Texas state minimum insurance sets the stage for this discussion, offering readers a glimpse into the legal requirements and essential coverage for drivers in the Lone Star State. This article delves into the minimum insurance mandated by Texas law, outlining the types of coverage, their financial responsibility limits, and the potential consequences of driving without adequate insurance.

Understanding Texas state minimum insurance is crucial for drivers, as it ensures financial protection in the event of an accident. The state mandates specific types of insurance coverage, including liability, medical payments, uninsured/underinsured motorist, and property damage. These coverages provide financial protection to drivers and other parties involved in accidents, mitigating potential financial burdens.

Texas State Minimum Insurance Requirements

Driving in Texas requires you to have the minimum amount of insurance coverage as mandated by the state. These requirements are designed to protect you and others on the road in case of an accident. Let’s dive into the details of what Texas law demands for your car insurance.

Liability Coverage

Liability coverage is essential in case you are at fault in an accident. It covers the costs of injuries and property damage to other drivers, passengers, and pedestrians. Texas law requires a minimum of:

- $30,000 per person for bodily injury

- $60,000 per accident for bodily injury

- $25,000 per accident for property damage

This means your insurance company will pay up to $30,000 for each person injured in an accident you cause, up to a total of $60,000 for all injuries in the same accident. It will also cover up to $25,000 for any property damage you cause.

Medical Payments Coverage, Texas state minimum insurance

Medical payments coverage (Med Pay) is optional in Texas, but it’s a good idea to have it. This coverage pays for your medical expenses, regardless of who is at fault in an accident. The minimum limit for Med Pay is $2,500, but you can choose a higher limit.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is also optional in Texas, but it’s crucial to have it. This coverage protects you if you are hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses. Texas law requires that you be offered UM/UIM coverage at the same limits as your liability coverage, which is $30,000 per person, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

Property Damage Liability

This coverage protects you if you cause damage to another person’s property, such as their car or a fence. The minimum required limit for property damage liability is $25,000 per accident.

Consequences of Driving Without Insurance

Driving without the minimum required insurance in Texas can lead to serious consequences, including:

- Fines: You could face a fine of up to $350 for your first offense, and the fine can increase with each subsequent offense.

- License suspension: Your driver’s license can be suspended for up to six months.

- Jail time: You could face jail time for driving without insurance.

- Higher insurance premiums: Even after you get insurance, you will likely face higher premiums for several years.

- Financial hardship: If you cause an accident without insurance, you will be personally liable for all damages, which can lead to significant financial hardship.

Understanding the Types of Texas Minimum Insurance

Texas law requires all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. This insurance covers damages to other vehicles and injuries to other people, but not your own vehicle or injuries. Understanding the different types of insurance coverage is crucial to ensure you have the right protection in case of an accident.

Types of Texas Minimum Insurance

Texas law requires drivers to carry three types of minimum liability insurance:

- Liability Coverage: This coverage protects you from financial responsibility if you cause an accident that results in injury or property damage to another person. It covers medical bills, lost wages, and property damage up to the policy limits.

- Medical Payments Coverage (MPC): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It covers medical bills, lost wages, and other related expenses up to the policy limits.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured in an accident caused by a driver who does not have insurance or does not have enough insurance to cover your damages. It covers medical bills, lost wages, and other related expenses up to the policy limits.

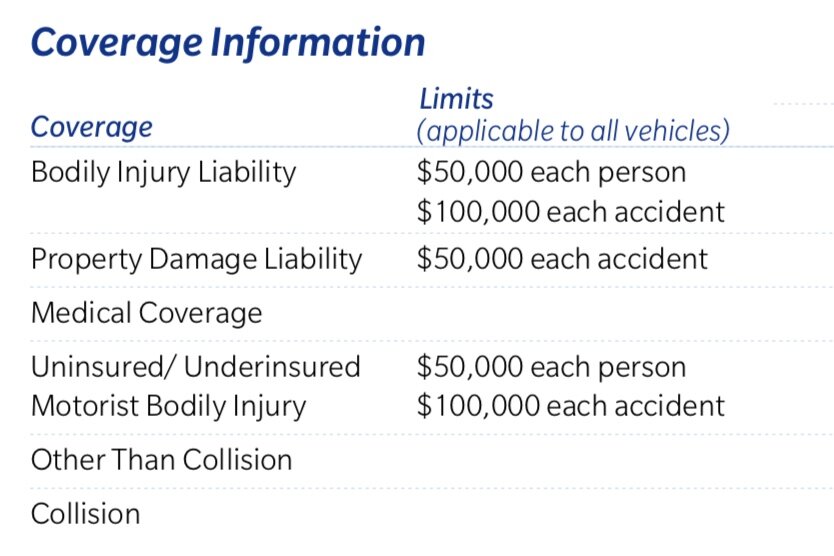

Texas Minimum Insurance Limits

The minimum insurance limits required in Texas are:

