When will Tesla Insurance be available in other states? This question is on the minds of many Tesla owners who are eager to take advantage of the unique features and benefits offered by this innovative insurance program. While Tesla Insurance is currently only available in a limited number of states, the company is actively working to expand its reach across the country.

Tesla Insurance is designed specifically for Tesla owners, leveraging data from the vehicles themselves to personalize rates and provide tailored coverage. The program has garnered significant attention for its potential to disrupt the traditional insurance industry, offering a more transparent and potentially less expensive alternative.

Tesla Insurance Expansion

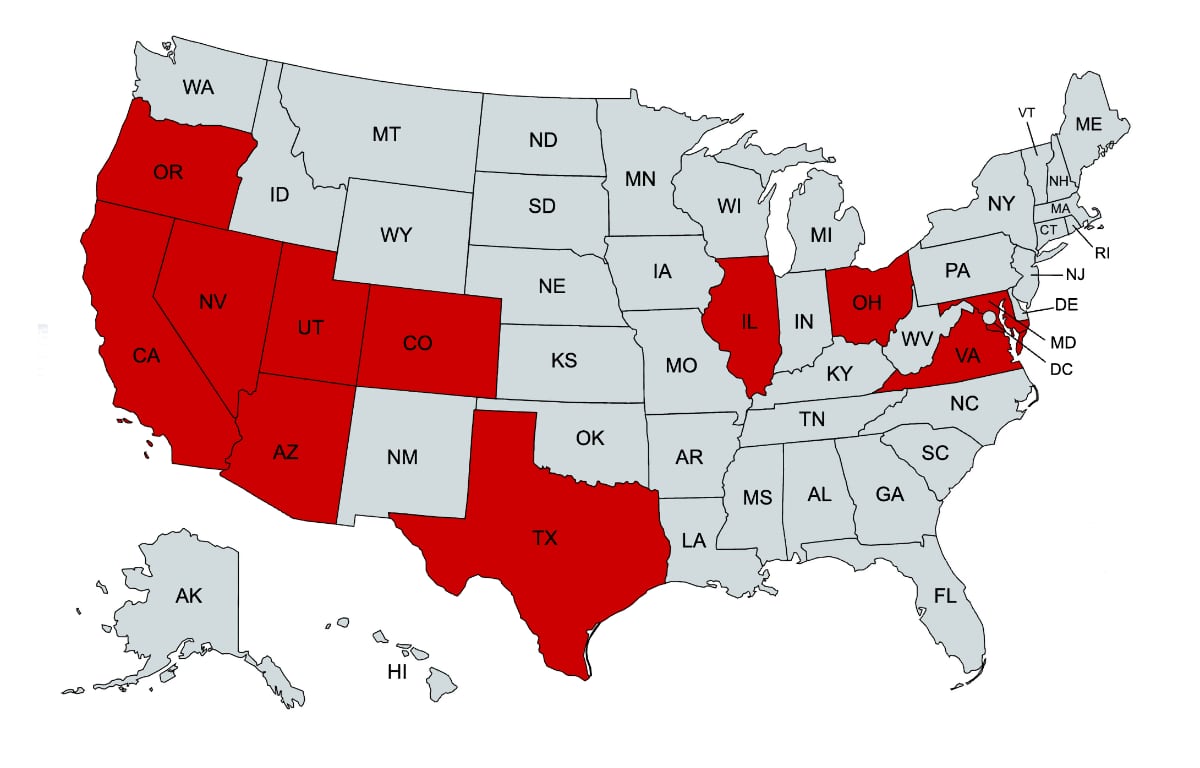

Tesla Insurance, the company’s foray into the insurance market, is currently available in a limited number of states. The expansion of Tesla Insurance to other states is a strategic move that aims to provide a comprehensive insurance solution for Tesla owners and contribute to the company’s overall growth.

Current Availability

Tesla Insurance is currently available in the following states:

- California

- Colorado

- Illinois

- Arizona

- Texas

- Oregon

- Nevada

- Oklahoma

- Utah

- Virginia

- Washington

- New Jersey

- New York

- Connecticut

- Rhode Island

- Massachusetts

- Pennsylvania

- Maryland

- Ohio

- Michigan

- Florida

- Georgia

- North Carolina

- South Carolina

- Delaware

- New Hampshire

- Maine

- Vermont

- Wisconsin

- Minnesota

- Iowa

- Missouri

- Kansas

- Nebraska

- Indiana

- Kentucky

- Tennessee

- Arkansas

- Louisiana

- Mississippi

- Alabama

- North Dakota

- South Dakota

- Idaho

- Montana

- Wyoming

- New Mexico

Timeline for Expansion

Tesla has not publicly announced a specific timeline for its insurance expansion to other states. However, based on the company’s previous expansion patterns, it is likely that they will continue to expand gradually, focusing on states with a high concentration of Tesla vehicles and favorable regulatory environments.

