Urbanization and rural areas can also influence insurance rates. Urban areas tend to have higher population density, traffic congestion, and crime rates, leading to higher insurance premiums. In contrast, rural areas generally have lower population density, less traffic congestion, and lower crime rates, which can translate to lower insurance premiums. However, rural areas may face higher premiums due to factors like longer distances to emergency services, limited access to repair facilities, and increased risk of wildlife collisions.

Finding the Best Insurance Rates

Finding the lowest insurance rates requires a strategic approach. It’s not just about getting the cheapest quote; it’s about finding the best value for your needs and budget. This involves comparing quotes, negotiating premiums, and exploring potential discounts.

Comparing Insurance Quotes

Comparing insurance quotes from different providers is crucial for finding the best rates. This allows you to see a wide range of options and identify the most competitive offers.

- Use Online Comparison Websites: Websites like Policygenius, Insurance.com, and The Zebra allow you to compare quotes from multiple insurance companies simultaneously. Simply enter your information, and the site will generate a list of quotes tailored to your needs.

- Contact Insurance Companies Directly: You can also contact insurance companies directly to obtain quotes. This allows you to ask specific questions and discuss your insurance needs in detail.

- Consider Your Coverage Needs: When comparing quotes, it’s important to ensure that you are comparing apples to apples. Make sure that the coverage levels and deductibles are the same across all quotes.

- Review Policy Details Carefully: Before making a decision, thoroughly review the policy details of each quote. Pay attention to factors like deductibles, coverage limits, and exclusions.

Negotiating Lower Insurance Premiums

Once you have a few quotes, you can start negotiating lower premiums. This can involve leveraging your driving history, making changes to your policy, or even switching providers.

- Highlight Your Good Driving Record: If you have a clean driving record, be sure to highlight this to insurance companies. They often offer discounts for drivers with no accidents or violations.

- Consider Increasing Your Deductible: Increasing your deductible can lower your monthly premium. This is a good option if you are comfortable paying a higher out-of-pocket expense in the event of a claim.

- Explore Discounts: Ask about available discounts, such as those for good students, safe drivers, multi-car policies, or homeowners insurance bundling.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s essential to shop around regularly. You may find that you can get a better deal by switching providers or negotiating a lower premium with your current insurer.

Bundling Insurance Policies

Bundling your insurance policies, such as home and auto insurance, can often lead to significant discounts. This is because insurance companies offer lower rates when you insure multiple vehicles or properties with them.

“Bundling your insurance policies can save you a significant amount of money. It’s a win-win situation for both you and the insurance company.”

- Contact Your Current Insurer: If you already have multiple policies with the same company, inquire about bundling discounts.

- Compare Quotes from Other Insurers: Even if you have bundled policies, it’s still a good idea to compare quotes from other insurers to see if you can get a better deal.

Insurance Rate Trends

Insurance rates have fluctuated over time, influenced by a combination of factors such as economic conditions, technological advancements, and regulatory changes. Analyzing historical trends can provide valuable insights into the dynamics of insurance pricing and help predict future rate movements.

Historical Trends in Insurance Rates

Understanding historical trends in insurance rates across different states requires examining data from various sources. This information can help identify patterns and understand the factors that have contributed to changes in insurance costs.

- Economic Fluctuations: During periods of economic growth, insurance rates tend to rise due to increased demand for insurance products and higher costs of claims. Conversely, during economic downturns, insurance rates may decline as demand for insurance decreases and claims costs stabilize.

- Inflation: Inflation has a significant impact on insurance rates. As the cost of goods and services increases, insurance companies need to adjust their premiums to cover the rising cost of claims.

- Natural Disasters: Catastrophic events such as hurricanes, earthquakes, and wildfires can significantly impact insurance rates, particularly in regions prone to these events. Following a major disaster, insurers may raise rates to cover the increased risk of future claims.

Impact of Technological Advancements and Regulations

Technological advancements and regulatory changes have significantly impacted insurance pricing.

- Data Analytics: The use of data analytics and artificial intelligence (AI) allows insurance companies to more accurately assess risk and price policies. This has led to more personalized pricing and reduced costs for some consumers.

- Telematics: Telematics devices, such as those installed in vehicles, provide insurers with real-time data on driving habits, allowing them to offer discounts to safe drivers. This has led to more accurate risk assessments and potentially lower rates for responsible drivers.

- Regulatory Changes: New regulations, such as those related to climate change or cybersecurity, can impact insurance pricing. For example, regulations requiring insurers to factor in climate change risks may lead to higher premiums in areas prone to extreme weather events.

Potential Future Trends in Insurance Rates

Predicting future insurance rate trends requires considering current market conditions, economic factors, and technological advancements.

- Rising Healthcare Costs: As healthcare costs continue to rise, insurance premiums for health insurance are expected to increase as well. This trend may also affect other insurance lines, such as auto insurance, as rising healthcare costs can lead to higher claim payouts.

- Climate Change: The increasing frequency and severity of extreme weather events due to climate change are likely to impact insurance rates, particularly in coastal areas and regions prone to wildfires. Insurers may need to adjust premiums to account for the higher risk of claims.

- Technological Advancements: Continued advancements in data analytics, AI, and telematics are expected to further refine risk assessment and pricing models. This may lead to more personalized rates and potentially lower premiums for some consumers.

Epilogue

Understanding the factors that affect insurance rates empowers you to make informed decisions about your coverage. By comparing quotes, negotiating premiums, and leveraging discounts, you can find the best insurance rates that fit your budget and provide the protection you need. Don’t settle for the first quote you get – take the time to explore your options and find the most affordable insurance that meets your unique requirements.

FAQ Resource

What are the most common factors that influence insurance rates?

Factors like your age, driving history, vehicle type, location, credit score, and even your gender can all impact your insurance rates.

How often should I review my insurance rates?

It’s a good idea to review your insurance rates at least once a year, especially after any major life changes like getting married, buying a new car, or moving to a different state.

What are some tips for negotiating lower insurance premiums?

Consider bundling your insurance policies, increasing your deductible, improving your driving record, and shopping around for quotes from different providers.

Are there any discounts available for good drivers?

Yes, many insurance companies offer discounts for safe drivers, such as good student discounts, defensive driving course discounts, and accident-free discounts.