| Coverage Type | Minimum Limit |

|---|---|

| Liability Coverage (Bodily Injury per person) | $30,000 |

| Liability Coverage (Bodily Injury per accident) | $60,000 |

| Liability Coverage (Property Damage per accident) | $25,000 |

| Medical Payments Coverage (per person) | $2,500 |

| Uninsured/Underinsured Motorist Coverage (per person) | $25,000 |

| Uninsured/Underinsured Motorist Coverage (per accident) | $50,000 |

When Each Coverage Becomes Crucial

- Liability Coverage: This coverage becomes crucial when you cause an accident that results in injury or property damage to another person. For example, if you rear-end another vehicle and cause injuries to the driver and passengers, your liability coverage will help pay for their medical expenses and property damage.

- Medical Payments Coverage (MPC): This coverage is important for covering your own medical expenses and those of your passengers, even if you are not at fault in an accident. For example, if you are involved in an accident where the other driver is at fault but does not have insurance, your MPC will cover your medical expenses.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage becomes crucial when you are injured in an accident caused by an uninsured or underinsured driver. For example, if you are hit by a driver who does not have insurance or does not have enough insurance to cover your injuries, your UM/UIM coverage will help pay for your medical expenses and other damages.

Factors Influencing Texas Minimum Insurance Costs

Understanding the factors that influence the cost of minimum insurance in Texas is crucial for drivers to make informed decisions about their coverage and budget. Several key factors come into play when insurance companies determine your premium, each contributing to the final cost.

Factors Affecting Texas Minimum Insurance Costs

Insurance companies use a complex system to calculate premiums, taking into account various factors that affect the risk associated with insuring a driver. These factors can significantly impact your insurance costs, making it essential to understand how they influence your premiums.

- Driver Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies view them as higher risks and charge higher premiums.

- Driving History: A clean driving record with no accidents or violations translates into lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions increases your risk and your insurance cost.

- Vehicle Type: The type of vehicle you drive also plays a role in your insurance cost. Sports cars and luxury vehicles are generally more expensive to repair, making them more expensive to insure.

- Location: Your location, including your city and zip code, influences your insurance costs. Areas with higher crime rates or more traffic congestion are considered higher risk, leading to higher premiums.

Tips to Lower Texas Minimum Insurance Premiums

Drivers can implement several strategies to potentially lower their insurance premiums and save money. By understanding these tips, you can take control of your insurance costs and make informed decisions about your coverage.

- Maintain a Clean Driving Record: A clean driving record is your best defense against high insurance premiums. Avoid speeding tickets, reckless driving, and other violations that could increase your risk profile.

- Consider a Higher Deductible: Choosing a higher deductible means you’ll pay more out of pocket if you have an accident, but it can lower your monthly premiums. This is a good option for drivers with a strong financial buffer.

- Shop Around for Quotes: Don’t settle for the first insurance quote you get. Compare rates from different insurance companies to find the best deal that suits your needs and budget.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate to insurance companies that you’re committed to safe driving practices, potentially leading to lower premiums.

- Bundle Your Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can lead to discounts.

Average Texas Minimum Insurance Costs

The average cost of minimum insurance in Texas can vary based on various factors, including those discussed earlier. However, it’s essential to understand that these are just averages and your actual costs may differ.

- Age: Younger drivers typically face higher insurance costs than older drivers due to the higher risk associated with their age group.

- Driving History: Drivers with a history of accidents or violations generally pay higher premiums than those with clean driving records.

- Location: Insurance costs can vary significantly depending on your location. Urban areas with higher crime rates or traffic congestion often have higher premiums.

Exploring Insurance Options Beyond the Minimum

While Texas law mandates minimum liability coverage, many drivers opt for additional insurance protection beyond the bare minimum. This decision often stems from a desire for greater financial security and peace of mind in the event of an accident. This section explores the various insurance options available in Texas beyond the minimum requirements, highlighting the benefits and potential drawbacks of each.

Higher Liability Limits

Increasing liability limits provides greater financial protection in the event of an accident where you are at fault. This is particularly important for drivers who have assets they wish to protect, such as a home or investments. Higher liability limits can help cover the costs of damages, medical expenses, and lost wages for the other party involved in the accident.

Collision Coverage

Collision coverage protects your vehicle from damage caused by an accident, regardless of fault. This coverage pays for repairs or replacement of your vehicle, minus your deductible. While not mandatory, collision coverage can be essential for drivers with newer or more expensive vehicles, as it can help offset the cost of repairs or replacement in the event of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage can be particularly valuable for drivers who live in areas prone to natural disasters or who have a high-value vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance. This coverage can help pay for medical expenses, lost wages, and property damage.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of fault. It is mandatory in Texas for drivers who have a driver’s license but not for those who have a commercial driver’s license. PIP coverage can help offset the cost of medical bills and lost wages while you recover from an injury.