Factors Influencing Expansion

Several factors influence the expansion of Tesla Insurance to new states. These factors include:

- Regulatory Environment: Each state has its own unique set of insurance regulations. Tesla must obtain the necessary licenses and approvals from state insurance regulators before offering its insurance products. The approval process can be time-consuming and complex, requiring extensive documentation and compliance with specific regulations.

- Market Demand: Tesla will likely prioritize states with a high concentration of Tesla vehicles and a strong demand for its insurance products. This ensures that there is a sufficient customer base to support the expansion.

- Competition: Tesla will need to consider the competitive landscape in each state. The presence of established insurance companies with strong market share may present challenges to Tesla’s entry into the market.

- Operational Infrastructure: Tesla needs to establish the necessary operational infrastructure in each new state, including partnerships with claims adjusters, repair shops, and other service providers.

Regulatory Hurdles and Approvals

Tesla’s insurance expansion involves navigating a complex regulatory landscape. The company must comply with specific requirements and obtain necessary approvals from state insurance regulators in each state. These approvals can be time-consuming and may involve:

- License Applications: Tesla must submit applications for insurance licenses in each state, providing detailed information about its business operations, financial stability, and insurance products.

- Rate Filings: Tesla must file rates for its insurance products with state regulators, demonstrating that the rates are fair and actuarially sound.

- Compliance Audits: State regulators may conduct audits to ensure that Tesla is complying with all applicable regulations and laws.

- Consumer Protection Requirements: Tesla must comply with state consumer protection laws, such as those related to privacy, data security, and dispute resolution.

Key Features and Benefits of Tesla Insurance: When Will Tesla Insurance Be Available In Other States

Tesla Insurance is a relatively new entrant in the insurance market, offering a unique proposition tailored specifically for Tesla owners. While traditional insurance options may provide basic coverage, Tesla Insurance aims to leverage the unique features of Tesla vehicles to provide more personalized and potentially cost-effective coverage.

Features and Benefits of Tesla Insurance

Tesla Insurance is designed to cater to the specific needs of Tesla owners, leveraging the advanced technology and safety features of their vehicles. Here are some key features and benefits:

| Feature | Description | Benefits | Comparisons |

|---|---|---|---|

| Safety Score | A proprietary system that analyzes driving behavior, including acceleration, braking, and turning, to assess the driver’s risk profile. | Lower premiums for safe drivers, promoting safer driving habits. | Traditional insurance companies may use credit scores or driving history, but Tesla Insurance’s Safety Score offers a more granular and personalized assessment of driving behavior. |

| Remote Monitoring and Diagnostics | Leverages Tesla’s extensive data collection capabilities to monitor vehicle health and identify potential issues before they escalate. | Reduced risk of accidents due to mechanical failures, potentially leading to lower premiums. | Traditional insurance companies typically rely on claims data and historical trends, while Tesla Insurance can proactively identify and address potential risks. |

| Over-the-Air Updates | Tesla vehicles receive regular software updates that can enhance safety features and driving experience. | Improved safety features and driving capabilities, potentially leading to fewer accidents and lower premiums. | Traditional insurance companies may not consider software updates in their risk assessments, while Tesla Insurance takes this factor into account. |

| Tesla Service Network | Access to Tesla’s extensive network of service centers for repairs and maintenance. | Faster and more convenient repairs, potentially leading to lower repair costs and quicker claim processing. | Traditional insurance companies may have limited partnerships with specific repair shops, while Tesla Insurance provides direct access to Tesla’s service network. |

| Personalized Coverage Options | Tailored insurance plans based on individual driving habits, vehicle usage, and risk profile. | More affordable and relevant coverage options, potentially reducing premiums compared to traditional insurance. | Traditional insurance companies often offer standardized plans with limited customization options, while Tesla Insurance provides a more personalized approach. |

Tesla Insurance Pricing and Rate Factors

Tesla Insurance pricing is influenced by a variety of factors, similar to traditional insurance providers. However, Tesla leverages data from its vehicles to personalize rates, potentially offering more competitive pricing for safe drivers.

Data-Driven Rate Personalization

Tesla Insurance uses data collected from Tesla vehicles to assess individual driving habits and personalize rates. This data includes factors such as:

- Mileage: Drivers who travel fewer miles generally have lower insurance premiums.

- Driving Behavior: Data from Tesla’s Autopilot and other driver-assistance systems can be used to assess driving style, such as braking habits, acceleration patterns, and adherence to speed limits. Drivers with safer driving habits may qualify for lower rates.

- Location: Factors such as traffic density, crime rates, and weather conditions in the driver’s location can influence insurance premiums.

- Vehicle Features: Features like Autopilot and Full Self-Driving capabilities can impact insurance rates. These features can enhance safety and potentially reduce the risk of accidents.

