State Farm home insurance cost is a critical consideration for homeowners seeking comprehensive protection. State Farm, a renowned insurance provider, offers a wide range of home insurance policies designed to safeguard your property and provide financial security in the event of unforeseen circumstances. This guide delves into the factors that influence State Farm home insurance costs, explores methods for estimating premiums, and compares State Farm’s offerings with those of its competitors. We’ll also uncover tips to help you save on your State Farm home insurance premiums.

Understanding the intricacies of State Farm home insurance cost is essential for making informed decisions about your coverage and budget. By examining key factors such as location, home value, coverage amounts, deductibles, and risk factors, you can gain a comprehensive understanding of how these elements impact your insurance premiums. We’ll also provide insights into customer reviews and experiences with State Farm home insurance, offering a balanced perspective on the company’s strengths and areas for improvement.

State Farm Home Insurance Overview

State Farm is a well-known insurance company offering a range of insurance products, including home insurance. They provide comprehensive coverage to protect your home and belongings from various risks.

State Farm Home Insurance Features and Benefits

State Farm’s home insurance policies are designed to offer peace of mind and financial protection in case of unexpected events. Their policies typically include features and benefits such as:

- Comprehensive Coverage: State Farm provides coverage for a wide range of perils, including fire, theft, vandalism, windstorms, hail, and more. This ensures that your home and belongings are protected against various potential risks.

- Personal Property Coverage: State Farm’s policies cover your personal belongings, such as furniture, electronics, clothing, and jewelry, against damage or loss. The coverage amount is typically based on the value of your possessions.

- Liability Coverage: State Farm’s home insurance policies also provide liability coverage, which protects you from financial losses if someone is injured on your property or if you are held liable for property damage caused by you or a member of your household.

- Additional Living Expenses Coverage: If your home becomes uninhabitable due to a covered event, State Farm’s policies can help cover the additional expenses you incur while you are away from your home, such as temporary housing, food, and other essential expenses.

- Discounts: State Farm offers various discounts that can help reduce your premium, such as discounts for safety features, security systems, and multiple policies.

State Farm Home Insurance Coverage Types

State Farm’s home insurance policies typically include the following types of coverage:

- Dwelling Coverage: This coverage protects the structure of your home, including the walls, roof, foundation, and other permanent fixtures, against damage from covered perils.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, clothing, and jewelry, against damage or loss from covered perils.

- Liability Coverage: This coverage protects you from financial losses if someone is injured on your property or if you are held liable for property damage caused by you or a member of your household.

- Additional Living Expenses Coverage: This coverage helps cover the additional expenses you incur while you are away from your home due to a covered event, such as temporary housing, food, and other essential expenses.

Factors Influencing Home Insurance Costs

State Farm, like other insurance companies, considers various factors when calculating your home insurance premiums. These factors are designed to assess the risk associated with insuring your property and ensure fair pricing for all policyholders. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums.

Location

Your home’s location is a primary factor influencing insurance costs. It encompasses various aspects, including:

- Natural Disaster Risks: Areas prone to earthquakes, hurricanes, floods, wildfires, or tornadoes typically have higher insurance premiums. For example, coastal areas facing hurricane risks often have higher premiums than inland regions.

- Crime Rates: High crime rates can increase the risk of theft or vandalism, leading to higher insurance premiums. Cities with higher crime rates generally have higher insurance costs compared to safer areas.

- Proximity to Fire Stations and Hospitals: Homes located closer to emergency services might have lower premiums, as quick response times in case of an emergency can potentially minimize damage.

Home Features

The characteristics of your home play a significant role in determining your insurance premiums. These features include:

- Age and Construction: Older homes, especially those built with outdated materials, might have higher premiums due to potential maintenance and safety concerns. Homes built with fire-resistant materials or newer construction techniques often qualify for lower premiums.

- Size and Square Footage: Larger homes typically have higher premiums due to increased coverage requirements and potential higher repair costs in case of damage.

- Roof Type and Condition: Homes with newer, well-maintained roofs, especially those with fire-resistant materials, often qualify for lower premiums. Older roofs with potential damage or wear and tear might lead to higher premiums.

- Security Systems: Installing security systems, such as alarms, motion sensors, or security cameras, can demonstrate proactive safety measures and potentially lower your premiums. Some insurance companies offer discounts for homes with such systems.

State Farm Home Insurance Cost Estimation

Getting an accurate estimate of your State Farm home insurance costs is crucial for budgeting and planning. This section provides a step-by-step guide to help you understand the factors involved and how to calculate your potential insurance premiums.

