State Farm Professional Liability Insurance is a crucial safety net for professionals across various fields. This insurance safeguards you from financial ruin caused by negligence or errors in your work. Imagine a world where a single mistake could cost you your entire livelihood – that’s the reality many professionals face. Thankfully, State Farm offers a comprehensive solution to this problem, providing peace of mind and the assurance that you’re protected.

State Farm Professional Liability Insurance covers a wide range of professionals, including doctors, lawyers, accountants, engineers, and more. The policy offers various coverage options, including defense costs, settlements, and judgments. It also provides valuable resources and support to help you navigate the claims process.

State Farm Professional Liability Insurance Overview

State Farm Professional Liability Insurance, also known as Errors and Omissions (E&O) insurance, is designed to protect professionals from financial losses arising from claims of negligence, errors, or omissions in their professional services. It acts as a safety net, providing coverage for legal defense costs, settlements, and judgments against the insured professional.

Types of Professionals Covered, State farm professional liability insurance

State Farm Professional Liability Insurance is typically available to a wide range of professionals, including:

- Accountants and bookkeepers

- Architects and engineers

- Attorneys

- Consultants

- Doctors and nurses

- Financial advisors

- Insurance agents and brokers

- Real estate agents

- Software developers

The specific professions covered may vary depending on the insurance policy and the state in which the professional operates.

Key Benefits and Features

State Farm Professional Liability Insurance offers several key benefits and features, including:

- Financial protection: This insurance covers legal defense costs, settlements, and judgments against the insured professional, helping to protect their financial well-being in the event of a claim.

- Peace of mind: Knowing that they have professional liability insurance can provide professionals with peace of mind, allowing them to focus on their work without the constant worry of potential lawsuits.

- Reputation management: A professional liability insurance policy can help to protect the professional’s reputation by providing coverage for claims that could damage their standing in the industry.

- Customized coverage options: State Farm offers various coverage options to tailor the policy to the specific needs of each professional, including limits of liability, deductibles, and coverage for specific types of claims.

- Claims support: State Farm provides claims support services to help professionals navigate the claims process, including investigation, defense, and settlement negotiations.

Coverage Options and Exclusions

State Farm Professional Liability Insurance offers various coverage options tailored to different professionals and their specific needs. Understanding these options and the associated exclusions is crucial for determining the right level of protection for your practice.

Coverage Options

State Farm Professional Liability Insurance offers a range of coverage options, including:

- Claims Made Coverage: This coverage protects you against claims made during the policy period, regardless of when the alleged act or omission occurred. This is the most common type of professional liability insurance.

- Occurrence Coverage: This coverage protects you against claims arising from incidents that occur during the policy period, even if the claim is made after the policy expires. This coverage is typically more expensive than claims-made coverage but provides broader protection.

- Defense Costs Coverage: This coverage pays for legal fees and other expenses incurred in defending against a claim, regardless of whether the claim is ultimately successful. This can be a significant benefit, as legal defense costs can be substantial.

- Settlement Coverage: This coverage pays for settlements reached with claimants, up to the policy limits. This coverage can help you avoid the risk of a large financial judgment against you.

- Punitive Damages Coverage: Some policies may offer coverage for punitive damages, which are awarded to punish the defendant for egregious misconduct. However, this coverage is not always available and may have specific limitations.

- Coverage for Specific Risks: State Farm may offer specialized coverage options for certain professions, such as medical malpractice insurance for doctors and nurses or errors and omissions insurance for financial advisors.

Exclusions

State Farm Professional Liability Insurance policies typically contain a number of exclusions, which are situations or events not covered by the policy. Common exclusions include:

- Claims arising from intentional acts: The policy generally does not cover claims arising from deliberate acts of misconduct or negligence.

- Claims arising from criminal acts: This exclusion typically applies to claims arising from illegal activities or criminal conduct.

- Claims arising from employment-related issues: This exclusion may cover claims related to discrimination, harassment, or wrongful termination.

- Claims arising from personal injury: This exclusion may apply to claims involving bodily injury or emotional distress, such as slander or libel.

- Claims arising from environmental damage: This exclusion typically covers claims related to environmental pollution or contamination.