Comparison to Traditional Insurance Providers

Tesla Insurance pricing can vary depending on the individual driver’s profile and location. However, some general observations suggest that Tesla Insurance can offer competitive rates, especially for Tesla owners with good driving records and who utilize advanced safety features.

Rate Factors and Impact

The following table summarizes key rate factors and their impact on Tesla Insurance pricing:

| Rate Factor | Description | Impact on Pricing | Examples |

|---|---|---|---|

| Driving History | Previous accidents, traffic violations, and insurance claims | Higher rates for drivers with a history of accidents or violations. Lower rates for drivers with clean driving records. | A driver with multiple speeding tickets may face higher premiums compared to a driver with no violations. |

| Vehicle Features | Safety features like Autopilot, Full Self-Driving, and advanced safety systems | Lower rates for vehicles equipped with advanced safety features, as they can reduce the risk of accidents. | A Tesla Model 3 with Autopilot may receive a lower rate compared to a Model 3 without Autopilot. |

| Location | Traffic density, crime rates, and weather conditions | Higher rates in areas with high traffic congestion, crime rates, or severe weather conditions. | A Tesla owner in a densely populated city may face higher premiums compared to an owner in a rural area. |

| Driving Behavior | Data from Tesla’s driver-assistance systems, such as braking habits, acceleration patterns, and adherence to speed limits | Lower rates for drivers with safe driving habits, as they are less likely to be involved in accidents. | A driver with a consistent record of smooth braking and adherence to speed limits may receive a lower rate compared to a driver with aggressive driving habits. |

Customer Experience and Feedback on Tesla Insurance

Tesla Insurance, launched in 2019, has garnered significant attention for its unique approach to car insurance, particularly for Tesla owners. It leverages data from Tesla vehicles to offer personalized rates and features, attracting a considerable customer base.

Customer Reviews and Feedback on Tesla Insurance

The user experience and customer support provided by Tesla Insurance have been the subject of much discussion, with both positive and negative aspects emerging.

| Aspect | Feedback | Positive Points | Negative Points |

|---|---|---|---|

| Pricing and Rates | Customers have reported mixed experiences with Tesla Insurance pricing. Some have found it to be competitive, while others have found it to be higher than traditional insurance providers. |

|

|

| Customer Support | Customers have generally reported positive experiences with Tesla Insurance customer support. The company offers a dedicated customer support team and online resources for assistance. |

|

|

| User Experience | Tesla Insurance offers a streamlined and digital-first user experience, with online account management and claims processing. |

|

|

| Coverage and Features | Tesla Insurance offers standard coverage options, but some customers have reported limited flexibility and customization options. |

|

|

Future Prospects and Potential Challenges for Tesla Insurance

Tesla Insurance has the potential to become a major player in the insurance market, leveraging its unique advantages and data-driven approach. However, its expansion will face challenges that require careful consideration and strategic planning.

Potential Challenges and Mitigation Strategies, When will tesla insurance be available in other states

Tesla Insurance’s expansion into new markets presents a range of challenges that could hinder its success. These challenges, their potential impact, and possible mitigation strategies are Artikeld below:

| Challenge | Impact | Mitigation Strategies | Potential Outcomes |

|---|---|---|---|

| Regulatory hurdles and licensing requirements | Delayed market entry, increased costs, and potential legal complications. | Proactive engagement with regulators, demonstrating compliance with local laws, and building strong relationships with state insurance departments. | Streamlined regulatory approval processes, lower operational costs, and a positive brand image. |

| Competition from established insurance companies | Loss of market share, price wars, and reduced profitability. | Differentiation through unique features, targeted marketing campaigns, and competitive pricing strategies. | Strong brand recognition, increased customer loyalty, and sustained market share. |

| Data privacy concerns and cybersecurity risks | Reputational damage, loss of customer trust, and potential legal liabilities. | Robust data security measures, transparent data usage policies, and compliance with privacy regulations. | Enhanced customer trust, reduced security breaches, and a strong legal defense. |

| Scaling operations and managing growth | Overwhelmed infrastructure, staffing shortages, and potential service quality issues. | Strategic investments in technology and infrastructure, talent acquisition and development, and efficient process optimization. | Improved operational efficiency, enhanced customer service, and sustainable growth. |

Last Recap

The expansion of Tesla Insurance represents a significant step towards a more personalized and data-driven approach to auto insurance. As Tesla continues to expand its footprint in the insurance market, it will be interesting to see how its innovative model influences the industry and shapes the future of car insurance.

FAQ Overview

What are the benefits of Tesla Insurance?

Tesla Insurance offers several benefits, including lower rates for Tesla owners, access to exclusive features, and a seamless user experience through the Tesla app.

How does Tesla Insurance use data from my car?

Tesla Insurance uses data from your car’s sensors and driving history to assess your driving behavior and personalize your insurance rates. This data helps to provide more accurate and fair pricing.

Is Tesla Insurance available in all states?

No, Tesla Insurance is currently only available in a limited number of states. The company is working to expand its availability to other states.