Estimating State Farm Home Insurance Costs

You can estimate your State Farm home insurance costs by following these steps:

- Gather your home information: Start by collecting essential details about your property, including its square footage, age, construction materials, and any upgrades or renovations. This information will help you provide a more accurate picture of your home’s value and risk profile.

- Determine your coverage needs: Assess the level of coverage you require, considering factors like your home’s replacement value, personal property, and liability risks. Choosing the right coverage level ensures you have sufficient protection in case of unexpected events.

- Select your deductible: Decide on the amount you’re willing to pay out-of-pocket in case of a claim. A higher deductible generally leads to lower premiums, but you’ll bear a larger financial burden if you need to file a claim.

- Consider additional coverage: Explore optional coverage options like flood insurance, earthquake insurance, or identity theft protection, depending on your location and specific risks.

- Contact State Farm for a quote: Once you have gathered the necessary information, contact State Farm directly for a personalized quote. You can request a quote online, over the phone, or through a local agent. State Farm’s representatives can provide you with a tailored estimate based on your specific circumstances.

Cost Range Estimates

Here is a table showcasing estimated cost ranges for various coverage levels and deductibles, based on average home values and typical insurance rates:

| Coverage Level | Deductible | Estimated Cost Range |

|---|---|---|

| Basic | $500 | $500 – $1,000 per year |

| Comprehensive | $1,000 | $1,000 – $2,000 per year |

| Luxury | $2,500 | $2,000 – $4,000 per year |

Note: These are just estimates, and actual costs can vary depending on individual factors.

Factors Affecting Home Insurance Costs, State farm home insurance cost

Several factors can significantly impact your State Farm home insurance costs. Understanding these factors can help you adjust your insurance strategy to potentially reduce your premiums.

- Location: Your home’s location plays a crucial role in determining your insurance costs. Areas with higher crime rates, natural disaster risks, or frequent weather events typically have higher premiums.

- Home Value: The replacement value of your home is a significant factor. Higher-value homes generally require more coverage, resulting in higher premiums.

- Construction Type: Homes built with fire-resistant materials like brick or stone may qualify for lower premiums than those constructed with wood.

- Safety Features: Installing safety features like smoke detectors, burglar alarms, and fire sprinklers can lower your premiums. These features demonstrate your commitment to reducing risk and can potentially earn you discounts.

- Credit Score: Your credit score can also influence your home insurance premiums. Individuals with higher credit scores generally qualify for lower rates.

- Claims History: Your past claims history is another important factor. If you have filed multiple claims in the past, your premiums may be higher.

- Deductible Amount: Choosing a higher deductible can help you lower your premiums. However, remember that you’ll need to pay more out-of-pocket if you file a claim.

- Coverage Level: The level of coverage you choose also affects your premiums. Higher coverage levels typically result in higher premiums.

- Discounts: State Farm offers various discounts, such as bundling discounts for multiple policies, multi-car discounts, and safe driving discounts. Exploring these discounts can help you save on your premiums.

