Car insurance quotes New York state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of car insurance in New York can feel daunting, but understanding the key factors that influence your premiums and the various coverage options available can empower you to make informed decisions.

This guide will provide a comprehensive overview of car insurance in New York, including the mandatory requirements, types of coverage, and factors that affect your rates. We’ll also delve into the intricacies of New York’s no-fault insurance system and explore tips for finding the best quotes and negotiating rates.

Understanding Car Insurance in New York State

Driving a car in New York State is a privilege that comes with responsibilities, including having adequate car insurance. This guide will provide a comprehensive understanding of car insurance requirements, coverage options, and the role of the New York State Department of Financial Services (DFS).

Mandatory Car Insurance Requirements in New York State, Car insurance quotes new york state

The New York State Department of Motor Vehicles (DMV) mandates that all vehicle owners maintain certain types of car insurance coverage. These requirements ensure that drivers are financially responsible for any damages or injuries they may cause to others in an accident.

- Liability Coverage: This coverage is the most fundamental requirement in New York State. It protects you financially if you are found at fault in an accident. It covers the other party’s medical expenses, property damage, and lost wages.

- Bodily Injury Liability (BI): This coverage pays for the medical expenses and lost wages of the other party if you cause an accident.

- Property Damage Liability (PD): This coverage pays for the repair or replacement of the other party’s vehicle or property if you cause an accident.

- Personal Injury Protection (PIP): This coverage is mandatory in New York State and provides coverage for medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of who is at fault. This coverage applies to you and your passengers.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It provides coverage for your medical expenses, lost wages, and property damage.

Types of Car Insurance Coverage in New York State

While liability, PIP, and UM/UIM are mandatory, there are other optional coverages that you can purchase to enhance your protection.

- Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Rental Reimbursement: This coverage helps cover the cost of renting a vehicle while your car is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault in an accident. It is a supplemental coverage to PIP.

New York State Department of Financial Services (DFS)

The DFS is the regulatory body for the insurance industry in New York State. It plays a vital role in ensuring that insurance companies operate fairly and responsibly.

- Regulating Insurance Companies: The DFS oversees the financial stability of insurance companies and ensures they meet the minimum capital requirements.

- Protecting Consumers: The DFS investigates consumer complaints and takes action against insurance companies that engage in unfair or deceptive practices.

- Setting Insurance Rates: The DFS reviews and approves insurance rates to ensure they are fair and reasonable.

Factors Influencing Car Insurance Quotes in New York: Car Insurance Quotes New York State

Getting a car insurance quote in New York can feel like navigating a maze. Many factors come into play, shaping the final price you’ll pay. Understanding these factors is crucial for getting the best possible rate.

Driving History

Your driving history plays a significant role in determining your insurance premiums. Insurance companies carefully analyze your past driving behavior, looking for any incidents that might increase your risk.

- Accidents: Any accidents you’ve been involved in, regardless of fault, will likely lead to higher premiums. The severity of the accident and the number of claims you’ve filed will influence the impact.

- Traffic Violations: Speeding tickets, reckless driving, and other traffic violations are also considered. Multiple violations can significantly increase your premiums.

- Driving Record: A clean driving record with no accidents or violations will result in lower premiums. Maintaining a good driving history is essential for keeping your insurance costs down.

Vehicle Type

The type of vehicle you drive is another major factor. Insurance companies assess the risk associated with different cars based on factors like:

- Safety Features: Cars equipped with advanced safety features like anti-lock brakes, airbags, and stability control are generally considered safer and may result in lower premiums.

- Value and Repair Costs: More expensive cars or those with higher repair costs tend to have higher insurance premiums.

- Theft Risk: Certain car models are more prone to theft, which can increase insurance premiums.

Age

Your age can also influence your car insurance premiums. Generally, younger drivers (especially those under 25) are considered higher risk due to their lack of experience.

- Young Drivers: Insurance companies may charge higher premiums for young drivers, but as you gain experience and age, your rates may decrease.

- Older Drivers: While older drivers generally have more experience, they may face higher premiums due to potential health concerns.

Location

Where you live can significantly impact your car insurance rates. Factors like:

- Population Density: Areas with higher population density often have more traffic, increasing the risk of accidents and leading to higher premiums.

- Crime Rates: Areas with higher crime rates, particularly car theft, can result in higher insurance premiums.

- Weather Conditions: Regions with extreme weather conditions, such as heavy snow or frequent storms, can increase the risk of accidents and lead to higher premiums.