Medical Payments Coverage, Texas state minimum insurance

Medical payments coverage (Med Pay) provides coverage for medical expenses for you and your passengers, regardless of fault. It is typically a smaller amount than PIP coverage and is often used to supplement health insurance.

Rental Reimbursement Coverage

Rental reimbursement coverage provides financial assistance to cover the cost of a rental car while your vehicle is being repaired after an accident. This coverage can be particularly helpful if you rely on your vehicle for work or transportation.

Roadside Assistance Coverage

Roadside assistance coverage provides help with unexpected situations such as flat tires, dead batteries, and lockouts. This coverage can provide peace of mind knowing that you have assistance available if you experience a breakdown.

Gap Insurance

Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe on your auto loan or lease. This coverage can be beneficial if you have a new vehicle or have financed a significant portion of the purchase price.

Choosing the Right Coverage

The best insurance coverage for you will depend on your individual needs and risk tolerance. Consider factors such as your driving history, the value of your vehicle, and your financial situation when choosing your coverage. It is also important to consult with an insurance agent to discuss your options and ensure you have the appropriate coverage for your needs.

Navigating the Texas Insurance Market

Finding the right insurance policy in Texas can be a challenging task, but it doesn’t have to be overwhelming. With a little research and planning, you can secure a policy that meets your needs and fits your budget.

Obtaining and Comparing Insurance Quotes

To start your search for the best insurance policy, you need to obtain quotes from different providers. Here’s a step-by-step guide to make the process easier:

- Gather Your Information: Before contacting insurance companies, gather all necessary information, such as your driver’s license, vehicle identification number (VIN), and driving history. This will streamline the quoting process.

- Utilize Online Comparison Tools: Many websites and apps allow you to compare quotes from multiple insurance companies simultaneously. These tools can save you time and effort by presenting quotes side-by-side, allowing you to quickly identify the best deals.

- Contact Insurance Companies Directly: Don’t hesitate to contact insurance companies directly to request quotes. This allows you to ask specific questions and clarify any details about the policy. You can reach out through their websites, phone numbers, or by visiting their local offices.

- Compare Quotes Carefully: Once you have gathered quotes from various providers, carefully review each one. Pay attention to the coverage limits, deductibles, and premiums. Don’t just focus on the lowest price; consider the overall value and the level of protection each policy offers.

Choosing the Right Insurance Provider

Selecting the right insurance provider is crucial for ensuring your peace of mind and financial protection. Here are some key factors to consider:

- Price: While price is an important consideration, it shouldn’t be the sole deciding factor. Compare premiums, but also consider the overall value and coverage offered by each policy.

- Coverage: Ensure the policy provides adequate coverage for your needs. Consider factors such as your driving history, the type of vehicle you own, and your financial situation.

- Customer Service: Research the reputation of each insurance provider for customer service. Look for companies known for their responsiveness, helpfulness, and ability to resolve issues quickly and efficiently.

- Financial Stability: Choose a financially stable insurance company that has a strong track record. This ensures that they will be able to pay claims when you need them most.

Understanding Policy Terms and Conditions

Before purchasing an insurance policy, it’s essential to thoroughly understand the terms and conditions. This includes:

- Coverage Limits: These limits determine the maximum amount the insurance company will pay for covered losses.

- Deductibles: The deductible is the amount you are responsible for paying out of pocket before the insurance company covers the remaining costs.

- Exclusions: These are specific situations or events that are not covered by the policy. It’s important to understand what is not covered to avoid surprises later.

- Renewals and Cancellations: Understand the terms related to renewing your policy and the circumstances under which it can be canceled.

Concluding Remarks: Texas State Minimum Insurance

Navigating the Texas insurance market can be overwhelming, but understanding the state’s minimum insurance requirements is a crucial step towards responsible driving. By obtaining adequate coverage and familiarizing yourself with the different insurance options available, you can ensure financial protection and peace of mind on the road.

Commonly Asked Questions

How do I know if I have the minimum required insurance coverage in Texas?

You can verify your insurance coverage by contacting your insurance provider or reviewing your policy documents. The policy should clearly state the coverage limits for each type of insurance.

What happens if I get into an accident without the minimum required insurance?

Driving without the minimum required insurance in Texas is illegal and can result in serious consequences, including fines, license suspension, and even jail time. Additionally, you may be held personally liable for any damages or injuries caused in the accident, potentially leading to significant financial burdens.

Can I get a discount on my Texas minimum insurance?

Yes, there are several ways to potentially lower your insurance premiums in Texas. These include maintaining a good driving record, taking defensive driving courses, bundling your insurance policies, and choosing a higher deductible.