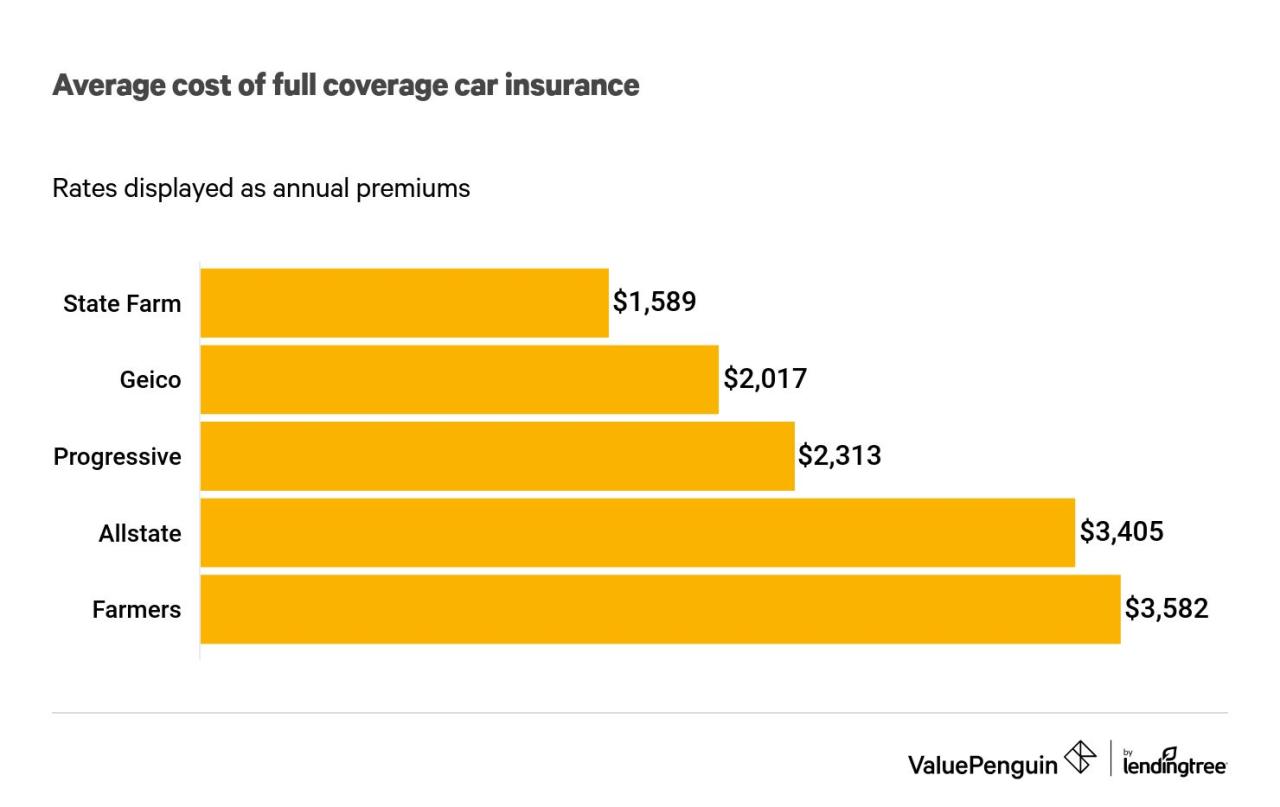

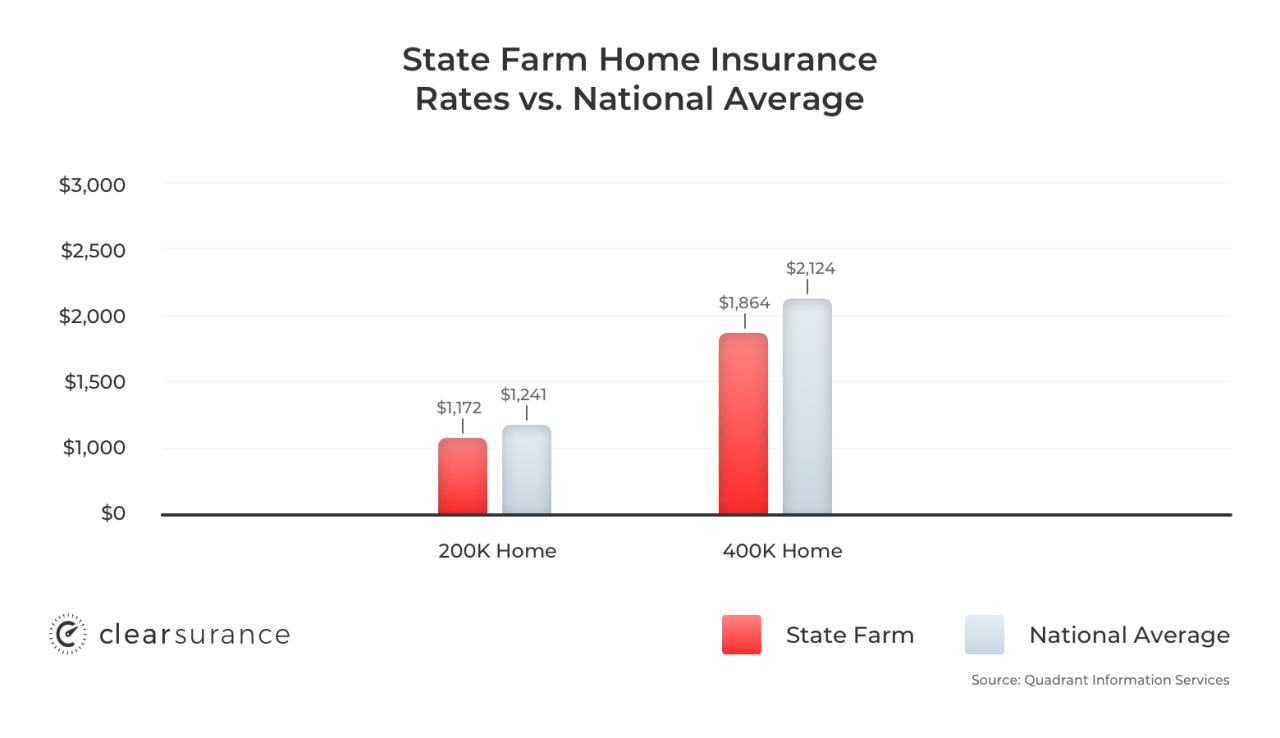

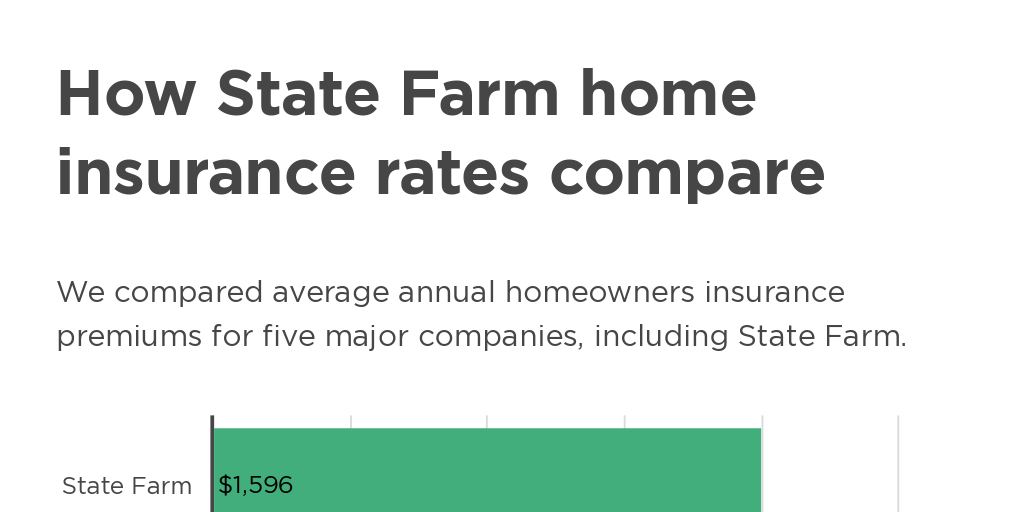

Comparing State Farm with Other Insurers

It’s essential to compare State Farm’s home insurance rates and policies with those of its major competitors to determine the best value for your needs. This comparison will help you understand the strengths and weaknesses of State Farm’s offerings and identify whether it’s the right fit for you.

State Farm’s Home Insurance Rates Compared to Competitors

State Farm is generally considered to be a mid-range insurer in terms of pricing. However, rates can vary significantly based on factors like location, coverage, and individual risk profiles. To get a true comparison, you should obtain quotes from several insurers, including:

- Allstate: Known for its comprehensive coverage options and competitive pricing.

- Farmers Insurance: Offers customizable policies and discounts for various factors, such as home safety features.

- Geico: Often known for its competitive rates and strong customer service.

- Progressive: Offers a wide range of coverage options and discounts, including bundling options.

- USAA: Exclusively for military members and their families, often offering competitive rates and excellent customer service.

State Farm’s Home Insurance Policies Compared to Competitors

State Farm’s home insurance policies offer standard coverage options, including:

- Dwelling coverage: Protects the physical structure of your home against perils like fire, wind, and hail.

- Other structures coverage: Covers detached structures like garages, sheds, and fences.

- Personal property coverage: Protects your belongings inside your home, such as furniture, electronics, and clothing.