Credit Score

In New York, your credit score can affect your car insurance premiums. While this may seem unusual, insurance companies argue that credit score can be a reliable indicator of risk.

“Insurance companies believe that people with good credit are more likely to be responsible and less likely to file claims.”

- Credit-Based Insurance Scores: Insurance companies use credit-based insurance scores (CBIS) to assess your risk. A higher credit score generally leads to lower premiums.

- Dispute Inaccurate Information: If you believe your credit score is inaccurate, you can dispute it with the credit bureaus to potentially improve your insurance rates.

Finding the Best Car Insurance Quotes in New York

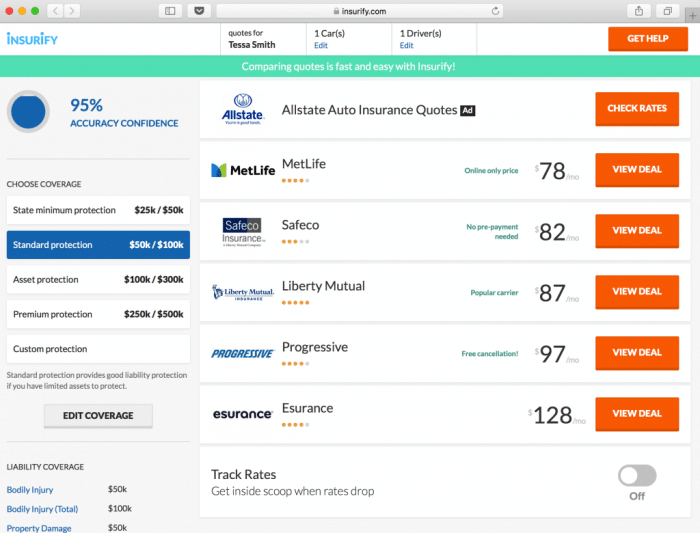

Securing the best car insurance rates in New York involves a strategic approach to comparing quotes from various providers. By following a systematic process, you can maximize your chances of finding the most competitive rates that meet your specific needs.

Getting Car Insurance Quotes in New York

To get the best car insurance quotes in New York, it’s crucial to compare offers from multiple insurers. This process involves gathering information about your vehicle, driving history, and coverage needs, then contacting different companies to obtain personalized quotes.

- Gather Your Information: Before contacting insurers, gather essential details about your vehicle, including its year, make, model, and VIN. Also, have your driving history readily available, including your license number, any accidents or violations, and your current insurance policy details.

- Choose Your Coverage: Determine the types of coverage you require, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Consider your budget and the level of protection you desire.

- Contact Insurance Companies: Contact various car insurance companies operating in New York. You can obtain quotes online, over the phone, or through an insurance broker. Be sure to provide accurate information to ensure accurate quotes.

- Compare Quotes: Once you have received quotes from multiple insurers, carefully compare them based on premium amounts, coverage options, deductibles, and any additional benefits or discounts offered.

- Choose the Best Option: Select the car insurance policy that provides the best combination of price, coverage, and value for your needs. Consider factors like customer service, claims handling, and the insurer’s financial stability.