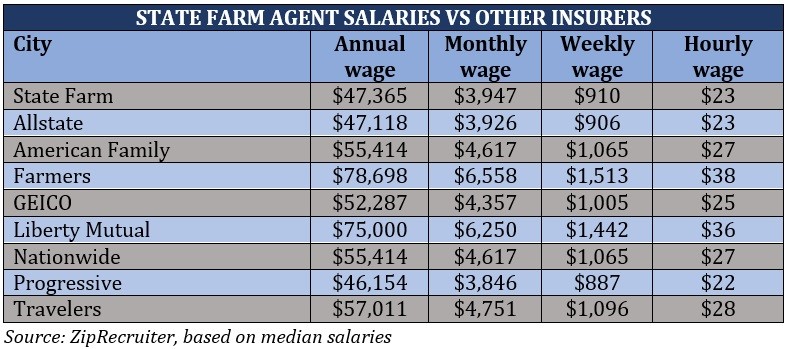

Comparison with Other Insurers

State Farm’s professional liability insurance policies are generally competitive in terms of coverage options and pricing. However, it’s important to compare policies from different insurers to ensure you’re getting the best value for your needs. Factors to consider when comparing policies include:

- Coverage limits: The maximum amount the policy will pay for covered claims.

- Deductible: The amount you’ll pay out-of-pocket before the policy covers the rest of the claim.

- Exclusions: The situations or events not covered by the policy.

- Premium: The cost of the policy.

- Customer service: The insurer’s reputation for providing responsive and helpful customer service.

Claims Process and Procedures

When you need to file a claim under your State Farm professional liability insurance policy, understanding the process is crucial. This section Artikels the steps involved, from the initial reporting to the final resolution.

Reporting a Claim

The first step in the claims process is reporting the claim to State Farm. You can do this by contacting your agent or calling the State Farm claims line. It’s important to report the claim promptly, as delays may affect your coverage. When reporting a claim, be prepared to provide the following information:

- Your policy number

- Your contact information

- The date and time of the incident

- A detailed description of the incident

- The names and contact information of any parties involved

- Any relevant documentation, such as incident reports, police reports, or medical records

Investigating the Claim

Once you have reported the claim, State Farm will begin investigating it. This investigation may involve reviewing your policy, gathering information from you and other parties involved, and potentially hiring an independent investigator. State Farm may also request additional documentation, such as medical records or witness statements. The investigation process can take some time, depending on the complexity of the claim.

Negotiating a Settlement

If State Farm determines that your claim is covered under your policy, they will begin negotiating a settlement with you. This process may involve multiple discussions and back-and-forth between you and State Farm. State Farm will consider various factors when determining the settlement amount, including the nature of the claim, the severity of the damages, and the applicable laws. You have the right to negotiate the settlement amount, and you may want to consider seeking legal advice if you are not comfortable with the terms of the settlement.

Resolving the Claim

Once a settlement is reached, State Farm will issue a payment to you. The payment may be made in a lump sum or in installments, depending on the terms of the settlement. If you are not satisfied with the settlement, you may have the right to file a lawsuit against State Farm. However, it is important to note that this is a last resort, and it is generally advisable to attempt to resolve the claim through negotiation.

Cost and Premium Factors

The cost of State Farm professional liability insurance premiums is determined by several factors, including the specific profession, experience level, and risk exposure. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premium costs.

Factors Influencing Premium Calculations

The premium for professional liability insurance is calculated based on a variety of factors that reflect the potential risk associated with your profession. Here are some key variables:

- Profession: Different professions have varying levels of risk. For example, doctors and lawyers face higher potential liability than accountants or teachers. State Farm considers the inherent risks associated with your profession when determining your premium.

- Experience Level: Professionals with more experience tend to have a lower risk profile, as they have a better understanding of their field and are less likely to make mistakes. This can result in lower premiums for experienced professionals.

- Risk Exposure: The nature of your work and the potential for claims also influence your premium. For example, a surgeon who performs complex procedures might have a higher risk exposure than a general practitioner.

- Claims History: Your past claims history, including the number and severity of claims, plays a significant role in premium calculations. A history of frequent or high-value claims can lead to higher premiums.

- Location: The location where you practice can also impact your premium. Certain areas may have higher litigation rates or stricter regulations, leading to higher premiums.

- Coverage Limits: The amount of coverage you choose can also influence your premium. Higher coverage limits typically result in higher premiums.

- Deductible: A higher deductible can lead to lower premiums. However, you will be responsible for paying the deductible amount if you file a claim.