- Liability coverage: Provides protection if someone is injured on your property or you cause damage to someone else’s property.

- Additional living expenses coverage: Covers temporary housing and other expenses if you’re unable to live in your home due to a covered event.

State Farm also offers several optional coverage options, such as:

- Flood insurance: Provides coverage for damage caused by flooding, which is typically excluded from standard home insurance policies.

- Earthquake insurance: Covers damage caused by earthquakes, which is also often excluded from standard policies.

- Identity theft protection: Offers financial protection and support if you become a victim of identity theft.

- Valuable items coverage: Provides additional coverage for high-value items, such as jewelry, artwork, and antiques.

Compared to competitors, State Farm’s policies are generally considered to be comprehensive and competitive. However, specific coverage options and policy features may vary from insurer to insurer. It’s crucial to carefully review the policies and coverage options offered by different insurers to ensure you choose the best fit for your individual needs.

Factors Making State Farm Competitive or Less Competitive

Several factors can influence whether State Farm is a competitive choice for your home insurance needs:

- Location: State Farm’s rates can vary significantly depending on your location. In some areas, they may be very competitive, while in others, they may be higher than competitors.

- Risk profile: Your individual risk profile, including factors like your credit score, claims history, and home safety features, can impact your insurance rates. State Farm may be more competitive for certain risk profiles than others.