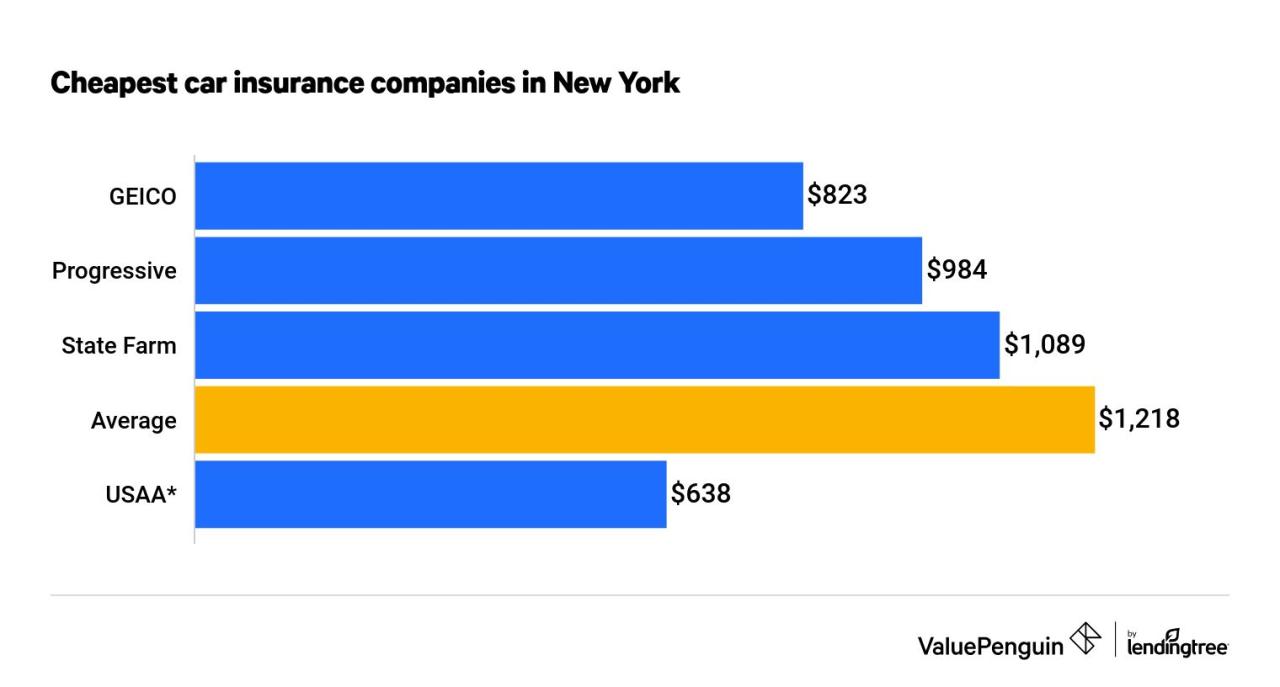

Reputable Car Insurance Companies in New York

Several reputable car insurance companies operate in New York, offering a range of coverage options and competitive rates. It’s essential to research and compare these companies to find the best fit for your needs.

- Geico: Known for its affordable rates and extensive online resources.

- State Farm: A major insurer with a strong reputation for customer service and financial stability.

- Progressive: Offers a wide range of coverage options and personalized discounts.

- Allstate: Known for its “good hands” advertising campaign and focus on customer satisfaction.

- Liberty Mutual: Offers a variety of coverage options and discounts, including accident forgiveness.

- New York Central Mutual: A regional insurer specializing in personal and commercial insurance.

- Nationwide: A national insurer with a strong reputation for financial stability and customer service.

Negotiating Car Insurance Rates and Finding Discounts

Negotiating car insurance rates can be a challenging but rewarding process. You can leverage your driving history, vehicle features, and other factors to potentially secure lower premiums.

- Shop Around: Obtaining quotes from multiple insurers is crucial for finding the best rates. Compare premiums, coverage options, and discounts offered by each company.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance, to potentially qualify for significant discounts.

- Improve Your Driving Record: Maintain a clean driving record by avoiding accidents, speeding tickets, and other traffic violations. A good driving history can lead to lower premiums.

- Consider Safety Features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts. These features can reduce your risk of accidents, leading to lower premiums.

- Pay in Full: Paying your car insurance premium in full upfront can often result in a discount compared to paying monthly installments.

- Ask About Discounts: Inquire about available discounts, such as good student, safe driver, multi-car, or loyalty discounts. Some insurers offer discounts for completing defensive driving courses or having a good credit score.

- Negotiate with Your Current Insurer: If you’re satisfied with your current insurer, consider contacting them to see if they can offer you a better rate. Highlight your good driving record, any recent safety upgrades to your vehicle, or any other factors that might qualify you for a discount.

“By diligently comparing quotes, negotiating rates, and taking advantage of available discounts, you can secure the best possible car insurance rates in New York.”

Understanding New York’s No-Fault Insurance System

New York State operates under a “no-fault” insurance system, which means that after a car accident, drivers involved are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system is designed to streamline the claims process and reduce the number of lawsuits.

The no-fault system aims to ensure that injured drivers and passengers receive prompt medical treatment and compensation for lost wages without the need for lengthy legal proceedings. However, it also has limitations and exceptions that are important to understand.

Filing a Claim Under New York’s No-Fault System

When you are involved in a car accident in New York, you must report the accident to your insurance company and file a claim for your injuries and lost wages. The process for filing a claim is relatively straightforward and involves the following steps:

- Report the accident to your insurance company. You should do this as soon as possible after the accident. Your insurance company will provide you with a claim form and instructions on how to file a claim.