Strategies for Reducing Premiums

While the factors mentioned above are largely outside your control, there are several strategies you can employ to potentially reduce your professional liability insurance premiums:

- Maintain a Clean Claims History: By minimizing the risk of claims, you can improve your claims history and potentially lower your premiums. This involves adhering to ethical practices, staying up-to-date on industry standards, and implementing risk management strategies.

- Increase Your Experience: As you gain experience, you may be able to negotiate lower premiums with State Farm. Demonstrating your expertise and a proven track record can help you secure more favorable rates.

- Consider Risk Management Training: Participating in risk management training programs can help you identify and mitigate potential risks in your practice. This can demonstrate your commitment to minimizing claims and potentially lead to lower premiums.

- Explore Coverage Options: Carefully evaluate the different coverage options offered by State Farm and choose the policy that best suits your needs and budget. You may be able to reduce your premium by opting for a lower coverage limit or a higher deductible.

- Shop Around for Quotes: Compare quotes from multiple insurance providers to ensure you are getting the best possible rates. State Farm offers competitive rates, but it’s always wise to explore other options to make an informed decision.

Benefits and Importance for Professionals

In today’s competitive professional landscape, protecting your career and financial well-being is paramount. Professional liability insurance, often referred to as errors and omissions (E&O) insurance, acts as a crucial safeguard for professionals in various fields. It provides financial protection against claims arising from negligence, errors, or omissions in the performance of professional services.

State Farm professional liability insurance offers comprehensive coverage tailored to meet the unique needs of professionals across diverse industries. It can help mitigate financial risks and provide peace of mind, allowing professionals to focus on delivering exceptional services without the constant worry of potential lawsuits.

Examples of Protection

Professional liability insurance provides a safety net for professionals facing potential claims. Here are some examples of how State Farm professional liability insurance can protect you:

* Medical Malpractice: A physician is sued by a patient who claims they suffered complications due to a misdiagnosis. The professional liability insurance covers legal defense costs and potential settlements or judgments.

* Financial Advisor Errors: A financial advisor provides incorrect investment advice, resulting in significant financial losses for a client. The insurance policy covers the advisor’s legal expenses and any financial compensation awarded to the client.

* Architect Design Flaws: An architect’s design flaw leads to structural issues in a building, causing damage and requiring costly repairs. The professional liability insurance covers the architect’s legal defense and financial liability for the damages.

* Software Developer Errors: A software developer releases a program with a critical bug, leading to data breaches and financial losses for a client. The insurance policy protects the developer from financial liability for the damages.

Consequences of Operating Without Insurance

Operating without adequate professional liability insurance can have severe consequences for professionals. Here are some potential risks:

* Financial Ruin: A single lawsuit alleging negligence or errors can lead to significant financial losses, potentially bankrupting a professional or business.

* Reputational Damage: A lawsuit, even if ultimately dismissed, can damage a professional’s reputation and make it difficult to attract new clients or secure future business.

* Legal Fees and Costs: Defending against a lawsuit can be extremely expensive, involving legal fees, expert witness costs, and other related expenses.

* License Suspension or Revocation: In some professions, operating without professional liability insurance can lead to license suspension or revocation, preventing professionals from practicing.

* Stress and Anxiety: The fear of a potential lawsuit can create significant stress and anxiety for professionals, impacting their mental health and ability to perform at their best.

Last Word

Investing in State Farm Professional Liability Insurance is an investment in your future. It provides the security you need to focus on your work, knowing you’re protected from unexpected risks. By understanding the benefits and coverage options, you can choose the right policy to meet your specific needs. This insurance is not just a financial safeguard; it’s a testament to your commitment to excellence and a guarantee that your practice will be protected from the unexpected.

Essential FAQs: State Farm Professional Liability Insurance

How much does State Farm Professional Liability Insurance cost?

The cost of State Farm Professional Liability Insurance varies depending on several factors, including your profession, experience level, and risk exposure. You can get a personalized quote by contacting a State Farm agent.

What happens if I have a claim?

If you have a claim, State Farm will handle the entire process for you. They will investigate the claim, negotiate with the claimant, and defend you in court if necessary.

What are the exclusions in State Farm Professional Liability Insurance?

There are certain situations that are not covered by State Farm Professional Liability Insurance, such as intentional acts, criminal conduct, and claims arising from events that occurred before the policy was in effect. It’s important to review the policy carefully to understand the exclusions.

What are the benefits of having State Farm Professional Liability Insurance?

The benefits of having State Farm Professional Liability Insurance include peace of mind, financial protection, access to legal and expert resources, and a streamlined claims process.