- Customer service: State Farm is known for its strong customer service reputation, which can be a significant advantage for some policyholders.

- Discounts: State Farm offers a variety of discounts, such as multi-policy discounts, safety discounts, and loyalty discounts. These discounts can make State Farm a more competitive choice for certain individuals.

- Financial strength: State Farm is a financially strong insurer with a strong track record of paying claims. This financial stability can be reassuring for policyholders.

Tips for Saving on State Farm Home Insurance

You’ve already explored the factors that affect State Farm home insurance costs and how to get an estimate. Now, let’s delve into practical strategies to potentially reduce your premiums.

Increasing Deductibles

A higher deductible means you pay more out of pocket if you file a claim. However, it can also lead to lower premiums. By accepting a higher deductible, you’re essentially telling State Farm you’re willing to shoulder more of the financial burden in case of a claim, which can result in lower premiums.

Bundling Insurance Policies

State Farm often offers discounts for bundling multiple insurance policies, such as home, auto, and life insurance. By combining your insurance needs with State Farm, you could potentially save money on your overall insurance costs.

Making Home Improvements

Certain home improvements can make your home safer and more secure, leading to lower insurance premiums. Installing smoke detectors, burglar alarms, and impact-resistant windows can all qualify for discounts. State Farm may also offer discounts for fire-resistant roofing materials or security systems.

Taking Advantage of State Farm Discounts

State Farm offers various discounts to help policyholders save money. Here are some common discounts:

- Multi-policy discount: Bundling multiple insurance policies with State Farm can often result in a significant discount.

- Safety discounts: Installing safety features like smoke detectors, burglar alarms, and fire-resistant roofing materials can qualify for discounts.

- Good driver discounts: If you have a clean driving record, you may qualify for a discount on your auto insurance, which can indirectly lower your home insurance premiums if you bundle your policies.

- Other discounts: State Farm may offer discounts for other factors, such as being a homeowner, being a member of certain organizations, or having a good credit score.

Customer Reviews and Experiences: State Farm Home Insurance Cost

Understanding what other customers say about State Farm home insurance can provide valuable insights into its strengths and weaknesses. By examining customer reviews, we can gain a comprehensive picture of their experiences with the company, including their satisfaction with the claims process, customer service, and overall value.

Claims Process

Customer reviews highlight both positive and negative aspects of State Farm’s claims process.

- Many customers praise State Farm’s responsiveness and efficiency in handling claims. They appreciate the promptness of claim adjusters and the ease of navigating the claims process.

- However, some customers express frustration with delays in processing claims or difficulties in communicating with adjusters. In certain instances, they report feeling that their claims were not handled fairly or that they were not adequately compensated for their losses.

Customer Service

State Farm’s customer service receives mixed reviews.

- Many customers commend State Farm’s friendly and helpful customer service representatives. They appreciate the availability of 24/7 customer support and the ability to easily access information online or through mobile apps.

- On the other hand, some customers report experiencing long wait times on the phone or difficulty reaching a representative who can address their concerns. Some also criticize the lack of personalized attention and the impersonal nature of interactions with customer service representatives.

Overall Value

Customer reviews reflect a wide range of opinions regarding the overall value of State Farm home insurance.

- Many customers consider State Farm to be a reliable and trustworthy insurer, offering competitive rates and comprehensive coverage. They appreciate the peace of mind that comes with having a reputable company protecting their homes.

- However, some customers find State Farm’s rates to be too high compared to other insurers, particularly for those with higher-value homes or riskier properties. Others feel that the coverage provided by State Farm does not justify the premium costs.

Final Wrap-Up

Ultimately, finding the right home insurance policy comes down to balancing your needs, budget, and risk tolerance. By understanding the factors that influence State Farm home insurance costs, you can make informed decisions and potentially save money on your premiums. Whether you’re a first-time homeowner or a seasoned veteran, this guide provides valuable information to help you navigate the complexities of home insurance and secure the best possible coverage for your property.

Q&A

What is the average cost of State Farm home insurance?

The average cost of State Farm home insurance varies depending on factors such as location, home value, coverage amount, and deductibles. It’s best to get a personalized quote from State Farm to determine your specific cost.

How can I get a free quote from State Farm?

You can obtain a free quote from State Farm by visiting their website, calling their customer service line, or contacting a local State Farm agent.

Does State Farm offer discounts on home insurance?

Yes, State Farm offers various discounts on home insurance, including multi-policy discounts, safety discounts, and good driver discounts. Contact your local State Farm agent to learn about available discounts.