- Seek medical attention. If you are injured in the accident, it is important to seek medical attention immediately. Your insurance company will cover your medical expenses up to the limits of your policy.

- Complete and submit the claim form. You will need to provide your insurance company with information about the accident, your injuries, and your lost wages. You will also need to provide documentation, such as medical bills and pay stubs.

- Receive payment for your medical expenses and lost wages. Once your claim is approved, your insurance company will pay for your medical expenses and lost wages up to the limits of your policy.

Limitations and Exceptions to No-Fault Coverage in New York

While New York’s no-fault system provides benefits for injured drivers and passengers, it does have limitations and exceptions.

- Limited coverage for lost wages. New York’s no-fault system only covers lost wages for up to 80% of your average weekly wage, up to a maximum of $2,000 per week.

- Limited coverage for medical expenses. Your no-fault insurance will cover your medical expenses up to a certain limit, which varies depending on your policy. If your medical expenses exceed this limit, you may have to pay the difference out of pocket.

- Threshold for suing for pain and suffering. In New York, you can only sue for pain and suffering if your injuries meet a certain “serious injury” threshold. This threshold is relatively high and includes injuries such as significant disfigurement, permanent loss of use of a body part, or a fracture.

Additional Considerations for New York Car Insurance

Beyond the fundamental aspects of car insurance, there are several additional considerations that New York drivers should be aware of. These factors can significantly impact the cost and coverage of your policy, so it’s crucial to understand them thoroughly.

Coverage Options in New York

New York state offers various coverage options for drivers, each with its own benefits and drawbacks. Understanding these options is crucial for choosing the right level of protection for your needs and budget.

- Personal Injury Protection (PIP): This coverage is mandatory in New York and pays for medical expenses, lost wages, and other related costs resulting from an accident, regardless of who was at fault. PIP coverage limits vary by insurance company and policy. While mandatory, you can choose to reduce your PIP coverage, which can lower your premium.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. If you have a car loan or lease, your lender may require collision coverage. You can choose to waive collision coverage if your vehicle is older or has a low value.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, natural disasters, and falling objects. Like collision coverage, you can choose to waive comprehensive coverage if your vehicle is older or has a low value.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. UM/UIM coverage pays for your medical expenses, lost wages, and other related costs. It is recommended to have sufficient UM/UIM coverage, as it can be crucial in protecting you from financial hardship in the event of an accident with an uninsured driver.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. Liability coverage is mandatory in New York and typically includes bodily injury liability and property damage liability. The minimum limits for liability coverage in New York are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

New York’s “Drive Safe New York” Program

New York’s “Drive Safe New York” program is a comprehensive initiative aimed at improving road safety and reducing traffic accidents. This program offers various incentives and discounts to drivers who demonstrate safe driving habits.

“Drive Safe New York” program aims to promote safer driving practices and reward safe drivers with discounts on their car insurance premiums.

- Discount Eligibility: Drivers who successfully complete a defensive driving course approved by the New York State Department of Motor Vehicles (DMV) are eligible for a discount on their car insurance premiums. These courses typically cover topics such as safe driving techniques, traffic laws, and accident prevention.

- Discount Amount: The discount amount offered by insurance companies varies depending on the specific program and the individual driver’s driving history. Drivers with clean driving records and those who complete a defensive driving course may qualify for significant premium reductions.

- Other Incentives: The “Drive Safe New York” program also offers other incentives, such as points reduction on driving records for certain traffic violations. These incentives can help drivers maintain a clean driving record and potentially lower their insurance premiums.

Closing Summary

By understanding the nuances of car insurance in New York, you can secure the coverage you need at a price that fits your budget. Whether you’re a new driver or a seasoned veteran, this guide provides the information you need to navigate the complexities of New York’s car insurance landscape and make informed decisions about your coverage.

FAQ Corner

What are the mandatory car insurance requirements in New York State?

New York State requires all drivers to have liability insurance, which covers damages to others in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

What are some tips for finding the best car insurance quotes in New York?

To find the best car insurance quotes, compare rates from multiple reputable providers, consider discounts offered for good driving records, safe driving courses, and bundling insurance policies. You can also use online comparison tools to streamline the process.

How does New York’s no-fault insurance system work?

New York’s no-fault insurance system requires drivers to file claims with their own insurer regardless of who is at fault in an accident. This system aims to expedite claims processing and reduce litigation.